$1 trillion of new mine investment needed

Today’s macroeconomic settings are increasingly supportive of commodity prices, with the impact of enormous fiscal programs globally and the rising threat of inflation already driving significant rises in most commodities. Bellwether commodity, copper, has doubled relative to last year's low, to reach an almost ten-year high.

We recently spoke with Sam Berridge, who is the Portfolio Manager for the Perennial Global Resources Trust in a webinar for our investors, and have pulled out a few highlights for you below. Sam has tilted exposure increasingly toward minerals in the electric vehicle supply chain, and we took the opportunity to understand the drivers and hear about some of his exposures, and why the mining sector needs $1 trillion of new mine investment to achieve climate targets.

Q: You’ve increased the exposure in the fund to the electric vehicle thematic, Sam, can you share your view on the outlook for this theme?

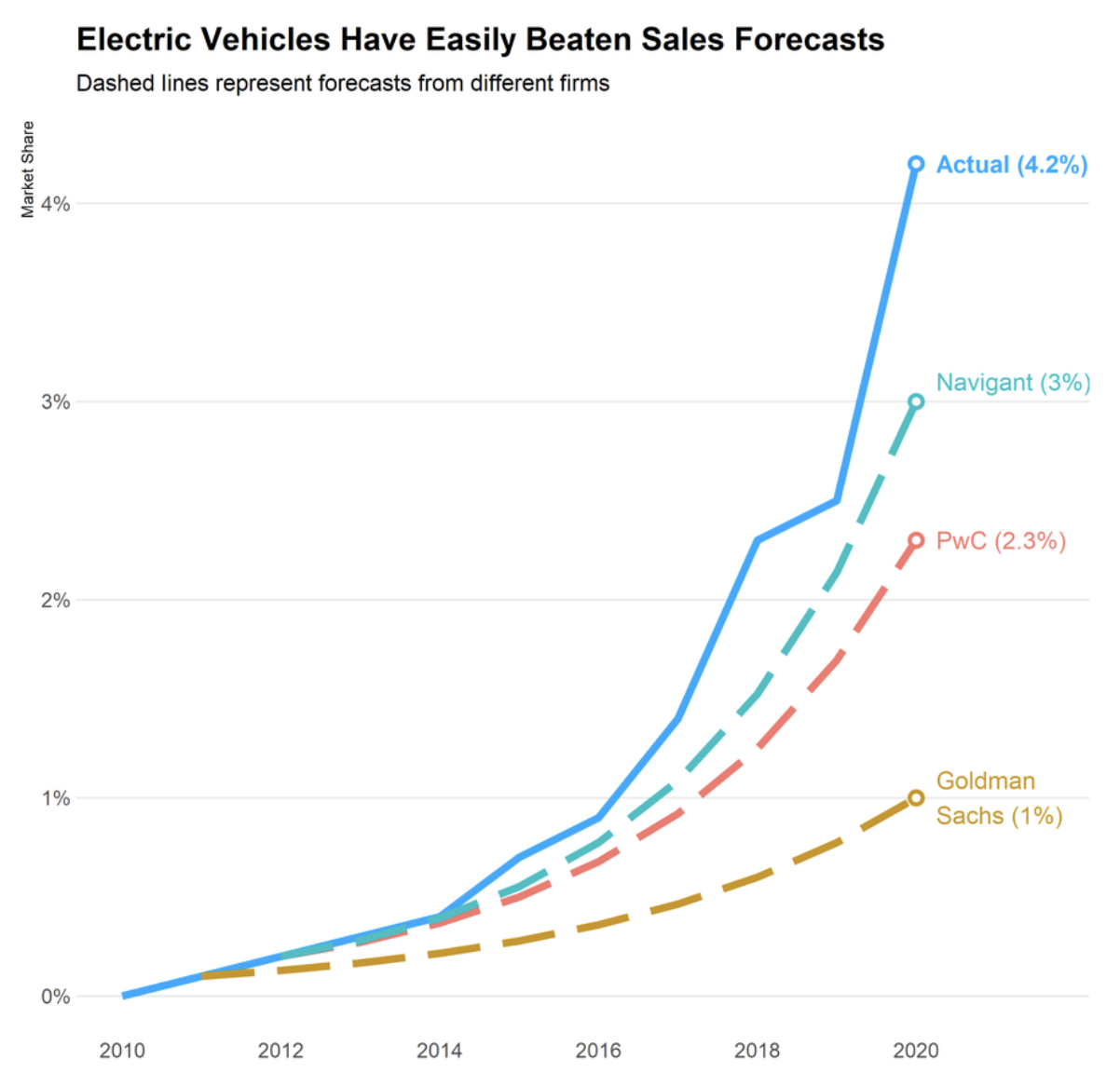

There have been a number of forecasts on EV sales. Now, Goldman Sachs, PWC, Navigant, an industry think tank, they've all been wrong. The actual results are surprising to the upside quite materially, as the image below shows. This should continue to accelerate as the range of EV vehicles on offer continues to expand.

