12 charts to help you make sense of the bond market

Yarra Capital Management

Bond yields are currently experiencing one of their fastest sell-offs since 2009, resulting in the largest one-month move in 10 years. While many in the market were expecting rates would be biased higher in 2021, this past week has rattled a few cages. What’s behind the dramatic move and where to next for bond yields?

10 years is a long time between drinks

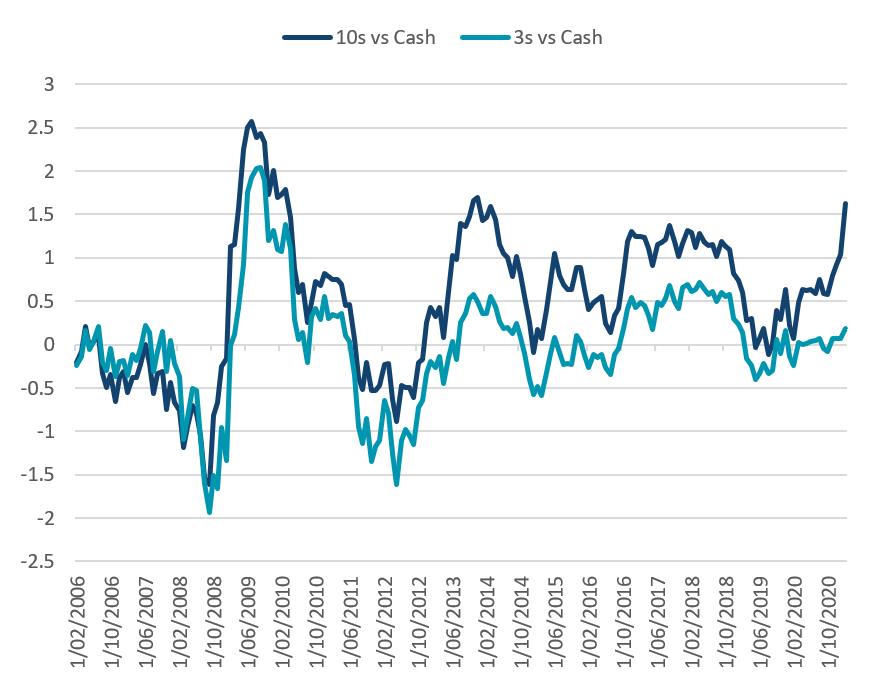

To understand what the bond market is telling us, we will examine the spread between bonds and cash. This provides us with an idea on where bonds should trade, as the spreads are relatively consistent through time. This allows us to forecast the cash rate, which the RBA provides clear guidance on, and then use the spread to determine what makes sense for bond yields.

