3 reasons why US stocks keep hitting all-time highs (and can the ASX 200 do the same?)

So far this decade, a remarkable phenomenon has been playing out in the stock market. The conventional wisdom around rapid rate hikes, the weaker consumer, extreme concentration risk, and valuation bubbles (to name a few) have all suggested that equity markets should be a lot lower than they are right now.

Bar the difficult year that was 2022, earnings growth has continued to expand and companies like Apple and Alibaba are approving share buybacks by the billions.

But how did we get here? Ned Davis Research has written a paper on this exact subject. In this wire, we'll share their key reasons (and the charts that go with it). Plus, we'll translate their reasons for the Australian market and attempt to find out whether the ASX 200 can do the same with the help of some insights from Shaw & Partners and Morgan Stanley.

First things first...

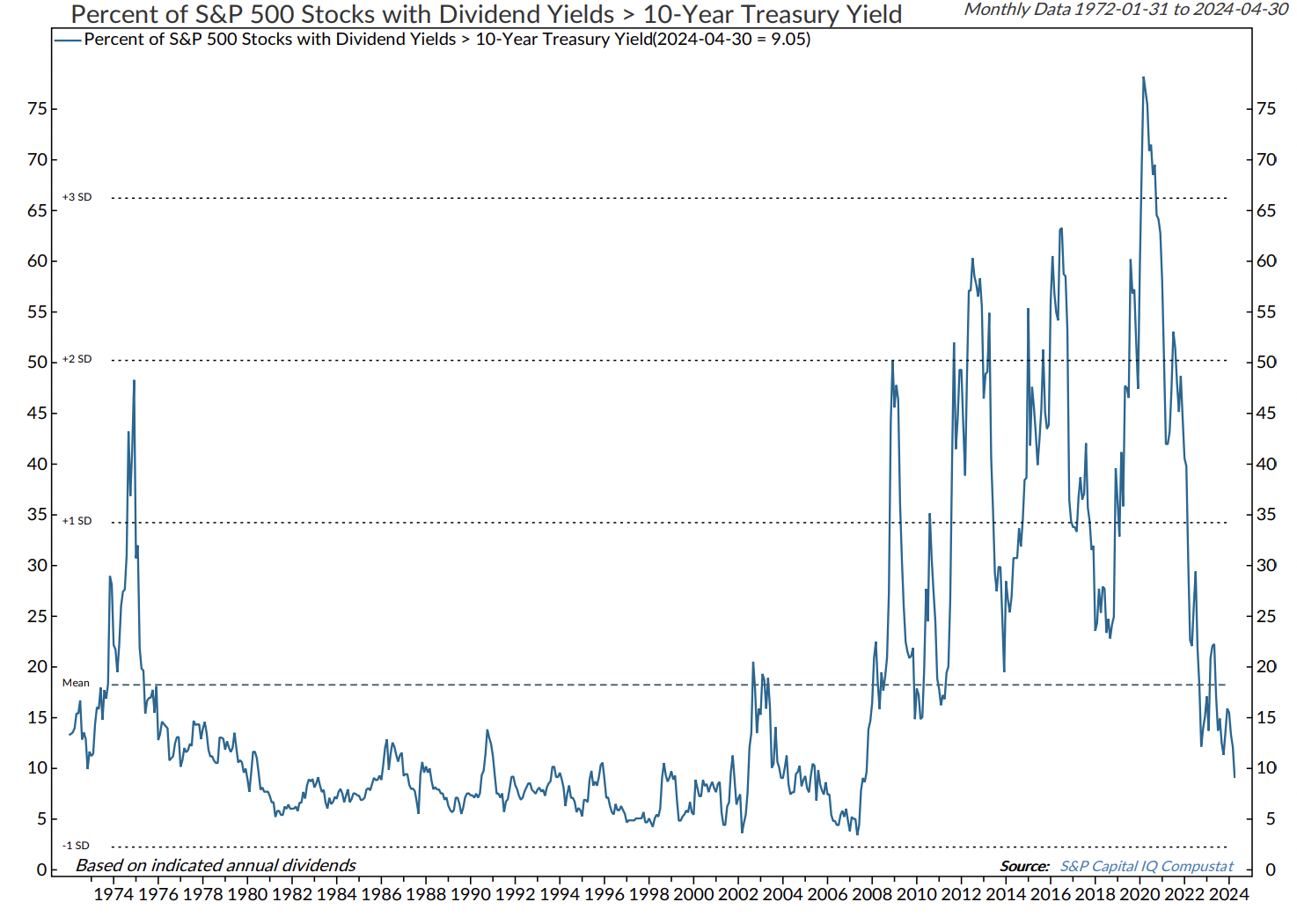

The best way to work out which investment is worth more of your time is to look at the percentage of stocks with a higher trailing dividend yield than a 10-year bond yield.

What the cold math demonstrates is that this percentage, as of the end of April 2024, is at its lowest level since 2007.

In other words, you can ride the rollercoaster that is the equity market - pick the top dividend-yielding stocks - and hope for the best. Or, you can park your money in a TD or a bond, wait for a catalyst to compress valuations, and then buy in when you think a meaningful correction has taken place. That's what the theory says anyway.

So if this is the opportunity, why do stocks keep hitting record highs?

Ned Davis Research's Ed Clissold and London Stockton boil this down to three more key reasons:

- The economy continues to grow, therefore corporate earnings continue to grow: "Widespread calls for recession have kept some investors on the sidelines, creating a wall of worry for the market to climb," Clissold and Stockton wrote.

