Are you one of the 46% of investors trying to change the world?

Once upon a time, investors believed you could either make money or help the world. In the modern fairy tale, you can do both – and it’s not a fiction, it’s a reality. The world of ESG investing has grown rapidly and investors are here for it – they want their investments to reflect their values and they know they can use investing as part of their toolkit for actively making a difference.

Australian Ethical and Investment Trends partnered for the second year of the ESG Report and the findings might surprise you… or it might not if you are one of the large number of investors already on board.

Diving into ESG or responsible investing

Investing on the basis of environment, sustainability and governance (ESG) factors sounds dry, and for many investors is a meaningless term but what it actually encapsulates is choosing investments on the basis of your values and morals, with the aim of doing good in the world. Other terms you might hear are responsible investing or sustainable investing. Some of the big areas under ESG investing include climate change, decarbonisation and renewable energy, human rights abuses (i.e. ending modern slavery in factory production) and ocean conservation.

These are major headlines in the world and investors want to do something about it – increasingly, they can put their money into it, alongside daily activities like recycling or buying local. According to Leah Willis, Head of Client Relationships (National) at Australian Ethical,

“Responsible investing is now among the top actions investors take to help improve the environment and their community, alongside recycling, reducing energy consumption and minimising waste."

It’s a growing space, with Bloomberg Intelligence’s ESG 2021 Midyear Outlook reporting that global ESG assets under management are likely to surpass $50 trillion by 2025.

“In Australia, RIAA’s annual Responsible Investment Benchmark Report 2021 found that 40% of all professionally managed investments in Australia are now managed using a leading approach to responsible investment. The report found that Responsible Investment Assets Under Management (AUM) increased by $298 billion to $1,281 billion in 2020, while the AUM managed by the remainder of the market decreased by $234 billion to $1,918 billion,” says Willis.

ESG is becoming mainstream

Sarah Brennan, CEO at Investment Trends, said the biggest three surprises to her on the results of the ESG Report 2022 were:

- 75% of people were aware of ESG investing.

- 46% of investors were consciously considering investing this way.

- the age profile of awareness and interest which contradicted stereotypes.

“There tends to be this generalisation that people who are aware of responsible investing tend to be the Zoomers and the younger generation. The thing that I think is quite exciting and, maybe surprised a few people, is it's pretty broad across the generations"

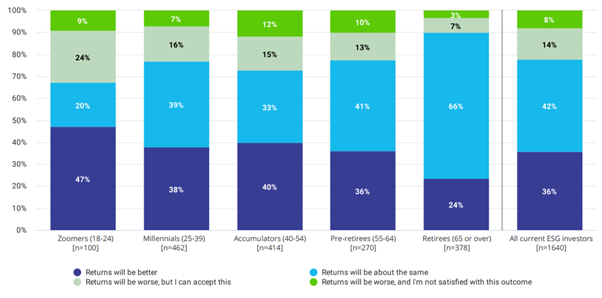

In fact, the results showed slightly higher awareness of responsible investing in those aged 55 years and over (88% compared to 84% for those aged 18-24 years). Older investors also had a more positive view on the likely performance of such investments with 90% of current ESG investors expecting performance to be the same or better compared to the average across all ages of 78%.

How do you believe investing responsibly will impact your portfolio returns in the long run when compared with investing without a responsible lens? By Age. Among current ESG investors

Brennan sees this as being down to a couple of factors, suggesting that younger investors have a longer investment time horizon so performance is less of an immediate focus but also that older investors may have greater access to education, support and experience.

“A high proportion of retirees have an adviser and therefore they’re getting that education side. Also, just by the nature of where they are at in their lifecycle, a higher proportion of money invested, and based on our data, more invested based on ESG, they’ve experienced already that they can and will do ok. If you’re already investing based on your principles for responsible investing, you’re actually seeing the outcomes already.”

Financial advisers are noticing the change, with 57% surveyed by Investment Trends experiencing increased client demand. In fact, 55% of adviser flows to responsible investments are client-driven. Many advisers see the trend as not just a positive for the environment and community (58%) but also in terms of better client engagement with their investments (62%). After all, if clients care about the issues they are invested in, they might take more interest in the ins and outs of their portfolios.

According to Willis, the increasing work done by financial advisers on this front has also been reflected in their own client base.

“Where growth and interest in responsible investing has traditionally been primarily driven by investors, we’re starting to see portfolio allocations to responsible investing driven increasingly by advisers.”

