The RBA should warn that it could raise rates again

High inflation and a still-tight labour market should see the RBA backtrack on policy and resume warning that it could rate rates again, something that CCI’s analysis has long suggested they should have delivered on last year.

Strong inflation at the start of this year places the RBA in a very uncomfortable bind when it meets next month to revise its outlook and decide on interest rates.

The RBA had recently turned neutral on interest rates, emphasising that it was “not ruling anything in or out”, but now seems likely to backtrack and warn again that the next move in interest rates could be up, with the governor likely regretting that her predecessor did not follow the RBA’s peers and raise rates more last year.

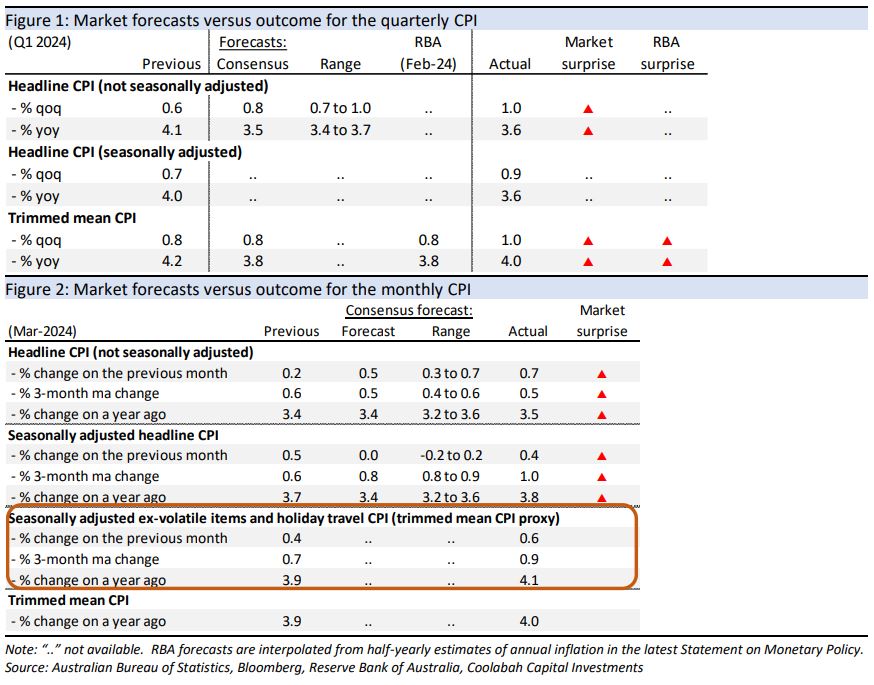

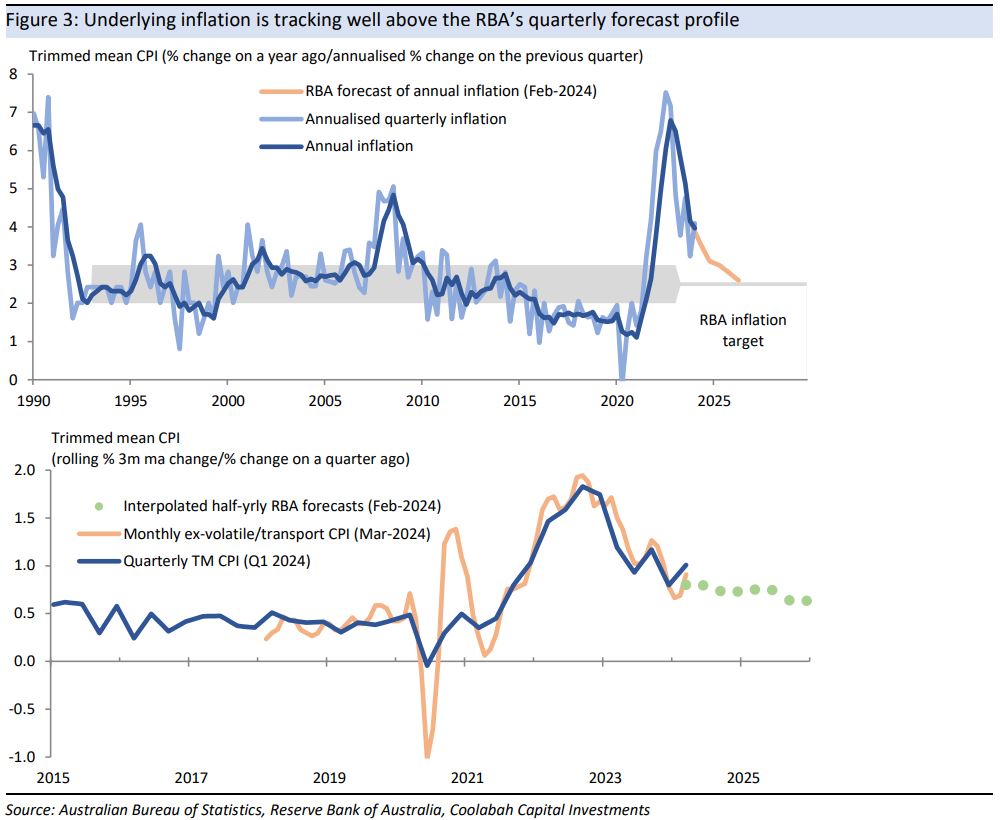

Echoing the experience of several other countries, underlying inflation accelerated in Q1 and is tracking well above the RBA’s forecast profile, with the trimmed mean CPI rising by 1% in Q1 and with the trajectory of the monthly CPI suggesting that it could plausibly increase by 0.9% or more in Q2.

At the same time, the labour market still remains tight in that unemployment of 3¾%, while off its multidecade low of 3½%, remains below the RBA’s 4½% estimate of full employment.

These developments should force RBA staff to revise up near-term forecasts for inflation and employment and temper the expected increase in unemployment when the bank’s outlook is updated in the Statement on Monetary Policy, due the same day as the 7 May interest rate decision.