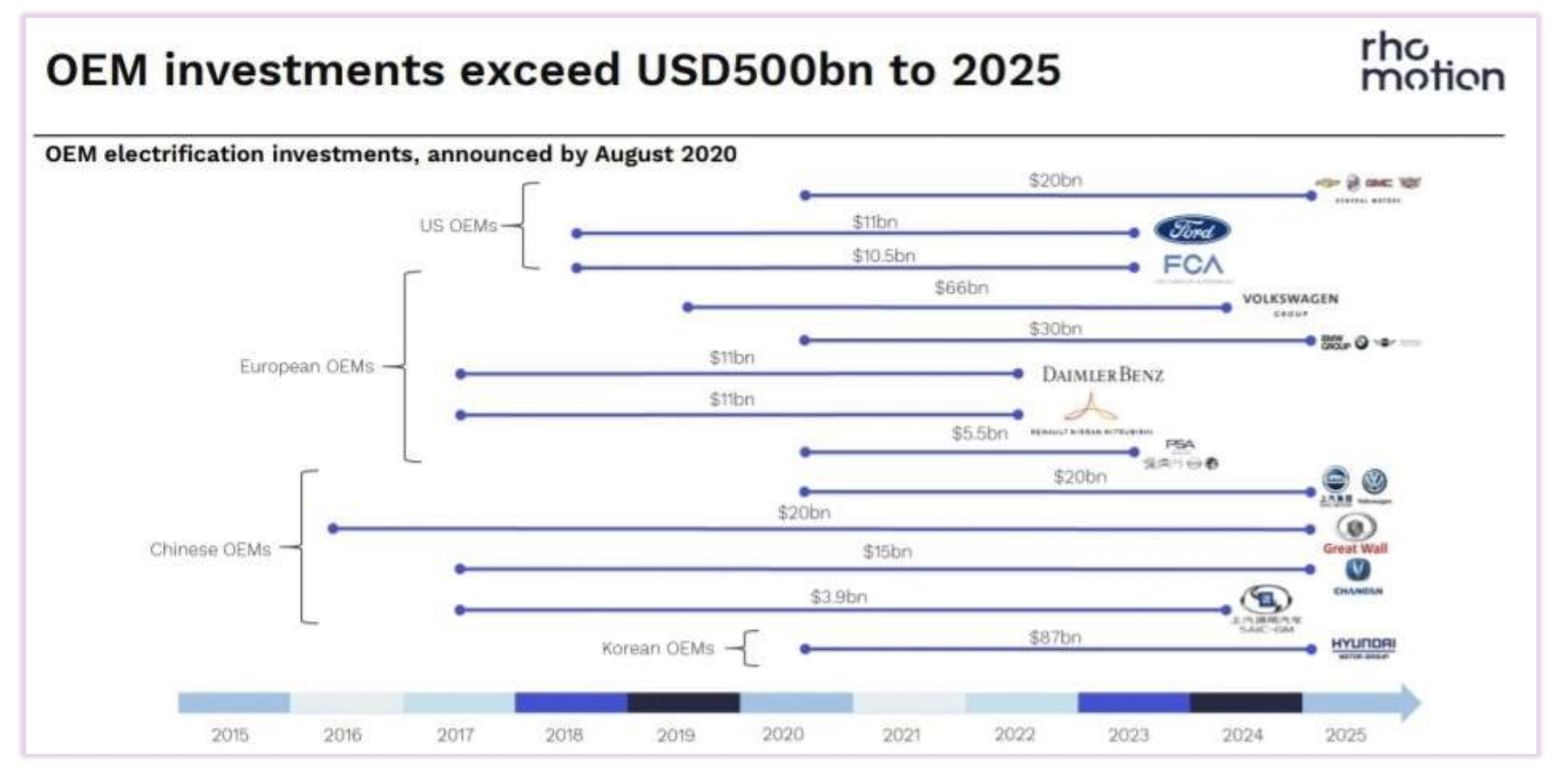

There have been many charts on this thematic, but one of my favourites is this next one by Rho motion, which highlights the expenditure by all the major car companies you've seen over the last five years. These sum up to half a trillion dollars on their EV investments by broadening their range, research and development efforts to meet or to move into this sector.

