2 stocks, 3 ETFs and 3 funds to weather higher rates and inflation

Inflation has proven to be more persistent than expected throughout 2021, with US core inflation finishing the year at 5.5% YoY, and headline inflation reaching a substantial 7.0% YoY. Similarly, in Australia, headline inflation came in at 3.5% for the year, which is outside the RBA target band of 2-3%..

The Federal Reserve is now expected to tighten at an accelerated pace with four rate hikes expected in the US starting in March. The RBA is also likely to follow with one hike forecast by Morgan Stanley in Q4.

Financial conditions are thus poised to tighten from current near-neutral levels. This has historically coincided with poor risk-adjusted returns for equities as a rise in long-term bond rates places pressure on equity valuations, while increasing volatility in capital markets. In this context we expect returns on equities and bonds to be limited in the first half of the year even possibly negative - therefore, where can investors find positive returns?

In our review we focus on several key instruments across all the major asset classes that we believe will perform in a challenging environment.

Macro backdrop: Stronger (than expected) inflation means higher yields

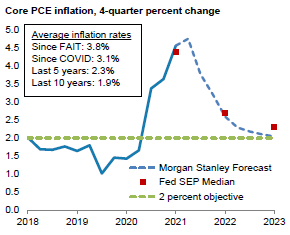

Recent US inflation data has been strong, although Morgan Stanley believes inflation will eventually moderate (see Figure 1), driven by supply bottlenecks easing (amid stronger supply) and rising labour force participation slowing wage growth. However, the key concern is that some components of core inflation have gathered significant momentum already. In addition, Morgan Stanley’s recent Brent price expectations in Q3 indicate higher oil prices are likely to offset some of the relief from supply chain normalisation.

Figure 1: Actual and expected US inflation is above target, having averaged more than 2% over most windows

Source: BEA, Federal Reserve, Morgan Stanley Research

Therefore, in the near term, inflation prints are likely to continue to be strong in the US and we see little risk of the Fed backtracking on its recent hawkish turn. In short, we expect the Fed to remain focused on monetary tightening until financial conditions also tighten. Morgan Stanley forecasts US core PCE inflation to peak in February, then remain relatively high into the middle of the year, before falling more sharply to 2.4% 4Q/4Q.

In response, Morgan Stanley believes the Fed will hike rates four times this year - in line with market expectations - and will also begin quantitative tightening in August.

Therefore, despite US 10-year treasury yields having risen nearly 30bps since the beginning of the year, we believe this move is far from over. Morgan Stanley expects the US 10-year yield to end the year at around 2.3% as investors need to reprice a higher growth/inflation backdrop over the medium term leading to a higher neutral and thus terminal rate. This means there is still another ~50bps to go. Therefore, despite the rising concerns over economic activity we believe it is still too early to increase exposures to US government bonds.

In Australia, we have seen how Australian government bonds have followed the trajectory of their US peers in spite of relatively lower inflation and a more dovish RBA. The current outlook of substantial tightening in the US has generated an aggressive pricing outlook of 4.3 hikes expected in the next twelve months (versus 5.3 in the US) although we only expect 4 hikes by the end of 2023. As result, we expect a similar move up in Australian government yields, but with reduced range.

We highlight 2 stocks, 3 ETFs and 3 managed funds across the major asset classes which we believe will likely benefit from higher rates and inflation, as well as potentially generate absolute positive returns in the months ahead in the context of high inflation/higher bond yields.

Commodities

The Bloomberg Commodities Index rallied 27% in 2021, compared to the MSCI World (USD) Index, which returned 22%. This was only the second year since 2010 that commodities outperformed equities.

We see continuous strength in commodities in 2022, given five key tailwinds: i) demand for inflation protection, ii) energy transition is net positive, iii) hedge against geopolitical risk. iv) re-opening still to support demand; and v) under-investment at play in several key markets.