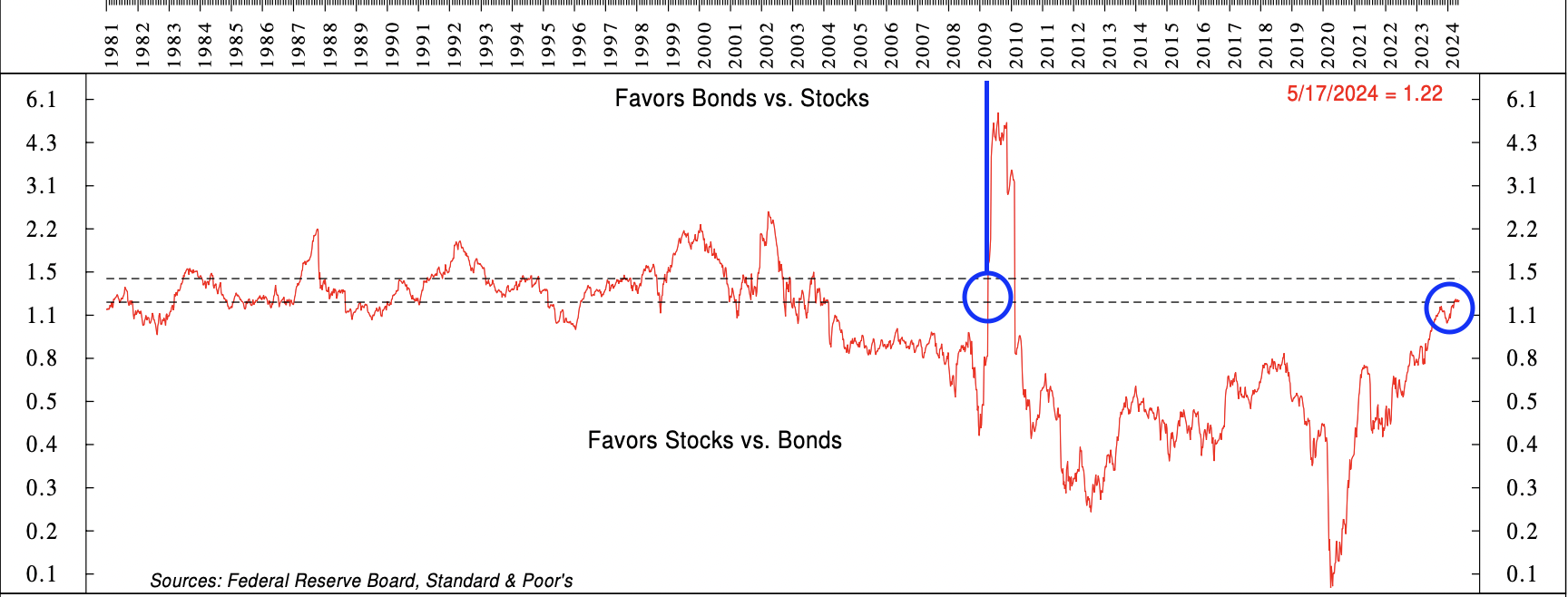

- Stocks are not cheap - but they're also not expensive either: "While relative valuations are the least attractive for stocks in over a decade, several indicators have merely returned to their pre-Financial Crisis ranges," the analysts wrote.

You can see this in action in the below chart. All you need to know is that the red line is climbing but only back to pre-Global Financial Crisis levels - a note that I've annotated with that blue circle on the left-hand side. Put another way, the 2008-2023 period has been abnormal.

- Although dividend yields in the US are traditionally low, companies are returning shareholder capital in other ways: "Whereas a dividend cut sends a message that future cash flows are in jeopardy, a suspended or cancelled repurchases program often has no repercussions for the stock price," analysts wrote.

The way the analysts look at this is to look at a different metric - the net payout yield which combines both dividend and buyback measures. While the S&P 500 dividend yield (1.33%) is well below its 40-year average, the net repurchase yield (1.73%) is well above its 40-year average.

"Repurchases are not as direct as dividends because investors have to sell shares to generate cash. As Jamie Dimon implied recently, a poorly timed repurchase destroys capital. But recognising that buybacks are likely here to stay, the net payout yield is a relevant valuation tool," analysts said.

What about Australia?

