2019 Market Outlook – Watermark Funds Management

Regarding the share market, I am firmly in the bear camp. I cannot see shares making a new high any time soon; we could however very well see the market test new lows later this year or early next year. I explain why in this wire in the context of my broader market outlook.

Shares fell sharply in the closing stages of 2018 and bottomed on Christmas Eve, before recovering most of their December losses in January. Many share markets around the world have moved decisively into bear territory as investors contemplate a confluence of slowing growth, rising inflation and restrictive monetary policy.

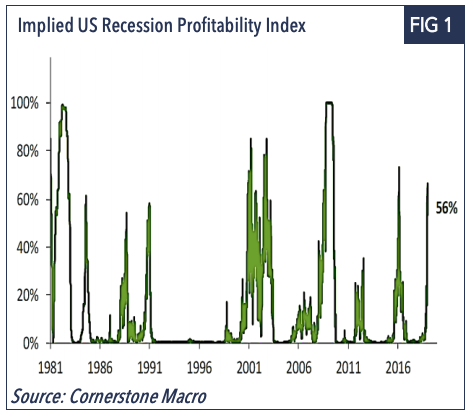

Economist’s use various market indicators to predict recessions (Fig 1), these indicators have all spiked higher recently, presaging a downturn given yield curves have flattened, and the value of shares, commodities and corporate bonds have all fallen together.

Activity indicators have slowed, with Europe, in particular, having a very weak final quarter to 2018 and China slowing faster than expected. Leading indicators in the US are holding steady. While we may end up seeing a small contraction in global industrial production in the quarters ahead, a broader economic downturn is not on the immediate horizon.

Shares were oversold going into Christmas. With the US Federal Reserve softening its stance on interest rates and trade tensions with China easing, shares have staged a strong recovery early in 2019. The key question now is whether this is simply a throw-back rally in a new bear market or a correction with the market yet to advance to new highs in the year ahead.

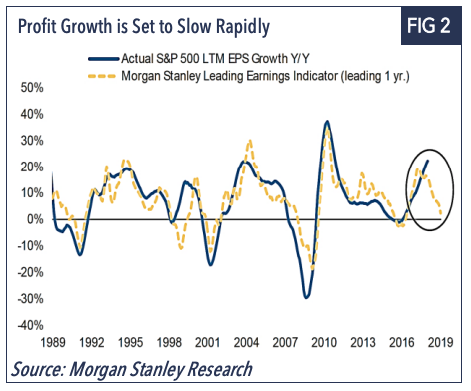

I suspect the answer lies somewhere in between, with 2019 looking much like 2018 where shares move sideways to down as the year progresses. We are running out of runway in this cycle, the prospect of another final rally diminishes as time slips by. With activity slowing, profit forecasts are too high and will have to be lowered, ensuring profit downgrades in the medium term (Fig 2).

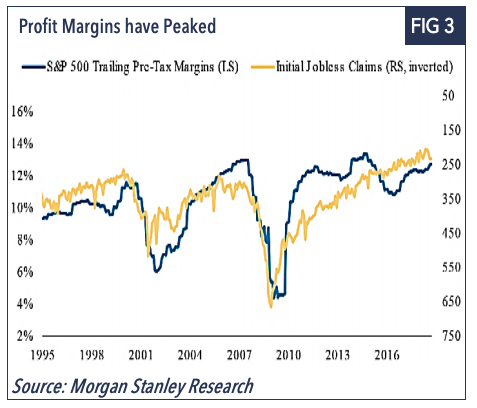

In Europe, for example, there will be no profit growth reported for the final quarter of 2018. It appears we could be in for an earnings hiatus not unlike the two years from 2014 through to 2016 when profit growth stalled on a stronger US dollar and falling oil prices. These cycles typically last a few years and don’t resolve quickly. We have a similar matrix now of slowing activity and rising costs, squeezing margins which look to have peaked (Fig 3).

While we are not looking for a downturn on the immediate horizon, we may see an ‘earnings recession’ where profits fall for a quarter or two given the inflated level of corporate profits which have tripled from GFC lows a decade ago. It is hard to see how shares can sustain a rally with this backdrop.

Incorporating some modest downgrades to 2019 profit forecasts for the S&P 500 Index, at 2750 the US market is trading at 16.5 times (P/E) forecast earnings, this looks fully valued at this late stage of the cycle.