Invesco Commodity Composite UCITS ETF (London listing: LGCU.L)

LGCU.L tracks the Solactive Commodity Composite Index using a synthetic structure designed to represent the collective performance of a wide range of commodities. The investible benchmark consists of multiple indices from leading global index providers who must meet certain criteria with regards to performance, volatility, years since inception as well as risk metrics to be eligible for inclusion. Currently, the index consists of four equally weighted commodities indices. The underlying index holds over 20 commodities, with key sector tilts towards gold (~9%), oil (17%), copper (~7%) and soybean (~8%). The ETF is unhedged.

Energy

We remain positive on energy on the back of a continuous rise in the oil price. Despite 2021 being one of the strongest years in the oil market in recent history, further strength lies ahead. With the prospect of low inventories and spare capacity by 2H, further demand recovery into 2023, and still limited investments, the oil market will likely be undersupplied in 2022. Morgan Stanley’s strategists expect that prices will need to rise to levels where some demand erosion takes place (at ~US$85-90/bbl) which supports US$100/bbl by 3Q, with risks potentially skewed higher.

Santos (ASX: STO)

Stock rating: Overweight

Price target: A$10.40

Santos explores for and produces oil, natural gas, LNG, and gas liquids predominantly in Australia. The company is focused on five core assets, Cooper Basin, GLNG, Darwin LNG, PNG, and Western Australia Gas fields. STO has a portfolio of opportunities that work in a lower for longer oil price environment, but it also retains leverage to higher oil prices.

In addition, STO’s potential divestments create upside on Free Cash Flow yields. STO is now a significantly larger company post its merger with Oil Search. Morgan Stanley believes the market will reward a more modest growth profile which prioritises cash returns to investors along with a focus on de-leveraging. Morgan Stanley recently completed a review of a range of divestment scenarios, with a full exit of Alaska assessed as the best-case scenario. Free cash yields for STO would approximate 10-15% and are potentially near 20% should current spot LNG prices persist. If STO were to adjust its current 20-30% of free cash policy to ~50%, dividends could double, with the stock yielding 8-10% compared to 4-5% now.

We also see STO as bearing lower earnings risk going into reporting season. STO recently released its fourth quarter production result with production in line with Morgan Stanley estimates. Revenue was 15% higher than expected with the main driver being higher realised LNG prices. Currently spot LNG prices are soaring at over US$30/mmbtu which is over 3x the 5 year average. STO also provided guidance on year end production costs which were better than Morgan Stanley’s forecasts.

BetaShares Global Energy Companies – Currency Hedged ETF (ASX: FUEL)

Our preferred energy sector ETF is FUEL.AX. FUEL.AX tracks the Nasdaq Global ex-Australia Energy Hedged Index, offering a diversified exposure to global energy companies as it provides exposure to all levels of the energy supply chain (e.g. production, transportation, storage and refining). Also given FUEL.AX is ex-Australia, the ETF is diversified across more than 10 countries.

