3 reasons (and 4 stocks) that prove the emerging markets slump is over

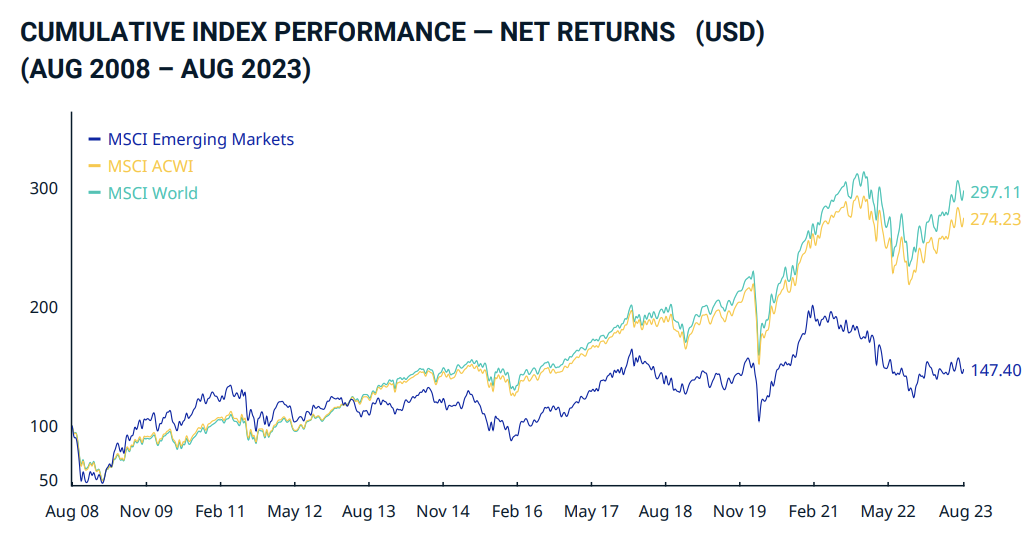

There is no denying that it has been a tough 10 years for emerging markets equities. In US Dollar terms, investing in the MSCI Emerging Markets Index has returned less than half of what investing in the MSCI World/developed markets index would have netted you. If you invested in early 2021, you would actually now be down more than 30% since that peak.

From COVID-19, to the relentless strength of the US Dollar, to the regulatory challenges in China, there have been plenty of reasons to remain anchored to developed market equities.

But all that appears to be changing

US stocks are richly valued, the greenback is slowly losing its lustre and, most importantly, companies in emerging economies are growing their earnings. And as any investor could tell you, it's earnings that lead share prices in the long-term.

So is now the best time in a decade to take a closer look at emerging market equities? And if it is, where do you start looking given it's such a huge universe with so many mega-trends playing out at once?

To illuminate us on the global opportunity, and in particular, the opportunities in emerging markets, I sat down recently with abrdn's Global Head of Equities and Head of Emerging Market Equities Devan Kaloo.

In this video, Kaloo will explain why he thinks it will be very difficult for the US to avoid a recession, what emerging markets he is looking at most closely, and the stocks and thematics he likes the best. He'll also share his views on the Australian equity market and how our stocks stack up against our global peers.

EDITED SUMMARY

The global macro outlook

Although a traditional recession is not expected in most areas of the developed world, it's still a concern that asset allocators need to have in the back of their minds. Kaloo says he finds it "really hard to envisage how higher rates don't lead to an economic slowdown", especially given how much debt there is in the global financial system.

The other major story of 2023 has been the massive run for US mega-cap tech stocks. While abrdn are structurally bullish on the technology story, they argue the better opportunities are outside of the US.

"We think there is a multi-year tech cycle coming through, and that's driven by AI," Kaloo said.

The Australian opportunity

To most of the world, our stock market is known for two things - digging things out of the ground and our position as a proxy to the Chinese economy. Kaloo believes our largest miners (ASX: BHP and ASX: RIO among them) still have "a lot to offer".

"They are well positioned for the transition story but there are also companies outside of that which look interesting like the banks and the healthcare companies," Kaloo added.

Is all this new-found pessimism around China justified?

With global bond yields surging, crude oil prices near 10-month highs, and a confidence crisis in China, there are no shortage of headwinds available for the bears to pick through. But Kaloo sees things more constructively.

"We are less pessimistic with regard to the outlook for the property market in China, and we think the authorities will get it under control. We think there are better valuation opportunities in China," he said.

Kaloo notes that China's economic future has had broadly one of two options placed on it:

- A "Japanification" style scenario, where company balance sheets struggle for a long time; or

- The experience of the Asian Financial Crisis, where large debt was financed in US Dollars

But Kaloo says neither of these two characterisations are correct for a very simple reason:

"Households don't have very much debt. Households have had to pay 50% down payments in order to get a mortgage. There is not a lot of debt and the debt is funded domestically," Kaloo explains. "The reason why this is relevant is because it means the slowdown is fairly containable and it is just a matter of time before there's enough policy support to see that recover," he added.

Specific opportunities in global markets

Kaloo is constructive on the global technology cycle, and cited AI, 5G, autonomous driving, and the digitisation shift which is taking place across the world at the moment. But there is one company he isn't buying at this moment.

"We think NVIDIA (NASDAQ: NVDA) is looking a bit expensive now. Our preference is to play this through emerging market plays," he said.

Kaloo prefers to express this trade through the hardware and infrastructure companies in the emerging markets. His top exposures are towards companies like TSMC (NASDAQ: TSM) and Samsung Electronics (KRX: 005930).

Beyond technology, he is also attracted to some of the largest emerging market banks. In Indonesia, he likes Bank Rakyat Indonesia (IDX: BBRI) and in India, his top pick is a crowd favourite in the industry - HDFC Bank (NSE: HDFCBANK).

.png)

.png)

4 topics

5 stocks mentioned

2 funds mentioned

1 contributor mentioned