3 reasons why we are on the cusp of a commodity super-cycle

As 2024 unfolds, the surge in commodity prices has been nothing short of spectacular, with sectors such as metals, energy, and agriculture all registering significant gains. This trend is not merely coincidental but indicative of a burgeoning commodity super-cycle, driven by three key factors:

- A pivot back to real assets

- Demographic shifts

- The global energy transition

What drives commodity super-cycles?

Historically, commodity super-cycles have been triggered by periods of intense industrialisation and economic expansion in major economies, such as the United States in the early 20th century and China in the early 21st century. These cycles are characterised by a significant lag between the growth in demand and the expansion of supply, leading to prolonged periods of rising prices.

The current globalized economy means that these cycles are influenced by worldwide factors rather than isolated regional developments.

For instance, although India's rapid development contributes to demand, the overarching cycle is globally interconnected.

We believe the difference this time is the cycle will be globally driven and the next 20 years could feel like a game of supply-gap "whack a mole"

Return to real assets

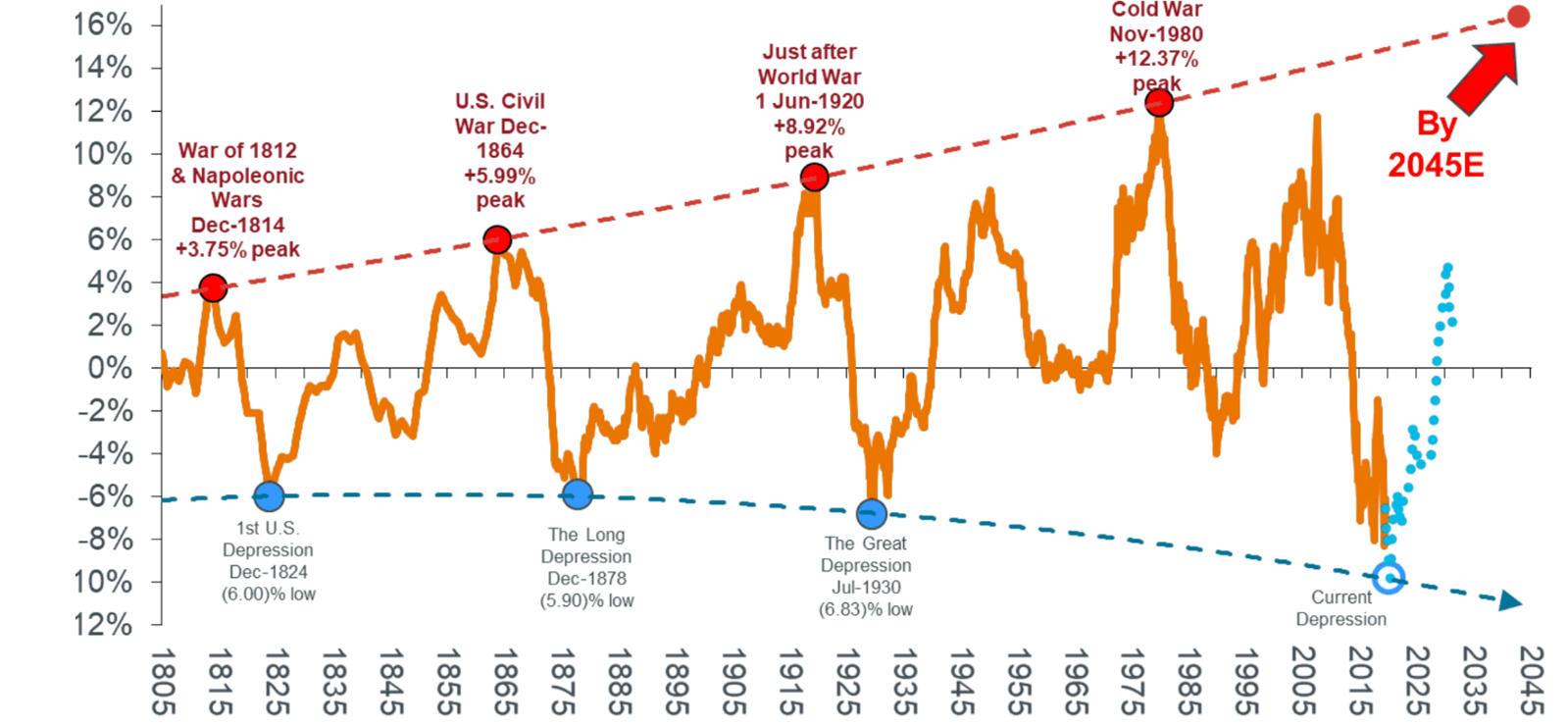

The fiscal and monetary policies of the past decade have heavily influenced equity markets, characterised by significant money printing activities by central banks, especially noticeable post the Global Financial Crisis (GFC).