Financials

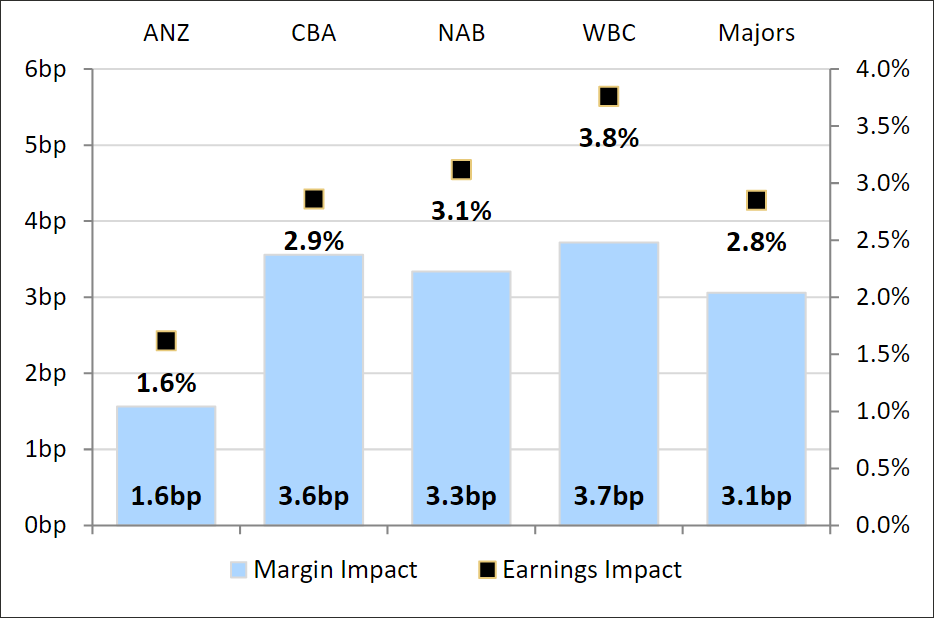

Financials is a highly cyclical sector that tends to benefit from improving macro conditions. At this point in the cycle, we anticipate good loan growth, low default rates and the potential for higher nominal interest rates. Banks are key beneficiaries of rising interest rates as they can generally reprice their loan book faster than their liabilities. Essentially, they can lift mortgage rates more quickly than they have to raise term deposit rates, enjoying a profit margin tailwind as the cycle advances.

Australian Banks

We believe banks can outperform the ASX in 2022 against a backdrop of higher rates. Earlier and larger rate rises and higher fixed rate mortgage pricing have improved the margin outlook, while loan growth expectations are reasonable and credit quality should be resilient. Morgan Stanley recently upgraded ANZ to Overweight.

This largest segment of the Australia Financials industry has been under pressure over the past ~5 years, primarily from lower rates, increasing competition, structural change, tougher regulation, and scrutiny of conduct. However, Morgan Stanley believes that a steeper yield curve and higher cash rates are broadly positive for the Australia Financials industry. In particular, valuations have become more appealing relative to the broader Australian market.

Figure 2: Major Banks: Margin impact of 25 bp increase in the RBA cash Rate

Source: Morgan Stanley Research

ANZ Bank (ASX: ANZ)

Stock rating: Overweight

Price target: A$31.00

Morgan Stanley recently moved to an Overweight recommendation on ANZ given the bank’s diversified business mix, improving loan growth trends, as well as materially better margin outlook (particularly with group-leading leverage to RBNZ rate hikes). In addition, ANZ has a sound track record and credible cost reduction strategy, while offering a lower credit risk profile given changes in its business mix. ANZ also had no ROE dilution from the 2019-20 capital raisings and moving forward offers a strong capital position with ongoing buybacks and growing dividends. Morgan Stanley’s price target of A$31.00 (up from A$28.30 previously) equates to an FY23E P/E multiple of ~12.5x, a dividend yield of ~5.0%, and a P/BV multiple of ~1.3x with an ROE of ~10.5%. The stocks currently exhibits solid valuation support with a wide P/E discount to peers.