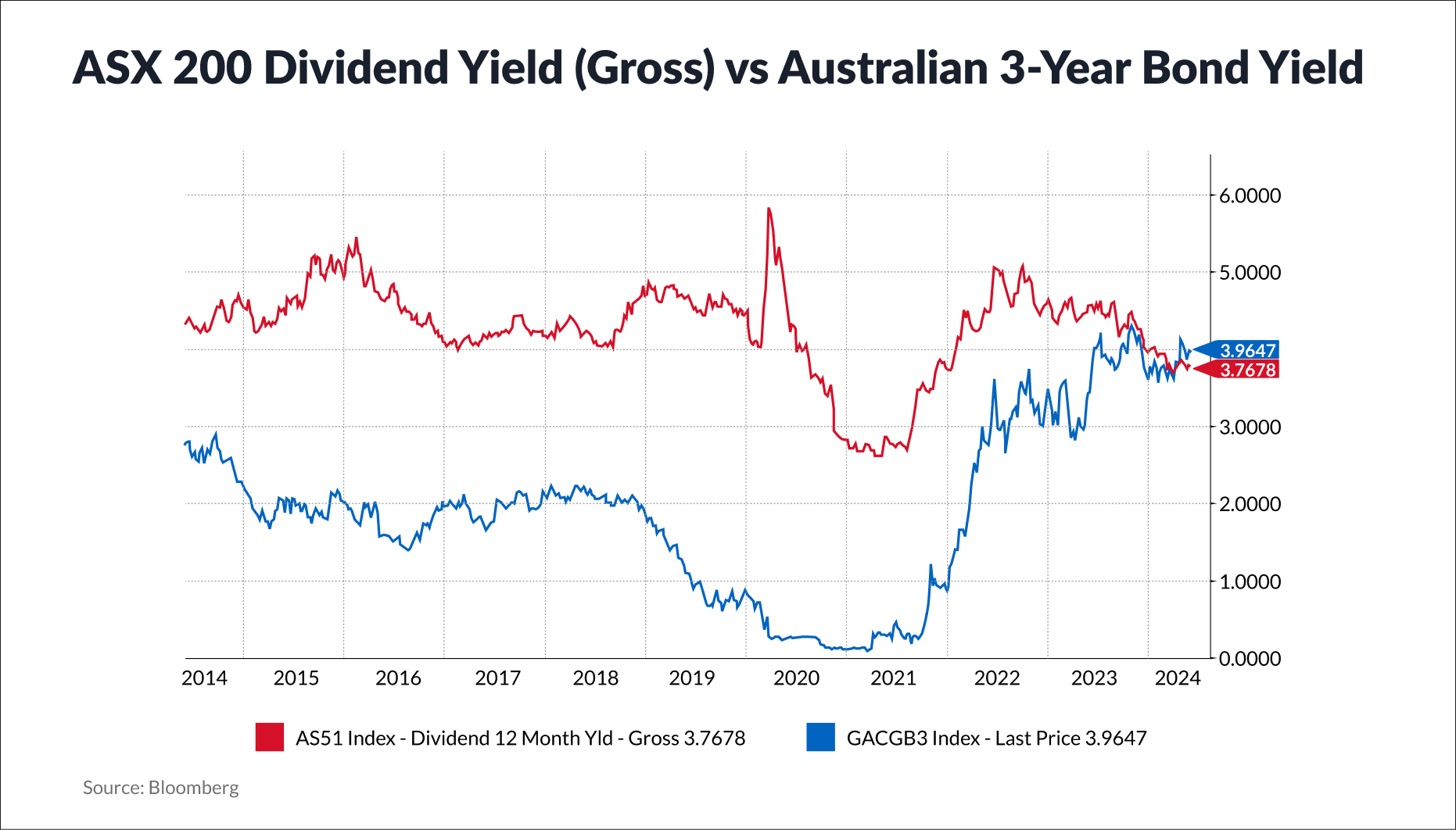

Let's compare these notes with the experience of the Australian equity market. First, let's compare dividend and bond yields. To do this, I've asked Kyle Rodda of Capital.com to help me out with the following chart. While it's not exactly an apples-to-apples comparison of the first chart, the general meaning is the same - the benchmark Australian short-term bond now yields more than the ASX 200 (even before taxes).

%20vs%20Australian%203-Year%20Bond%20Yield.jpg)