Higher inflation and a still-tight labour market should trigger an active discussion among board members about whether they need to raise rates further, particularly when there is a risk that it takes longer to return inflation to the newly-mandated midpoint target of 2½%.

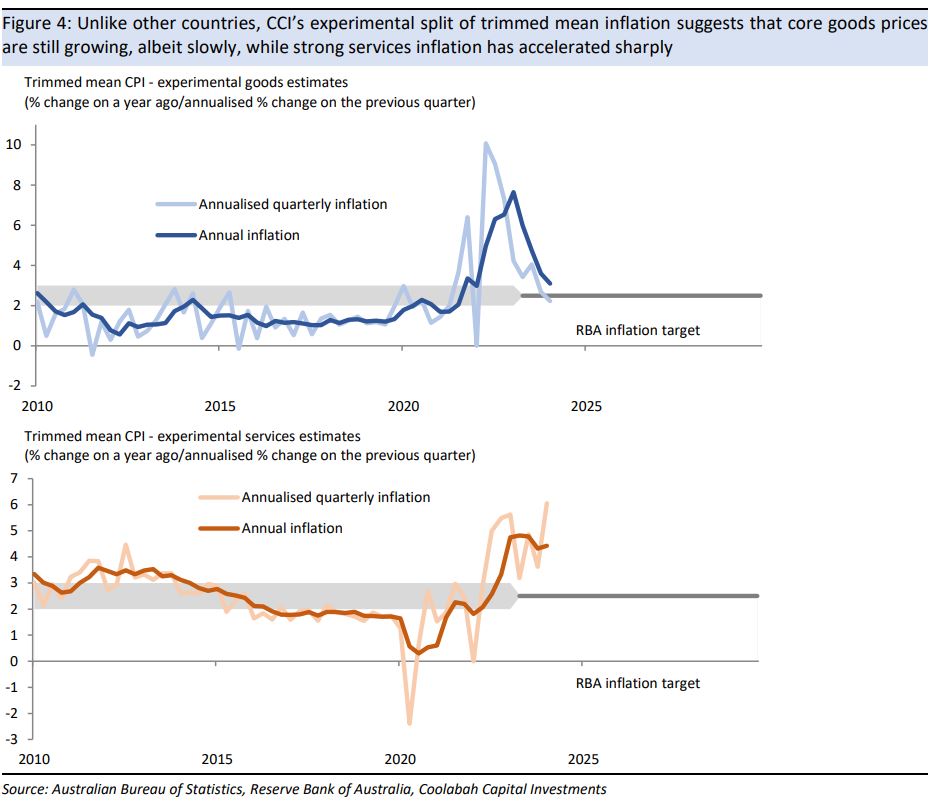

Board members would also be disappointed by the mix of inflation, where CCI's experimental measure split of the trimmed mean CPI points to a rapid acceleration in already-high core services inflation, with slow growth in core goods prices contrasting with the flat-to-down moves seen in other countries.

CCI’s policy rule analysis has long suggested that the RBA should have followed its peers and raised rates to about 5%, but the RBA purposefully decided to raise rates by less than its own outlook would imply in order to limit the damage to unemployment.

Some policy-makers might continue to run that line given weak economic growth, but that view should be challenged by July’s income tax cuts, which are worth $21bn for the financial year as a whole, equating to about ¾% of GDP.

The RBA believes that the rejigging of these cuts towards low- and middle-income taxpayers will not have much effect on the outlook, but there is the clear risk that cash-constrained households spend the money at a time when rising house prices are driving wealth higher and real incomes are past their low point.

4 topics