Confessions of an amateur stock investor - I bought the top on GME

In the first of what I hope becomes a regular column (provided I can convince my colleagues to reveal their most embarrassing investing stories, or there’s readers out there brave enough to share theirs), I wanted to take a lighthearted look at the other side of investing.

We’re all more than happy to share our own success stories, or hear the same from others in the hopes we can emulate them in future, but what of the times it all goes wrong?

Investing is tough and it’s easy to make mistakes, but there’s just as many lessons to be learned in failure as there are in success.

On a fateful day in January 2021, I made a decision I’m not proud of.

Covid had created a monster in the form of a mob of ravenous retail investors who found themselves with too much time on their hands, nothing to spend their money on and a kind of burning nihilistic animus that could only have been brought about by a global pandemic.

This new movement reached its zenith during the now-infamous GameStop saga, where retail investors took on the titans of Wall Street and won… at least for a time.

For those who somehow missed the story, here’s a quick summary.

During the pandemic, GameStop (NYSE: GME), the struggling brick-and-mortar video game retailer, had attracted the attention of professional investors for the wrong reasons.

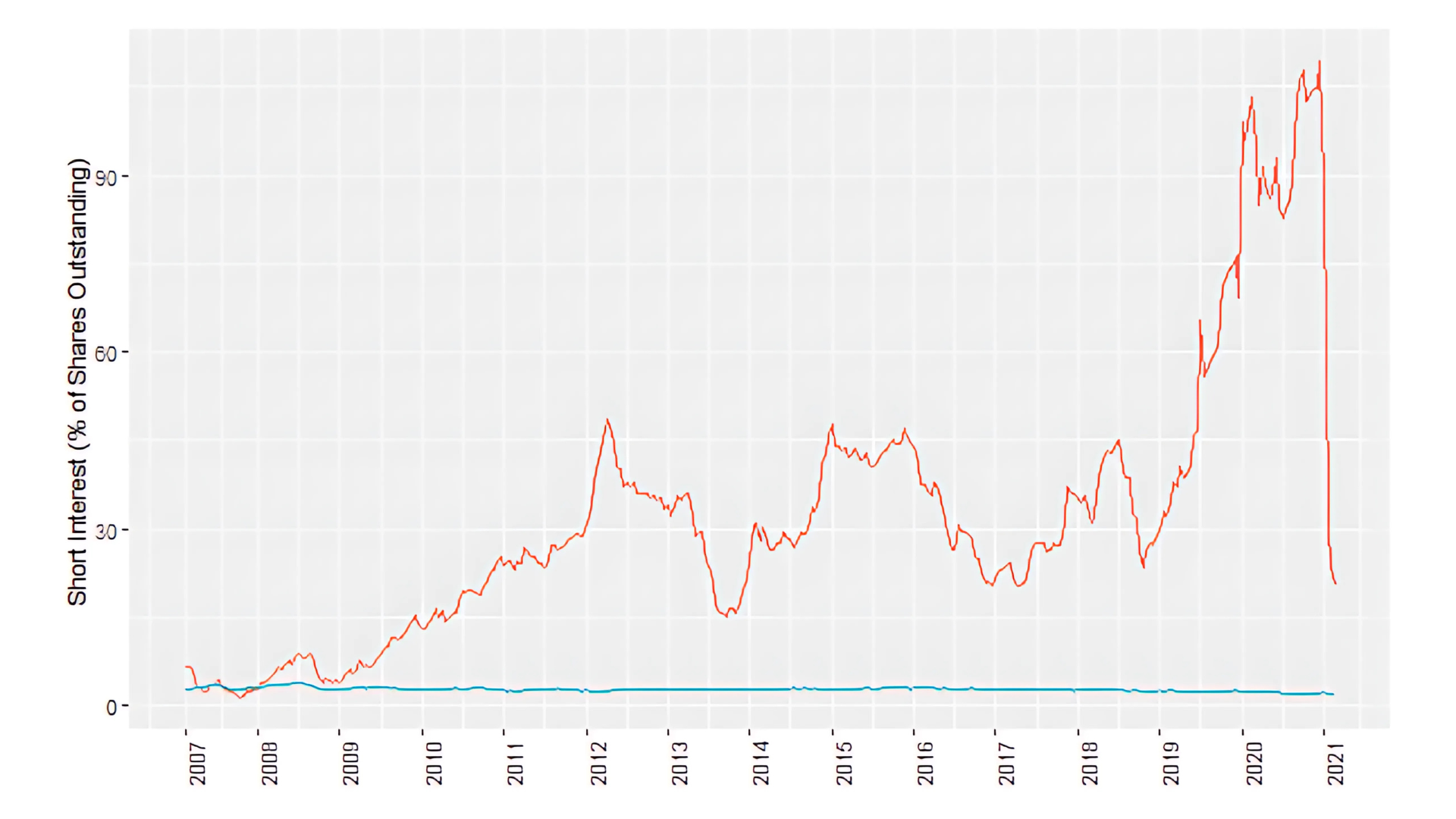

With physical stores closed thanks to lockdowns and the growing threat from digital stores, it looked an easy target for short sellers, and so it proved.

As the story picked up, buying GME became the clarion call for a new generation of activist investors who believed the deck was rigged in favour of the fat cats.

On the first day of trading in 2021, GME closed at a price of US$17.25.

Over the next few weeks, short interest in GME grew as a war of words erupted between GME’s vocal retail investor base and short sellers like Citron Research and Melvin Capital.

By January 22, outstanding short interest on GME stock had reached 140%.

Something had to give.

Those investors then proceeded to put their money where their mouth was, pushing the price of GME higher and higher and even earning the backing of Elon Musk.

On January 27, GME went stratospheric, setting the internet ablaze and making global headlines as it surged past $300 a share.

I had a little bit of money sitting on a trading app, enough to buy a couple of shares in the skyrocketing stock.

