Rents pose a risk to US inflation

The Fed believes that growth in the stock of US rents - which are a key contributor to core inflation - will eventually slow in response to higher interest rates and a looser labour market, but in the near term measures of new rents are giving strongly conflicting signals on the outlook. The official measure of new rents points to a sharp slowdown, but its usefulness is undermined by large revisions to recent history. The private-sector Zillow measure points to growth returning to pre-COVID averages, but with rents yet to catch up with earlier large gains, suggesting housing costs could hold up for longer than anticipated by the Fed.

Housing costs – which capture the “service” provided by a home – are an important low-frequency driver of underlying inflation because they have a large weight in measures of consumer prices and the change in housing costs tends to be less volatile than the prices of other goods and services.

Housing costs are nearly always proxied by market rents in CPI measures of consumer prices, although some countries also include other costs (note that market rents normally incorporate public housing).

- The euro area and UK CPIs only use market rents, but the US and Japan CPIs add in imputed rents – awkwardly termed owner-equivalent rents – which capture what a home-owner would pay to rent their home.

- Some countries, such as Australia and New Zealand, take a different approach, adding in the price of a new home (excluding land).

- Less commonly, Canada is backward in adding in mortgage interest charges.

However, housing costs that are measured as part of the more comprehensive consumption price deflator that is included the quarterly national accounts – also available monthly in the US as the Fed’s preferred PCE deflator measure of consumer prices – adhere to the UN statistical standard and comprise market and imputed rents.

Imputed rents are estimated by either relying on market rents or surveying homeowners, such that market and imputed rents are highly correlated, where growth in market and imputed rents can vary because rented homes are skewed towards apartments and owner-occupied homes are skewed towards houses.

In the US, the stock of rents accounts for about 40% of the core CPI and close to 20% of the core PCE deflator.

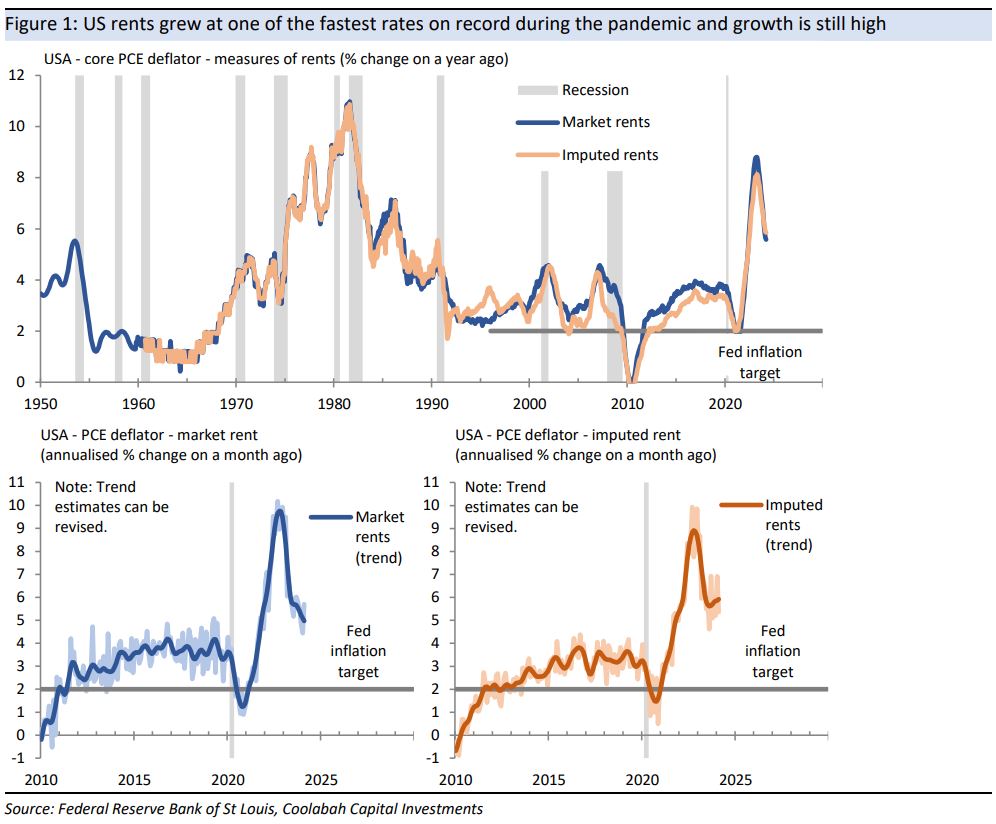

At the height of the pandemic, the US PCE measure of market rents increased at an annual rate of almost 9%, with growth in imputed rents not far behind at about 8%.