The US government debt has skyrocketed to a staggering $34 trillion, growing by $1 trillion every 100 days with similar trends observed globally. This unsustainable path has increased reliance on the U.S. dollar, which holds the status of the world's reserve currency. However, as debt levels continue to climb, there is a noticeable shift towards real assets. Investors, wary of currency devaluation, are increasingly turning to traditional stores of value like gold and silver. Cryptocurrencies, which often track the movements of tech-heavy indices like the Nasdaq will likely suffer at first but once the dust settles, they will look like an attractive alternative

Demographics and urbanisation

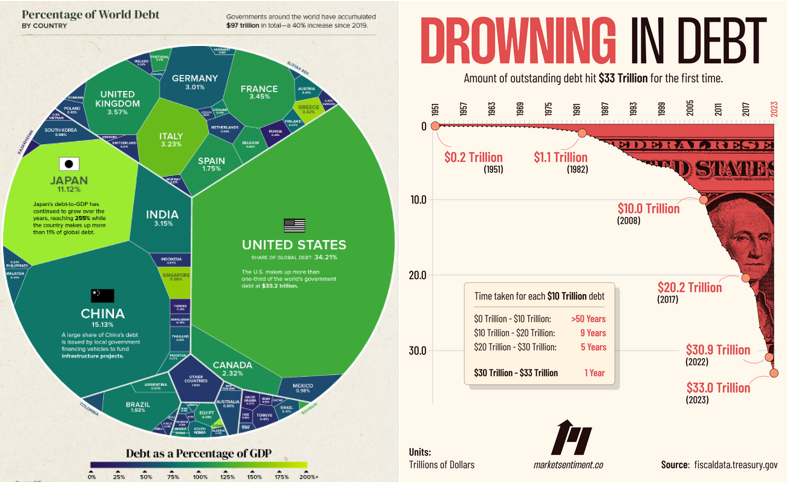

The world's population growth has slowed, but the demand for resources continues to increase. This is further compounded by significant urbanisation; over the next three decades, two billion people are expected to move to urban areas in a historic migration. While urban living typically suggests improved energy efficiency, the reality points to increased energy consumption and reduced numbers of primary producers, like those seen in China's recent urbanisation phase.

In the last two decades (2001-2019), China's food imports skyrocketed by 2900%, reflecting the reduced agricultural output and increased urban demand. This demographic shift not only amplifies demand for housing and consumer goods but also stresses the agricultural sector, where increased productivity must meet growing global needs amidst competition for vital resources like fertiliser components.

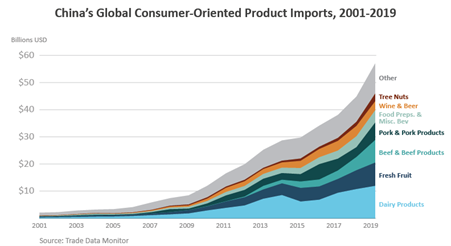

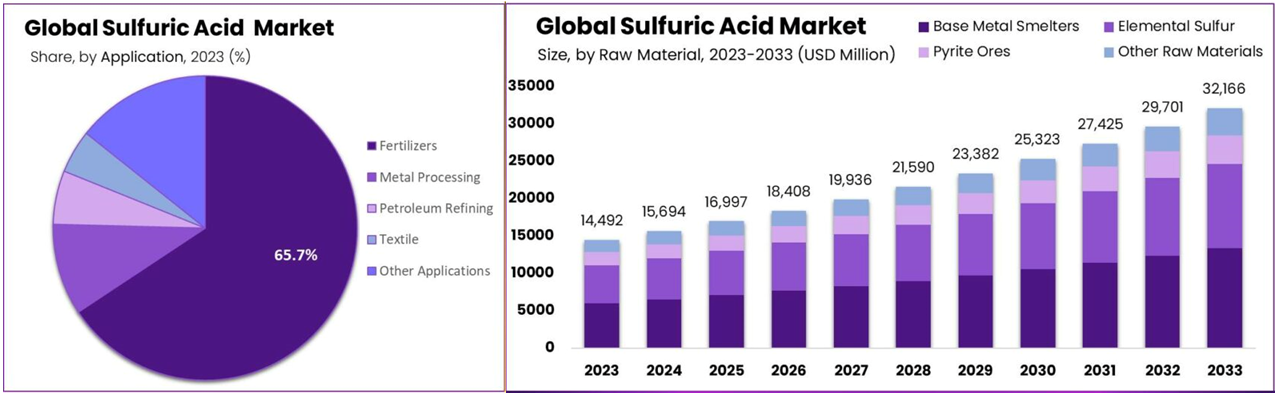

Fertilisers will play a crucial role in agricultural productivity. Phosphate rock and sulfuric acid are the two major raw materials for manufacture of phosphate fertilisers. However, the production of fertilisers is challenged by the competition for key ingredients, such as phosphates and nitrates, from other industrial sectors, particularly mining.

