3 high-quality stocks to buy during the 'Trump slump' panic

Markets have been rattled lately, driven by fears of rising inflation, potential stagflation, and renewed global trade tensions sparked by recent U.S. protectionist policies – quickly dubbed the 'Trump Slump'. However, our view is that the time to sell those lower conviction holdings was last week, when we delivered our Macroeconomic Wake Up Call to subscribers of A Rich Life.

By the time you’re reading this, it might be too late to start shorting the market, even if you have an adequate risk management capacity to do so safely. Assuming that you’ve already sold out of your low conviction stocks you were thinking of selling anyway, we think now is time to prepare yourself for bargains that might arise in the future.

After all, as every seasoned investor knows, the best opportunities usually emerge when the headlines scream the loudest.

Why You Need a Watchlist of 'Fluffy Dogs'

The phrase “you can’t pat all the fluffy dogs” is a metaphor used to explain that you can’t own shares in all the top quality stocks. However, that doesn’t mean you shouldn’t try to have some “fluffy dogs” in mind, for when markets suffer a broad sell off.

After all, what better time to top up on high-quality multi-year stock market compounders than during a broad-based panic?

Without preparing a list of “fluffy dog stocks” for a sell-off like the one we are in now, you might find that you miss top notch opportunities due to indecision, when those fleeting moments arrive. Not only that, but by preparing lists of high quality stocks we like – and the price we would pay for them – we can prime our own psychology to take advantage of market volatility, rather than run scared and sell at the worst possible moment (peak panic).

To get you started, I've highlighted three high-quality stocks that deserve a place on any investor's watchlist. Please let us know what high quality “fluffy dog” stock you have your eye on, and you could even share your buy price target, if you dare!

1. Netwealth (ASX: NWL)

Netwealth is a technology-driven wealth management platform thriving as advisers abandon legacy systems for modern, flexible alternatives. Its recent results speak for themselves: half-year revenue of $155.4 million (+26%), NPAT of approximately $58 million (+47%), and EBITDA margins reaching an impressive 50.2%. Netwealth’s minimal capital expenditure requirements typically ensure robust cash generation and an exceptionally strong balance sheet.

I view Netwealth as high quality because of its powerful market position, superior profitability, and because it’s family owned and run. With Funds Under Administration (FUA) hitting $101.6 billion and consistently strong net inflows, Netwealth has plenty of runway left. Structural tailwinds – such as growing superannuation balances and increased financial advice demand.

Recent market jitters have pushed its share price from $31.68 on 21 February to around $26.82 at the time of writing* – a ~15.3% drop, making it a compelling candidate for your watchlist.

I recently wrote this Livewire article on the funds management platforms.

2. Pinnacle Investment Management (ASX: PNI)

Pinnacle is a multi-affiliate investment management firm supporting and investing in leading boutique fund managers. Perhaps more compelling is Pinnacle’s strategic positioning – it remains a preferred growth stock among top-performing fund managers, reflecting its strong credibility. While other investors’ opinions should always be taken with a grain of salt, I believe it’s more relevant in this situation as many of these managers are directly competing with Pinnacle affiliates.

Its recent half-year results were exceptional, delivering NPAT growth of 151% to $75.7 million, thanks largely to strong affiliate performance fees. Revenue grew 16.7% to $27.6 million on a statutory basis, or 54.2% to $454.5 million when including Pinnacle Affiliates on a 100% aggregated basis. Although Pinnacle had negative free cash flow this half due to substantial strategic investments, the balance sheet remains robust, with a comfortable net cash balance of around $90 million offsetting borrowings of approximately $100 million.

