ASX 200 to rise, CBA reports $2.4 billion cash profit for Q3, Citi downgrades Perpetual

ASX 200 futures are down 19 points to 7,806, as of 8:25am AEST.

It's likely to be a single stock trade narrative today. The last and largest of the Big Five - Commonwealth Bank - has handed down its Q3 trading update this morning. Elsewhere, REA Group and News Corp as well as Orica have already issued their earnings to market. All of these results are in our ASX Today section in the Wrap.

Elsewhere, we'll get earnings from Light & Wonder. Ampol and Helia are due to hold AGMs and off the back of its special dividend surprise, Westpac trades ex-dividend. And we've already had a broker move that's raising eyebrows.

Let's dive in.

S&P 500 SESSION CHART

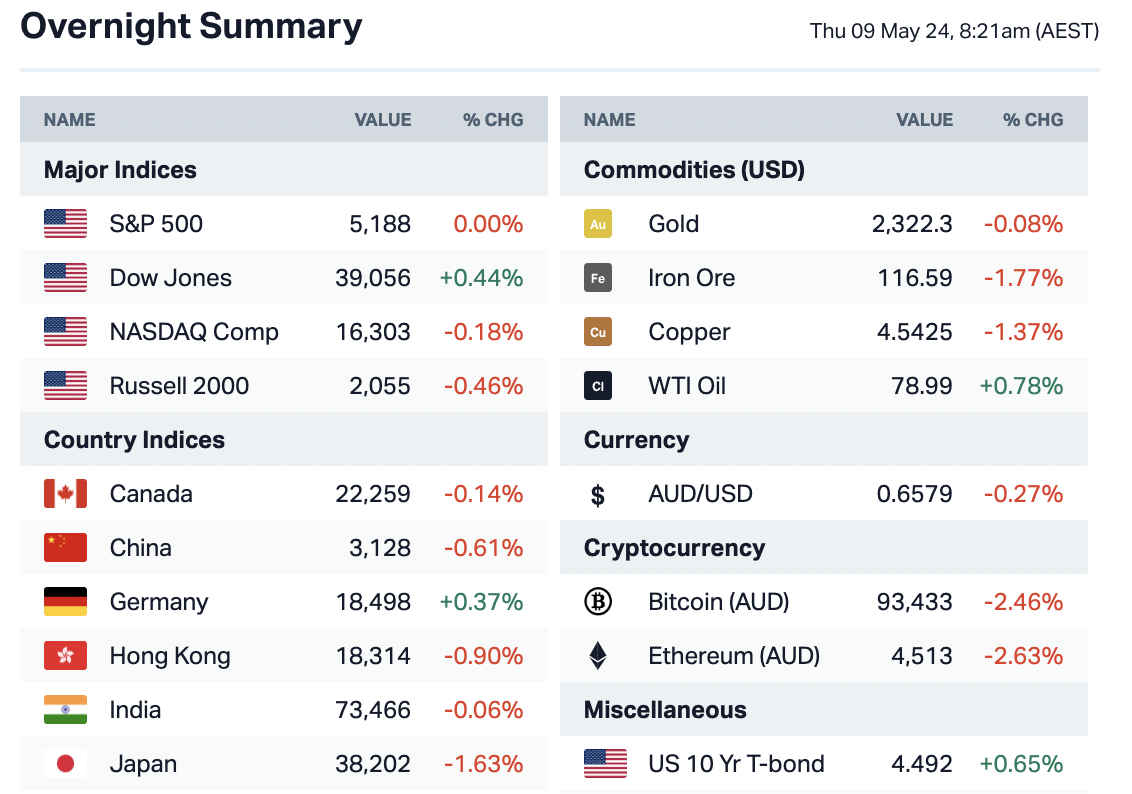

OVERNIGHT MARKETS

- Dow pops more than 170 points to notch sixth positive day and longest win streak in 2024

- European markets close higher as investors react to more earnings; Sweden’s central bank cuts rates

- 10-year Treasury yield inches higher as investors weigh interest rate outlook

- US crude oil recovers losses after surprise stockpile decline

- Gold holds ground as investors await US data for rate-cut clues

INTERNATIONAL STOCKS

- KKR to buy Perpetual's corporate trust and wealth management units for US$1.4B ($2.175B)

- Airbnb expects a stronger summer quarter, spurred by Olympics, but shares fall

- Robinhood’s stock rallies as company swings to profit, drums up more business

- Shopify shares plunge 18% on weak guidance

- Affirm’s upbeat earnings reflect differentiated buy-now-pay-later approach

- AMC’s Q1 loss narrows and ‘better times are ahead’ says CEO Adam Aron

- Chinese iPhone shipments jumped ~12% in March after Apple slashed prices

- Amazon's cloud services breaks into Europe 5G networks with major Telefonica deal

- Boeing supplier Spirit AeroSystems' cash and inventory crisis continue to spiral

CENTRAL BANKS

- BOJ's Ueda in strongest signal yet, hints possible policy action if yen moves impact inflation

- Sweden's central bank enacts 25 bps hawkish rate cut, its first in eight years

- Markets fade chance of RBA rate hike this year, while rate cut calls undermined by strong inflation

ECONOMY

- Booming profits from corporate America may be enough to shield the US economy from a downturn

- Report finds US will triple domestic chip output capacity by 2033, fuelling industry growth

- Stock buybacks soaring to highest level since 2018 in sign corporate America is bullish on the US economy

- Asia Pacific to get big investment for data centre as AI boom goes into overdrive

- German industrial output drops by less than expected in March thanks to construction

- German economic institute expects economy to stagnate in 2024

ASX TODAY

Commonwealth Bank (ASX: CBA) has handed down its Q3 trading update. The numbers are as follows:

- H1 Cash NPAT -3% to approximately $2.4 billion

- Net interest and operating incomes -1% quarter-over-quarter

- Operating performance -5% on the prior quarter due to a small rise in operating expenses (the Bank says it's due to staff costs and higher amortisation)

- CET1 Ratio of 11.9%

-

News Corp (ASX: NWS) and REA Group (ASX: REA) report together, given the latter is owned by the former. Here are the key numbers:

- NWS Q3 revenue -1% year-over-year to US$2.42 billion

- NWS Net income -29% year-over-year to US$42 million

- REA Q3 revenue +15% to US$256 million, could have been US$266 million (or 5% more) if it were not for negative currency fluctuations)

- REA: Residential listing volumes +6% year-over-year, Sydney and Melbourne listings +20% and +18% respectively.

And following news that American funds management giant KKR is going to buy Perpetual (ASX: PPT)'s trustee and advice businesses, Citi has downgraded Perpetual from buy to NEUTRAL with a new price target of $23.25 per share.

Key Events

Companies trading ex-dividend:

Thursday 9 May: Future Generation Australia (FGX) $0.034, United Overseas Australia $0.02

Economic calendar (AEST):

- Tentative – CNY – Trade balance

- 9:00pm -GBP – BoE monetary policy report, MPC official bank rate

- 10:30pm – USD – Unemployment claims

- Tomorrow, 3am – USD – 30-year bond auction

This Morning Wrap was written by Hans Lee and Chris Conway.

2 topics

4 stocks mentioned