GM Motors and Volvo recently said their full fleet won't have any internal combustion engines in it by 2035, and they joined Volkswagen and a few of the other major manufacturers who are also heading down that path.

Q: Looking at the decarbonising theme more broadly, what other drivers are there?

The infrastructure that supports these EVs is also going to have to be upgraded. About 90 million barrels a day of oil is being converted into energy at the moment. That's going to have to start running through grids and copper networks over the next 5-10 years and beyond, and it's going to require a lot of metal to upgrade that. This is a longer-term demand thematic, and it will need more mine investment to meet this. Wood Mackenzie put a figure on it in late last year of roughly $1 trillion of new mine investment required to meet their forecast demand by 2035.

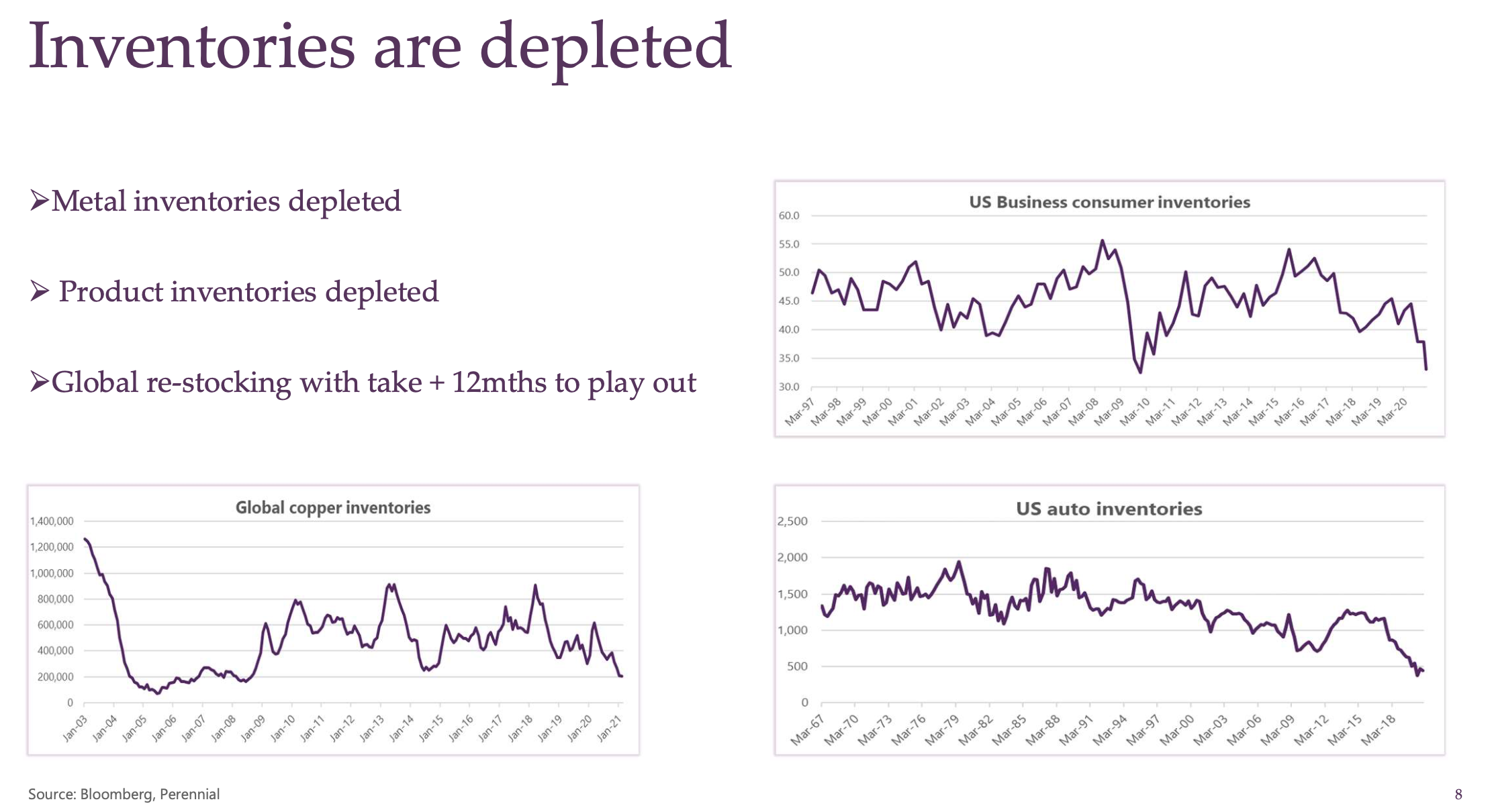

That's a medium to long-term thematic, but in the shorter term what's exercising my mind is the inventory situation. Base metal inventories generally are pretty depleted. Copper's probably looking the more acute out of all of them as the chart below on the left shows.