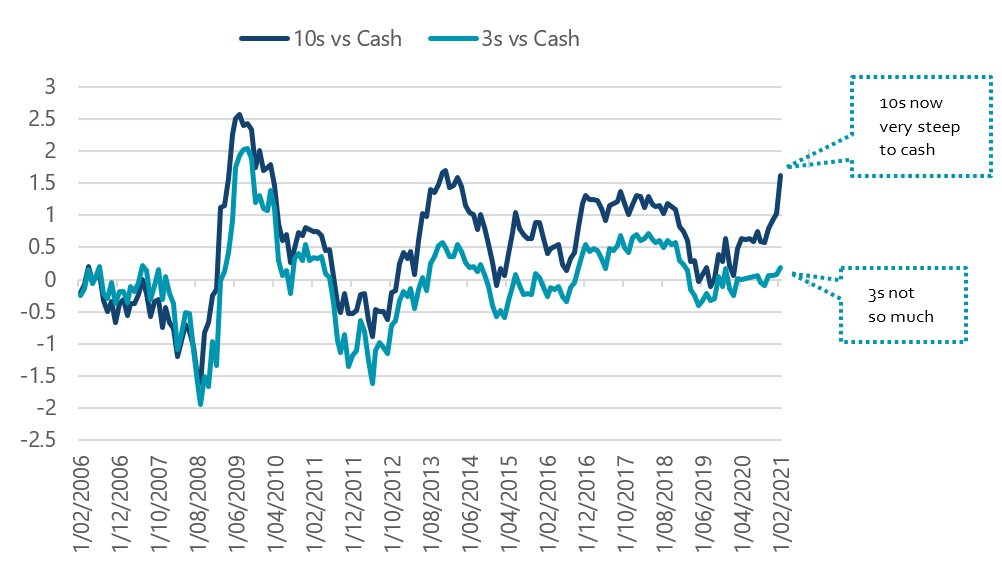

Chart 1 - Bonds (10-year and 3-year) vs cash

Source: Bloomberg, Nikko AM

10-year yields

Let’s start with 10-year yields since that is the part of the curve moving the fastest. The 10-year bonds are now about 165 basis points over cash, which is pretty close to the 2013 highs of +170. Over the past 10 years, when the cash rate has been stable, the pickup on 10-year bonds has been about 1.30% to 1.70%. So, we are now at the top end of that range.

