How to invest $1 million in 2024

Each year, Barron's releases a list of Australia's Top 100 Financial Advisers. Pitcher Partners' Charlie Viola and Lipman Burgon & Partners' Paul Burgon have featured high on this list over the years, and both ranked in the top 10 in 2023.

As part of Livewire's Outlook Series for 2024, I had the opportunity to host an in-depth panel discussion exploring how these two investing gurus are allocating capital on behalf of their clients over the year ahead.

Whilst there is no 'one size fits all' when it comes to investing, there are nuggets of insight from this session that can help all investors - no matter the size of your nest egg.

In this wire, I'll highlight the key themes that caught my attention. However, I strongly recommend watching the panel session to capture all the value.

Listen & Follow

Time codes

- 0:00 - Introducing the experts

- 0:49 - Charlie Viola’s top three factors influencing asset allocation in 2024

- 3:20 - Paul Burgon’s top three factors influencing asset allocation in 2024

- 6:15 - Asset classes where Paul and Charlie are overweight or underweight

- 9:53 - Why Private Markets will play a bigger role in portfolios in 2024 and beyond

- 12:40 - Charlie Viola’s Asset Allocation framework for 2024

- 16:33 - Paul’s Strategic and Tactical Asset Allocation frameworks for 2024

- 22:26 - How these advisers are innovating in 2024

- 25:50 - Four investing traps to avoid in 2024

What will most significantly impact investment returns in 2024 and beyond?

Will it be how much exposure you have to "The Magnificent Seven"? Could it be an outsized allocation to small-cap stocks long overdue for a turnaround? Or will holding traditional fixed-income assets insulate your portfolio from the volatility that lies ahead?

According to Charlie Viola and Paul Burgon, taking control of your emotions is the most important thing to get right and is one of the critical roles they play when helping clients.

"Our view is that investor behaviour is the number one driver of returns. If we get the investor behaviour right … we think you're going to get really consistent, long-term outcomes for the clients," Burgon says.

Short-term influences like volatility, alarming headlines, or a stock tip from a friend at the golf course can cause you to take actions that undermine your investment plan. Well-thought-out asset allocation is designed to see you through those periods of volatility. If you are constantly chopping and changing, the plan can't (and won’t) work.

Clarifying what you can handle regarding volatility and committing to your plan is essential for long-term investing success.

