3 ways to play defence in your portfolio

When I asked friends and colleagues around the industry how their portfolio performed during March, the most common reaction was “I’m too scared to look”. And when they did, it was much worse than expected.

One of the key regrets they expressed was holding too much equity risk, and the fact we had the fastest bear market in history a little over two months ago made the experience particularly brutal in a financial sense.

Of course, markets have made a stunning comeback since 23 March. But for those who don't want to despair over steep equity price declines in future, it may be worth thinking about how to offset the risk within portfolios.

One simple way could be to consider asset classes that can play a stabiliser role during times of crisis and build exposure to them through exchange-traded funds (ETF). Here, Peter Harper of BetaShares discusses three such themes and ways to play them.

1. Fixed income – The portfolio stabiliser

Fixed income, regardless of where yields are at, can provide a level of capital stability that's not generally available in the equity market and that is desirable to some investors, Harper says.

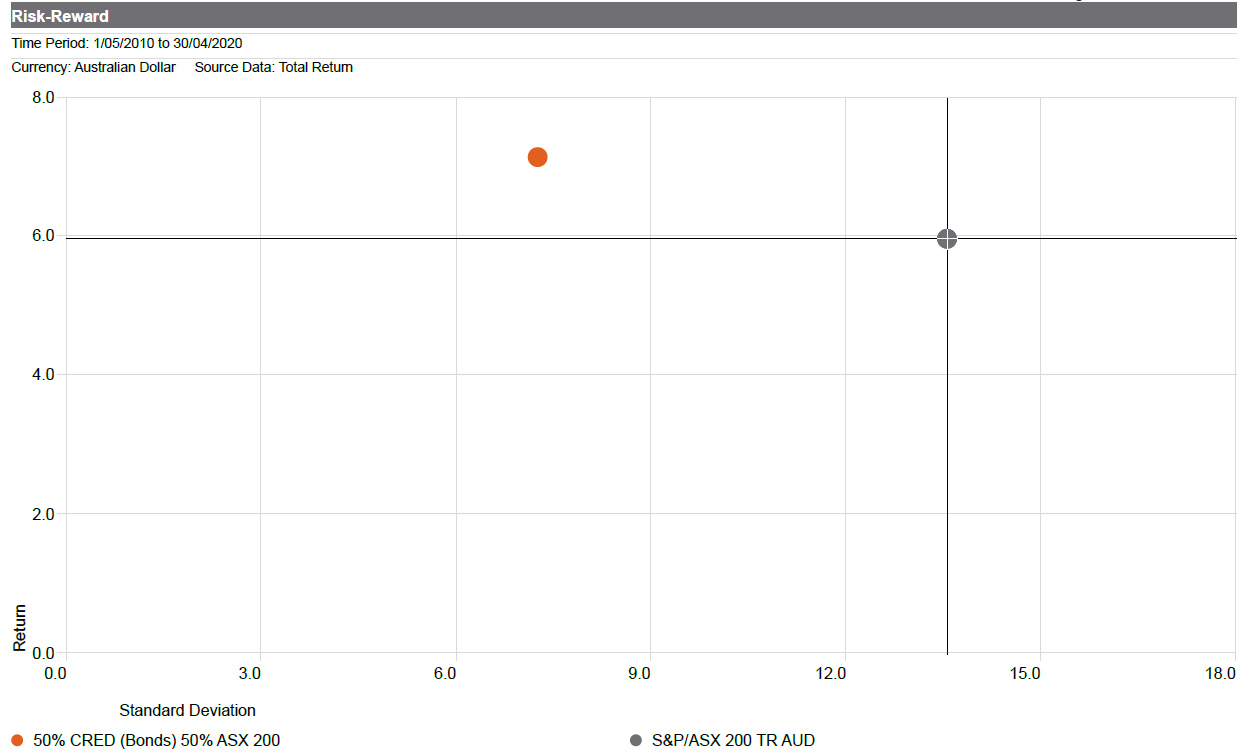

To illustrate this point, he’s provided a graph below that shows the performance of a portfolio comprising 50% investment-grade corporate bonds and 50% invested in the S&P/ASX 200 Index over the last 10 years. The result is that investors achieved a higher return with lower risk.