I submitted a market order at around US$360 a share, a few percent off the intraday high of $380, and above the close price of $347.

It then reached around US$500 in pre-market the next day, before trading platforms controversially halted buy orders (while keeping sell orders open), stopping the surge in its tracks.

Over the next few days, I then watched my admittedly modest investment drop more than 70% until it became too embarrassing to even look at the price.

The worst part is I still can’t explain why I did it.

I like to think I’m normally relatively good at keeping my emotions in check when investing.

I’m a big adherent of the classic Buffett wisdom of being greedy when others are fearful and fearful when others are greedy.

I can’t remember any other time when I’ve bought the top or sold the bottom on any other investment.

None of the obvious explanations cover it either.

I didn’t like GameStop as a company, and still don’t.

I also didn’t buy any of the bigger conspiracy theories around GME triggering the ultimate short squeeze and sending the share price into the thousands or tens of thousands of dollars.

Or there being some kind of nefarious Wall Street plot to stop that possibility from becoming reality.

I also didn’t feel particularly strongly about sticking it to the hedge funds, which had become the rallying cry for the millions of retail investors that had jumped on the trade.

I even found the whole meme stock movement pretty silly.

I had absolutely no good reason to buy GME… and yet I did so anyway.

If I had to put the decision down to anything, I think it would be an overwhelming sense of FOMO (fear of missing out).

Not FOMO around missing the opportunity to make money, but simply FOMO around not being involved in what was one of the strangest moments in stock market history.

I believe I still technically own the shares, which are now worth next to nothing, but uninstalled the trading app years ago and have long forgotten my login details.

The only remaining evidence I have that proves I really did “invest” in GME is the yearly email I get reminding me to vote at the GameStop annual meeting - which now serves as a humbling reminder of the dangers of getting caught up in the moment.

Got an investing confession you'd like to share? Leave it in the comments below or email me at tom.stelzer@livewiremarkets.com

3 topics

1 stock mentioned