ASX 200 to rise, ANZ to buy back $2bn in shares, RBA in focus

Apart from the latest RBA monetary policy decision, which will be handed down this afternoon, it's actually quite a busy day on the corporate front. The next big bank (ANZ) has already handed down its half-yearly numbers, declaring an 83 cent per share dividend and initiating a $2 billion buyback. You can find more of these numbers later in the Wrap.

Later today, Coronado Global Resources will hand down its quarterly result while G8 Education and Iluka Resources will hold AGMs. Finally, the first major bank to report - the NAB (ASX: NAB) - trades ex-dividend.

And that's before we discuss the latest geopolitical developments. Israel began hitting targets in the city of Rafah, despite Hamas accepting a proposal to pause the fighting. Israel says the proposal for peace remains "far from its necessary requirements."

Let's dive in.

S&P 500 SESSION CHART

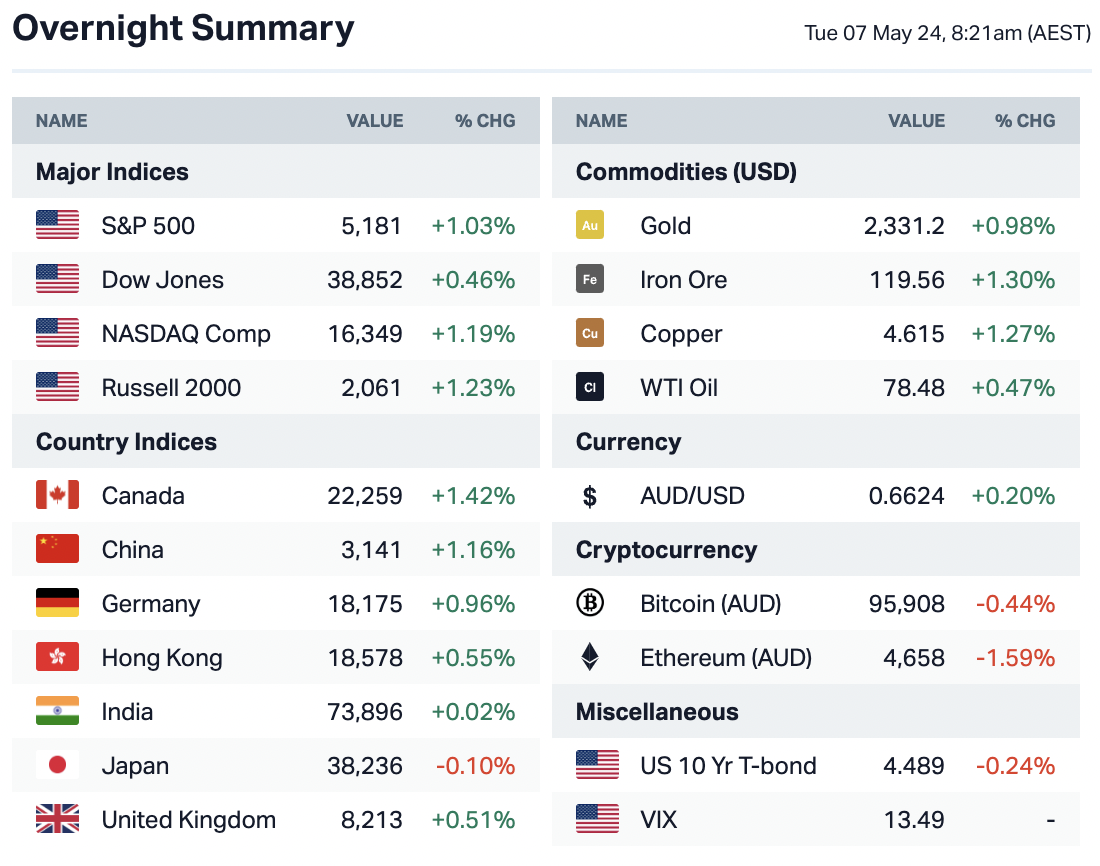

OVERNIGHT MARKETS

- Stocks close higher as renewed rate-cut hopes boost Wall Street

- Dow climbs more than 170 points to post fourth straight winning day, propelled by rate cut hopes

- European markets close higher as traders assess possible rate cuts, fresh PMI data

- Treasury yields are little changed as traders get more clues on next Fed moves

- Oil prices hold firm amid confusion over status of Gaza cease-fire proposal

- Gold gains on soft dollar, rate cut hopes

- The bar is creeping higher for second-quarter earnings

INTERNATIONAL STOCKS

- Lucid posts bigger loss, but keeps production guidance intact

- Hims & Hers shares rally as forecast bumped higher and more profitability said to be ahead

- Reddit set to report its first results as a public company. Analysts are eyeing its upside

- Tyson Foods’ stock turns lower after sales miss, as chicken remains weak

- Boeing gets hit with fresh FAA investigation — this time over 787 Dreamliner

CENTRAL BANKS

- RBA expected to keep rates on hold, seen keeping base rate steady amid inflationary pressures, solid job market, but two-way risks remain

- Fed’s Barkin thinks the U.S. economy will slow further, cooling down inflation

- ECB Chief Economist Lane confident inflation en-route to 2% target

- BoE expected to keep rates unchanged this week, but investors look for clues on a cut in June or August

ECONOMY

- Americans are sitting on a record amount of tappable home equity at $11 trillion

- Stock-market bulls face test as consumers start to show signs of stress

- Eurozone composite PMI at 11-month high boosted by services sector

- Eurozone Sentix investor confidence improved for the six consecutive month in May

- China's services sector expansion slightly slowed with rising costs, but new orders and business sentiment improved

ASX TODAY

Here are the ANZ (ASX: ANZ) numbers:

- H1 cash profit of $3.55 billion

- Cash EPS of $1.18 per share

- ROE of 10.1%, 42 basis points lower than H2 2023

- Will commence a $2 billion on-market share buyback (while trying to find $200 million in savings)

- Declares 83c per share dividend, 65% franked

- Coronado Global Resources (ASX: CRN) hands down its Q1 update.

- G8 Education (ASX: GEM), Iluka Resources (ASX: ILU) hold their respective AGMs.

Key Events

Companies trading ex-dividend:

- Wednesday 8 May: Resmed (RMD) - $0.052, NAB (NAB) - $0.84

- Thursday 9 May: Future Generation Australia (FGX) $0.034, United Overseas Australia $0.02

Economic calendar (AEST):

- 2:30pm – AUD – Cash rate, RBA monetary policy statement, RBA rate statement

- 3:30pm – AUD – RBA press conference

- 3:45 – 7:00pm – EUR – A host of European data including German factory orders and trade balance, French payrolls and trade balance, British construction PMI and eurozone retail sales

This Morning Wrap was written by Hans Lee and Chris Conway.

2 topics

5 stocks mentioned