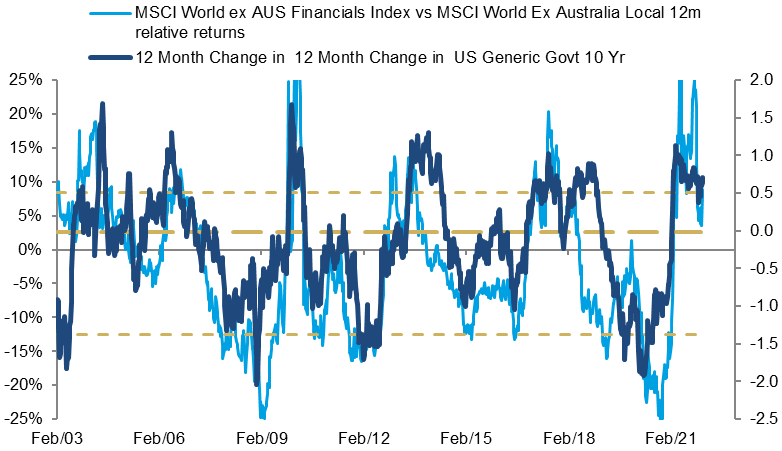

International Financials

We continue to like International Financials, given the (still) historically depressed relative valuation levels and the potential for higher nominal yields (see Figure 3). Also the earnings backdrop for Financials is improving, given a strong 3Q earnings season, bottoming relative earnings revisions breadth and accelerating forward EPS growth. Finally, Financials globally continue to trade at depressed multiples on a relative basis, and currently at levels similar to those during the GFC – and this is despite the rally we have seen in other cyclical stocks.

Figure 3: Global Financials (YOY%, LHS) outperformance trade in pair vs US 10yr yield direction (%, 12m change, RHS)

Source: Bloomberg, Morgan Stanley Wealth Management Research

BetaShares Global Banks – Currency Hedged ETF (ASX: BNKS)

Our preferred financials sector ETF is BNKS.AX. BNKS.AX invests in a portfolio of the world’s largest banks outside of Australia, tracking the Nasdaq Global ex-Australia Banks Hedged Index. Being ex-Australia, BNKS.AX enables investors to spread their financial risk beyond the Australian banking sector with around ~41% of the portfolio in the US.

Fixed Income

Despite US 10-year treasury yields having risen nearly 30bps since the beginning of the year, we believe this move is far from over. Morgan Stanley expects the US 10-year yield to end the year at around 2.3% as investors need to reprice a higher growth/inflation backdrop over the medium term leading to a higher neutral and thus terminal rate. This means there is still another ~50bps to go, and therefore, despite the rising concerns over economic activity we believe it is still too early to increase portfolio exposure to US government bonds.

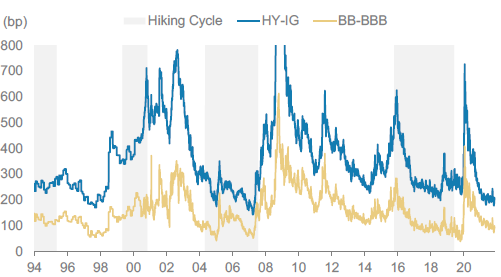

On the contrary, we expect sub-investment grade to fare well. Historically, while the very early window of a tightening cycle is associated with some volatility, credit spreads can trade in a relatively tight range well into a hiking cycle. In addition, early rate hikes also often see High Yield outperform Investment Grade as the growth outlook remains healthy and default concerns remain muted (see Figure 4).

We expect this playbook to hold this time again given the forecast impact from four rate hikes in 2022, combined with the Fed balance sheet unwind. we only see a marginal impact on sub-investment grade credit: In High Yield, we push our year-end spread to 350bp (up from 330bp earlier), while keeping Loan spread forecasts unchanged at 425bp.

Figure 4 High Yield has fared better than Investment Grade through past hiking cycles

Source: Bloomberg, Morgan Stanley Research

In conclusion, we expect spreads to widen modestly from today's levels, and we continue to favour Credit with a high enough running yield to offset duration losses. This implies a preference for Loans over High Yield bonds (due to less interest rate sensitivity) and High Yield over Investment Grade. If our rates’ expectations materialise, loan outperformance over bonds should be more pronounced as they will receive a boost from the USD cash rate which is likely to end the year above 1.0%.

Bentham Global Income Fund (APIR: CSA0038AU)

The Bentham Global Income Fund aims to generate income by investing in global credit markets with some potential for capital growth over the medium to long term. It has a historical bias to global loans and typically has an interest duration of between -3 and 3 years, and led by a highly experienced and stable team.

