3 strategies to protect your portfolio's gains in every market

Note: This video was taped on Thursday 22 August 2024.

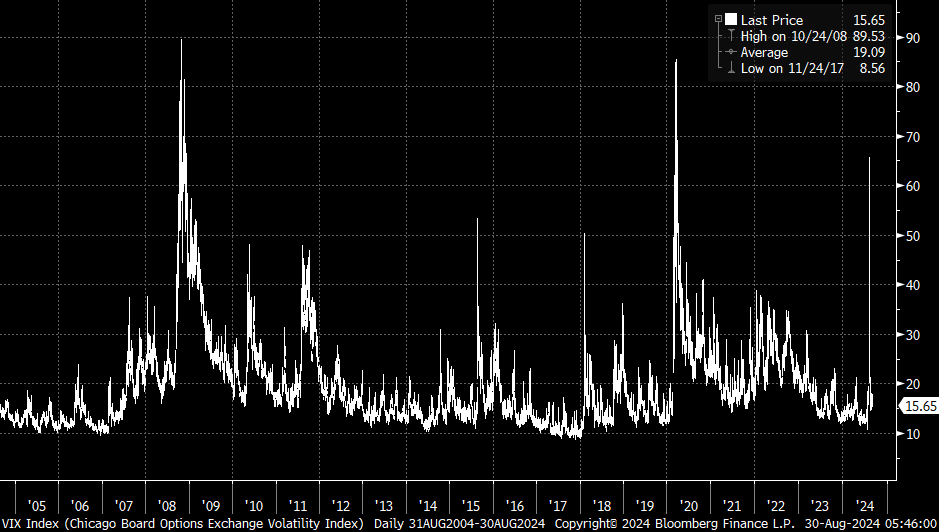

Bar a huge volatility spike in early August, global equity markets have been rising in a relatively benign environment. Before the global sell-off kicked into high gear on August 5th, the benchmark fear gauge (the US VIX Index) had not climbed above 20 points all year.

But unlike 2008 and 2020, this spike was unusual because a) it happened so quickly and b) you had to move equally quickly to lock in your profits.

"Volatility went up fast for no good reason and when markets realised it was a head fake, it came down fast as well," says David Elms, Head of Diversified Alternatives at Janus Henderson Investors.

"You had to be quick to monetise and it required nimble thinking," Elms added.

Moreover, Elms, who manages the Janus Henderson Global Multi-Strategy Fund, said it emphasised why investors should have a protection strategy built into their portfolios before a crash happens.

In this first episode of a series dedicated to alternative investing, Elms shares his big-picture view on the markets and how the team thinks about which strategies work best in a benign environment. Plus, we'll do a deep dive into portfolio protection and the three different ways Elms and his team use strategies to safeguard the Fund's performance.

In upcoming episodes, we will discuss the use of alternative investment strategies in correction-prone environments and their value in a bull market.

edited transcript

What probability would you place on a harder landing and what probability would you place on a soft landing?

Elms: It's a good question. And I guess before answering the question on its own terms, the strategy that I run for our investors is not a strategy that tries to explicitly take large macro views. So we want to build something that is robust to a hard landing, robust to a soft landing. And we do that by the way that we blend strategies and the way that, in particular, we use optionality and protection in our strategies. But if I answer your question, I would be tilting towards a harder landing than I believe is priced in the current consensus.

What do you mean when you say you invest in strategies at a "bottom-up level with a top-down portfolio strategy?"

Elms: We run seven different strategies, we call six of them risk-on strategies. And that doesn't mean that they only work in bull markets. They're individually hedged to to produce profiles that are positive in up, flat, and down markets.

But the problem is, what happens in a crisis? What happens if COVID comes back? What happens if the world starts to move the way it looked it was going to move on August 5th when you had the big sell-off in Japan?

For that environment, we have a seventh strategy, and the seventh strategy provides air cover for the first six. It's called protection and it's designed to sit unobtrusively in the background in normal environments but make strong returns in a crisis where the other strategies tend to struggle, regardless of being individually market-neutral. So, bottom-up risk-taking in the first six strategies, but protection provides air cover on a top-down basis for the other six.

What different avenues of portfolio protection do you have at your disposal?

The three strategies we run are:

- Trend Following: Sometimes you can slide gradually into a crisis and it starts to be reflected in prices, and a trend following strategy adapts based on the direction of prices.

- SLV (Systematic Long Volatility): The SLV strategy uses options so that you always have something in the portfolio when a crisis happens quickly. For instance, if a plane flies into a building like it did in 2001, or you have an earthquake in Japan like 2011, or even COVID in 2020, which came pretty quickly from a financial markets perspective. You can't rely on a signal being there in prices. You need to have the protection in place and be ready to go as the crisis unfolds.

- Discretionary Macro: That's a judgement-driven macro [strategy] with long convexity. So again, setting up options trades that have limited downside and, as much as possible, uncapped upside to benefit from views that are non-consensus in their setup.

How do you handle long periods of low volatility in markets?

Elms: I mentioned August because it's really unusual. If you look at the 20-year history of the VIX, there are three big spikes. One was in October 2008 during the GFC. If you say October 2008, that's normally enough for people [to know what happened]. [Another was in] March 2020. That's enough; people know what happened, and people know volatility went up in both those environments.

But the third big spike, if you look at that chart is now August 2024. And there's no really good reason for it. There's a bit of an accident in the volatility markets and if you were quick, you could monetise that effect, but it didn't spill over. The reason we've been talking about August is that it's still live. It's possible that things can still emerge in the last week or so of August, but also because, unusually, volatility went up fast and for no good reason.

When the market realised it was a bit of a head fake, it came down fast as well. So you had to be quick to monetise, to take your profits and it required nimble thinking. The good thing about running a multi-strategy fund is that we can be nimble. We have all the levers in our control, we're not allocating to different funds. Everything operates in the portfolio.

In these long, low-volatility periods, do you find you are equally-weighting your use of strategies?

But if we look at any particular point in time, we're not equally weighted at any particular point in time. There'll be a strategy with better prospects and with more activity, with more mis-pricing. And what we tend to do is concentrate risk more, not over-concentrate it, not run a completely under-diversified strategy, but tilt more to the best opportunities at any point in time.

2 topics

1 fund mentioned

1 contributor mentioned