Watching the headlines

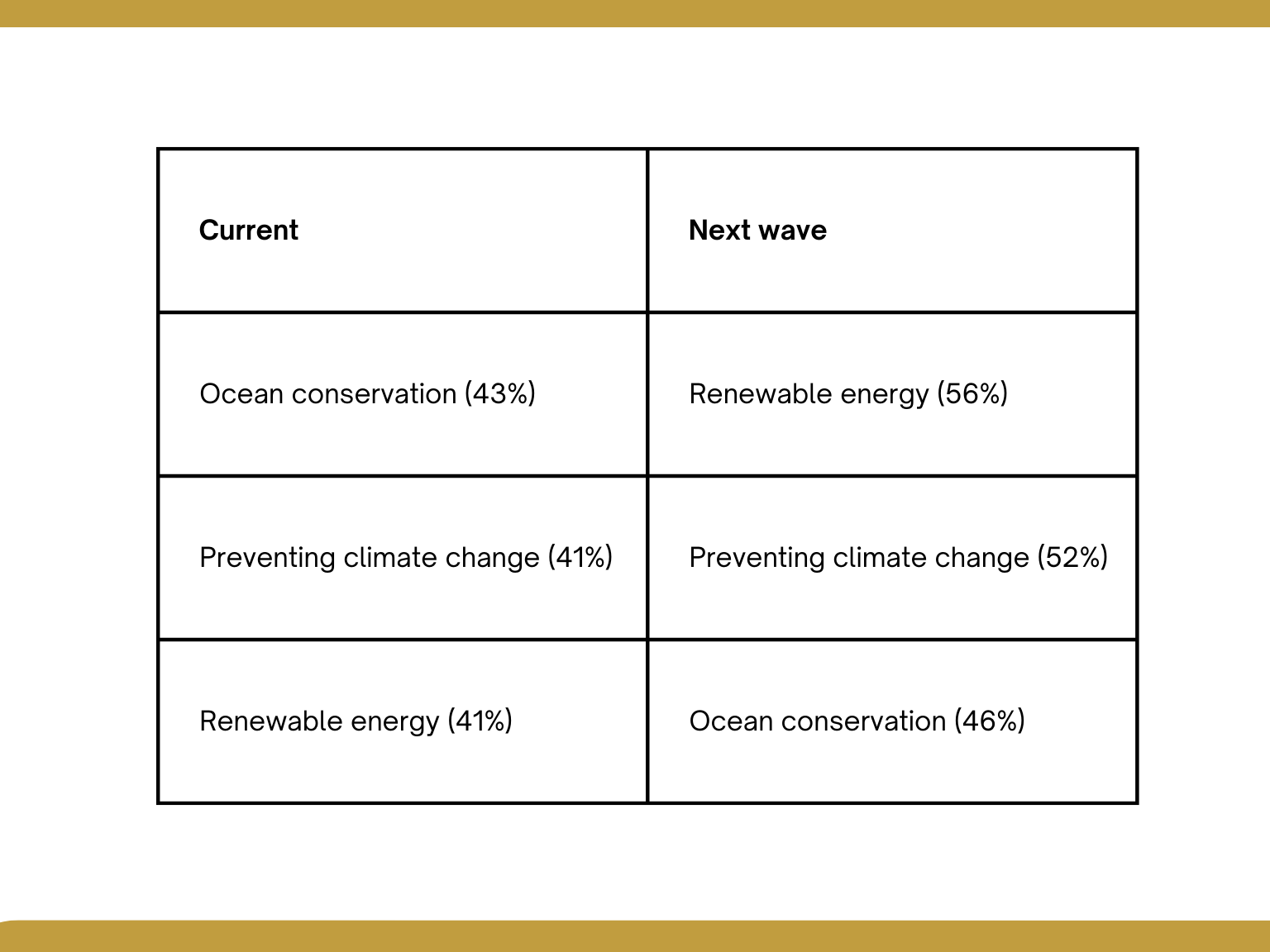

The environment forms the largest focus of concern for investors with the top three areas investors want to support and are seeking investment options for including renewable energy, ocean conservation and preventing climate change.

This is probably not surprising when you look at the past few years – Australia has experienced droughts, floods and bushfires in a very short space of time, while there have been a number of protests over climate concerns held globally.

“Talking to advisers, post the bushfires a couple of years ago, there was a real increase in questions around responsible investing and the opportunity for impact” says Brennan.

It’s a great opportunity for product issuers to own a space that investors are currently searching for options on.

