2 ASX-listed ETFs that could help you beat inflation and earn an extra 4% in yield

It should be no surprise to investors that dividends are a function of the market cycle. When times are tough, revenues are slowing, and the outlook is uncertain, dividend payouts can and do get cut back. For income investors, this reality may push them into other assets like term deposits, which in some cases, can earn you 5% per annum. This conundrum creates a good question - why should I get out of cash?

While putting your cash into these assets may be a safer bet, it can lock your portfolio out of opportunities to top up your income with capital gains as well. Cameron Gleeson, Senior Investment Strategist at Betashares explains this through the below scenario.

"For example, take a 12-month term deposit of $100,000 with an interest rate of 5% per annum. Most of your $5,000 interest is actually being eaten up by inflation. On the other hand, equities can deliver capital growth over the long term, and where a company has a consistent dividend yield on a growing stock price, the increasing income and capital can compensate for inflation," Gleeson says.

The Goldilocks era for income - and its impact on stocks

Gleeson agrees that we are in a Goldilocks period for income for all asset classes but in the context of stocks, it provides an additional hedge against inflation.

"We're still in a relatively strong inflationary environment and a term deposit doesn't give you a hedge against inflation, whereas equities can do that," Gleeson says. "You can see corporate earnings grow with inflation and therefore, dividends can grow in line with or can beat inflation."

Yields are higher but are declining

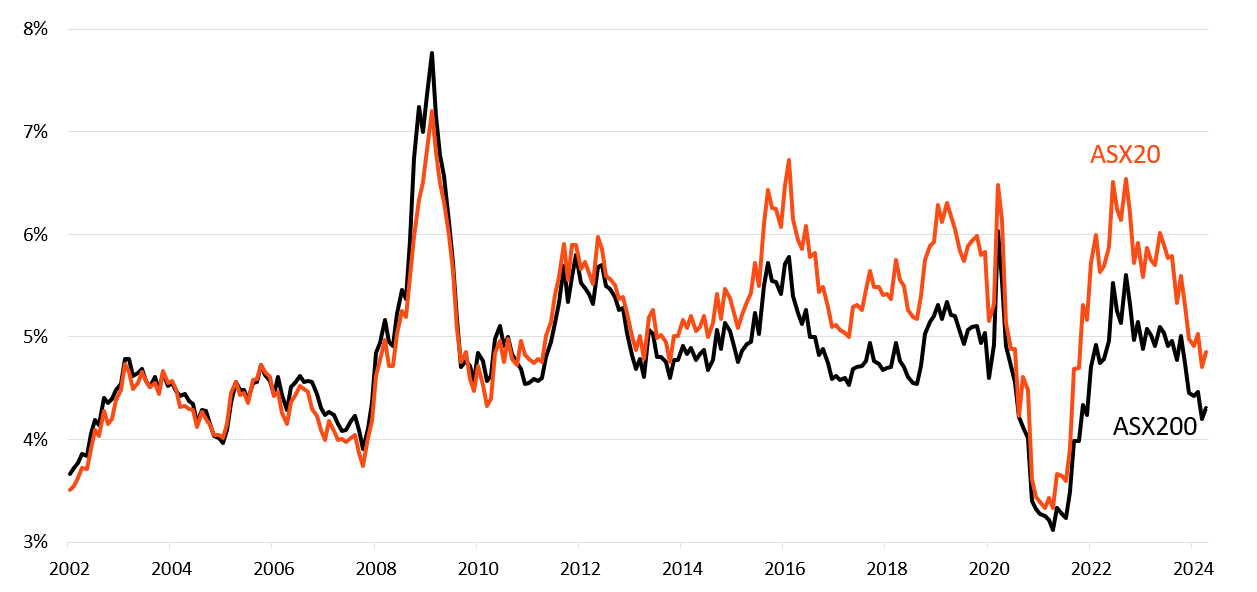

In recent times, the ASX 200's dividend yield has become both highly concentrated (the top 20 stocks generate most of the payouts) and has started to decline as the ramifications of an economic slowdown hit corporates.

"Previously, the yield you could generate out of the rest of the index (the smaller 180 stocks) was equivalent to the Top 20, but increasingly it's the Top 20 driving the overall yield of the index," Gleeson notes.

