2025 interest rate outlook: Good and bad news for ASX investors and mortgage holders

In 2024, the Reserve Bank of Australia (RBA) danced the monetary policy tango: attempting to continue to pare back rampant post-pandemic inflation without completely tanking the Australian economy. So, did it succeed?

1. Australian Inflation Check:

,%20Source%20Fair%20Economy%20ForexFactory_1.png)

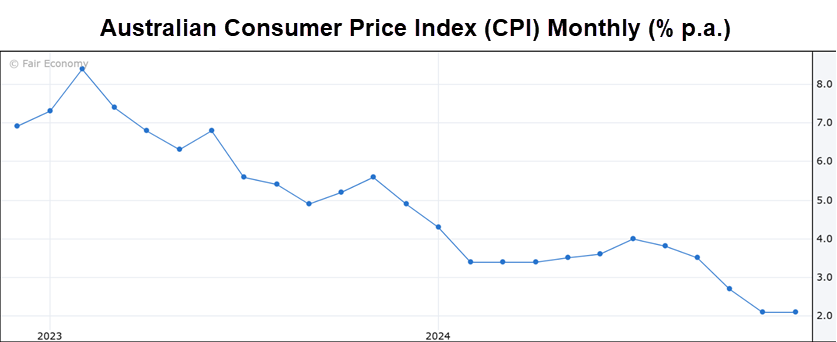

After peaking at 8.4% p.a. in December 2022, the monthly consumer price index (CPI) has fallen to just 2.1% based on the most recent data covering the 12 months to October. The RBA’s target range for inflation is 2-3%, so it would appear mission accomplished on this basis.

However, it’s underlying inflation that the RBA is concerned about, not the so-called “headline” data shown in the graphic above. Underlying inflation is measured by the trimmed mean or “core” CPI, which removes larger price increases or decreases (most recently, these are typically electricity, petrol, and food).

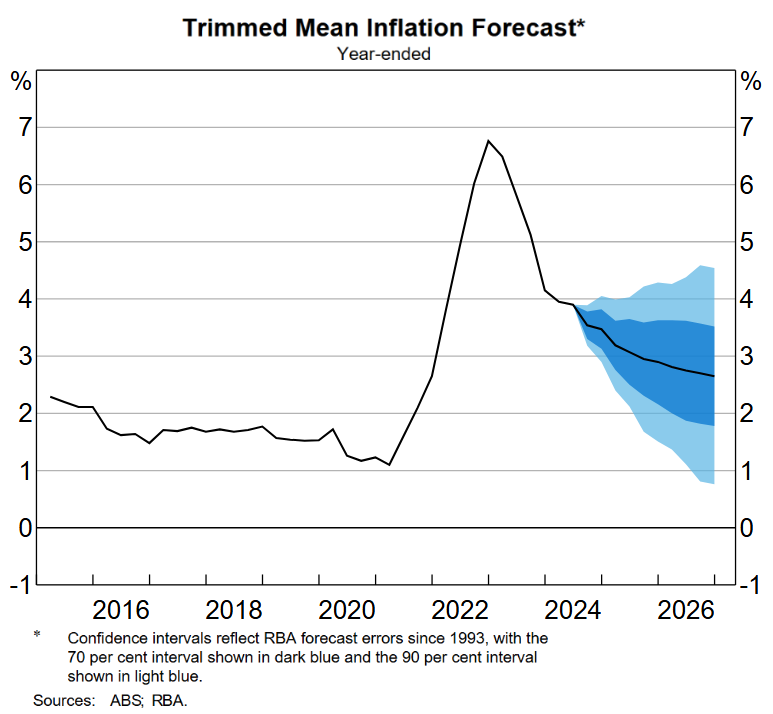

The most recent trimmed mean CPI for the September quarter was 3.5% p.a., and economists are forecasting around 3.4% p.a. in the December quarter – that data is due to be released on January 29. Either way, the RBA’s preferred measure of Aussie inflation remains substantially above its target range.

The trend in underlying inflation is also down, however, as seen by the RBA’s most recent graphic on this item, above. The RBA predicts trimmed mean CPI will return to the top of the target band by the end of 2025 and the mid-point by the end of 2026.

In summary, whilst substantial progress was made on inflation in 2024, the RBA considers there remains substantial work to be done. Based upon recent RBA rhetoric, it appears that a pick-up in inflation, or a slower-than-expected return to target – remains the greatest near-term risk for the Australian economy.