The top three factors to consider when building a portfolio in 2024

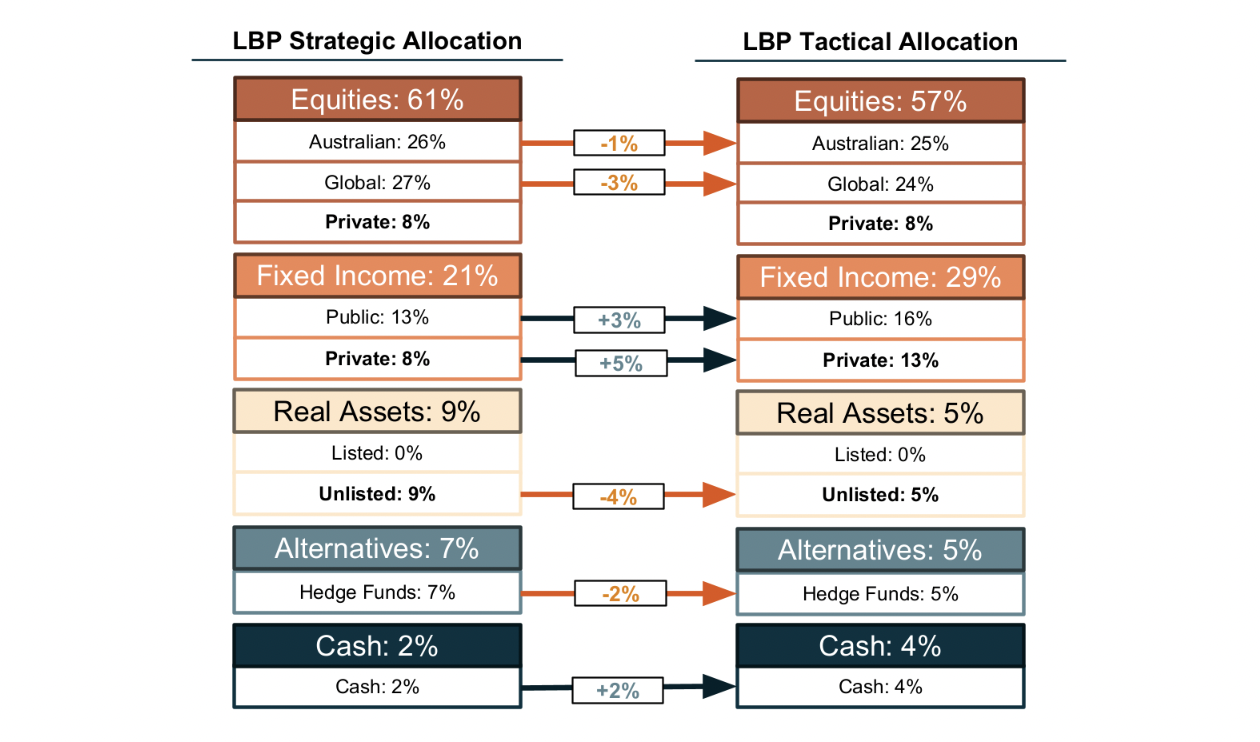

Advisers typically work from a strategic asset allocation, providing a framework for tactical allocations that increase (overweight) or decrease (underweight) exposure to the different asset classes.

These overweight and underweight tilts are determined based on how they view the macro outlook and the opportunity set across asset classes. Relative valuations between asset classes, the macroeconomic environment and the growth of private markets are three dominant factors influencing tactical allocations in 2024.