The energy transition

The urgency of combating climate change has accelerated the shift towards sustainable energy sources, reshaping commodity markets. This transition, endorsed globally by agreements like the Paris Accord, is causing fluctuations in commodity demand—particularly for those critical to renewable technologies. Elements like lithium, copper, and uranium are experiencing what might be termed "super squeezes," where short-term supply shortages are precipitated by robust demand.

Lets take copper and uranium as an example.

Uranium has had a triple shock with production falls, geopolitical issues and regulatory changes.

At the COP28 summit, a commitment to tripling nuclear power capacity within 15 years highlighted the global consensus on scaling up clean energy solutions. Yet, immediately following, leading uranium producers announced significant cuts in output due to shortages of essential materials like sulfuric acid. Add to this the US recent decision to ban Russian imports and a "squeeze" is highly likely.

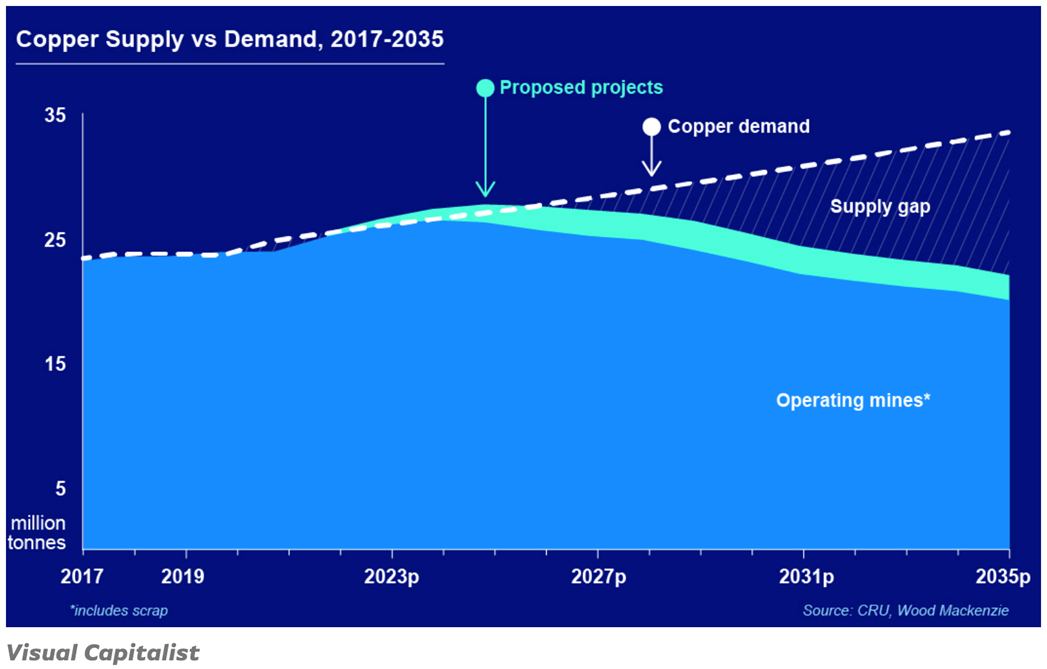

Copper on the other hand has different issues as major global mines come to "end of mine life". The low copper price over the last two years has seen little development or exploration and demand for the energy transition as major infrastructure is turned over at a rapid pace in the coming decades.

How we are playing it (for now)

It is crucial to understand it wont all happen at once so the best way to play it is through companies that have a foot in multiple camps.

BHP (ASX: BHP) – BHP has one of the best broad exposures, and it is unlikely by accident. Despite being around 50% iron ore, the company has been busy in the background planning for the future with a large investment in Potash (fertiliser) and the recent play for Anglo American would make BHP the biggest copper producer in the world by quite a distance.

Add to this the worlds largest uranium deposit at Olympic Dam with a whopping 56-year mine life and BHP is well placed to take advantage of multiple segments in the cycle

Newmont (ASX: NEM) – The worlds biggest gold producer is located in nine locations across three continents. Not only will it benefit from a “store of value” pivot, Newmont also has a huge amount of copper deposits and can quickly shift some gold mines into copper production if the margin increases

Incitec Pivot (ASX: IPL) – known for fertiliser and explosives, Incitec Pivot manufactures key ingredients of ammonia, CO2, DEF, fluorosilicic acid and industrial urea used in agriculture, mining and refining.

For pureplay exposures we like

- Agriculture sector: Elders (ASX: ELD), Rural Funds Group (ASX: RFF)

- Real assets play - Silver via Global X Physical Silver (ASX: ETPMAG); Gold via Northern Star Resources (ASX: NST)

- Energy Transition - Copper via Hillgrove Resources (ASX: HGO) and Global X Copper Miners ETF (ASX: WIRE) and Uranium via Betashares Global Uranium ETF (ASX: URNM) and Paladin Energy (ASX: PDN)

5 topics

11 stocks mentioned

3 funds mentioned