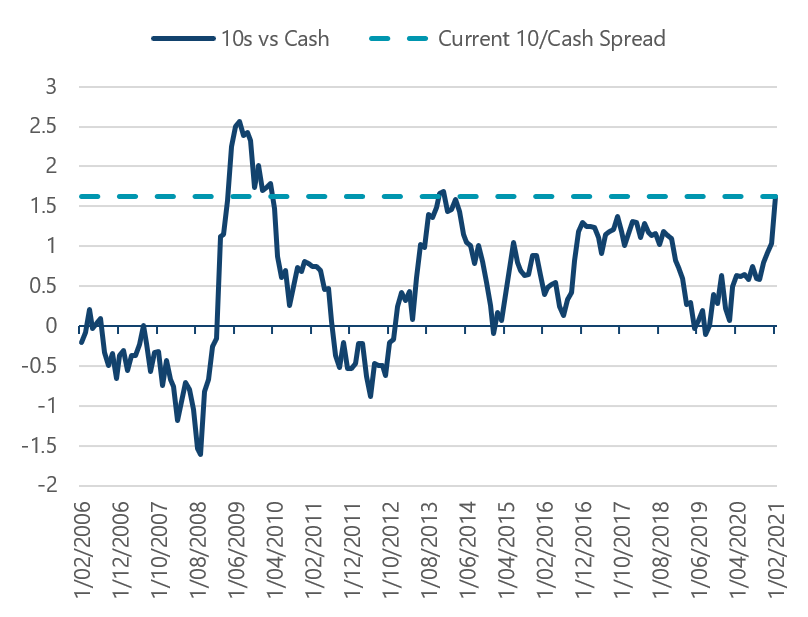

Chart 2 - Bonds vs cash

Source: Bloomberg, Nikko AM

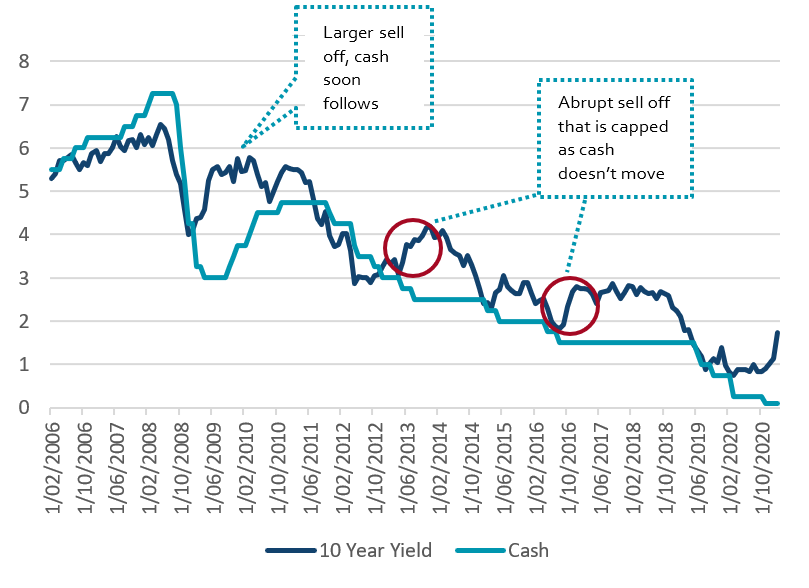

At the moment, we believe that the periods of 2013 and 2016 are the best comparisons to use when setting our yield expectations. This is because in 2013 and 2016 there where ‘reflation trades’, with 2013 thought to be the US achieving ‘escape velocity’ and 2016 had the market believing Trump’s corporate tax cuts would generate strong levels of inflation. While neither turned out to be sustainable for the economy, and differ slightly to the current narrative, it is a good comparison from the perspective of this is where bond yields can go when the cash rate stays stable.

We don’t think that making a comparison to 2009 is justified in the current environment, when the cash/bond spread went out to +250 basis points, because the wider spread differential was reflective of the fact that the cash rate was about to be hiked 200 points. As we will come to below, the RBA is going to lengths to tell the market that this isn’t a likely outcome.

Chart 3 Bonds and cash

Source: Bloomberg, Nikko AM

This means we can break down our 10-year expectations as following:

- If we believe that the cash rate won’t move, then bond yields should stabilise around these levels.

- If we believe that the cash rate will be hiked, then 10-year bonds yields could rise another 50 – 100 basis points.

- If the RBA has to cut, then 10-year bonds could fall 50 – 100 basis points.

At the present time, we don’t think that the cash rate can rise and therefore we should see 10-year yields top out around these levels. While the sell-off has occurred far faster and gone farther than we originally expected, we still think that the cash rate will be stable for years to come.

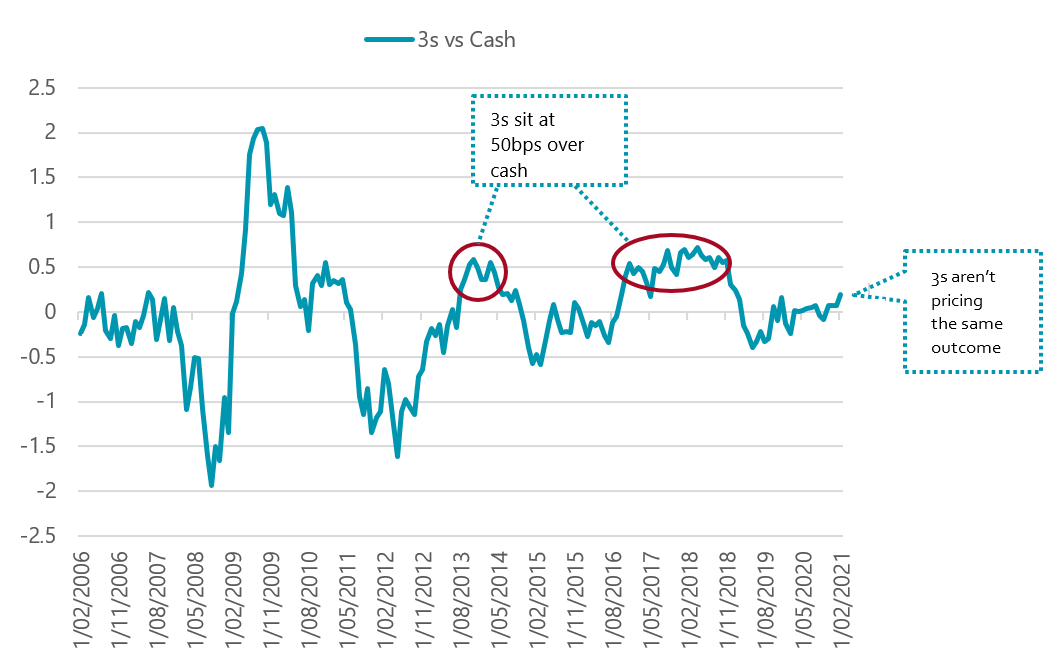

3-year yields

The 3-year yields are a little different since they are trading at only 10 basis points over cash. You can see from Chart 4 that in 2013 and 2016, when the 10s moved higher, the 3s started pricing a more positive environment too. This time, however, the 3s have been stuck far lower, which reflects the RBAs yield curve control (YCC) policy. The RBA has thrown a lot of money at the 2024 bonds, which is causing them to be stuck at close to cash.