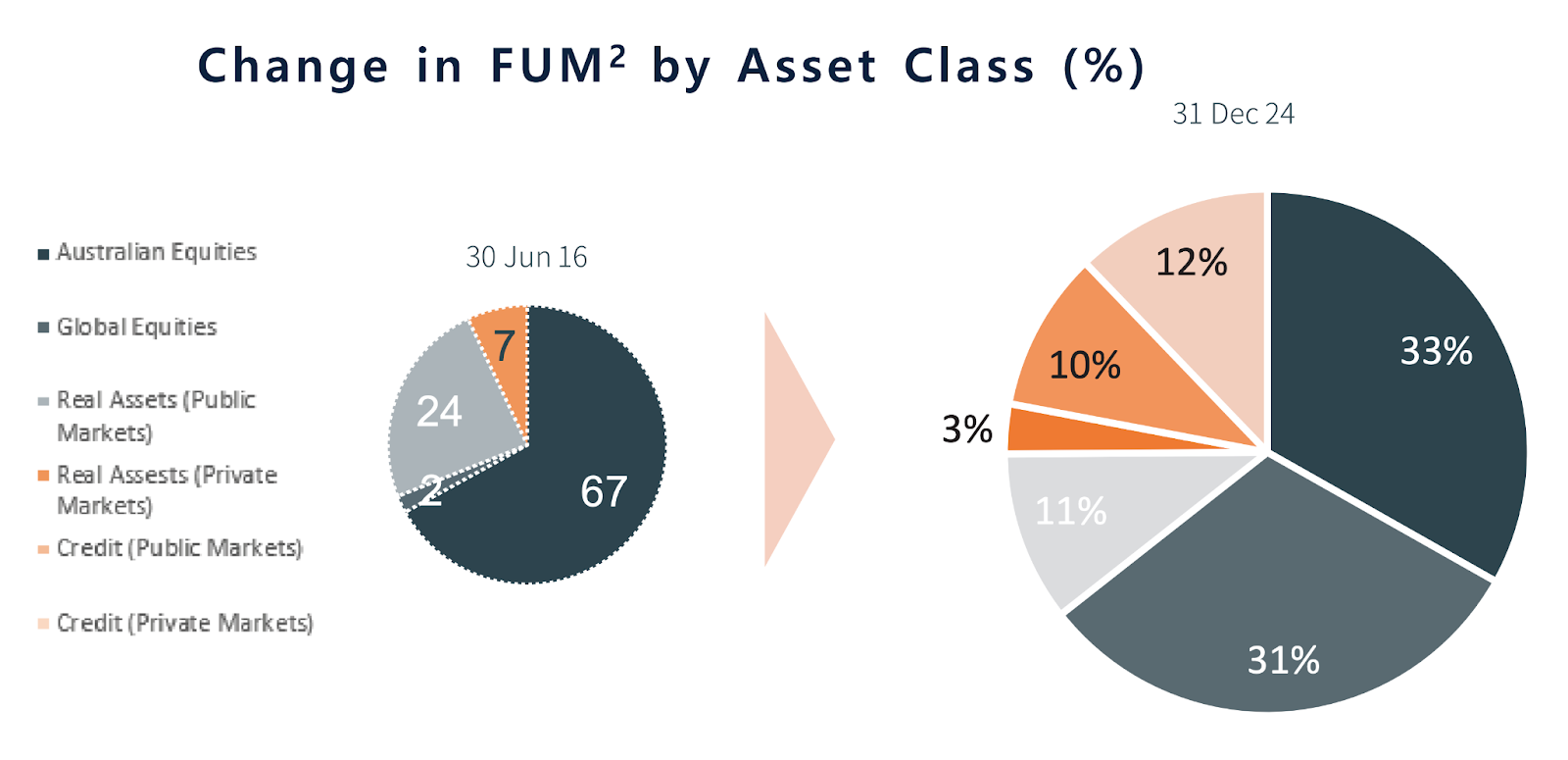

Pinnacle’s diversified approach helps reduce risk. Its portfolio includes both Australian and global equity managers, private equity and private debt managers, and infrastructure managers. Its AUM is sourced from both retail and institutional investors, both in Australia and overseas. Its affiliates, including high-performing names such as Hyperion Asset Management, consistently generate alpha, reinforcing Pinnacle’s ability to sustainably grow profits.

Pinnacle has fallen further than the market in recent weeks, likely due to the Hyperion funds holding large positions in Tesla, Block, and Wisetech which have fallen 45%, 41.5%, and 30.4% since the end of January. The falls will be a big hit on Hyperion's performance, which will likely lead to lower performance fees. However, its worth noting that Hyperion only accounted for $17.2 billion of Pinnacle's $155.4 billion of FUM as at 31 December, and each of Hyperion's three funds was outperforming its benchmark by more than 20% as of their 31 January update1.

The recent 28.5% pullback from $25.17 on 4 February to around $18.00 at the time of writing on March 11 provides investors with an increasingly attractive entry point into a proven business model.

I've been waiting for an opportunity to buy PNI at the right price, so I'll be keeping a close eye on this one in the days and weeks ahead.

3. AUB Group (ASX: AUB)

AUB Group is an insurance broker network that benefits from structural tailwinds such as rising insurance premiums driven by inflation and increased climate-related insurance claims. Unlike insurers, brokers like AUB benefit from rising premiums without bearing the increased claim liabilities, because their fees are often expressed as a proportion of the total cost of the policy.