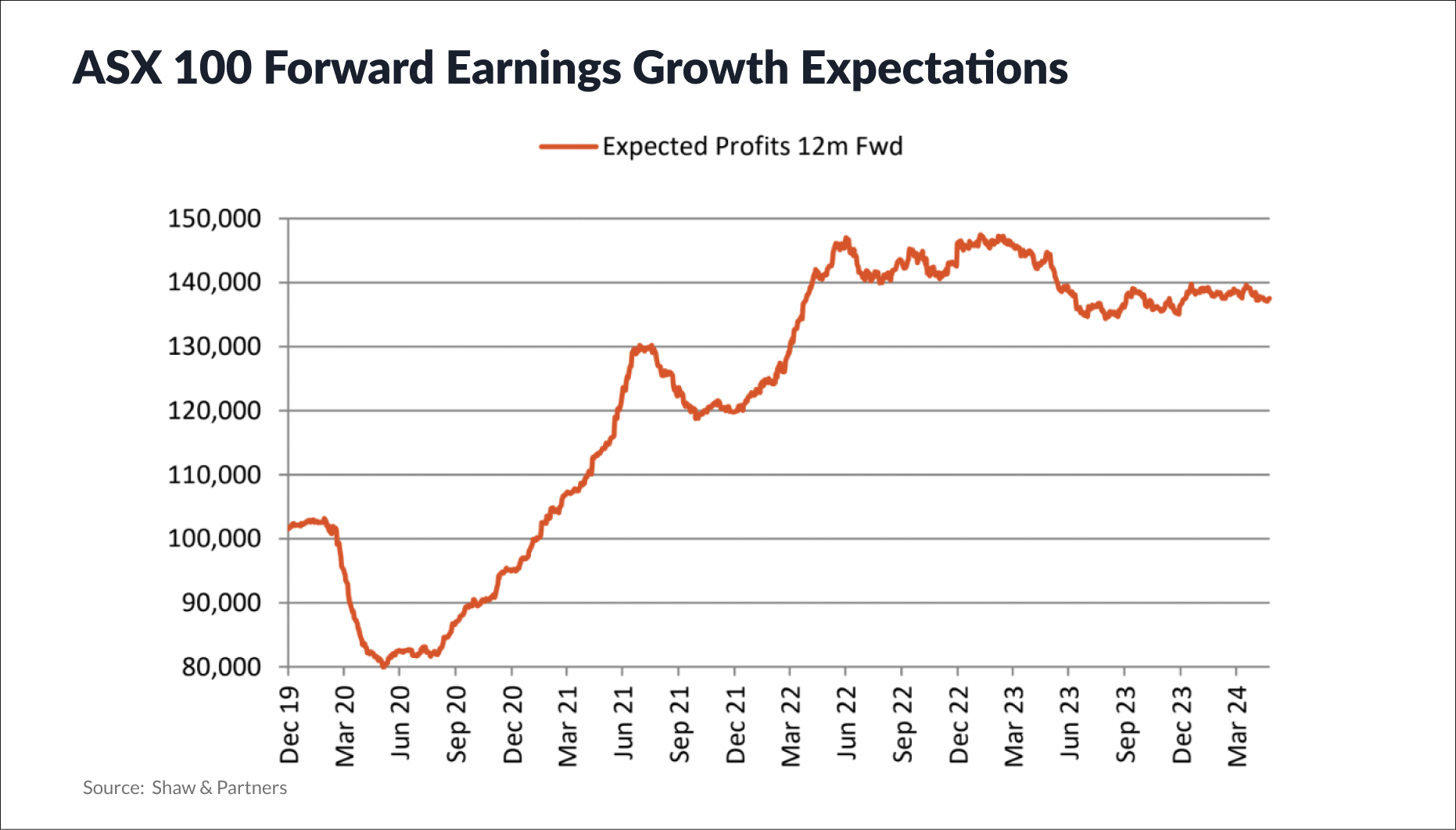

The second point around the economy's relationship with corporate earnings is far more salient in Australia than it is in the US. In Australia, quarterly GDP growth slowed all through 2023 and the Q2 2024 call is likely to show a further slowdown - caused by a very weak consumer. Earnings growth, as seen in this next chart from Shaw and Partners, has also flat-lined since the middle of 2023 and is likely to remain that way.

