3 key risks facing growth stocks

With high quality, growth-focused Australian small cap businesses enjoying a stellar run of recent outperformance, this month we have shared with investors some thoughts on macro risk identification and how our portfolios are currently positioned should we see an unexpected shift in the current investment climate.

Professional money managers can often be unfairly characterised as a relatively pessimistic group of individuals, primarily due to a continual pre-occupation with trying to evaluate risk and the possibility of negative or unexpected outcomes.

Like a beachgoer in glorious summer weather continually checking forecasts for the chance of rain, this anxious behaviour has a tendency to accelerate through periods of better performance!

1: The Reflation Trade...Again?

The impact from a sudden and unexpected earnings reflation period in Australia would be one of the more obvious concerns near term, particularly given higher-quality/higher-growth businesses saw a preview of how the market could position for such a period through the ‘false-start’ reflation trade through the second half of 2016.

A reflation environment is characterised by a period of rising prices and stronger economic growth, meaning businesses with earnings tied to the underlying economic cycle (i.e. cyclicals, financials and resource companies) begin to see an improvement in fortunes given the tailwinds of a better economic climate.

These types of businesses are generally not high quality and typically aren’t overly expensive either. The ability for these companies to see a rapid improvement in earnings on the back of a more favourable operating environment can make them attractive investment propositions at the point when the underlying cycle immediately turns. Equally, the premium the market is willing to pay for higher-quality businesses that have managed to generate earnings growth independent of the cycle will often compress given similar growth opportunities are now available at cheaper valuations.

Our own investment philosophy is based around identifying businesses that we feel are in (or about to enter) a period of structural growth. As such, the portfolio will tend to maintain a natural bias toward higher-quality business models that typically attract valuation multiples around, or above, current market valuations. While the level of earnings growth on offer generally more than compensates for higher prices, as risk managers we need to be cognisant of the risk these companies could face should we see an unexpected reflationary period.

For now, the current outlook for price inflation in Australia remains broadly uninspiring. Despite an obvious impact recently from surging energy costs, Consumer Price Index (CPI) data again underwhelmed market expectations in October, with the headline CPI running at just 1.8% year-on-year. Bearing in mind electricity prices rose an estimated +8.9% through the last quarter alone, the underlying softness in the remainder of the pricing basket is fairly pronounced. For cyclical-type businesses hoping to increase their earnings margins via price increases, the current environment continues to remain fairly challenging.

Global inflation reads, on the other hand, have been more positive with forward-looking PMI surveys still elevated and business confidence measures indicating more enthusiastic corporate boardrooms. In contrast to Australia, there are real signs of reflation beginning to emerge in the US and the market has begun to position for this: US bond yields have risen some ~14% in recent months in anticipation of higher rates, while equity market leadership has begun to rotate toward sectors more linked to the health of the domestic economy (namely banks/financials, cyclicals and domestic industrials).

While underlying inflation isn’t overly dramatic, we continue to monitor the data for any evidence of this having an effect on Australian inflation and the outlook for the current suite of companies we own. At present, we don’t feel current developments are likely to impact the Australian investment landscape overly negatively.

2: Financial or liquidity crises

Of course on the other side of the risk equation, Australian investors must also give some thought to the impacts from a financial meltdown type scenario, one most likely initiated by some rapid unwind in debt-funded asset pricing (primarily housing) and how the portfolio could be exposed in such an event. An obvious outcome of multi-year, generational-low interest rates has been the subsequent increase in financial leverage accumulated at the consumer level in recent years – this is not the first time that a sustained period of borrowing costs has led to some level of exuberance in asset pricing, and the most obvious beneficiary in Australia has been the East Coast residential housing market.

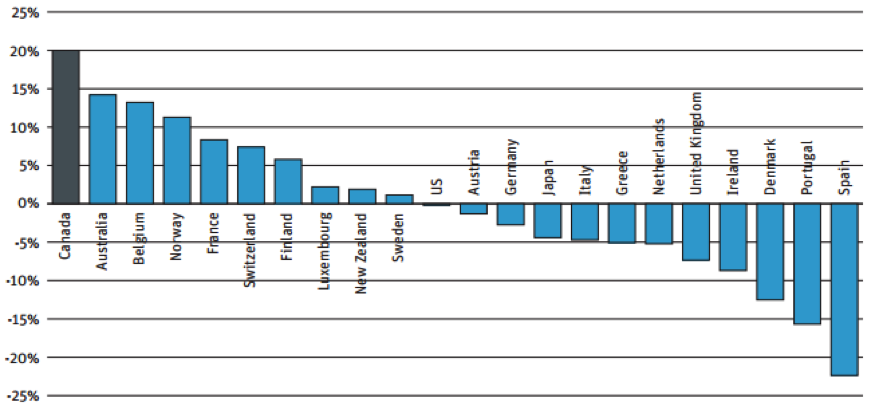

The growth in private sector debt (i.e. household and non-financial corporate debt) as proportion of GDP in Australia has grown rapidly in recent years, sitting second only to Canada in terms of growth since 2012. While the Australian economy has reaped the multiplier benefits from the housing boom (primarily the elevated home construction cycle and positive wealth effect from rising home prices), higher-than-average debt levels through a period of slowing growth can be problematic. At the very least, it makes the local economy far more susceptible to movements in interest rates, employment levels and living costs as consumers struggle to meet their monthly interest obligations under larger amounts of debt.