These growth rates were among the fastest in over a century, surpassed only by the late 1970s/early 1980s and the aftermath of WW1.

Growth in both types of rent has slowed sharply over the past year or so, but remains well above pre-COVID averages of 3¼-3½%.

The estimated trend in market rents shows annualised monthly growth slowing to about 5%, with annualised growth in imputed rents slowing to about 5½%.

In judging the outlook for the stock of rents, the Fed takes two approaches:

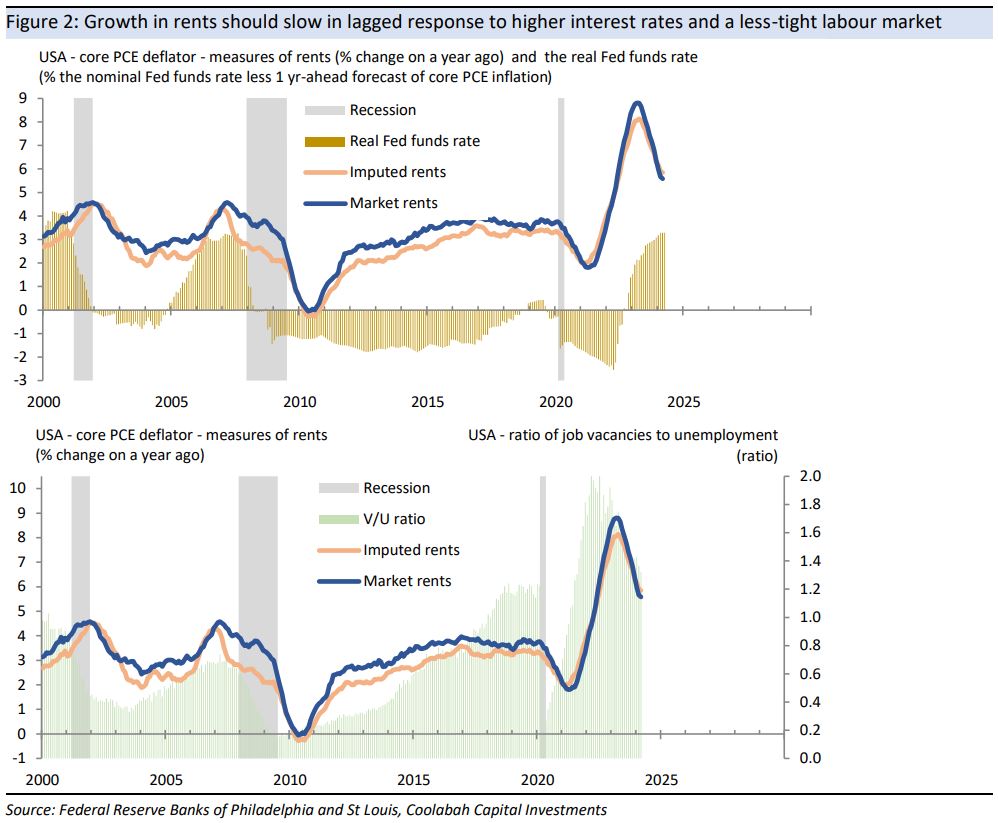

- The first is structural, where growth in rents is expected to eventually slow given the lagged effect of higher interest rates on the demand for housing (the Fed views rents as driven more by demand than supply because if the lags involved in building homes); and

- The second is a leading indicator approach, using measures of the flow of new rents as a guide to the stock of rents.

The policy-driven view that growth in rents will eventually slow is reflected in the loose lagged relationship between real interest rates and rents, as well as the lagged relationship between the state of the labour market – as proxied by either the unemployment rate or the vacancy-unemployment ratio – and rents.

However, there are strongly conflicting signals on the outlook from two commonly-used measures of new rents, one pointing to weakness, the other strength.

