Conflicting messages on policy from the RBA

The RBA delivered conflicting messages on monetary policy, retaining a neutral policy bias even as the board discussed raising rates for the first time since February.

That is, the press release unexpectedly retained its neutral policy bias that the board had adopted last month, repeating that, “The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the board is not ruling anything in or out”.

However, Governor Bullock later indicated at her press conference that the RBA had switched back to a weak tightening bias, in that the board considering raising rates today, something that last happened in February.

In the end, the board opted to keep interest rates on hold because policy was restrictive, citing the familiar cash flow squeeze on spending, believing that “we have rates at the right level to return inflation to target” given a balanced outlook.

Even so, the press release added a qualification about inflation that “[the board] will remain vigilant to upside risks” and Governor Bullock repeatedly cautioned that the RBA would act if inflation was high and persistent (“if we think we have to [hike], we will”).

In terms of triggers for a rate hike, Governor Bullock said the board had been discussing its tolerance for returning inflation to the 2-3% target range by the end of 2025, which remains its central case.

She said that the RBA would respond if "inflation expectations were starting to shift and that it was going to take markedly longer to come back to target".

She also suggested the RBA would act if inflation stopped declining and services inflation was stuck at a level that was not consistent with the inflation target.

Bullock squared the conflicting messages on policy by saying that while the risks around the outlook were “reasonably balanced”, perhaps with some upside risk, the “cost [of inflation] on the upside” was more than the “cost on the downside”.

Interestingly, Governor Bullock seemed more circumspect when asked about fiscal policy ahead of next week’s Commonwealth budget and the July income tax cuts.

Usually she would say fiscal policy was a non-event for the RBA and add that the income tax cuts do not alter the staff's outlook.

Instead, she said the treasurer had said both privately and publicly that “inflation was front of mind” for the government, with her briefer comment perhaps indicating that she is reserving judgement until the budget and tax cuts are out of the way.

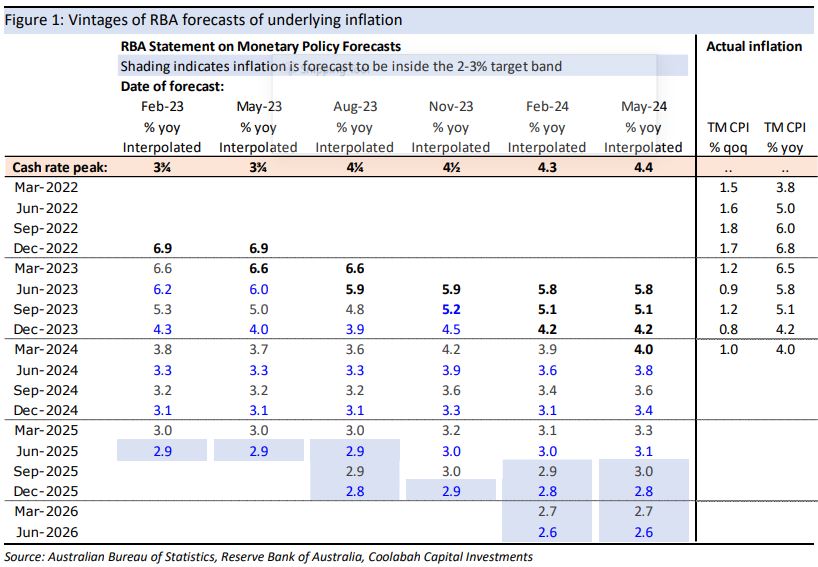

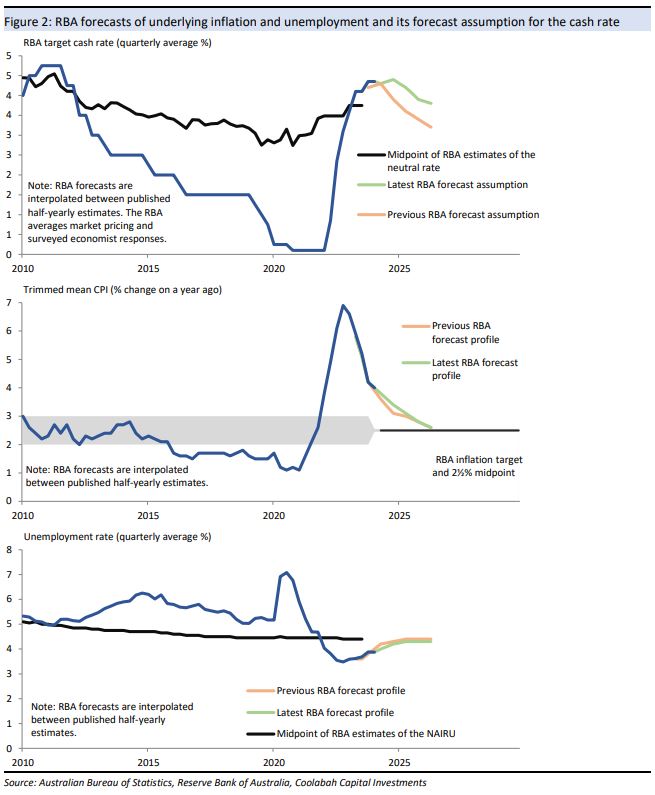

On the staff forecasts, the revisions did not seem to hang together.

The RBA revised up its near-term forecasts for underlying inflation, but still thinks inflation will slow to 2.8% by the end of 2025 and 2.6% by mid 2026.

The RBA said that the longer term forecasts were left unchanged because it now assumed that the cash rate would stay high for longer, noting that the market was pricing in some near-term risk of a hike (previously the forecast profile for the cash rate was a mechanical average of market pricing and surveyed economist expectations, but economist forecasts have now been dropped).

This seems something of a stretch, partly because the RBA’s own modelling points to a long lag between higher interest rates and inflation, while the RBA simultaneously forecast a slower rise in the unemployment rate to a marginally lower peak of 4.3% (previously 4.4%) despite a higher assumed cash rate.

The next key events and indicators for the RBA ahead of its 17-18 board meeting are the Commonwealth budget (14 May), the Q1 wage price index (15 May), the April CPI (29 May), and Q1 unit labour costs (5 June).

The CPI will be particularly

important given the trajectory of the latest monthly numbers points to a risk

that underlying inflation could again exceed the RBA’s outlook in Q2.

3 topics