2 stocks 1 sector

Over the last few years, falling interest rates have driven absolute market valuations to all-time highs – by many metrics. Given these high starting valuations, slowing lead indicators of economic growth, tightening financial conditions as well as geopolitical unrest, the risk of market drawdowns via rising interest rates is now greater. Simply put – slowing lead indicators provides challenges for cyclical stocks and rising interest rates creates a problem for long equity-duration stocks (growth).

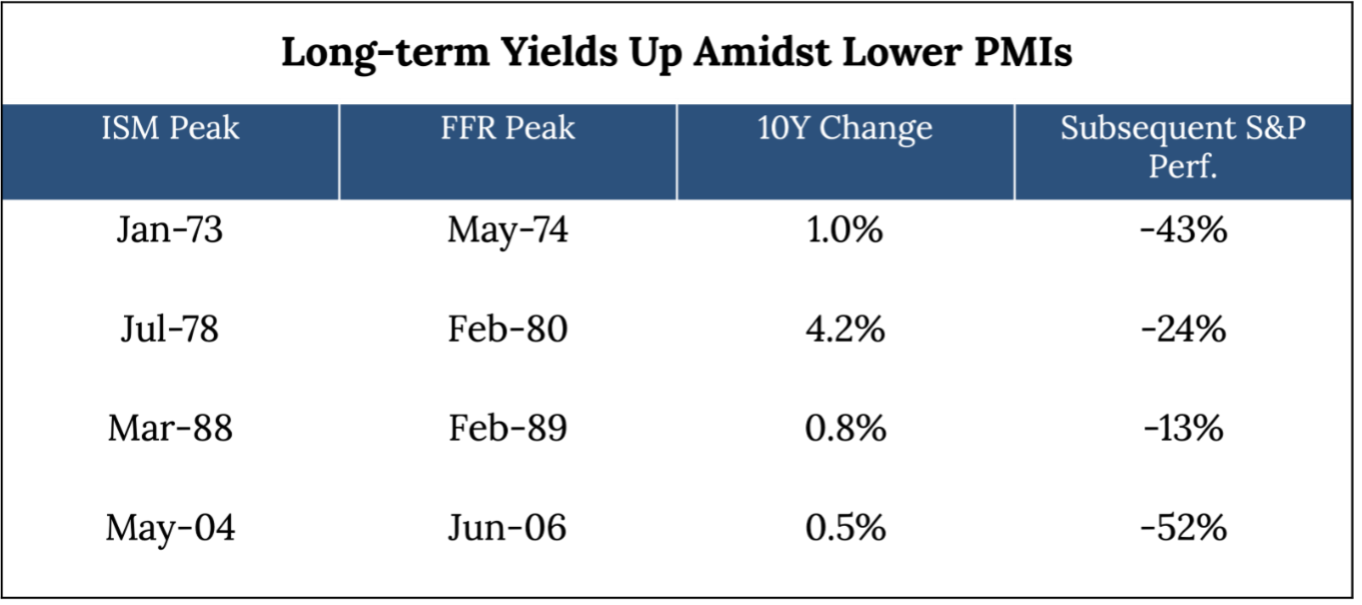

These precise conditions are not common. In fact, there have only been four instances of rates rising at the same time as slowing economic growth over the past 50 years. The subsequent S&P performance in each of these four instances was strikingly negative.

In this environment, as we have said often, investors need to be well diversified across region, sector, style and return type – but for today I wanted to focus on sector, and specifically Healthcare.

Reflecting recent strong equity market gains and global growth, the Healthcare sector is the second most underweight sector after Real Estate from a client holding perspective according to custodian StateStreet Advisors which has allowed our fund to take advantage of some extremely attractive value on offer. We would expect that as lead indicators of economic growth decelerate and investors question their more cyclical holdings - that the healthcare sector which has never experienced a down year of earnings expectations going back to 1996, will gain more investor mind share.

Johnson & Johnson, Sanofi, Novartis and McKesson are currently in our top 10 holdings, representing 23% of our equity exposure. And there are fundamental reasons for this, brought to life by these two companies.

J&J – Well known to most people globally Johnson & Johnson has an excellent long term track record of steady and profitable growth. An ungeared balance sheet when combined with successful acquisitions over time and very low financing costs provides upside potential to earnings. They are diversified across three broad lines of business: Pharma, Consumer and Medical products, making it one of the most diversified healthcare stocks on the market. Currently trading at a historical low valuation both absolutely and relative to the market, J&J are well placed to deal with the current environment of growth and inflation/interest rate challenges. Plus they have over 50 years of consistently growing the dividend.

Sanofi – is a French based multi-national with a market cap of around 120bn euros, making around 9bn euros per year with some growth – which means you’re getting your money back in a little over 10 years. This profit is after 6bn euros in R&D the company spends to ensure that its business is multi-generational. With leading prescription drugs such as Dupixent, and the long –acting insulin drug Lantus, Sanofi have an 8% earnings yield, P/E 11-12x, and no debt on the balance sheet. So again a beneficiary of the inflation regime and potential growth upside, but a path to doubling your money even without growth over a 10-year period.

In a world of uncertainty – to own companies that continue to invest at attractive rates of return, which reward investors with sizeable cash dividends, which carry no debt, and which have a low duration, provides excellent prospects for absolute returns and the benefit of diversification.

5 topics