Private Sector Debt-to-GDP Change in Advanced Economies (past 5 years)

Source: BIS & Canadian Centre for Policy Alternatives

Ironically, from a portfolio positioning perspective, it is the businesses that are best placed to perform in a reflationary cycle that will ultimately the most exposed in a financial crisis event.

With the bulk of private sector debt held at the household level, it is the cyclical businesses heavily reliant on a healthy domestic consumer and the providers (and ultimate owners) of outstanding debt (i.e. banks and financials) that will likely feel the most discomfort.

Unfortunately, these are also the exact grouping of businesses that would perform best through a reflationary episode – the risk manager’s conundrum.

3: Upside risk

Of course, the final risk factor facing portfolio management teams in the current market is ‘upside risk’, remembering that risk works both ways.

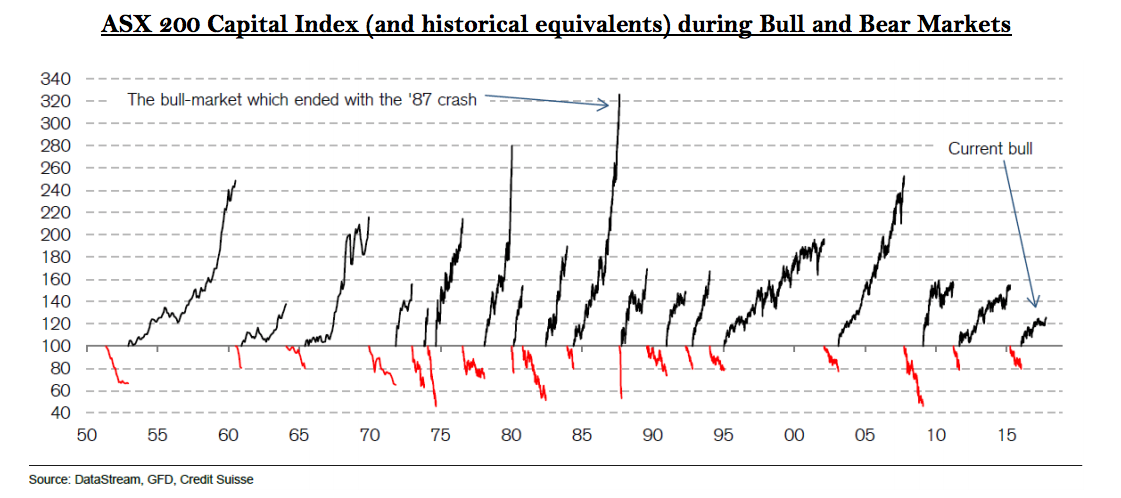

Positioning a portfolio too conservatively can ultimately result in a missed opportunity of participating in further upside, particularly in the latter stage bull markets where the bulk of returns tend to be generated toward the end of the cycle.

While the current bull market run in Australian equities has some tenure in terms of time (i.e. months passed since the last -20% pullback), the overall share price appreciation over the period has been relatively muted versus historical market moves. A recent analysis from Credit Suisse highlights that the current bull market in the ASX 200 is the 18th since 1950 and, if it were to end today, would be the smallest in terms of total share price return (with the median bull market run over the last 70 years delivering a total capital return of 70%).

While we recognise that risk levels are more elevated at this stage of the cycle, we tend to view the current environment as continuing to remain broadly supportive for equities - particularly for those businesses that are continuing to deliver sustainable and ongoing earnings growth. While equity market valuations do sit at a premium to longer-term averages, we are yet to see any meaningful warning signs of irrational exuberance emerge (e.g. increasing levels of M&A, significant increases in corporate leverage, unbridled optimism, ‘new’ valuation metrics etc).

We will continue to remain cognisant of the various risks that Australian businesses could potentially face under either a reflation or financial crisis scenario, however, at present we continue to feel these risks remain largely contained.

Growth remains difficult to find for larger capitalised, older-world businesses and, as a result, the opportunities available for higher quality, emerging growth businesses in Australia continues to remain compelling.

This Wire is an excerpt from the Ophir Letter to Investors – October 2017

5 topics