The inventories of end products are important to monitor too. The two charts on the right (above), show US consumer inventories and auto inventories both at very depressed levels, which is a function of COVID. Going into the pandemic there was a buyer's strike, all the stockists let go of their stock and didn't order any more. The manufacturers themselves slowed down production because all of a sudden demand dried up. Also, they had to shut down production in a lot of cases because COVID was making operation difficult or impossible.

But demand has come back much quicker than people expected, which will put further pressure on the depleted metal inventories.

Q: How well prepared is the mining industry to meet this increased demand?

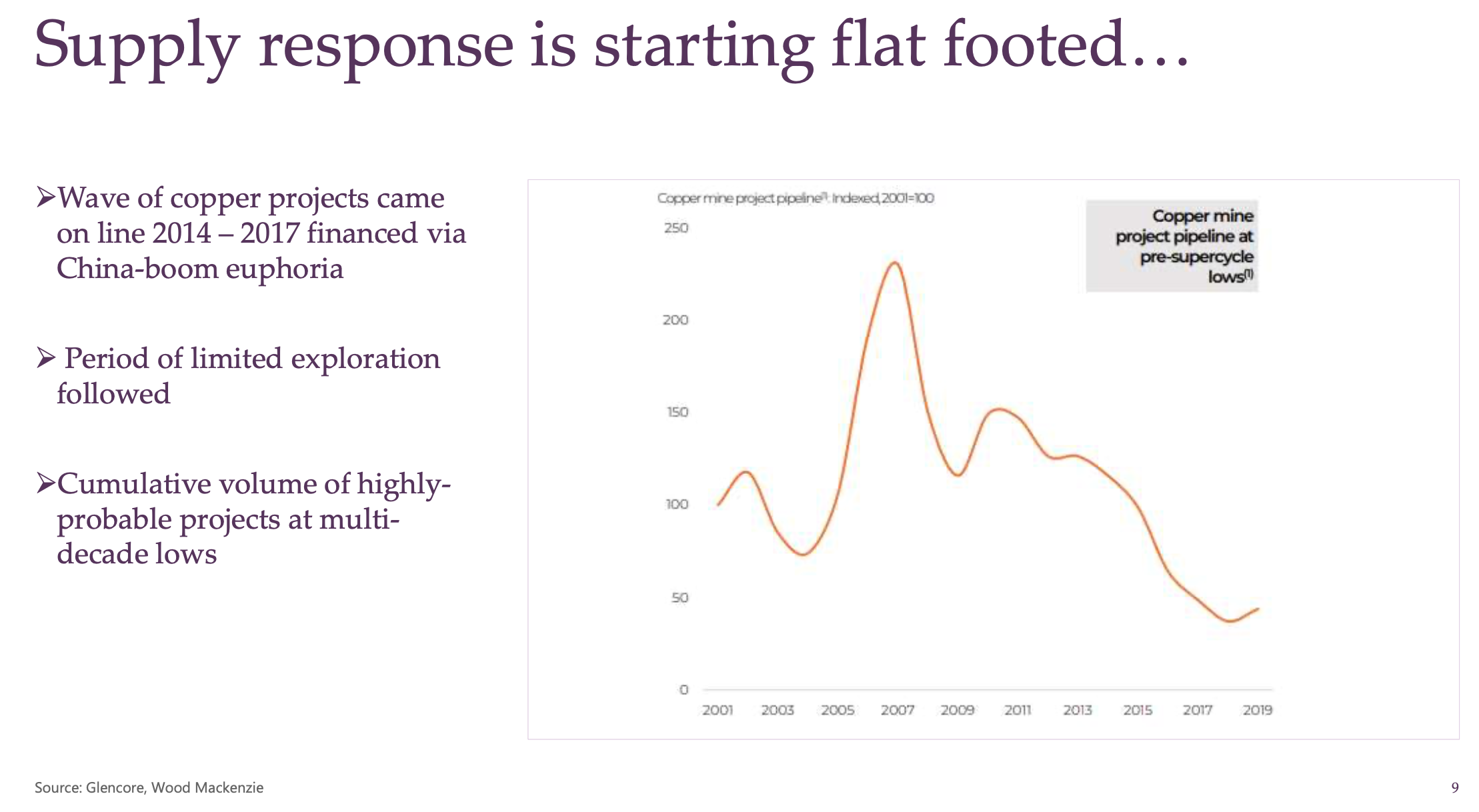

The mining industry is standing very much flat-footed. Looking through the copper lens again, this is a chart from Glencore's recent half-year result, which shows the copper mine project pipeline, i.e.: this is the sum of highly likely projects as forecast from 2019.

