How to identify the world's highest quality small and mid-cap stocks

Note: This interview was recorded on Friday 26 April 2024.

Fund Profile

- Name of the fund: Vaughan Nelson Global Equity SMID Fund (available as an unlisted managed fund and quoted managed fund ASX: VNGS).

- Asset Class: Global small and mid-cap stocks (SMIDs)

- Year started and size: 1 June 2022, US$34.3 million (as at 31 March 2024)

- Description of strategy: The Vaughan Nelson Global SMID Cap Equity team seek investments that can generate attractive returns over the longer term. Stock selection is driven by this targeted return objective, not benchmark construction.

- Investment objective: The Fund aims to outperform the MSCI ACWI SMID Cap Index (after fees and expenses and before taxes) on a rolling five-year basis.

- Link to fund page

Three standout qualities of long-term compounders

Global manager Vaughan Nelson is searching for quality compounders - and the small and mid-cap universe is its hunting ground.

As outlined by portfolio manager James Eisenman, Vaughan Nelson uses a targeted return approach when picking stocks, trying to predict their total return potential over three years rather than just tracking a benchmark.

"We're willing to trade time for value, so we don't mind being a bit early if we think we can hit our return target over a two to three-year time horizon," he explained.

In particular, there are three factors that Eisenman and his team look out for when picking stocks.

- Sustainably high or improving returns on capital

- A healthy industry structure (and also, where the company sit within this structure)

- A management team with a strong track record of capital deployment

According to Eisenman, investors can find these characteristics in a variety of businesses, but he noted that they typically deploy capital continuously and compound earnings consistently over time.

"That could also be cyclical businesses that go through an industrial cycle, like a trucking company," he explained.

"But as long as they're continuing to deploy capital and the business is getting better and taking market share from peak to peak of their cycle, that can be something we could buy as well."

Two examples

One of Vaughan Nelson's top holdings is a semiconductor company called Monolithic Power Systems (NASDAQ: MPWR), which makes chips that reduce energy consumption for a variety of electrical systems.

"Most recently, they've benefited from the AI trend that's been driving Nvidia (NASDAQ: NVDA). A lot of their chips go into data centres. They sit near the Nvidia chips within those centres. So as those are upgraded and built out, they benefit from that," Eisenman said.

In addition, the company has high gross margins, strong returns on capital, and invests heavily in R&D.

"With a three to four year time in between their R&D investments and when they actually gain revenue from those specific products, it gives you a long line of sight into the outlook on growth for the company over the next 2-4 years, not just the next 2-4 quarters," he added.

Another stock the team has recently added to the portfolio is Beijer (STO: BEIJ-B) - a Swedish heating, ventilation, and air conditioning distributor.

"It benefits from increasing energy efficiency trends driven by regulations," Eisenman said.

In this case, the company has a strong history of effectively deploying capital - via M&A, new product lines and entering new markets.

"They're earning high returns on that deployment of capital over time, and they'll continue to do so in the future," he added.

Volatility

Eisenman notes that the small and mid-cap universe actually provides investors with better diversification than large caps. He believes we have started to see early signs that capital has started to flow out from the large end into the small end - though it remains slightly more volatile.

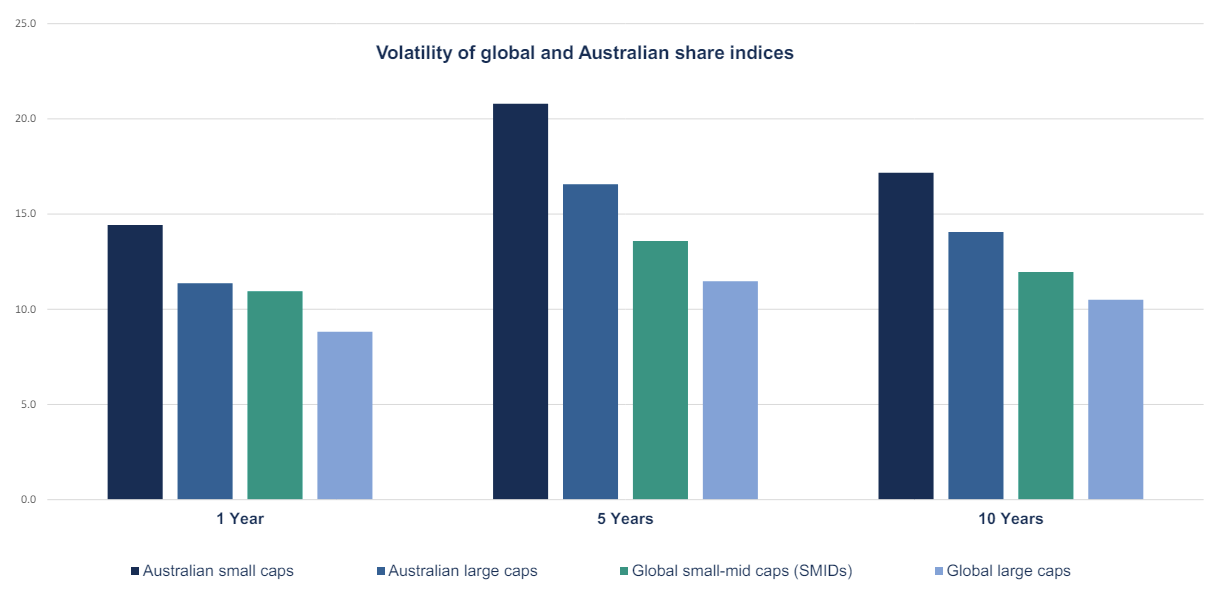

"There's more volatility at the very low end of the market cap range, and that's not really an area where we spend a lot of time or put much capital, but it's a bit of a misconception that the SMID space as a whole is more volatile," Eisenman said.

"It's slightly more volatile than the global large-cap space. But if you compare it to Australian small caps or the ASX 300, it's actually less volatile, which was a bit surprising to me and maybe surprising to other people as well."

Aussie small caps (dark blue) are far more volatile than global small-mid caps (green).

Source: Vaughan Nelson. and Morningstar Direct, to end March 2024. Indices, in order left to right, S&P/ASX Small Ordinaries TR AUD, S&P/ASX 300 TR, MSCI ACWI SMID NR USD, MSCI ACWI NR USD. Investments can go up and down. Past performance is not a reliable indicator of future performance.

To further protect the portfolio from volatility, Eisenman notes that the team employs a "quality bias" - meaning that the average name that makes its way into the portfolio is usually less volatile than the index in general.

"To the extent we want to own a name that may have a lot of volatility around it because there are times when you want to be cyclical and you actually want that upside volatility, we would just manage that with position sizing and judging the risk-reward upside/downside trade-off and handle it in that way," he added.

Small caps for big thinkers

Vaughan Nelson is a global leader in small-mid cap equities and has been investing on behalf of Australian clients since 2008. For more information, visit the Vaughan Nelson website or view the fund profiles below.

More from Undiscovered Funds

An exclusive series dedicated to unearthing some of Australia's up-and-coming funds.

- The top-performing area of the ASX over the last 10 years

- The high conviction portfolio with a "no excuses" approach

- The durable growers helping the world "cheat nature"

- Pedigree, people, and performance - unpacking new fund launches

- Undiscovered Funds: View the list of 12 Managed Funds and ETFs

4 topics

3 stocks mentioned

2 funds mentioned

1 contributor mentioned

.png)

.png)