2. Australian Economic Growth Check:

%20growth.%20Source%20Reserve%20Bank%20of%20Australia.png)

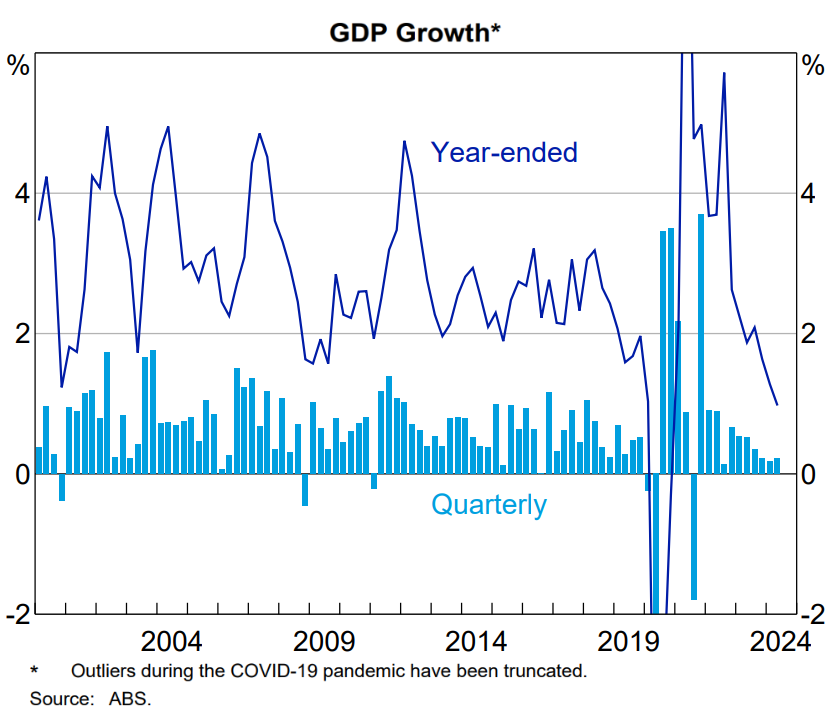

Australian economic growth is usually measured by Gross Domestic Product (GDP), which accounts for the total value of goods and services produced by the Australian economy.

The old saying, “You can’t make an omelette without breaking a few eggs,” is particularly true when it comes to monetary policy. Central banks typically pull the higher interest rates lever to fight inflation – and this typically results in lower economic growth. During periods of lower economic growth, most households do it at least a little tougher.

This was the experience in 2024, with Australian GDP grinding to a meagre 0.3% quarterly growth and 0.8% annualised growth in the September quarter. Outside of the period immediately following the pandemic, this was the slowest rate of growth in over 20 years.

Both the RBA and economists expect GDP growth to rebound in 2025, however, to around 1% p.a. in the December quarter (data to be released March 5) and to around 1.5% p.a. by the end of this year.

Interest rate relief is on the way…But…

So, it could be argued that whilst the RBA made modest progress on inflation, the Australian economy has suffered as a result. There is some good news on this last point, however, which could help deliver the forecast rebound in the Australian economy as well as much-needed relief to struggling Australian households. Interest rate cuts are coming, and soon. There is some bad news also, though – market pricing has shifted modestly towards a higher Reserve Bank official cash rate (“OCR”) in the longer run.