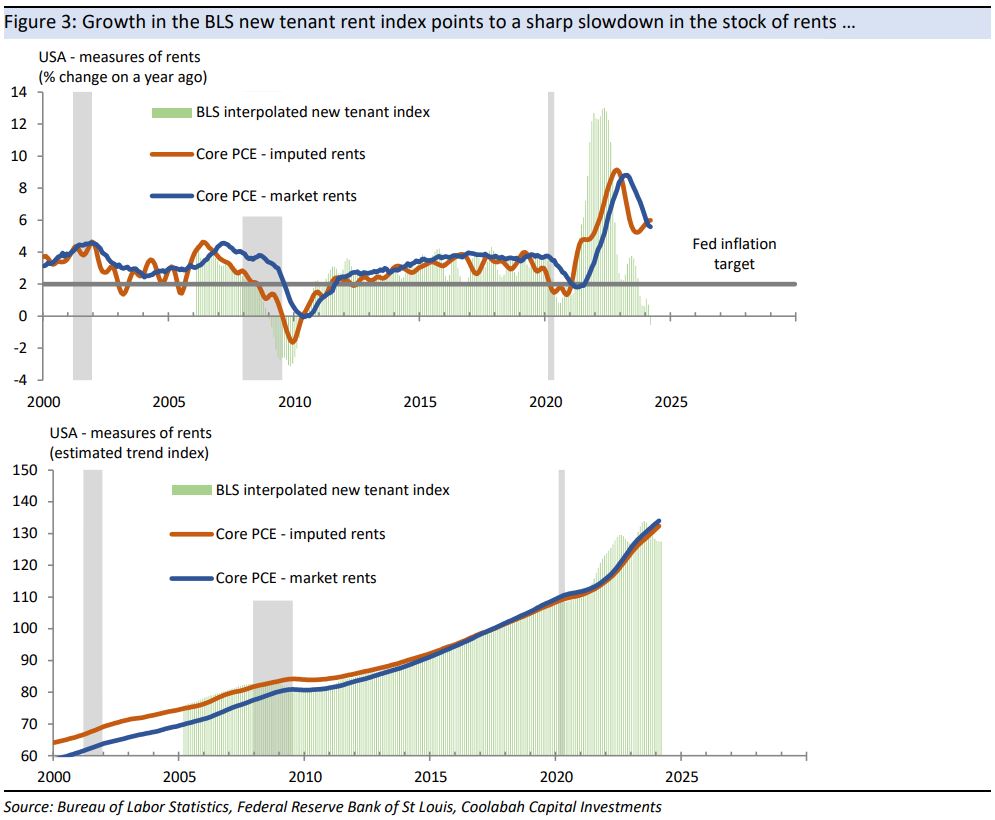

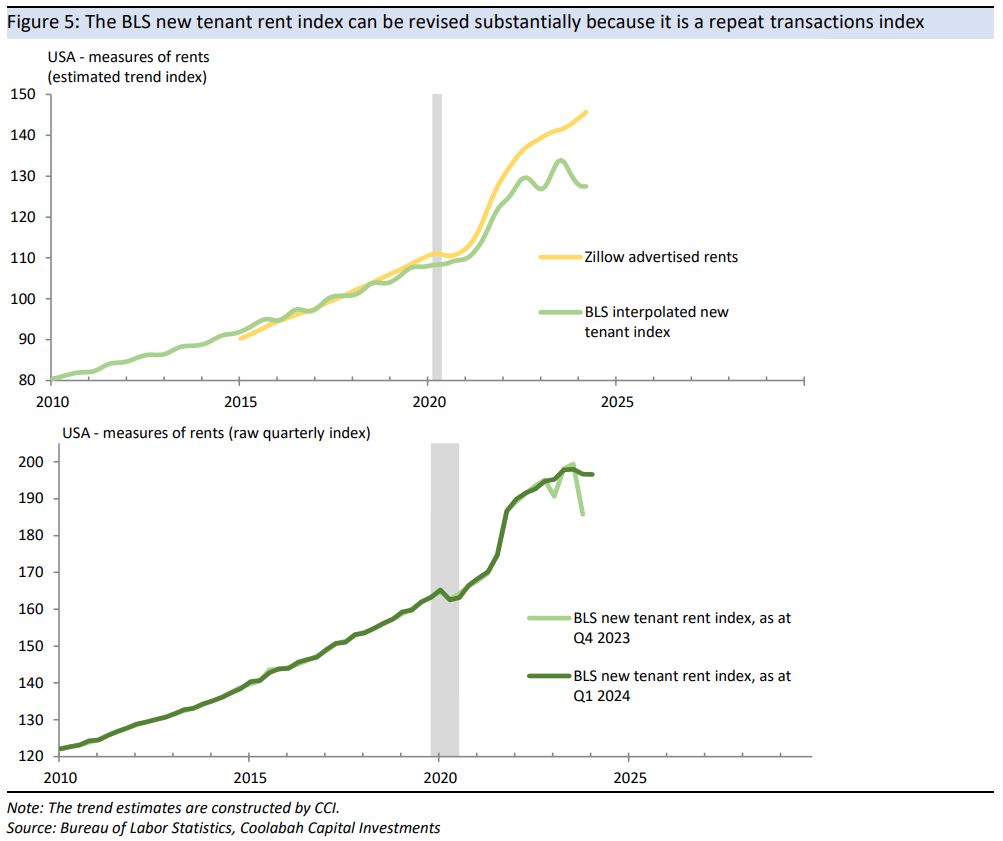

- The experimental BLS “new tenant rent index” – which was developed by the Cleveland Fed and appears favoured by Fed Chair Powell – points to a sharp slowdown in growth in the stock of rents, with the possibility that rents eventually fall a little.