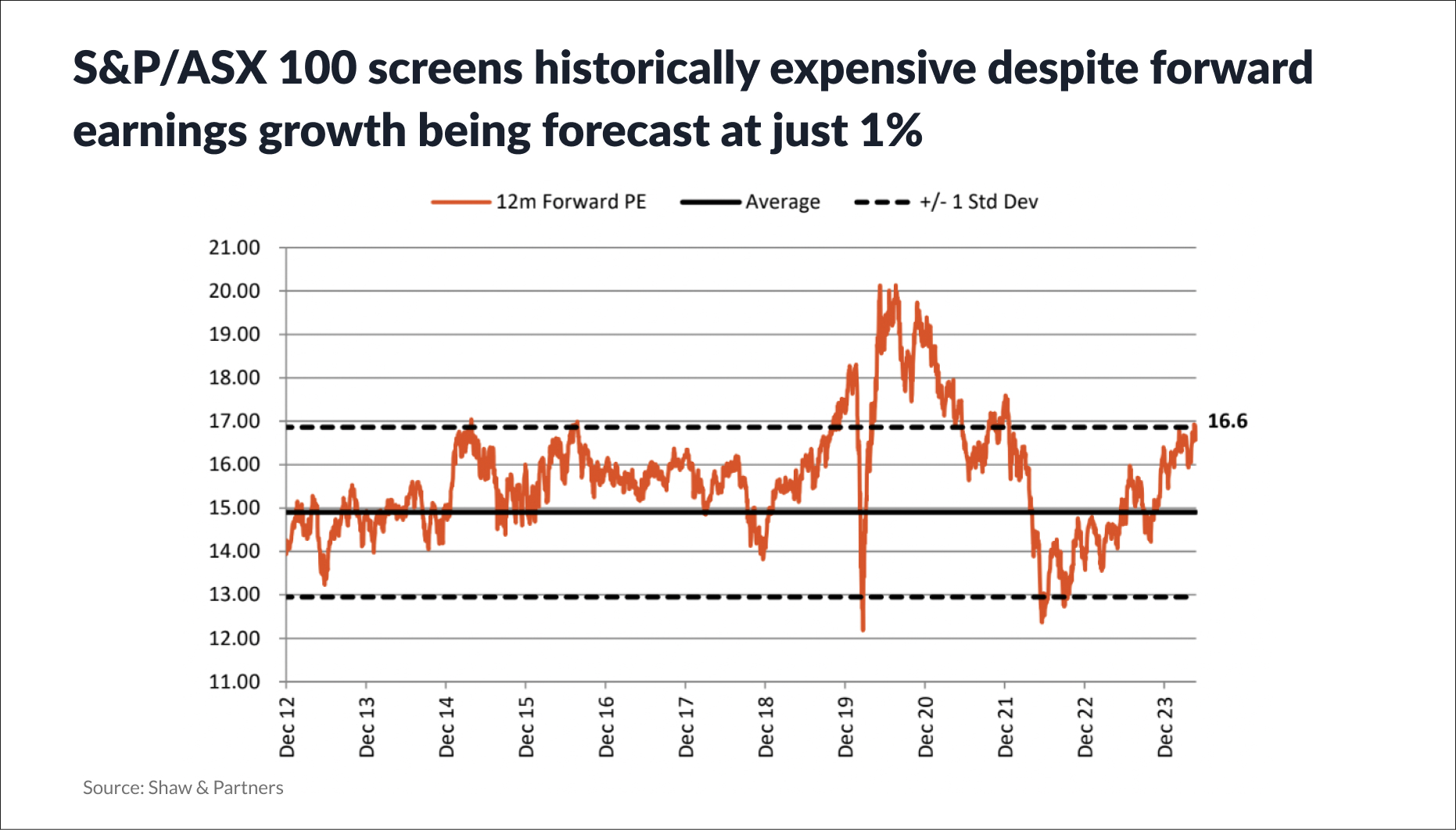

Regarding the third argument around valuations, the Shaw and Partners team have also sent us this chart which looks at how the market looks versus the long-run average. The chart simply suggests the market is expensive (compared to history) and is especially so given the market's forward earnings growth forecast (see above chart).