Top concerns of current and next wave ESG investors

This focus was reflected when Investment Trends interviewed financial advisers about the concerns their clients had, with 53% noting that renewable energy had come up in conversation, followed by climate change and fossil fuels (51% for both).

“We are seeing the view coming through from retirees that they're investing, not just for them, but they're investing for the next generation and that's one of the reasons why they see responsible investing as so important. It might not change something next year, but it will change stuff for the future. That's good for their kids and grandkids,” said Brennan.

The challenges of responsible investing

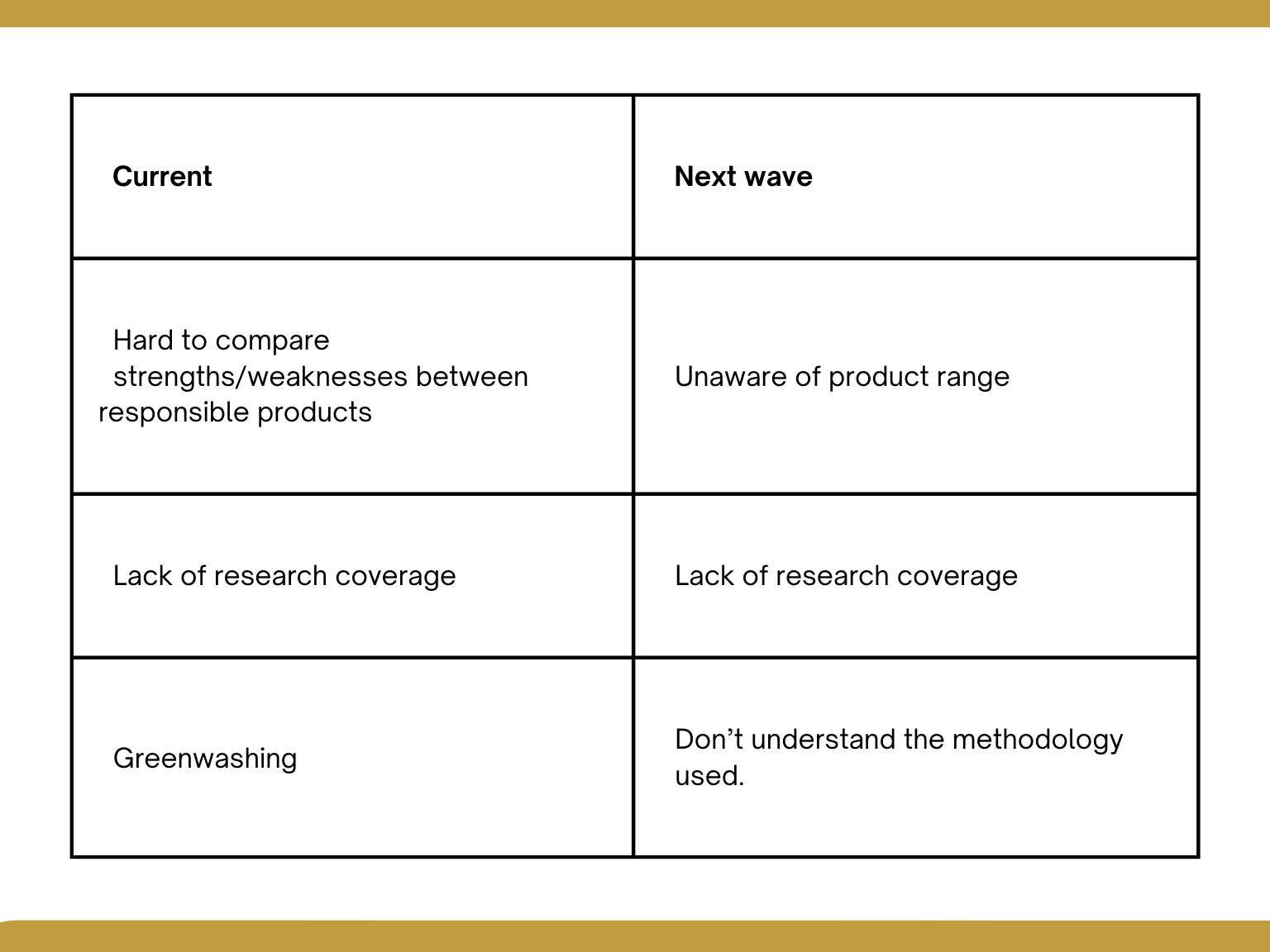

According to financial advisers, the top three challenges for recommending responsible investment products are:

- greenwashing

- lack of standards on terminology

- limited availability on platforms.