Alternatives

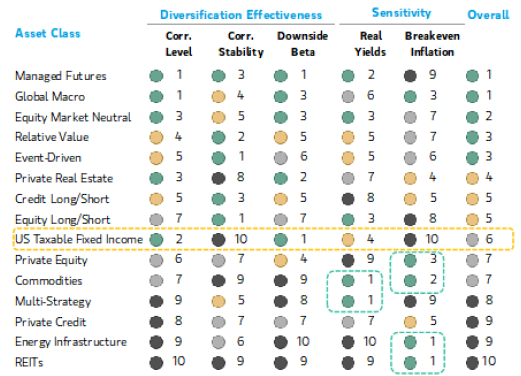

We have also been increasingly positive on Alternatives given expected higher rates from central banks as well as likely higher volatility in the context of higher yields. Our view is supported by a recent study from our US colleagues, where both diversification effectiveness as well as sensitivity to rising real yields and breakeven inflation were considered.

Hedged strategies (ie Hedge funds) appear among the most effective diversifiers, while real assets have demonstrated effective hedging benefits given rising real yields and breakeven inflation levels.

Figure 5: Hedged strategies appear among the most effective diversifiers

Source: Bloomberg, FactSet, Morgan Stanley Wealth Management GIC. Data as at 31 December 2021

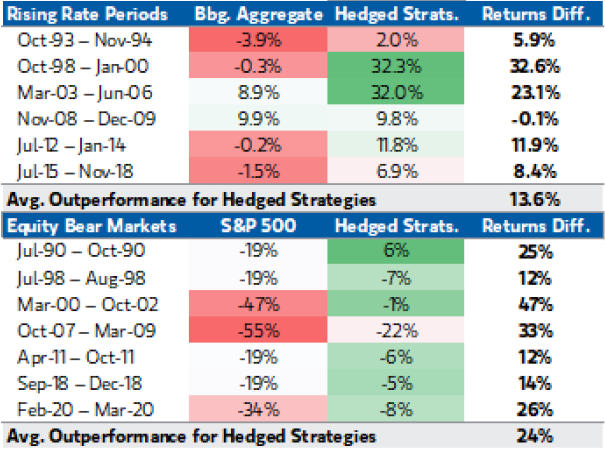

Hedged Funds have also historically outperformed traditional fixed income in periods of rising rates and equities during equity bear markets (see Figure 6). This further reinforces our view for Long Short, Market Neutral and Relative Value strategies.

Figure 6: Hedged strategies historically do better than bond when yields rise and equities during corrections

Source: Bloomberg, FactSet, Morgan Stanley Wealth Management GIC. Data as at 31 December 2021. Hedged strategies’ performance proxied with HFRI Fund of Funds Composite Index.

Ausbil 130/30 Focus Fund (APIR:AAP0008AU)

The Ausbil 130/30 Focus Fund employs a style agnostic approach in constructing a long/short portfolio of Australian equities. The Fund believes outperformance requires identifying changes in earnings at an early stage through proprietary research blending top-down macroeconomic analysis, bottom-up stock research, ESG and quantitative analysis.

It is our preferred fund in the category as, relative to peers, the Ausbil 130/30 Focus Fund has managed to deliver risk adjusted excess returns without a strong style bias or excessive leverage. The Fund benefits from using multi-faceted research in a risk constrained manner overseen by an experienced investment team with specialists.

Sage Capital Absolute Return Fund (APIR:CHN5843AU)

The Sage Capital Absolute Return Fund employs a market neutral strategy that uses both fundamental and quantitative processes to identify long and short investment opportunities. The quantitative process uses momentum, quality and valuation dispersion between ASX listed companies to rank long and short opportunities while the fundamental process uses company analysis to identify mispriced growth.

It is our preferred fund in the category as it is managed by a team of highly experienced portfolio managers. The Fund has also posted impressive returns since inception, both on an absolute and risk adjusted basis.

Please click 'Contact' if you would like a copy of the full Morgan Stanley report.

Specialist advice from Morgan Stanley

Morgan Stanley Australia focuses on providing individuals and institutions with specialist strategic advice and then helping implement these strategies through superior investment execution. For more of my insights, follow me here.

3 topics

1 contributor mentioned