#1 Equity valuations look unattractive relative to bonds

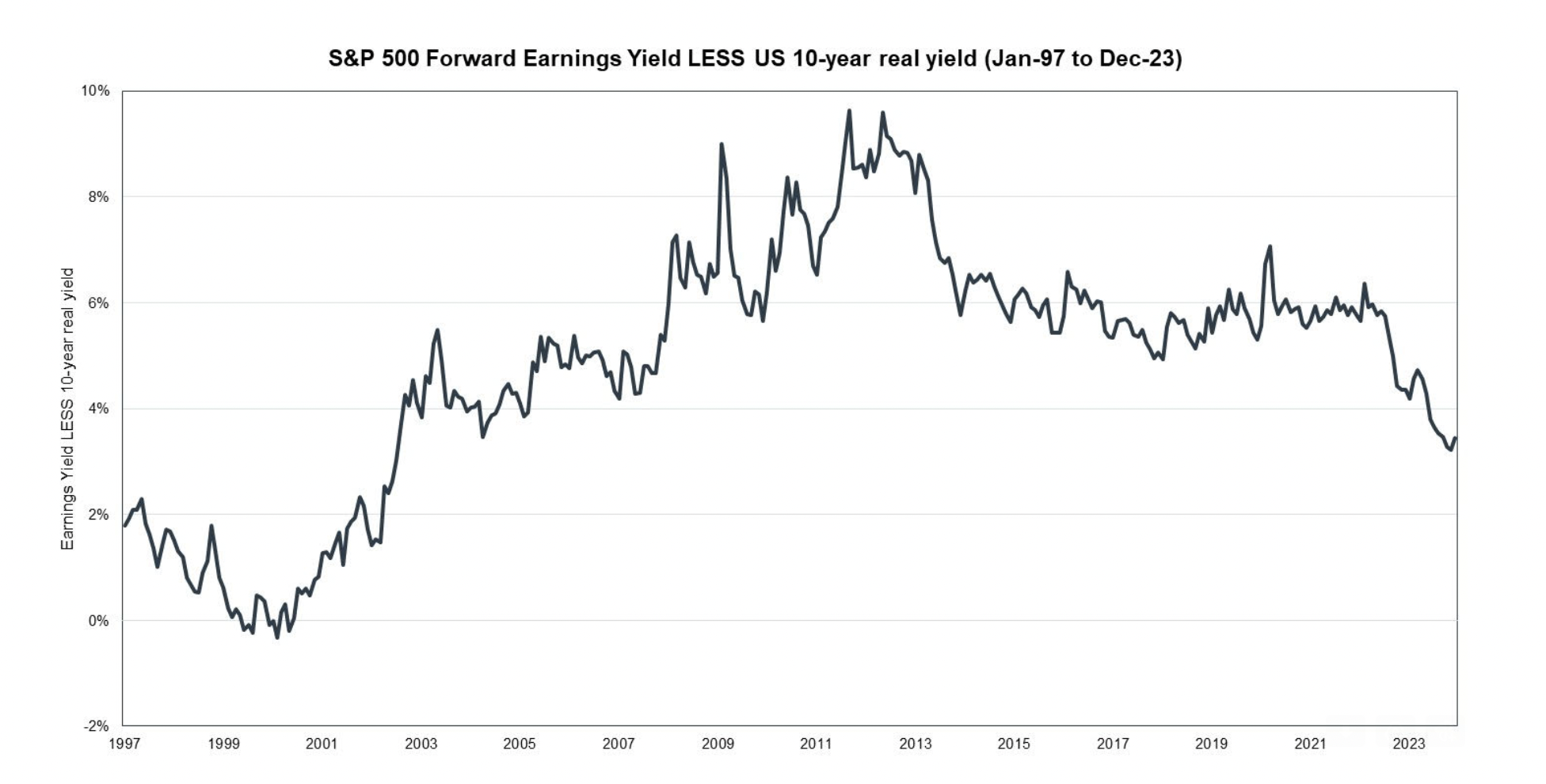

Viola provided the chart above to point out that equity valuations relative to bonds are at the worst level in 20 years. Typically, investors would receive a premium for taking the additional risk of investing in equities. That premium isn't available today, and that is why Viola is holding an underweight allocation to equities.

"We're looking to be underweight equities at this point and waiting for weakness in markets before we dive back into equity markets," Viola says.

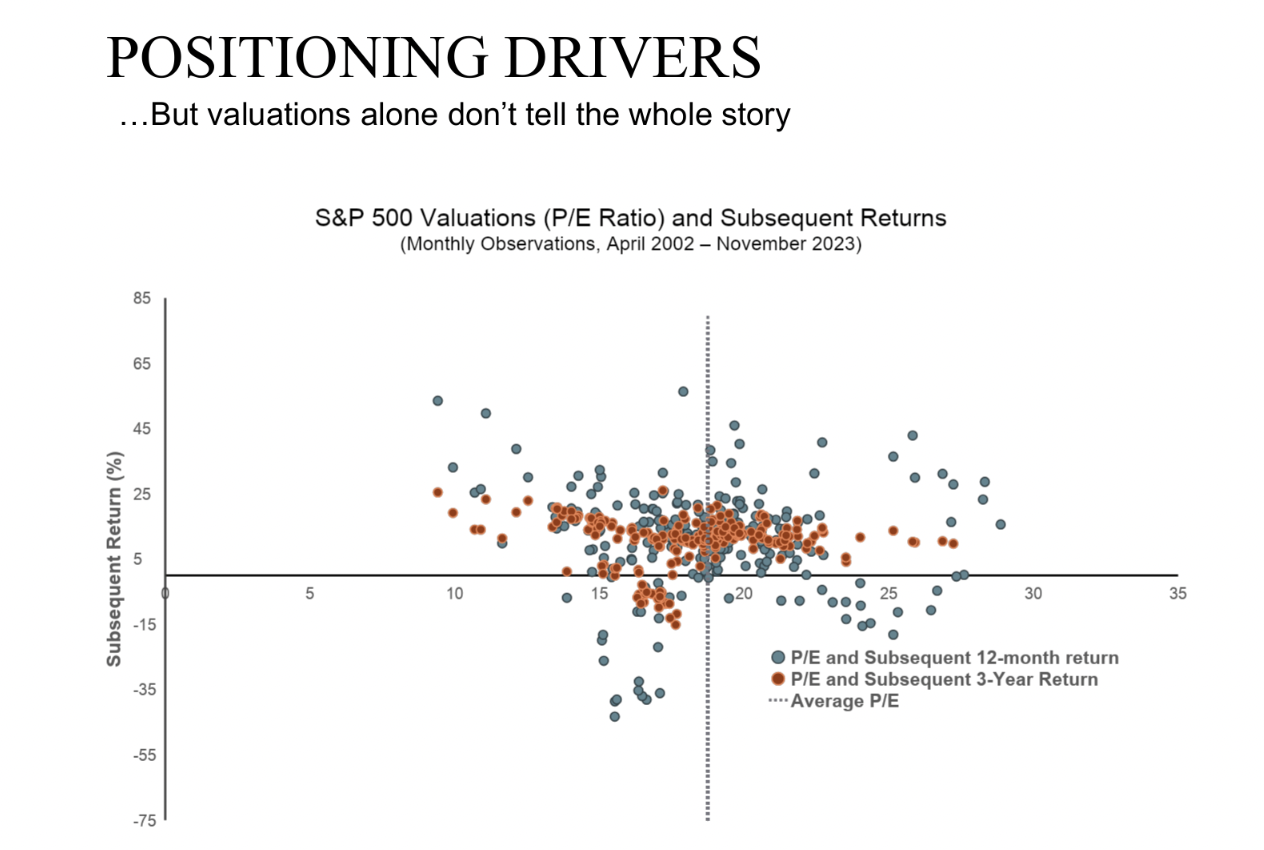

Burgon is a little more confident about the outlook for equities, although he agrees that they look expensive relative to bonds. He uses the chart below to help illustrate that valuations alone are a poor indicator of future returns. If valuations were a good indicator of future returns, there would be a clear trend on the graph; this is not the case. Equities can stay expensive and cheap for long periods of time.