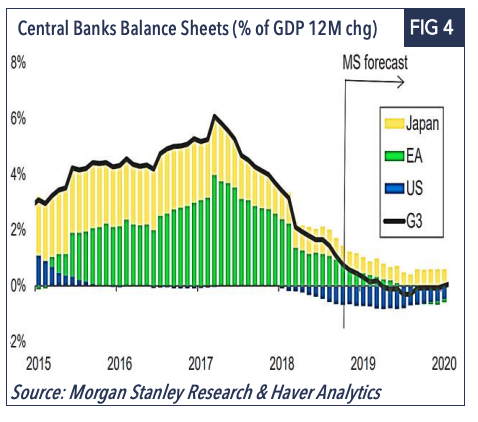

There is some good news however, in so far as interest rates will increase more slowly than many feared, as the US Federal Reserve steps back from the abyss. Share markets will still be challenged through 2019 however as all G4 Central Banks will either be raising interest rates or withdrawing liquidity through ‘Quantitative Tightening’ (unwinding QE), a first for this cycle (Fig 4)

No one fully understands the sensitivity of the economy to interest rates. There are many who believe policy in the US has already been tightened too far- while US interest rates are now at ‘neutral’ levels, because they have been below neutral for so long, market stresses are likely to emerge sooner.

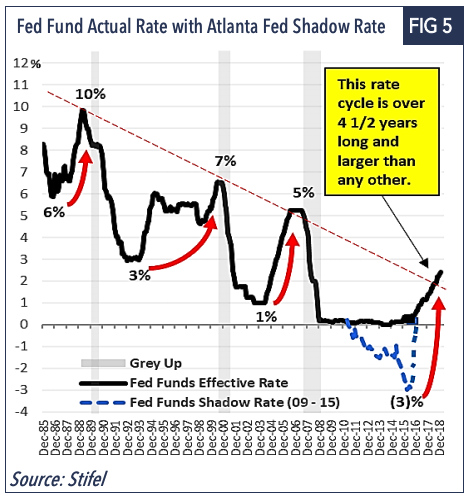

In Fig 5 below, you can see how contrary to convention wisdom, a different interpretation would suggest policy tightening has been underway for more than 4 years. The starting point was not when interest rates increased above the zero bound, but when the ‘shadow rate’ bottomed at minus 2%. (As the Fed policy rate cannot go below zero, the “Shadow Rate” adjusts for the impact of QE -as measured by the Atlanta Federal Reserve).

If we accept that policy was most accommodative half way through 2014, then the extent and duration of the subsequent tightening has been the most significant of the last four cycles. Furthermore, with each cycle, as the debt burden has increased, policy has become more restrictive as interest rates approach the neutral rate.

This thesis would suggest that monetary policy has already been tightened to the maximum extent before stresses emerge in the economy - this would certainly explain the upheaval in debt and equity markets in recent months, risk markets have sent a very clear signal here. The US Federal Reserve is still guiding to further rate increases this year and next, though they appear less committed to these following recent developments.

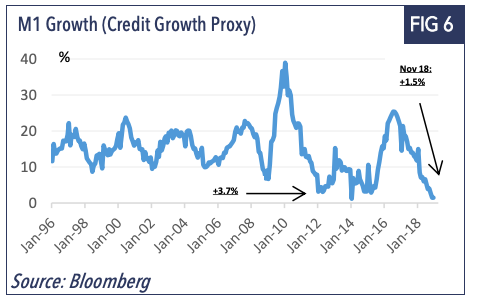

For shares to rally to new highs, we would need to see a return to synchronised growth as occurred in 2016/2017. This is unlikely as the world’s second-largest economy China is decelerating quickly as credit to the shadow banking sector was removed last year (Fig 6)

Consumer spending and trade have contracted in recent months, and while the property sector has held up surprisingly well, it is likely to fall later this year given weaker orders held by major developers. The central government is well progressed in re-stimulating the economy by cutting interest rates and taxes while lifting infrastructure spending. This is unlikely to boost activity until later in the year.