Chart 4 - 3-year bonds vs cash

Source: Bloomberg, Nikko AM

Hence, for this part of the curve it is not just about what the cash rate will do, but what the RBA will do with their YCC policy. We can assess this via a number of scenarios:

- If you believe that the RBA will continue to run the YCC policy, then 3-year bonds should not move.

- If you believe that the RBA will end this policy in the near term, then 3-year bonds should rise by about 40 basis points.

There is no indication yet that the RBA wants to end this policy, but it does stand to reason that this will be the first policy that the RBA would try to remove when they want to tighten conditions. When they are ready to start reducing monetary policy support, we believe the order will be:

- Remove the YCC.

- Stop buying bonds via quantitative easing (QE).

- Hike interest rates.

Some have started speculating that the removal of the YCC could be as early as July/August 2021. In our view, we don’t believe this will occur until the current QE program ends, which is at least October. However, given the RBA hasn’t had a strong outing over the past week, it’s anyone’s guess. This means over the next six months we could easily see this part of the curve trying to push higher, potentially by 20 – 40 basis points if the RBA does not confirm its commitment to its YCC policy.

The cash rate—when will it move?

All of the above is prefaced on the cash/bond spreads, but it raises the question of when will the RBA move the cash rate?

At the moment, the RBA is telling us they do not expect this to occur for at least three years and, in reality, it is probably even further away:

“The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.”

—RBA Monetary Policy Decision (February 2021)

The reason this is so far away is that the RBA last year said that it was not going to hike rates in anticipation of inflation but instead, wait to see actual inflation show up. Lowe spoke about this in a recent speech:

“In October, we changed the nature of our forward guidance about the cash rate. The focus is now on actual outcomes for inflation and unemployment, rather than forecast outcomes… The Board will now want to see evidence that inflation is consistent with the target before it increases the cash rate. It is not enough for inflation to be forecast to be consistent with the target.”

—Opening Statement to the House of Representatives Standing Committee on Economics, Phillip Lowe (2020)

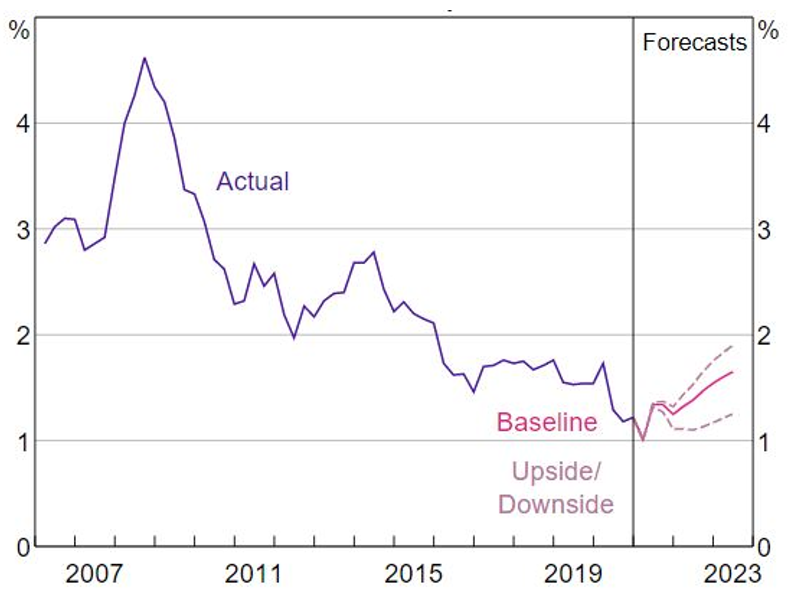

If you look at the RBA forecasts, they are currently showing no signs of inflation until 2024. Even under a more optimistic scenario than their baseline forecasts, the RBA still does not expect core inflation to be sustainably in the 2 – 3% band for a number of years, with wages remaining below 2%.