Burgon agrees with Viola’s view that fixed-income assets look attractive relative to equities, and that is where his firm has an overweight position. In addition to providing attractive returns, Burgon believes that bonds have regained their defensive characteristics and can help offset volatility in risk assets such as equities and credit.

"We've got bonds at yields of 10-year highs, we've got private credit that's paying 8-10%, and we've also got bonds that can now play a defensive part in the portfolio. It's natural for us, just putting the macro aside, on a relative value basis, to be overweight in those types of asset classes," Burgon says.

#2 The impact of interest rates and rising unemployment

From a big-picture perspective, Viola and Burgon are waiting to see how global economies respond to the changing interest rate environment. The consensus is that central banks have managed to engineer a soft landing. Neither of our experts, however, is willing to discount the prospect of a bumpy 2024.

Viola believes that investors are baking in expectations that interest rate cuts in 2024 will provide a tailwind for risk assets. He is unconvinced, noting that the S&P500 and NASDAQ are boasting 23.47% and 42% gains for the year to date. With these solid returns and the poor relative valuation to fixed income, Viola is happy to keep some cash on the sidelines in anticipation of weakness.

"We are probably still slightly concerned that those rate cuts may not have the impact that investors want and that markets want. So we might see a bit of disappointment from that perspective," Viola says.