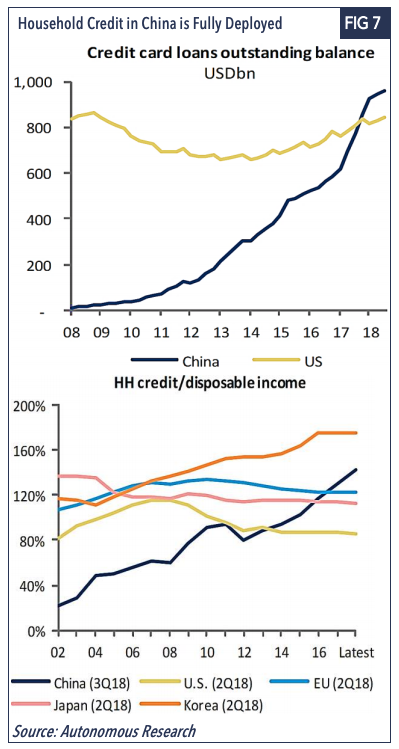

The extent of the slowdown in Chinese consumer spending has surprised many (auto sales as an example fell 20% in the second half of 2018). The importance of this should not be missed, as capital formation in China matures, growth in Chinese household consumption has become the largest single contributor to global growth. This could be a blind spot for economists, who have come to presume growth in Chinese consumption will continue at elevated levels. With the rapid growth in access to debt, household leverage has accelerated, doubling in the last decade. Household debt/disposable income in China- the best measure of debt serviceability is already above the levels of Europe and the US (Fig 7). Taking credit cards alone (ex-store cards), the outstanding credit card debt in China now exceeds the credit card debt of the US, an economy that is 50% larger.

The other major factor undermining confidence last year was the capriciousness of the Trump administration. This will only get worse as we approach the 2020 presidential contest, with new far-left ideas set to unsettle markets further.

Turning to Australia, a slowing Chinese economy will be pivotal given the importance of the trade relationship. Growth in export volumes and commodity prices have been a tailwind for our economy in recent years but this is now waning. The outlook for domestic demand is mixed. There is good news, we are finally seeing some modest growth in household income which has been absent in recent years.

The bad news is the positive impulse from public spending and the mining recovery is peaking, while a contraction in credit is deflating an overvalued housing sector and creating stresses in some indebted sections of the economy. Consumption, the dominant force in the economy, has been supported in recent years by a reduction in the savings rate as income growth has been anaemic. The savings rate is now low and unlikely to fall further however, so we need to see an increase in wages to sustain growth in spending from here.

Australian household indebtedness is high for a developed economy and credit will no longer be a source of support, particularly as banks tighten unsecured lending. Consumer confidence is the critical swing factor and falling house prices don’t help. Recent weakness in retail sales and discretionary spending would suggest households are becoming more cautious. State and federal elections this year are likely to dampen spending further and disrupt business continuity.

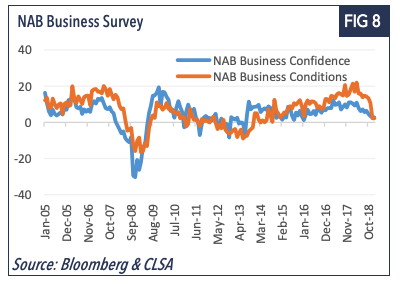

For the optimists on the economic outlook, who have pointed to a recovery in business investment, a cursory look at the latest NAB business survey of business confidence would be alarming (Fig 8)

On balance we suspect the economy will lose momentum this year, absent an external shock or disorderly deflation of the housing bubble, we are unlikely to see an outright contraction in activity any time soon as a new Federal Labour Government is likely to boost spending and wages buttressing domestic demand.

As for the share market - I am firmly in the Bear camp. I cannot see shares making a new high any time soon; we could however very well see the market test new lows later this year or early next year.

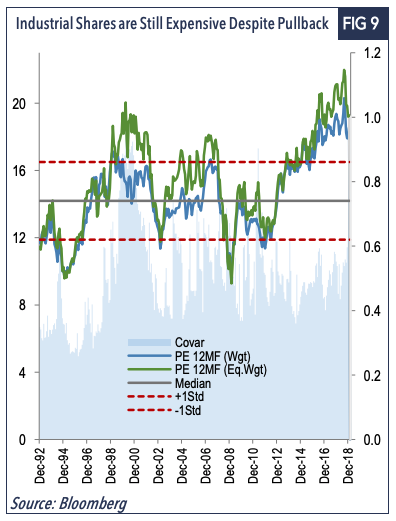

Key sections of the market are challenged - profits are unlikely to grow for the major banks in the medium term; this is also true for defensive sectors such as telecom and utilities. Mining companies have held up remarkably well given the slowdown in China and will most likely trade sideways from here. This leaves the broader industrial market where growth is still overvalued (Fig 9) despite the recent pullback, and profit expectations are likely to be paired back as the economy slows.

The funds are overweight the defensive segments of the market: infrastructure, regulated utilities, property, general insurance and staples; while maintaining shorts in housing and retail. The portfolio is neutral in mining, with shorts in the bulk commodity producers and longs in base metals and gold. We are in a bear market for oil, given the weaker demand backdrop and are defensively positioned in this sector. Overall, we retain our fully hedged position which has served us well in recent months though stock selection has detracted from performance

3 topics