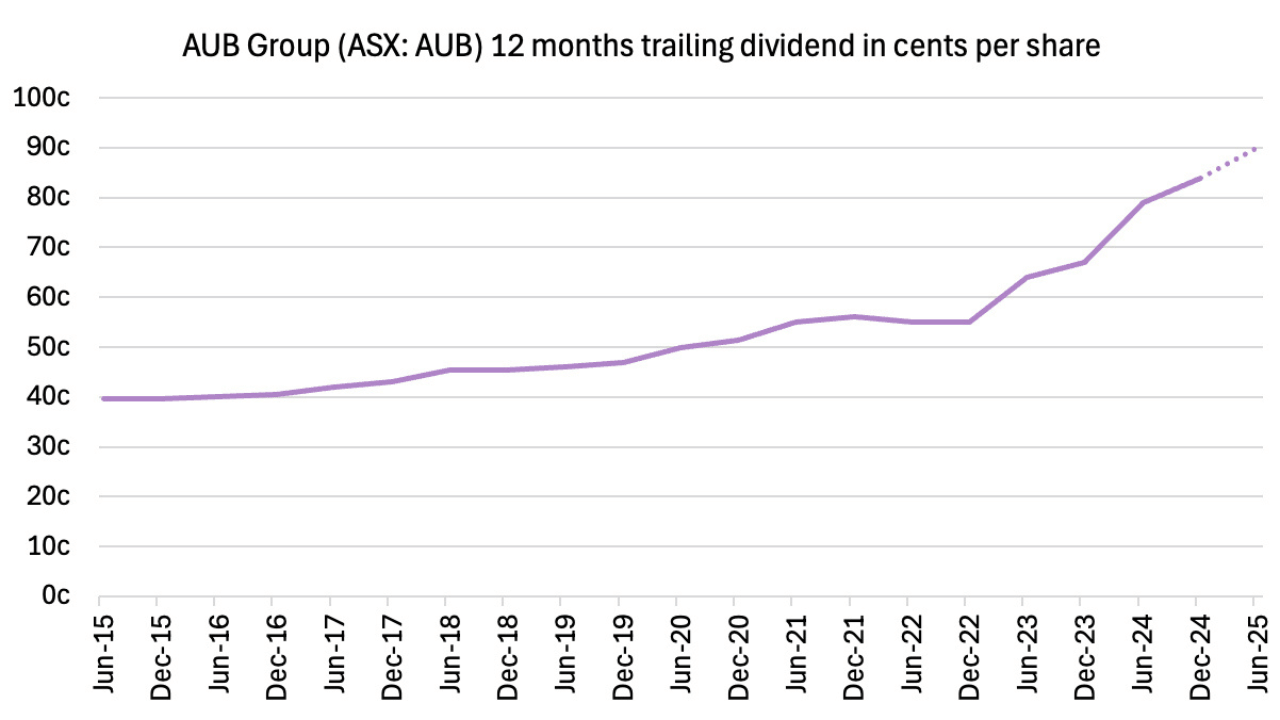

AUB Group’s statutory earnings per share were down in H1 FY 2025 largely because of movements in contingent consideration, but its underlying earnings per share were up 5% to about 68c per share. The second half is always stronger for AUB Group, and during the H1 FY 2025 results conference call CEO Mike Emmett said that, “In the second half of '25, we anticipate strong organic growth of 8% to 16% combined with growth from acquisitions of 11.9% to 13.9%.”

Broker analysts are estimating underlying earnings per share of about $1.68 for FY 2025 and a full year dividend of around 90c for the full year.

If these estimates are correct, then at the current share price of $28.81 AUB Group trades on a forecast FY 2025 underlying price to earnings multiple of under 17.2 and a forecast FY 2025 dividend yield of over 3.1%. The editor of this article Claude Walker already owns shares in AUB Group, and as disclosed in his recent analysis of the AUB Group H1 FY 2025 result, already considers AUB shares attractive at the current price.

Conclusion

If you are going to panic, it is best to panic before everyone else does. Once panic arrives, markets offer opportunities to purchase shares in high-quality companies, at attractive prices. So we think you can benefit by answering the following questions, even if only to yourself.

What high quality stocks do you have on your watchlist? And when will you pounce?

Unlock Deeper Insights With A Rich Life

Independent, incisive commentary covering Australian business, investing ideas, global markets, and more – tailored for active investors. Read our latest updates on A Rich Life.

* Tuesday March 11th, approximately midday.

The author of this article, Patrick Poke, owns Netwealth (ASX:NWL) shares. Claude Walker, who edited this article, owns AUB Group (ASX:AUB) shares. Neither the author nor the editor will trade shares in any of the companies mentioned for at least 48 hours following the publication of this article.

Sources:

- HGGCF, HAGCF, and HSGCF January 2025 Fund Updates, and Pinnacle Investment Management H1 FY 2025 Results Presentation.

1 topic

8 stocks mentioned