3 traits that all good small and micro-cap stocks have

This episode was taped on Tuesday 3 September 2024.

In the world of active stock picking, you've got to have a point of difference. It's not enough to say that you are a small-cap investor, or that you play only in the Australian market. Professional investors sell themselves, their track record, and most importantly, the process by which they hunt for alpha. In the case of Australian small and micro-caps, the challenge is that investors often look at these stocks as riskier, more debt-laden, and more challenging to navigate.

And that reputation is warranted, says Marcus Burns of Spheria Asset Management.

"The vast majority - 2/3 or more - of those small and micro-cap stocks don't make earnings or cash flow. There are a lot of speculative names particularly in mining stocks or biotech stocks that are burning money," he says.

However, this fact also serves as an efficient filter for small-cap investors who want to regulate their risk and spot winners more easily and quickly than self-directed investors.

Indeed, free cash flow is the north star for the team at Spheria Asset Management, but it is far from the only trait they look out for in a potential investment.

In this episode of The Pitch, Burns introduces the three traits his team looks for in picking small-cap winners. We'll also discuss two previous winners and ask him to identify a company that could become the next big winner for the Fund.

Edited Transcript

What in your process makes your team different from the rest?

Burns: It's a competitive space. There are quite a few small-cap managers in Australia. What we try to do is control for risk. As you said, there are a lot of names out there and a lot of stories out there.

We really focus on picking stocks that will perform well through most cycles.

To that end, we focus on free cash flow generation, strong balance sheets, and lastly, we believe valuations still matter. These are the three bedrocks of Spheria. And through the cycle, we think this gives you superior long-term returns.

What is your North Star?

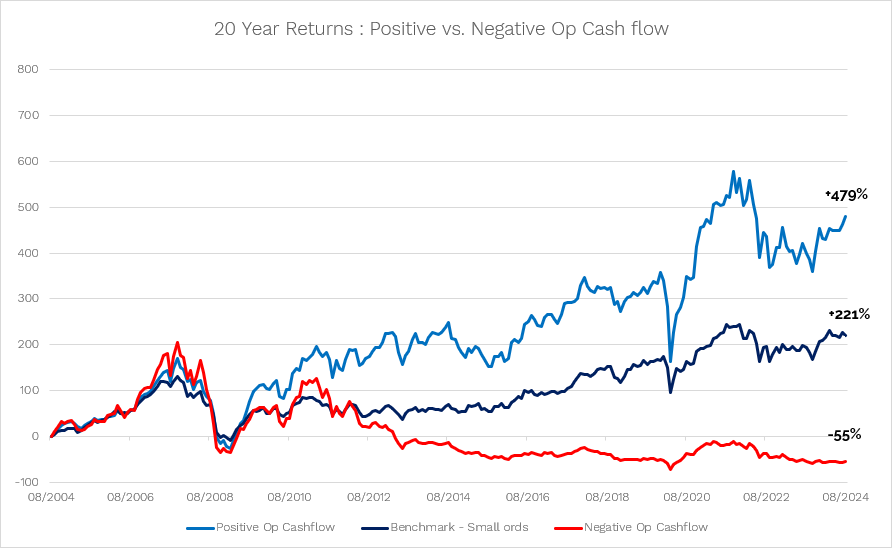

Cash flow generation - it's as simple as that. We show investors the chart below;

.png)

Over 20 years, if you just bought small caps that had positive free cash flow, not even valuation or balance sheet considerations. Just positive free cash flow and compared to stocks with negative cash flow, the difference in performance over 20 years is just absolutely mind-blowing. So, if it comes down to one thing, it'd be cash flow generation.

How important is a strong management team?

It is important, but I think a very famous investor once said, "If you could choose the business over the management team, which would you choose?" We would choose the business. They are really critical and they can take those cash flows to be reinvested, or for acquisitions, or do buybacks.

The way management teams drive operational efficiency in a company or allocate capital are the two things they should be doing day-to-day to enhance returns over a long period of time.

But it's also really easy to get sucked into a charismatic story from a charismatic leader - that's the danger we flag here.

If the charismatic leader is not backed up by a sound business or a sound cash flow model, we'd just flag that it'd be worthy of caution.

Small and micro-caps have a reputation for being riskier. Is this true or false?

I think, as a general rule, I'd have to say it's true. You mentioned there are 192 names in the small-cap index and several thousand micro-caps are listed in Australia. The vast majority, maybe two-thirds or more, don't make earnings or cash flow. So there are a lot of speculative names, particularly in mining explorers or biotech stocks that are in early stages that are burning cash.

I think they are risky propositions for investors because you have to know the story well. Is the balance sheet sufficient enough to carry it through until it makes money? And so, we do pick and choose through that long list of names based on business quality, free cash flow, and valuations. And they are poorly covered.

So yes, while it's a risky place to be playing, the lack of research means you can find some really interesting names in there.

Tell us about some previous winners, and one you hope will become a winner.

Well, thank you for letting us show off and hopefully, we'll give you a forecast that comes to fruition!

In both of our funds, we have exposure to a company called Supply Network (ASX: SNL). It supplies bus and truck parts to the after-market in Australia and they are the leading player in that space.

It's very well run and the management team have been in place there for more than 15 years, and it's been a really great win for our investors.

It's compounded at 20-30% total returns for more than a decade now.

A more recent win was Mader Group (ASX: MAD). The founder is still the chairman of the company. It does maintenance services for mining equipment and that's been an incredibly good growth story for many years. It's now moving internationally from Australia into the US and Canada and it seems to be succeeding overseas.

In terms of picking a future winner, I probably fall back on a retailer called Universal Stores (ASX: UNI).

It's targeted at the youth market, selling clothing to 15-25-year-olds. It has roughly 100 stores in Australia but it's relatively immature, so it's got places to go in both Australia and potentially, internationally.

It has a great cash flow generation, a great management team that has driven like-for-like sales through good and bad times, and it's also very innovative. It not only has this brand but it's also launched a new brand called Perfect Stranger, so they are constantly innovating new sub-brands to push out growth.

Access to great businesses with strong fundamentals

Marcus's fund focuses on small cap businesses that generate predictable free cash flows at an appropriate multiple for the forecast growth profile. Learn more by visiting Spheria's website, or fund profile below.

3 stocks mentioned

1 fund mentioned

1 contributor mentioned