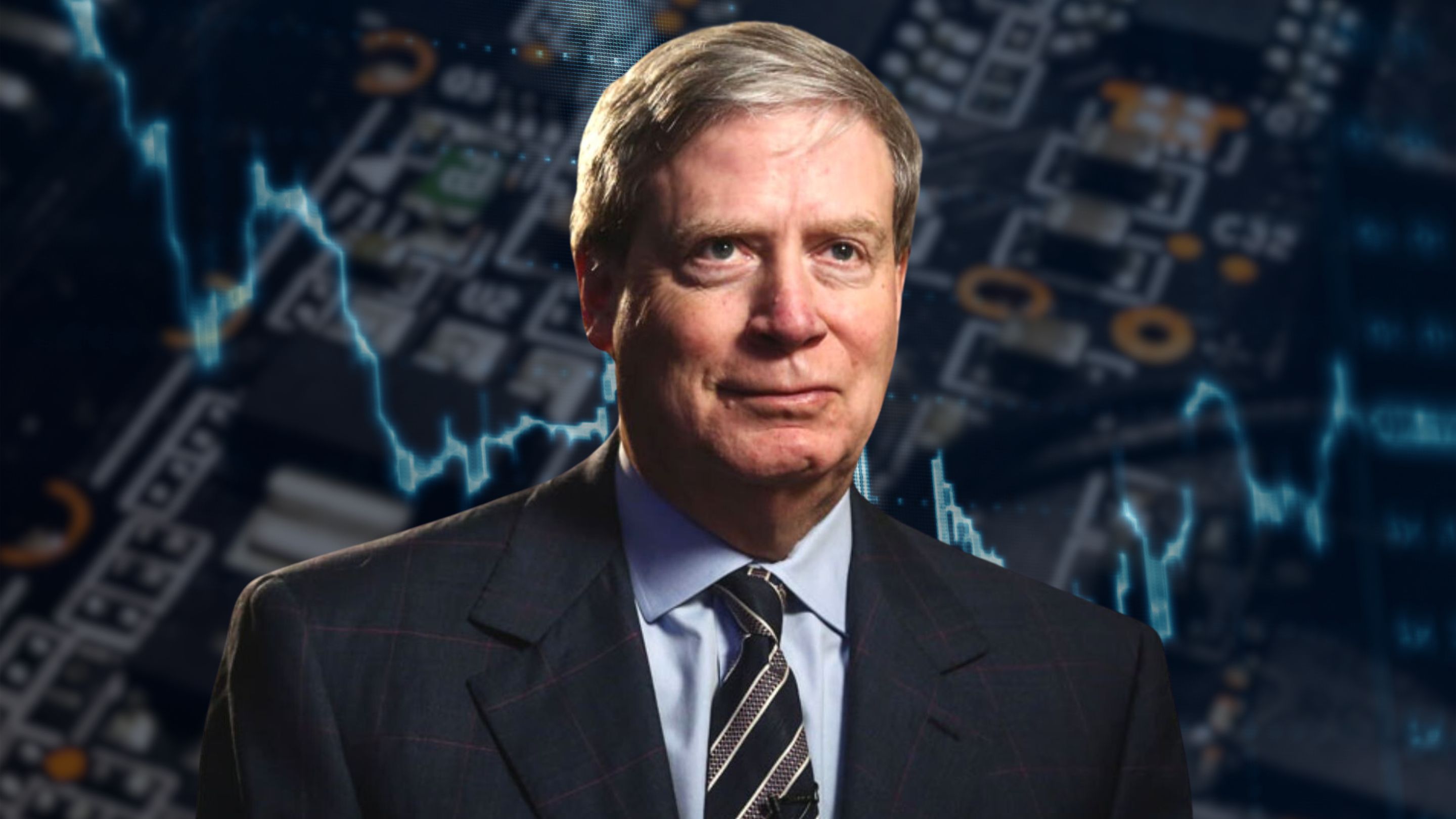

Famed investor Stanley Druckenmiller slashes his stake in NVIDIA

Billionaire investor Stanley Druckenmiller has revealed he cut his position in NVIDIA (NASDAQ: NVDA) during an interview with CNBC on Tuesday night, arguing artificial intelligence (AI) may be a "little overhyped now".

Druckenmiller's family office, Duquesne Capital Management, bought NVIDIA shares in late 2022, at just $150 a share, on the back of a recommendation of one of the firm's younger partners.

A month later, ChatGPT was released to the public and, as revealed in the interview, this led Druckenmiller to increase his position "substantially".

"Even an old guy like me could figure out what that meant," he said.

"But when the stock went from $150 to $900 - I'm not Warren Buffett, I don't own things for 10 or 20 years - we did cut that position and a lot of other positions in late March... We've had a hell of a run. A lot of what we recognised has become recognised by the market now."

NVIDIA's share price has soared more than 210% higher over the past 12 months. It is currently trading on a P/E of 76.48 times. Analyst estimates for 2025 have the stock trading at 40.16 times as earnings ramp up further. As it stands, very few investors are betting against the chipmaker, with only 1.21% of its shares on float being shorted. And it seems any sell-down in the stock has been rapidly bought back up again by AI-hungry investors.

That said, Druckenmiller remains bullish as ever on AI over the long term - and argues that it could be as big as the internet. He believes capital expenditure in artificial intelligence will eventually lead to a payoff, but that could be four to five years from now.

"AI might be a little overhyped now but underhyped long term,"

he said.

.jpg)

It comes after the US Federal Reserve announced it would keep rates on hold at 5.25-5.5% last week, as inflation continues to remain stubbornly above its targets. In December, Jerome Powell teased that the monetary policy tightening cycle was likely over, with cash rate cuts coming on the horizon.

"It seemed to me the Fed was in a perfect position - inflation was coming down, financial conditions were tightening - and to some extent, I feel like they fumbled on the five-yard line with the game on the line," Druckenmiller said.

"I remember saying to some of my partners, that's the speech I thought we might hear in March, as opposed to now, because there are like four or five more months that could potentially lead to inflation coming down the way they needed it to come down. Instead, they set financial conditions on fire again."

Bitcoin prices have lifted nearly 50% since the US central bank's December pivot announcement, while equities and credit have equally raced higher.

"Why are we even talking about cuts? If you remember, we did trillions of dollars of QE because [inflation] was 1.7% instead of 2% over a decade. But somehow, now that we are at 3% versus 2%, we've got to start cutting rates to bring in a smooth landing? To me, it didn't make any sense. It was a huge mistake," Druckenmiller said.

While Powell has somewhat pivoted since December - and although further hikes are not on the table - Druckenmiller worries that forward guidance is putting the Fed in a bind.

"I don't know where inflation is going to be in a year. Jerome Powell doesn't know where inflation is going to be. I don't think anybody knows. But they worked so hard and they did so much work when they went from basically 0% to 5%, I'd hate to see them all throw it away here," he said.

"I would rather they just get rid of forward guidance and do their job."

4 topics

1 stock mentioned

.png)

.png)