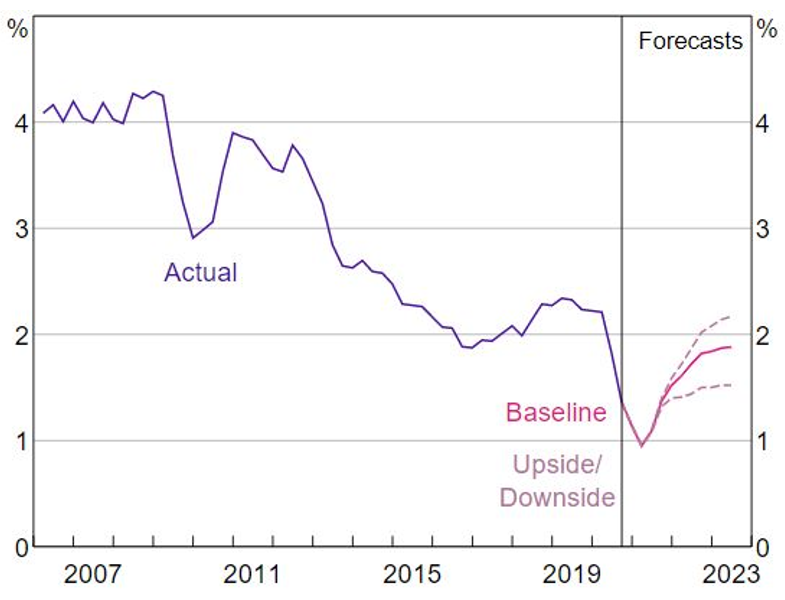

Chart 5 - Wage price index growth (forecast scenarios, year-ended)

Source: ABS, RBA

Chart 6 - Trimmed mean inflation

Source: ABS, RBA

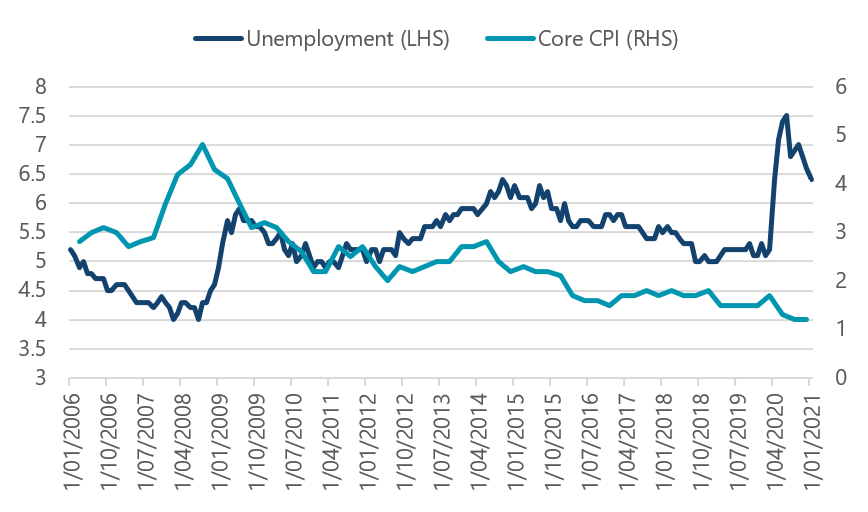

This makes sense, as the RBA wasn’t able to generate 2% inflation even when unemployment fell to 5% in 2018. We are likely years away from the unemployment rate falling back to those levels, and inflation could be even further away if the RBA thinks that they will need an unemployment rate closer to 4% to generate consistent inflation.