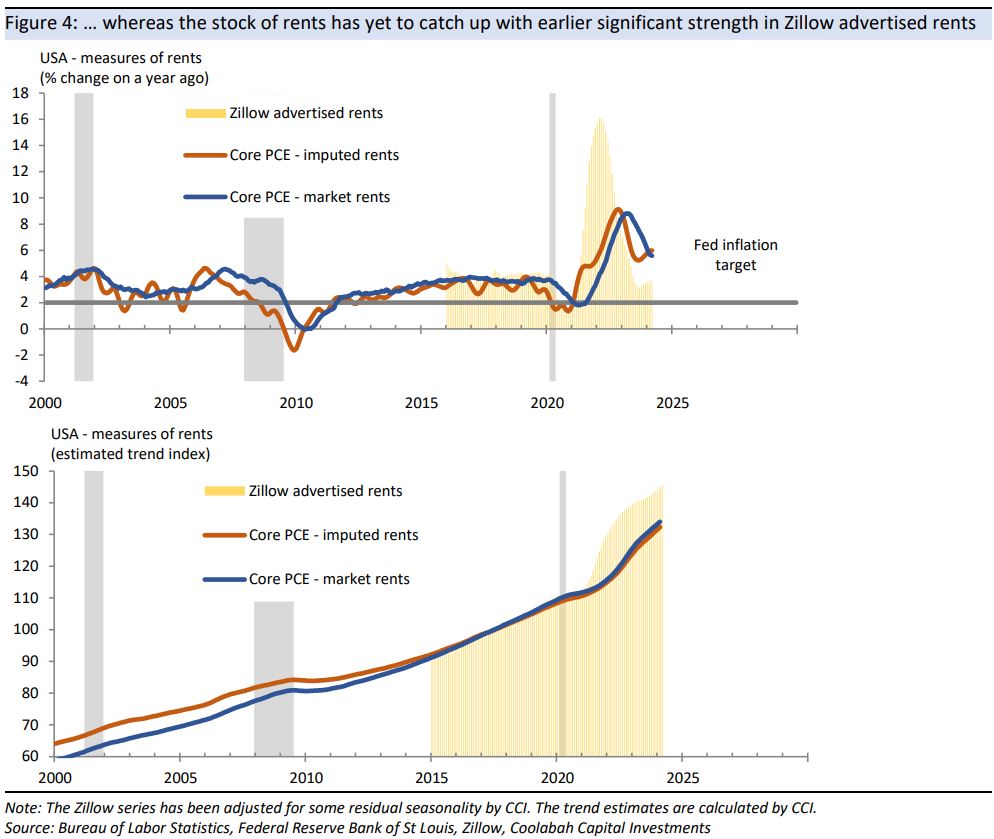

- The private-sector Zillow measure of advertised rents – which seems favoured by the San Francisco Fed – points to slower eventual growth in line with pre-COVID experience, but with the stock of rents yet to catch up in the interim with substantial earlier growth in the Zillow series.

The unprecedented divergence between the BLS new tenant index and the Zillow advertised rents series is difficult to reconcile over their relatively short histories.

However, the usefulness of the BLS index is greatly reduced by its propensity for substantial revisions to recent history. For example, the Q1 2024 index points to new rents holding steady, whereas the Q4 2023 vintage had reported a large decline (this comparison is made using the raw data not adjusted for seasonality).

Substantial revisions occur because the new tenant rent index is a “repeat transaction” series, where recent history is revised when tenants change homes.

In fact, the BLS explicitly warns that, “the most recent periods of a repeat transaction index like the New Tenant Rent Index are prone to large revisions because the rent observations spanning those periods accumulate gradually as tenants move”.

With revisions casting doubt over the weaker signal from the new rent

index, this leaves the Zillow advertised rent index pointing to the risk of a

catch-up in the stock of rents ahead of slower growth over the medium to long

term resulting from higher interest rates and a weaker labour market.

If this happened, growth in housing costs would hold up for longer than anticipated by the Fed, placing ongoing pressure on inflation.

3 topics