10-baggers are everywhere (so are 100-baggers)

MX Capital

A 10-bagger is a stock that goes up 10-times in value. It is a concept made famous by Peter Lynch, the well-known fund manager from Fidelity. For most fund managers, picking a 10-bagger is often enough to make a career. I have some good news and some bad news for you.

The good news is that 10-baggers are everywhere. Every single stock in Australia and New Zealand has a 1-in-7 chance of being a 10-bagger during its life in the next 35 years.

The bad news is, your typical fund manager is not likely to benefit from it. While this article does not discuss how to pick a 10-bagger or 100-bagger, it discusses the structural challenges facing fund managers to fully benefit from one.

And what about the mystical 100-bagger? Turning $100,000 into $10m is undoubtedly life-changing. There are a lot of them, and they are near you.

10-baggers are everywhere, so are 100-baggers

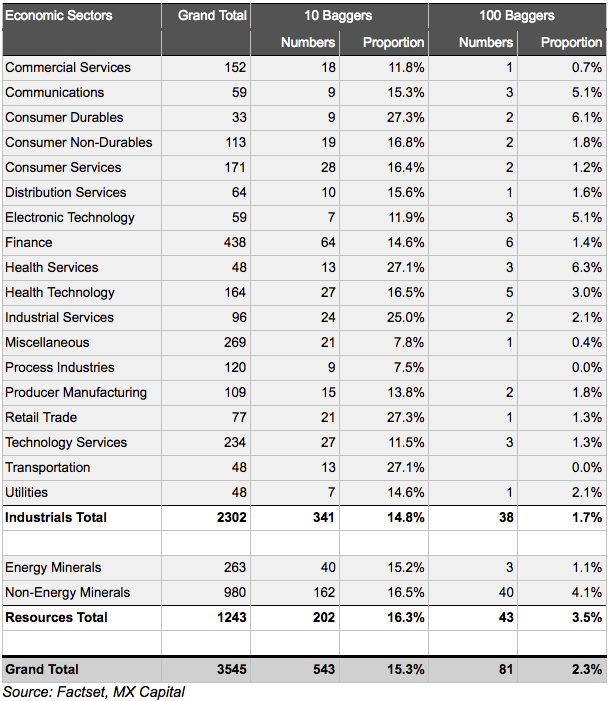

MX Capital conducted a study on all the stocks that have ever been listed in Australia and New Zealand over the past 35 years based on the Factset database. Stocks that have seen its share price increased by more than 10-fold or 100-fold are counted by sector, in the table below.

Out of 3545 stocks, 15% of them, or a 1-in-7 chance that a stock’s share price would increase more than 10-fold during its listed life.

It is interesting to note that 10-baggers exist in all industries. The probability is similar for industrial stocks and resources stocks.

100-baggers are not that rare, 2% or 81 stocks returned more than 100-fold. Some of the well-known names are:

- Realestate.com.au, from $0.049 in September 2001 to $83.88 in May 2018, returning 1712 times, excluding dividends.

- ARB was $0.096 in July 1991, and its share price appreciated 230 folds to $22.06 in May 2018, over a 27-year timespan.

- CSL was $0.77 in June 1994, now is $170.55 as of 3 May 2018, and one of the world’s most respected companies.

- TPG Telecom was an interesting case. It was $0.093 in November 2008, after David Teoh took control of the business, and it was $12.61 in late July 2016, a whopping 135x return in less than 8 years. Mr Teoh is still running TPG and is entering the mobile market. In another five years’ time, the return will likely exceed 135x.

The 10-bagger journey is long but rewarding

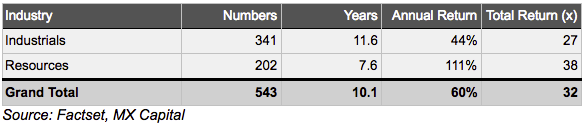

It takes on average 10 years for a stock to go up 10-fold, a bit longer for industrial companies and shorter for resources companies. But the reward is very attractive, the median return was 32x of the starting share price.

Duration and return of 10-baggers:

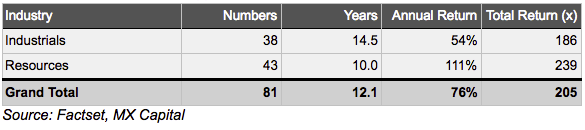

100-bagger are not too different from 10-bagger on the surface, except they compound on a faster rate and take 2 additional years to get you 205 times the starting share price. While 12 years is a long time, if it means compounding $50,000 savings to $10m which is ample of money to retire on, most people will wait.

Duration and return of 100-baggers:

The Realestate.com journey shows why it is hard for fund managers to ride 100-baggers

To make money from 10-baggers is simple: find a stock that can compound at a high rate for at least a decade. But it is not easy. Your typical fund manager is not likely to benefit much from them, and it is not due to his stock picking ability.

A 10-bagger requires high compounding. The easiest way to have a high compound rate is to start from a small base. For example, Realestate.com started at $2m revenue in 2000, and grew it every year to $766m in 2017. Growth is easiest from a low base, but it is hard for a fund manager to pick them.

Listed in the tech-boom, Realestate.com.au fell more than 95% after the IPO to a mere $2.6m market cap in September 2001. Being a business with $2m revenue, a significant loss-making position and not much cash at the bank, no institutional investor would look at a stock like that. Even when the share price had recovered to $0.80 (with the potential to go up another 100x), its market cap was around $50m, a space for micro-cap managers only.

The second critical ingredient is time. To maximise the benefit from this once in a lifetime opportunity, your manager will need to sit there and do nothing for more than 17 years. Sitting there doing nothing is one of the most challenging things to do, considering he needs to overcome all of the following:

- Once the stock appreciates 3-4 times, it will likely breach your manager’s “safe” position size and your manager will trim the position materially over time;

- Being the biggest position in a portfolio, any volatility in share price will cause your manager’s monthly return to be volatile, another reason to trim the position again;

- REA traded at a premium valuation for many years. It would have breached anyone’s target valuation. Your manager would likely to sell it because it was “too expensive, I could buy something else cheaper.”

- One of the most successful online company (Google) entered the space, so you would ask if it is going to kill the business? (Google withdrew from real estate advertising within two years.)

- During the GFC, REA’s share price declined more than 50% from $7.40 in Nov 2007 to $3.50 in Jan 2009. Whoever sold the stock in Nov 2007 felt like a hero for 18 months, except that $3.90 of decline is less than 5% of today’s $83 share price.

- Your favourite manager has probably made enough money to retire, the incoming young fund manager would want to buy something more exciting.

- Your manager needs to be “active” and do something to show he is adding value, such as turning over the portfolio several times a year.

In the game of 100-bagger hunting, success ends success. If your fund manager picks a 100-bagger, his fund will likely become a lot bigger due to good performance and continued capital inflow. Eventually, the fund will become so large that the manager will never look at another micro-cap again, as “it won’t move the dial”, voiding its ability to invest in another 100-bagger.

This is an area that a private investor can significantly outperform a fund manager, as he doesn’t have all these institutional constraints. Knowing all these constraints, MX Capital has designed its structure from inception to enable effective 100-bagger hunting.

3 stocks mentioned

Weimin has more than 10 years direct experience in the Australian small to mid-cap equity market honed over 3 years with Ophir Asset Management as a portfolio manager, and 7 years with Kosmos Asset Management as an analyst.

Expertise

Weimin has more than 10 years direct experience in the Australian small to mid-cap equity market honed over 3 years with Ophir Asset Management as a portfolio manager, and 7 years with Kosmos Asset Management as an analyst.