The miracle of compound interest

We know, you have probably heard this all before, but it is still one of the most fascinating investing phenomena out there: The miracle of compound interest! Here’s an example...

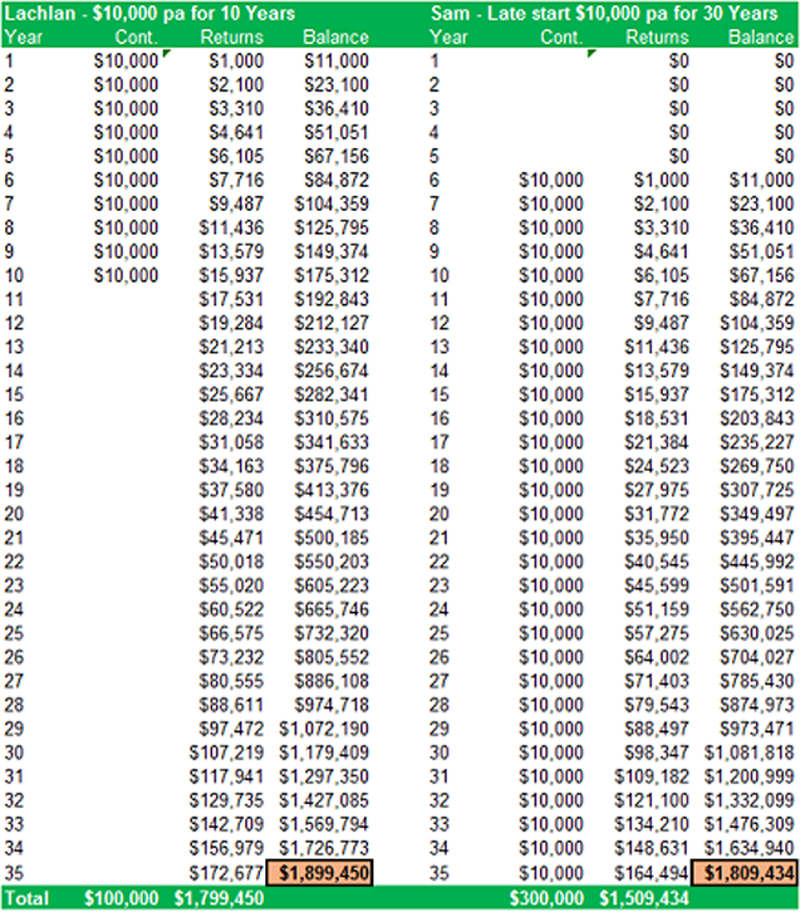

Two friends Lachlan and Sam, both 25, are interested in investing. They both have the potential to save and invest $10,000 per annum, if they scale back their daily purchased coffees, regular expensive nights out and weekend smashed avocado café breakfast.

Lachlan commits right away to investing $10,000 per year in outstanding investments averaging 10% per annum returns, with some sacrifices on his behalf.

Sam, on the other hand procrastinates and puts it off, figuring he will start in the future when he “earns more and can afford it”.

Now the amazing part.

Lachlan invests $10,000 per annum for 10 years, with total contributions of $100,000. Sam eventually starts five years after Lachlan, and invests $10,000 per annum for 30 years, with total contributions of $300,000. The results…after 35 years, Lachlan has a larger investment balance than Sam, even though he only invested $100,000 versus $300,000 for Sam.

No matter how many times we calculate it, we’re always impressed by the difference starting early can make.

Improving long term returns

Of course, that’s all easy to say, and hard to do right? Not necessarily. Here’s the top ways we think all investors can improve their long- term investment performance and harness the power of compound interest:

- People procrastinate – Just like Sam above, people always assume they will start later when they can afford it. Don’t wait, start now! The benefits of starting just one year earlier are massive.

- Stick with it. Make regular, consistent contributions to take advantage of dollar cost averaging. Initially it appears that not much is happening. It’s boring and it’s easy to think that you’re not making much progress, and your resolve to continue is tested. Later, however, things become downright fascinating! From relatively limited contributions early, the annual growth escalates to something quite amazing.

- Consider retiring later, or continuing to work part-time. In many cases continuing to work part-time, particularly for men, has proven to be a better way to adjust to retirement living.

- Don’t lose money. Ever. Over time, many investors have found out the hard way that highly geared investments, complicated funds and poor quality stocks can go to zero. If you have a large portion of your assets in investments such as these, then the consequences can be devastating in a big market correction.

- Focus on finding great investments and investment managers and diversifying properly. Maintain an excellent quality diversified investment portfolio to help avoid both large drawdowns (negative return periods) and sequencing risk (the risk of a large loss at an inopportune time such as just before or after retirement).

- Focus on long term market cycles, rather than making rash short-term decisions.

Diversifying properly

The hardest step in the process is maintaining an excellent quality diversified portfolio. Our best ideas in constructing an investment portfolio are:

Achieve real diversification. Owning all four big banks is not diversification. Own assets from different asset classes, investment styles, investment strategies and geographies. Your portfolio needs to be able to cope with a wide range of potential outcomes, both positive and negative, and perform reasonably in all markets.

Focus on downside risk and draw downs. Everybody loves the stock/fund that goes up 30% in one year. However, you usually don’t hear much about it when it falls 40% the next year. Investing is about consistency and avoiding large draw downs. Imagine a fund that never tops the performance tables in any one year. But, through good times and bad, it always manages to be in the 60%-80% percentile, with no significant draw downs. Over a full market cycle, you can almost guarantee that fund will be near the very top. You don’t need to be the top performer every year, but you must make sure you are never near the bottom.

Make sure you have the best stock brokers, fund managers and advisors working for you. They should be adding more value than the fees they are charging.

A lot of this is not hard and doesn’t take that long. But it could pay huge dividends (pun intended!)

A small effort, for a huge gain

When all is said and done, the investment decisions you make early on in your investing lifetime, and the returns you and your advisors can generate, will have a huge impact on your retirement standard of living.

A small amount of effort regularly can make a huge difference in the end.