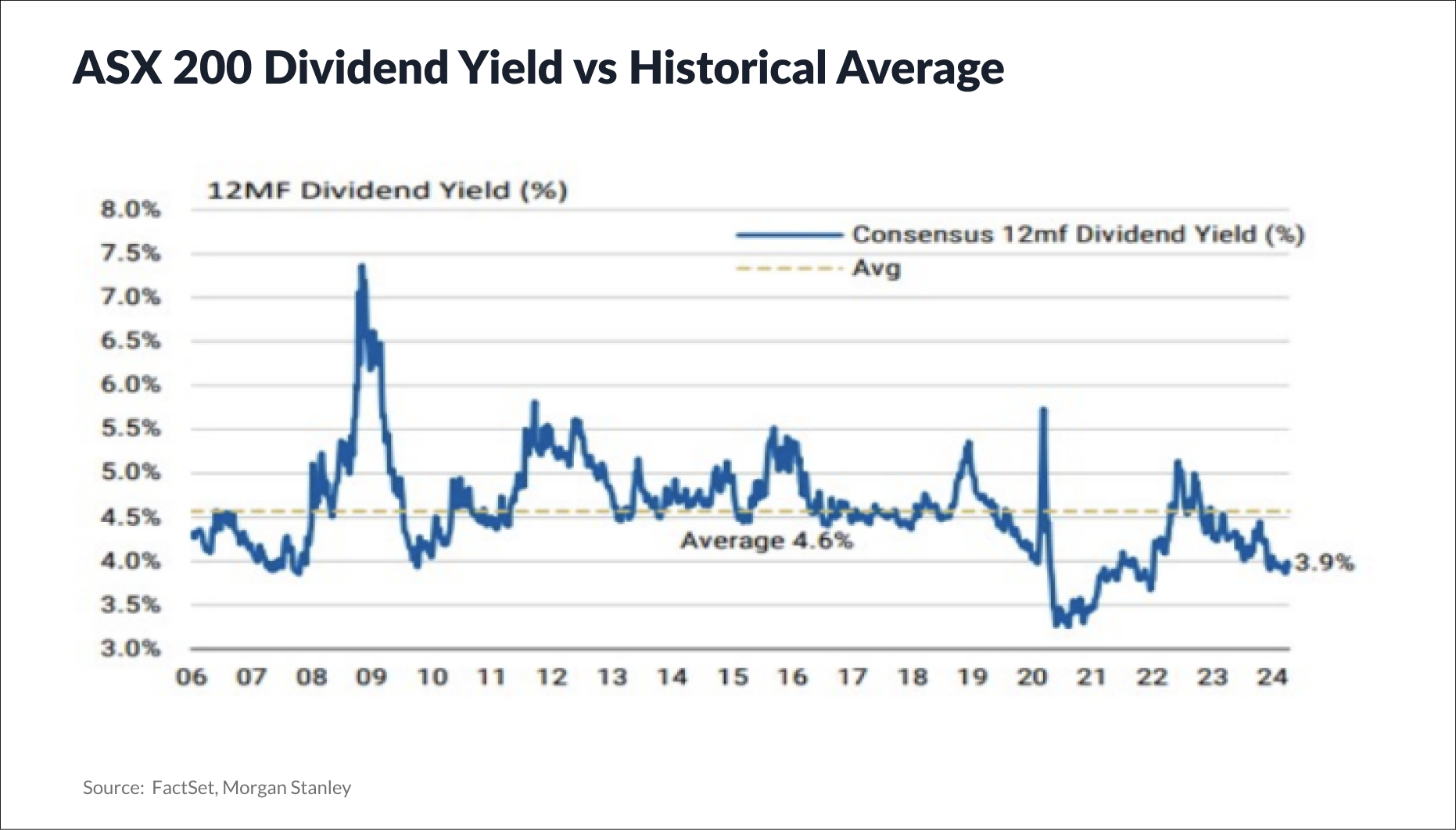

Finally, Australia is not well-known for its share buybacks but we are known for our dividends. The ASX 200 12-month forward dividend yield (3.93% to be exact) is currently tracking well below its long-run average (4.6%). Add this to a measly capital gain score of just 1.2% and the team at Shaw and Partners think that the total shareholder return for the S&P/ASX 100 is just 4.93% - hardly exceptional.

Conclusion? The economic growth profile does matter to the earnings of stocks - and the contrast between Australia and the US suggests stateside is still the place to be. It also explains why the US stock market can keep hitting all-time highs repeatedly in a way that the Aussie bourse has not been able to do in the same way.

Until economic growth starts to rebound and that starts to show up in the Australian consumer and corporate earnings, Australian share market returns may continue to lag the Americans for some time to come. And, as the Ned Davis analysts pointed out, dividend yields do gyrate and affect share prices in a way that buybacks do not.

If you want any proof of that, look at what happened to the share price of Fletcher Building (ASX: FBU) when it recently cut its dividend following a tough earnings report. Or when the ASX (ASX: ASX) simply warned shareholders that the dividend payout ratio could be cut from this year onwards. Or when WA-based shipbuilder Austal (ASX: ASB) eliminated its payout in a surprise move - sending shares 12.5% lower in one day.

5 topics

3 stocks mentioned