Chart 7 - Unemployment and core CPI

Source: Bloomberg, Nikko AM

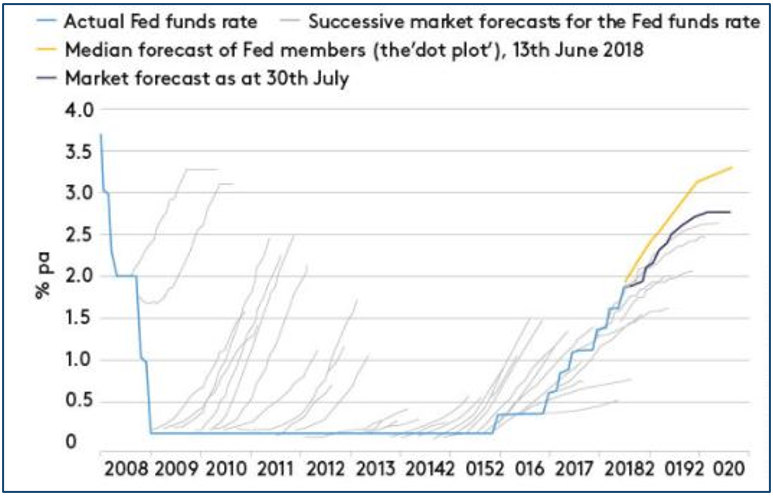

While the market is bullish on the RBA eventually being able to hike the cash rate (some now seem to be thinking 2022), it is good to put this in perspective of the US when they first hit zero. For years the market forecasted higher cash rates, which just never eventuated. This could be a very similar setup, with the market expecting moves well before the central bank is able to deliver it.

Chart 8 - US Federal Reserve funds rate

Source: (VIEW LINK)

Do we believe the RBA will be able to hike soon? The simple answer is no. There is nothing over the past 10 years that tells us inflation will be a problem, and even the central banks that have constantly over-estimated inflation are saying it’s probably not happening.

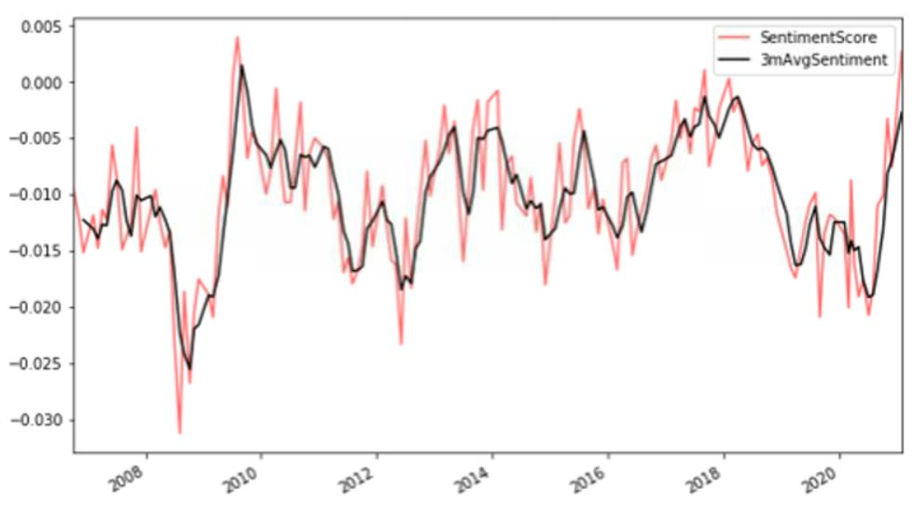

However, it’s important to note that despite the RBA telling us that they are on hold until at least 2024, they couldn’t be more positive in their language. Here is our sentiment indicator on the RBA minutes, which determines how positive RBA language is. Currently the sentiment used in RBA language is very similar to 2009, focusing on the rebound that is occurring globally.