He adds that even with really low yields, fixed income may be able to provide certain advantages that other exposures like cash and TDs can't necessarily.

“Fixed income investments historically are negatively correlated to equity markets. In a falling equity market environment, long-duration fixed income products have the potential to rise in value and significantly cushion some of that downside risk.”

The other factor is that fixed income investments will often pay an income level or return over cash, which can be particularly important for conservative investors in a low rate environment.

While the overall benefit of fixed income is apparent, selecting the right exposure can become a nuanced task and is dependent on each investor’s circumstance. Harper offers the following considerations:

- Short-dated bonds are more capital stable, while higher duration instruments offer a better offset against equity risk

- Investment-grade corporate bonds currently yield around 3%, compared to sub-1% for government debt, but do carry a higher level of default risk

- If you believe rates will rise, consider funds that have floating-rate exposure

In today’s environment, Harper reckons it makes sense to have exposure to long-dated government debt to provide a defensive buffer against market shocks, while keeping corporate bonds in a portfolio to generate income (without the same volatility as equities).

“At the moment we like investment grade corporate bonds. If you look at that part of the market, we recently saw a 5.2 standard deviation widening in credit spreads throughout the COVID crisis. Now, that's one of the most significant widenings in credit spreads in the last 15 years. And so we think that leaves investment grade corporate bonds looking relatively attractive from a pricing perspective.”

Avenues to invest in fixed income include BetaShares’ Australian Government Bond ETF (ASX:AGVT) and Australian Investment Grade Corporate Bond ETF (ASX:CRED).

2. Hybrids – The income replacer

Investors of bank stocks are having a roller coaster ride this year. At one stage the financials sector was off ~35% year-to-date. On top, investors were kicked in the teeth with savage dividend cuts and suspensions.

However, what’s interesting is that investors in bank hybrids have fared far better. Prices for instruments across the CBA PERLS and Westpac Capital Notes franchises have rebounded close to or even above their issue price of $100 (from around $85-$90 in March). The Solactive Australian Hybrid Securities Index, which the BetaShares Active Australian Hybrids Fund (ASX:HBRD) tracks, is down only 1.72% this year. All the while, the income from hybrid instruments hasn’t stopped.

Harper says the reasons why hybrid security prices have snapped back is because the Big Four are among the best-capitalised banks in the world and can withstand a severe economic downturn. This is giving holders confidence that conditions won’t be triggered whereby banks could be required to convert hybrids into equity.

“APRA recently stress tested the Aussie banks for a 35% drop in house prices, and 11% unemployment. In this dire scenario, common equity tier one ratios fell to around 8 to 9%. Even then that's significantly above the 5.125% level that would see hybrids automatically converted into bank shares. So even under stringent stress testing you wouldn't say hybrid securities went close to conversion levels.”

Looking forward, Harper says the decision by some banks to reduce or defer dividends and in NAB’s case, raise capital, are arguably positive for bank credit holders and negative for equity holders. Put that together with the upgrades to bank credit ratings to late last year (covered by Christopher Joye here), and there is a compelling case to use hybrids as an “income replacement” from bank equities. HBRD, which invests in a mix of hybrid securities, is offering a yield of around 4.07%.

“We would argue that hybrids could be an interesting replacement for some people considering holding bank equity now, due to the fact that those events we talked about were positive for credit. And, because they sit higher in the capital structure, hybrids arguably offer a more consistent and certain level of income than bank equity.”

3. Gold – The hedge for uncertainty

Gold traditionally is a safe haven asset and a store of value. They're the primary reasons people have invested in gold over centuries, Harper says.