For the unfamiliar, greenwashing is where a company makes false or misleading claims about their green credentials to encourage customers to use them. It has become more common as global consumers have become more educated about responsible and sustainable activities – but the good news is that many countries have been policing this behaviour. Australia is no exception. ASIC undertook a review of superannuation and investment products and released an information sheet to assist issuers in avoiding greenwashing when offering or promoting products.

“The ASX also recently warned companies against using the market's disclosure system to make unnecessary or misleading statements that overstate climate and emission reduction achievements,” says Willis.

It’s worth drawing attention to last year’s standout concern. Just under 40% of advisers saw a limited range of investment managers as a major challenge. This year, the number has more than halved, perhaps testament to increased access in the market as well as work done by providers like Australian Ethical to educate investors.

According to Willis, “Australian Ethical has also been increasing its investment in support for advisers who wish to meet the growing demand for ethical investment. This includes a new adviser resource hub, extending the adviser team to provide national coverage, and a new online resource to help advisers talk about climate with clients.”

Current investors share this view that greenwashing is a barrier to investment, but also find the lack of research coverage a challenge.

Barriers to investing in responsible products.

There’s also a challenge in how exactly to present information about performance of ESG investments – investors have very different expectations here according to Brennan.

“That's definitely a trend that's very much emerging of how do we report, not just what I've bought and sold and the returns, but how do I report the impact that my decisions have contributed? The challenge with that is that, just as with looking at investment returns, we should be looking at the long term but we live in a world of instant gratification.”

Leading the charge: top of mind investments

The most popular way for investors to access responsible investments has been actively managed funds and active ETFs. This makes sense from a few angles.

- Using active managers mean the research is done for you. You can set and forget.

- A fear of greenwashing may mean investors find it harder to use direct shares as an ESG strategy.

- Most advised portfolio models will make use of managed investments.

There are slight differences in the way investors and financial advisers approach selecting responsible investments. Financial advisers rank competitive fees, track record and an investment philosophy that aligns with the client’s views as the top selection factors.

In the case of investors, brand reputation has overtaken track record in the space of a year as the top factor for 53% of those surveyed. Investors also want the investment to be easy to buy and sell. From this perspective, it makes sense that ETFs have been a popular investment choice.

The three brands most commonly recognised for responsible investments by financial advisers and investors were Australian Ethical, BetaShares and Vanguard. Nearly 30% of financial advisers had recommended products from either Australian Ethical or BetaShares (or both) in the past 12 months.

The changing face of the investment landscape

It’s easy to forget how quickly awareness of ESG investing and availability of responsible investments has changed in the past few years. Even across the two years of running the ESG Report, Australian Ethical and Investment Trends has seen positive change. We originally initiated this research with Inv Trends and continue to partner with them to deliver.

This is a trend that is unlikely to drop off.

“Key long-term tailwinds continue in our favour. One significant example is the recent Federal election which has underpinned the community focus on climate, with more ambitious net zero targets in place under the new government, plus also greater expectation going forward of taking climate action supported by the newly elected Teal and Green candidates.” Leah Willis

It may also be a case of getting onboard or being left behind. While ESG investing once carried concerns of accepting poorer performance in order to do good, evidence increasingly suggests otherwise.

Just consider Responsible Investment Association Australasia’s (RIAA) Responsible Investment Super Study 2021 which found leading responsible investing super funds typically outperformed peers over 3,5 and 7 year timeframes. As an example (and noting that past performance is not a reliable indicator of future performance), Australian Ethical’s Balanced Fund was a top quartile performer in the Mercer survey over 3 and 4 years to 31 March 2022 (keep in mind that past performance is not a reliable indicator of future performance).

Considering responsible investing?

Both product issuers and the financial advice industry are rising to the challenge, so we’ll continue to see more investments in this space. For those wanting to make some responsible changes in their own portfolios, a few places you can look include:

- RIAA’s website which also includes product certifications.

- The Responsible Returns website (also an RIAA initiative)

- Your financial adviser

- Product issuer websites, such as Australian Ethical, which include a range of resources.

Investors can put their money where their mouths (or hearts) are – and even better, it doesn’t need to compromise their financial future if they do.

Read more about one of the themes of responsible investing - decarbonisation in our megatrend series: Decarbonisation 2022 | Livewire (livewiremarkets.com)

Create the tomorrow you want to see

More than just hope or ambition, Australian Ethical harness the power of your money to create real change for people, planet and animals while growing your portfolio. Click here to find out more.

4 topics

2 contributors mentioned