Chart 9 - RBA sentiment score

Source: Reserve Bank of Australia, Nikko AM

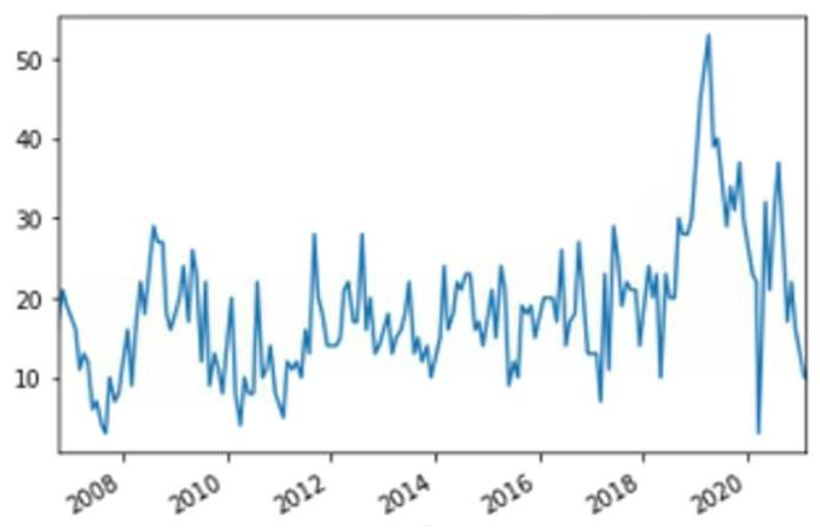

What’s of note is that the RBA has stopped using words like ‘decline’, ‘declined’, ‘weak’ and ‘slower’, as shown in Chart 10, which you can see how many times it was used below. Interestingly they used these words more in 2019 when the house market was slowing. Showing what they are really scared about.

Chart 10 - Word count for: decline, declined, declines, contracting, weak, slower, slowed, slow and slowing

Source: Reserve Bank of Australia, Nikko AM

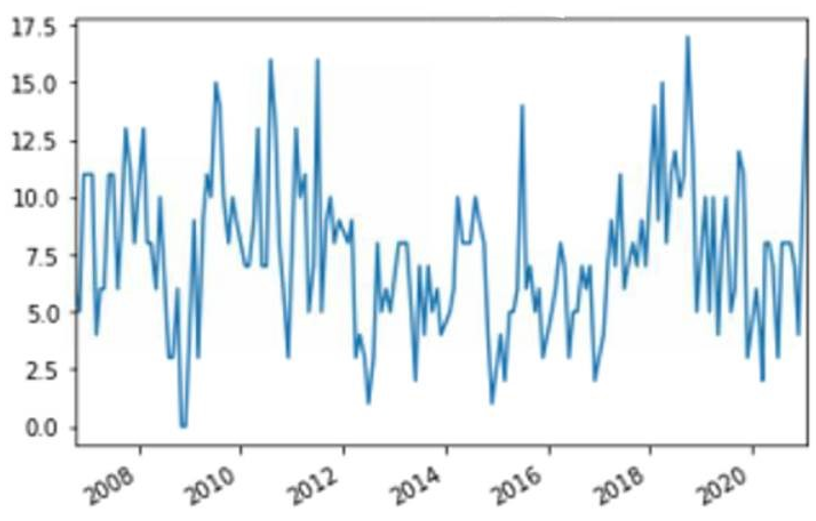

Now the RBA is using language such as ‘strong’ and ‘improved’ far more, which is similar in nature to early 2018 when they were expecting hikes.

Chart 11 - Word count for ‘strong’ and ‘improved’

Source: Bloomberg, Nikko AM

This pickup in language, and the fact that the market is now talking reflation, could end up in mid curve rate bets. (i.e. selling those 3-year bonds mentioned above because the RBA is about to give up!). After all, the market likes to speculate that if you aren’t cutting, you must be hiking.

Chart 12 - Bonds vs cash— 10yr and 3yr

Source: Bloomberg, Nikko AM

Conclusion

Overall, it’s been a pretty brutal sell off and not something that we had anticipated. But as we don’t expect the cash rate to move over the next few years, it’s looking like we should be getting towards the end of it for 10-year bonds. 3-year bonds could have further to run if the RBA doesn’t stand by its YCC policy, as they have not priced in the positive environment that longer bonds are now suggesting.

Learn more

The award winning Nikko AM Australian Bond fund invests in a diversified portfolio of investment grade Australian fixed income assets that aims to deliver an active return for a competitive fee. For further information, visit our website.

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...

Expertise

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...