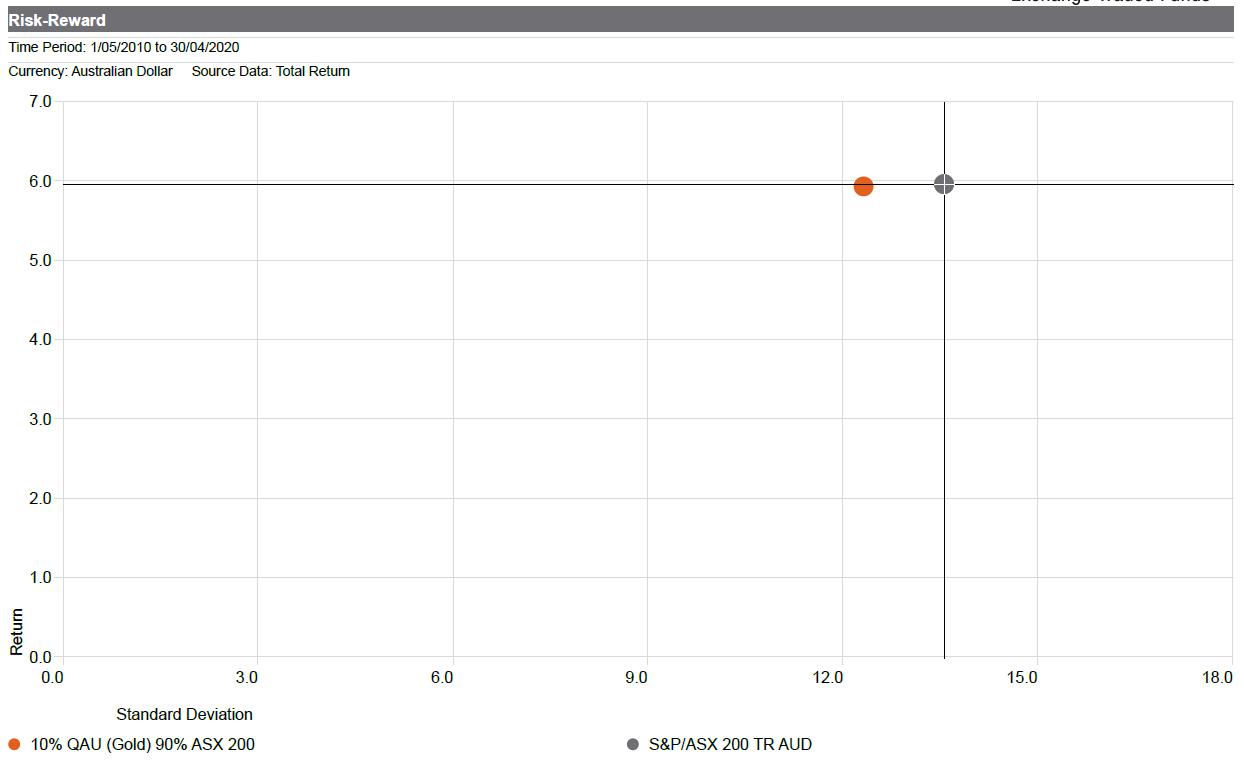

He adds that gold as an asset class has low correlation to other asset classes, and therefore may offer portfolio diversification. The chart below shows that holding 10% of a portfolio in gold bullion (with the balance in the S&P/ASX 200) provided the same return at lower risk over the last 10 years.

The precious metal in Australian Dollar terms has risen 16% this year and Harper reckons there are several good reasons why the price will be supported:

- Negative interest rates – Vast amounts of government debt are offering negative yields, so inflation levels are almost certainly higher than nominal interest rates suggest

- Central bank and institutional buying – Demand for gold has risen among large buyers, who may consider it a superior alternative to parking money in negative yielding bonds

- Portfolio diversification – If and when inflation expectations emerge in the future, then gold will benefit as it is deemed a store of value

However, despite the stellar run from gold companies like Evolution Mining (ASX:EVN) and Northern Star (ASX:NST), which have ridden the Australian gold price to record highs, Harper believes now is the time to allocate to gold bullion hedged in US dollars. One way to do this is through the BetaShares Gold Bullion ETF (ASX: QAU).

Harper says there will be times in the cycle where he’s more bullish on gold companies than gold bullion, but for now he favours the latter as it removes the volatility created by having operating leverage to the gold price.

“I personally have the view that holding gold bullion and avoiding the company-specific and equity market component of the risk in gold companies may produce a better outcome in an uncertain environment.”

Tip: The ASX publishes its Investment Products Monthly Update here. Access these reports to see a full list of ETFs available including details such as fees, size and performance.

Learn more

ETFs are one of the fastest growing investment vehicles in the Australian market. For a full range of products available to investors, please visit BetaShares website.

4 topics

4 stocks mentioned

1 contributor mentioned