Historical ASX200 and ASX20 net dividend yield

Source: Bloomberg, Betashares, as at 30 April 2024. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

Gleeson adds that focusing too much on dividend yields as a way of picking investments opens you up to traps.

"A strategy focused solely on dividend yields can lead you down the dangerous path of the potential for dividend traps. Investors don't want to erode their capital by inadvertently investing in a stock that has an unsustainable yield," Gleeson notes.

2 ETFs to generate yield without moving too far up the risk curve

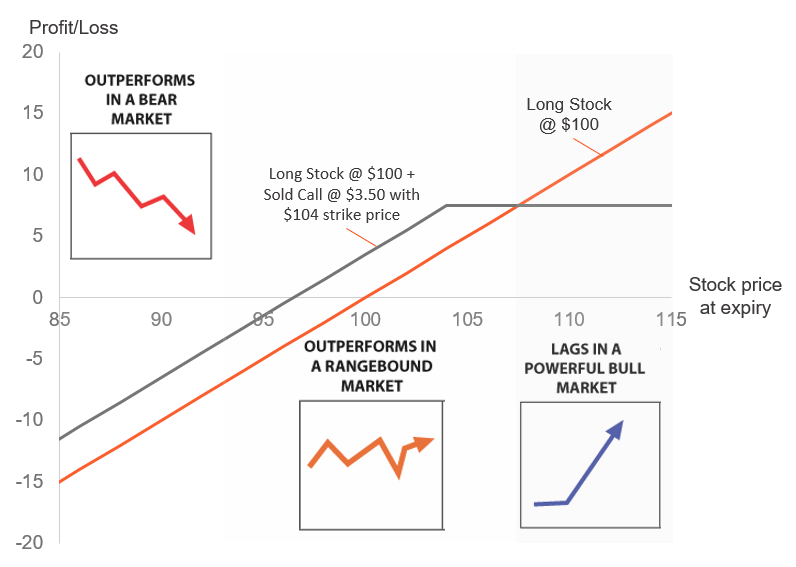

With concentration risks building, Gleeson highlights that one way to earn outsized incomes without spreading yourself too thin is to utilise a covered call strategy, like the Betashares Australian Top 20 Equity Yield Maximiser Fund (ASX: YMAX).

"This is an investment strategy where you hold a portfolio of stocks and you aim to generate dividends out of those stocks. But you also generate income from selling call options over this basket of stocks you hold and that can generate additional income there," Gleeson says.

YMAX currently has a running 12-month gross distribution yield of 9.8% and while it invests in the top 20 stocks, the covered call strategy allows investors to participate in some upside and can generate an extra 4% yield (by historical standards). That 9.8% yield figure is about double the S&P/ASX 200 index. And there is one other key benefit:

"The [other] benefit of this strategy is writing call options lowers volatility and lowers your market beta. In some senses, this can be seen as a way of reducing your risk and exposure to volatility in equity markets," Gleeson adds.

This, in addition to the fully franked dividends that come with many major ASX-listed stocks, explains how the ETF can generate such outsized payouts for its clients. A basic example of a covered call strategy and the markets in which it typically outperforms or underperforms a long stock position is found in the chart below:

Covered call strategy payoff

Another income ETF available to investors is the Betashares FTSE RAFI Australia 200 ETF (ASX:QOZ), which tracks an index that selects and weights the top 200 ASX-listed stocks based on each company’s economic footprint, rather than its stock market capitalisation. One of the fundamental inputs for this index is dividends.

"One of the inputs for this is to look at the dividends each stock produces. This doesn't mean stocks are selected purely on dividends, but dividends are one of the metrics used, resulting in a well-diversified portfolio that also has a higher yield than the broad market," Gleeson says.

QOZ has a running 12-month gross distribution yield of 6.5% and has delivered a total return of 11.6% over the past 12 months.

Learn more about Betashares Equity Income Funds range

An equity income fund may be suitable for an investor looking for relatively high yields, a regular income stream, and exposure to equities. To learn more about Betashares range of Australian equity income ETFs, please see the fund profiles below, or visit the Betashares website.

3 topics

3 stocks mentioned

3 funds mentioned

1 contributor mentioned