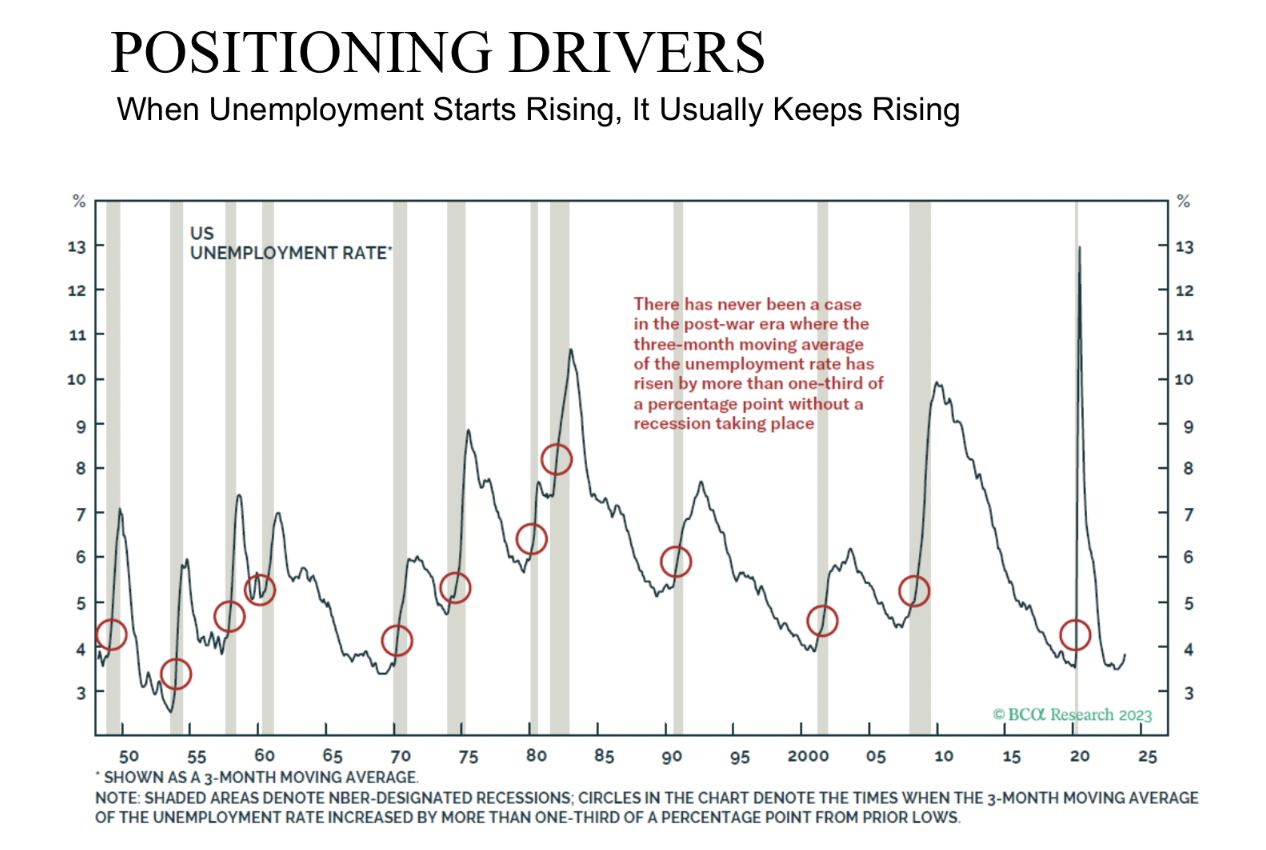

Burgon is also cautious about the economic outlook for 2024 and is paying close attention to unemployment levels in the US. In the post-war era, a strong correlation has been between rising unemployment and recession, as shown in the chart below.

As it becomes harder for people to find jobs, it has a flow-on effect on confidence and spending. This can be hard to pinpoint, but it has a knock-on effect on the economy.

"You don't need any crisis for that to occur ... As people start reducing spending, one person's spending is another person's income; you can see us heading into a recession."

#3 Private Markets are an ever-growing opportunity set

The proportion of clients’ portfolios that get allocated to private markets continues to grow. Viola says allocations have doubled or tripled in the past decade, and he expects them to play a significant role in portfolios.

There are a few reasons provided to explain this shift. Private markets are larger than public markets and present more investable opportunities. Liquidity in private markets has increased significantly as more investors target this space - this means companies no longer need to come to public markets for capital or liquidity.

Burgon explains that the dispersion of returns in private markets is much larger than in public markets. In simple terms, the difference between the best and the worst performers is far greater; therefore, the opportunity to generate better returns is available.

He also argues that the drivers of excess returns are clearer. For example, fund managers might generate returns in private markets from operational expertise rather than simply owning equity and hoping management will do well.

The final point is that private markets don't trade on sentiment like public markets do. Bringing this back to the opening of this article, it effectively removes the emotion and sentiment that is so dominant in public markets.

How would you invest $1 million in 2024?

So, to put the theory into practice, I asked my two guests to share how they would allocate $1 million in 2024. You can see their overweight and underweight allocations in the charts below.

Please remember that these advisers tailor portfolios to their clients' needs, and the allocations below are starting points.

Charlie Viola's Asset Allocation

Asset class callouts

Real Assets: Viola calls out real assets that can generate returns that are independent of the economic cycles. Examples given are good operating real estate such as pubs and marinas that are hard to replace.

Cash: An overweight cash position reflects his view that equities look expensive. This cash would be used to increase equity positions during a selloff.

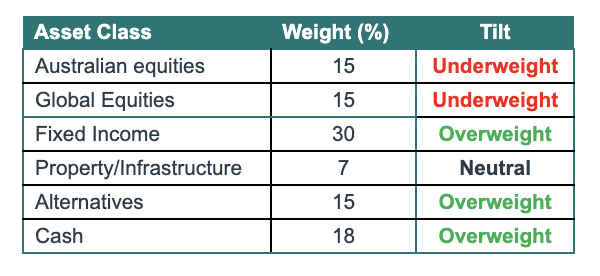

Paul Burgon's Asset Allocation

Asset class callouts

Real Assets: Underweight - Burgon believes the time to buy is when rates start to fall, however, he believes office is an area to avoid

Equities: Burgon is not super negative on equities at the moment, but he does think there is significant risk in the second half of next year.

Alternatives / Crisis Alpha: Burgon says he is planning to introduce an allocation to 'Crisis Alpha' such as hedge funds that can generate returns if risk assets get hit.

Four tips to avoid the potholes in 2024

As much as we all love to think about compounding our investments, the best way is to start avoiding significant losses. On that point, Viola reiterated his cautious stance on global equities. While he expects pockets in artificial intelligence to do well, global equities could struggle overall.

Burgon says investors should be cautious about Wholesale Funds being marketed without a long track record. He adds that whilst private markets are attractive, the wide dispersion of returns means they can also be a minefield. This is an area where professional advice can add significant value.

Burgon's final tip is to avoid the temptation to trade on hot tips.

“Any investment that's brought to you by a friend of yours from the golf club, I'd be exceptionally cautious about,” Burgon says.