The pipeline of new projects is looking very depleted and it's going to take some time for this to be backfilled. As well as the fact that you need to go and find these projects first, the mining industry is facing tightened environmental regulations, local community objections to mining, and the industry is being put under a much more tightly focused microscope in general. So, the ability for suppliers to respond I think is going to be hampered by that.

And what makes the longer-term thematic even more compelling is that when you look at the increase in supply actually achieved over the last decade, versus the growth rate of supply required going forward. So, from 2010 to 2019, the growth rate achieved in copper production was just 0.5 million tonnes a year. However, the growth rate required to meet demand forecasts created under the 1.5’C scenario put together by the IEA, will require up to 1 million tonnes a year of new copper production.

For context, the largest copper mine in the world is Escondida, which does about 1.2 - 1.3 million tonnes per annum. The second biggest is Grasberg which does around about 0.5 – 0.6 million tonnes per annum. And these are very unique projects. It's quite difficult to even find a copper project which will produce more than 0.2 million tonnes per annum, then get it permitted and get it into production. So this is a real challenge that the industry is facing.

Q: So what is a preferred copper exposure in the portfolio Sam?

We've participated in a placement of KGL Resources (ASX:KGL) which has a permitted project in the NT that looks economically viable. It has a very tight register and has been almost privately funded up until just recently.

While there is a core asset there, which looked like fair value at the point of investment, the exploration upside around that project is very compelling. A lot of these targets are very low hanging fruit and have confirmed mineralization present, it just hasn't been drilled around. Exploration upside is something that we will not pay for in its own right. But we do like the free option of exploration success, which is what we think we're getting with that one.

Q: Looking beyond copper, to the more niche battery minerals, which of those do you think presents the best opportunity?

In the short term, a lot of the lithium equities have run reasonably hard, but I think there's still more to go in that sector. The price of spodumene (a lithium-bearing mineral) has only just crept up towards $500 a tonne, but companies still aren't making great margins at that price. It is such a small market in terms of tonnage, their prices probably have got the scope to move a little bit higher. But note that lithium is a very common mineral and there are a number of new projects, new capacity and idled capacity that can meet demand as prices allow.

Cobalt's not so easy. A lot of cobalt coming out of the Democratic Republic of Congo has problems increasing production, and the European or US vehicle manufacturers are wary about accepting cobalt out of the DRC, because of the way in which it's mined, so that’s an area of interest.

High-purity alumina is looking compelling at the moment, but once again it is a very small market, so there will be a reasonably small window where one or two producers will get into production and they'll do very well. Some of the high purity alumina producers are moving quite quickly and we've got exposures to A4N (ASX:A4N) and FYI resources (ASX:FYI). Note it's not like iron ore thought where a new mine might add 1.5% to global supply, or lithium where a new project might add 5 - 6% to global supply. High-purity alumina would be higher than that again.

Q: You also have some mining tech within the portfolio, can you talk about that?

I go out to the mines for site visits frequently, and I get a good look at this tech in use which created investment ideas. For example, companies like Dug (ASX:DUG) which is a high-performance computing (HPC) firm. The oil and gas industry uses HPC for processing seismic data, but their cost of processing power or cost of supply is materially lower than their peers due to a patented heat exchange technology, which allows them to sit their hard drives in baths of oil.

Michael: Thanks, Sam

Sam: You're welcome.

-----------------------------------------------------------------------------------------

Find out more

Moving early on emerging themes via a high-quality active manager offers an effective way to provide exposure. Last year we were the seed investor in the Perennial Global Resources Trust managed by Sam, and the unit price for the Trust has nearly doubled since that time. There are a number of other funds where we have been foundational investors that have performed well. Please click follow to read about other funds that we write about - or click 'CONTACT' to line up a call to find out more about investing with Lucerne.

-----------------------------------------------------------------------------------------

3 topics

7 stocks mentioned