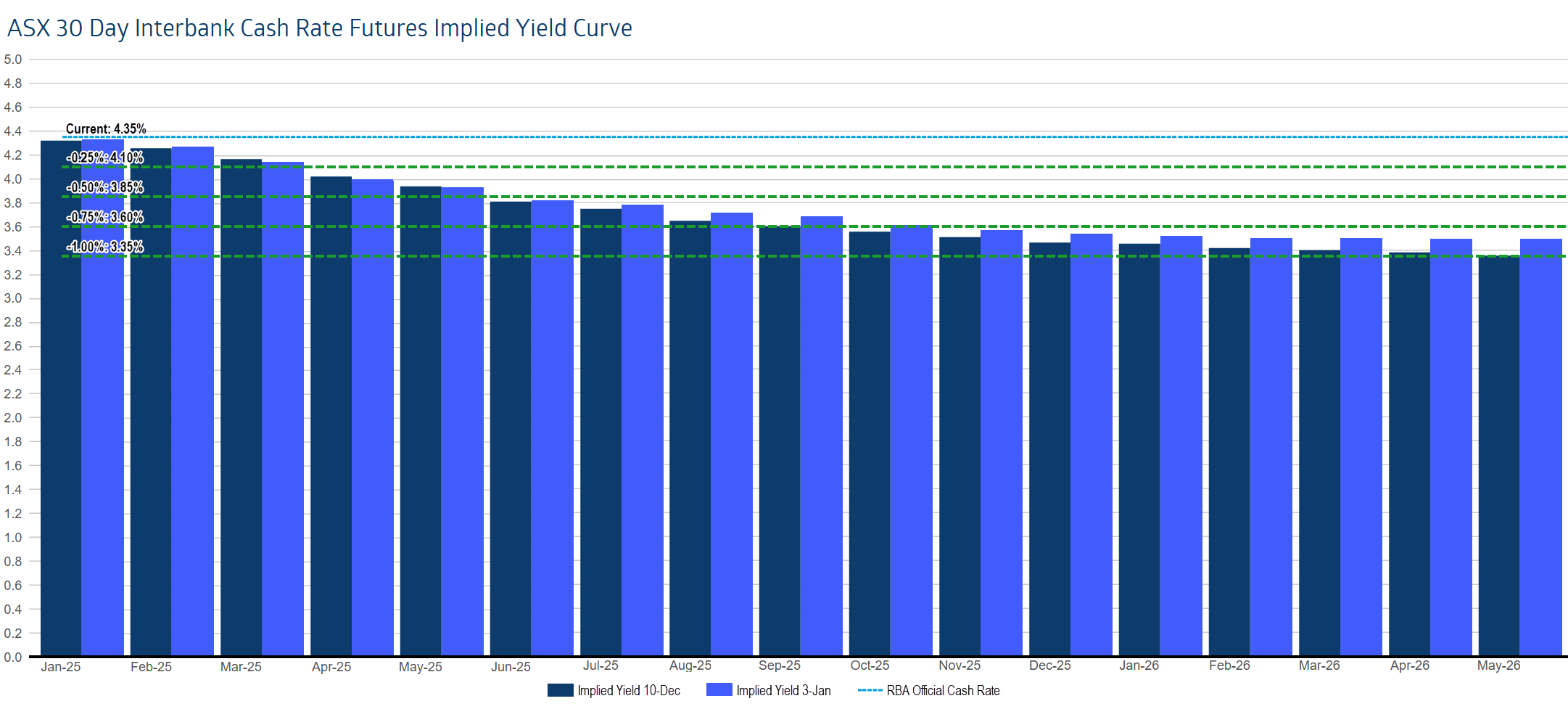

To understand how markets are positioning for RBA interest rate policy in 2025, we must look to the ASX 30-Day Interbank Cash Rate Futures Implied Yield Curve (“the yield curve”). It is the widely used proxy for where the RBA’s OCR will be at the end of each month of the year, looking out around 18 months.

I have overlaid the yield curve for Friday (light blue bars) with the yield curve for our most recent update on December 10 (dark blue bars) to illustrate the change in market expectations for the timing and magnitude of RBA interest rate cuts over the last few weeks. Note that update showed a significant reeling in of the timing and magnitude of forecast rate cuts – so any improvement since then is particularly telling. I’ve also drawn on the schedule levels equating to the next 1.0% of 0.25% cuts.

Generally, the market has firmed its expectation for multiple 0.25% rate cuts in the first half of 2025. That’s the good news. The bad news is that it now expects just one (not the previous two) rate cuts in the second half of the year with a higher than previously expected OCR by year’s end.

These are the key takeaways for investors and mortgage holders from the latest yield curve:

- The next RBA meeting is 5-6 February, the market sees this meeting as slightly less likely to deliver the first 0.25% rate cut (probability has decreased from 34% to 30%)

- The second RBA meeting of 2025 is 31 March-1 April, the market is factoring a 100% chance of a 0.25% rate cut by the end of April - so this is the most likely meeting to deliver the first rate cut.

- Given the yield curve is forecasting an OCR of 4.00% by the end of April, this implies that it sees a 40% chance of a larger 0.50% cut on April 1 (up from 28%).

- The chance of a second 0.25% cut at the 19-20 May meeting grows to 68% (forecast OCR 3.93%), and it is a lock by the 7-8 July meeting (forecast OCR 3.78%).

- The third 0.25% cut timing is now pushed out from September to November.

- Previously, there was a 98% probability of a fourth rate cut by May 2026, but the market has now all but ruled this possibility out, with the OCR holding around 3.50% for the remainder of the look-forward period. This implies the RBA may, at some point in the second half of 2025 or early 2026, deliver a smaller 0.10% rate cut to round the OCR off at 3.5%

Seeking Goldilocks

Based on recent market pricing, investors and mortgage holders are still likely to see up to three 0.25% interest rate cuts in 2025. Pricing has firmed that the RBA will likely act decisively and swiftly when it does decide to cut rates with the first cut priced for April, and with a modestly larger probability of 0.50% of cuts by its May meeting.

From there, markets are now expecting fewer cuts in the OCR in the second half of 2025, and it is more likely to settle around 3.5% in the medium-to-longer run.

Is 3.5% the goldilocks level of official Australian interest rates, enough to provide relief to mortgage holders while at the same time sufficient to stave off the recurrence of the inflation threat? One thing is for sure: 2025 is shaping as one of the most pivotal years for the Australian economy in possibly a generation.

This article first appeared on Market Index on Monday 6 January 2025.

5 topics

8 stocks mentioned