Why "old cyclical" stocks are worth watching

There is an ongoing debate among portfolio managers and asset allocators when it comes to US vs Global equity allocations...

Some say the US market has it all, no need to bother with global stocks. And armed with hefty helpings of recency bias, they have been right on this view for the past decade — where tech-heavy US equities have strongly outperformed (not to mention a strong US dollar hurting returns of offshore assets).

Yet, proponents say global is cheap (and it is — cheap vs history, cheap vs US), offers diversification benefits, and undergoes long-term cycles of under/out-performance (and after 15-years of underperformance is due for a turn).

But here’s something else to consider…

As noted, the US market is heavily skewed to tech.

Meanwhile, what I call “Old Cyclicals“ (energy, materials, financials, industrials) have been squeezed out to multi-decade low market-cap weightings.

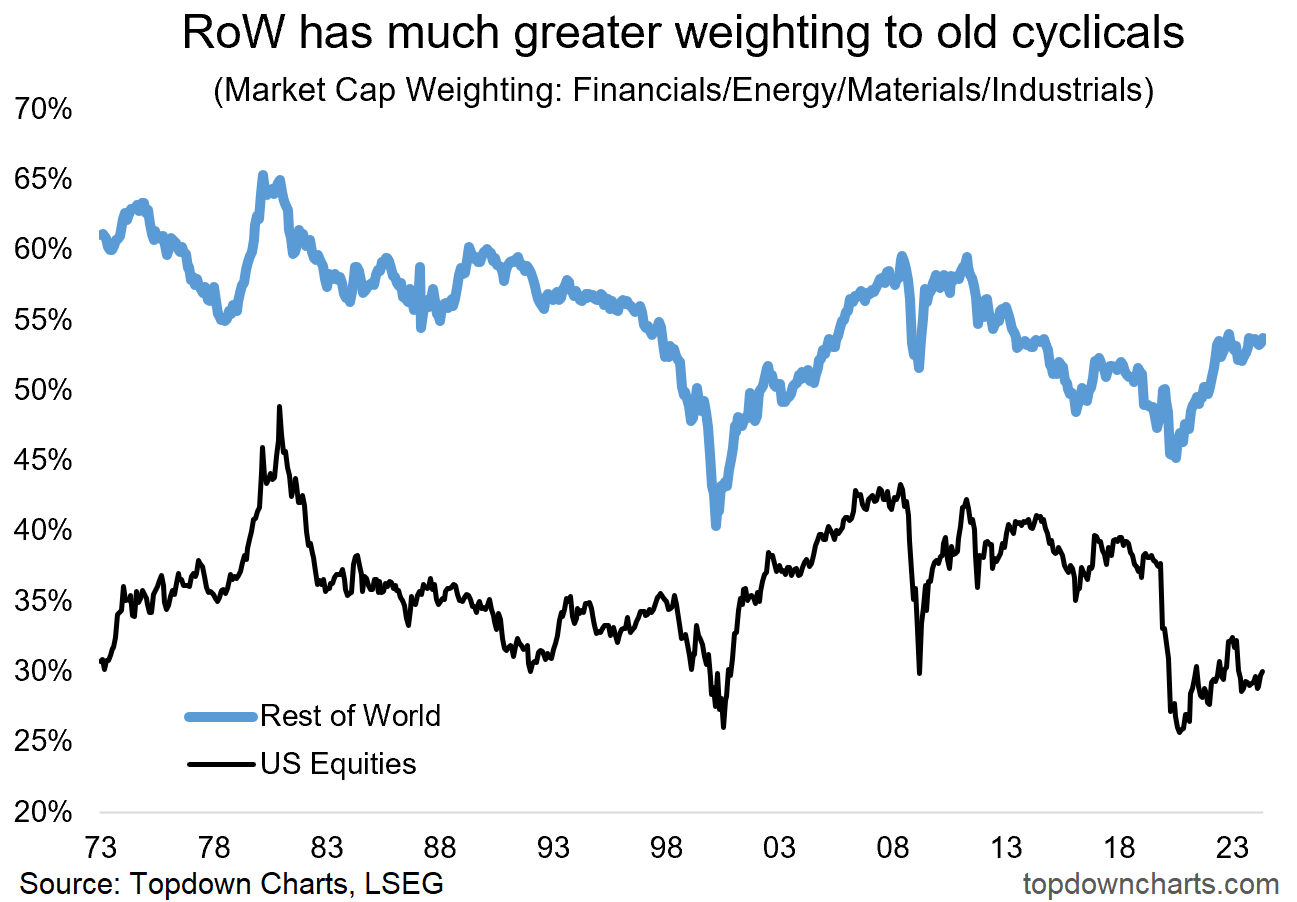

If you look at global stocks though, the weighting to Old Cyclicals is around *twice* that of the USA (see this week’s chart below).

Why do we care about this?

Several key themes are underway right now (global manufacturing reacceleration - restocking, trade rebound; global capex surge - reshoring, energy transition, geopolitics; commodities revival - supply constraints, demand rebound) — these themes will present strong tailwinds to the old cyclical sectors.

Indeed, you can probably make a case for a rotation or transition from services + software to goods + hardware. And this will show up big time in old cyclical relative performance — this is likely to be broadly bullish should these sectors become the new drivers of strength in the stock market.

But looking at this week’s chart, if you think old cyclicals are going to do well, then you want global stocks where the weightings are higher, the valuations are cheaper and flows have been shunned. It’s a bit of a contrarian take, and not something many are talking about, but I sense it will become a key topic of conversation in the coming months…

Key point: Sectors skews are likely to favor global vs US stocks as several macro-thematic tailwinds converge on the “old cyclicals“ sectors.

5 topics