3 wires you shouldn't miss this weekend

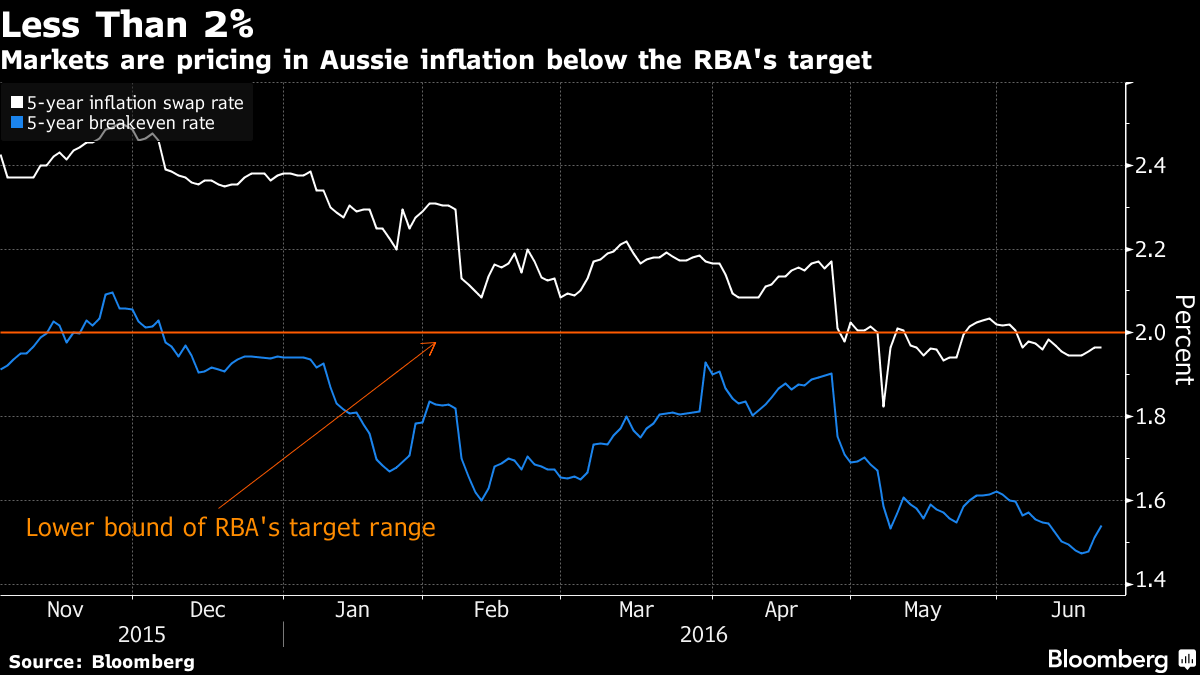

Is deflation here to stay?

The surprisingly low March quarter CPI data caught many investors and commentators off guard and resulted in the RBA cutting the cash rate in May. Unlike most other developed nations, our official inflation data is not released monthly; however, the Melbourne Institute’s Monthly Inflation Gauge produced a reading of -0.2% in May. There’s been significant speculation about whether this is just a one-off or a more meaningful shift. We asked four economists what they think, and whether cutting rates is an effective response to disinflation. Access the Collection here: (VIEW LINK)

The future has already arrived

"Disruption and opportunities are not five, 10 or 20 years away. They are happening now,” Transurban CEO, Scott Charlton, told Fairfax recently. While many are focussing on the disruption that could occur in the distant future, they’re being distracted from what's happening right now. Never one to ignore emerging trends, Rudi Filapek-Vandyck from FNArena explores four megatrends that were identified by Macquarie analysts as having the largest impact on Australian businesses: Internet of Everything, Wearables, Big Data, and Virtual Reality. Read Rudi's Weekly Insights for more detail: (VIEW LINK)

Why Perpetual are investing in Shaver Shop's IPO

Following the high-profile events around the failed Guvera IPO, it’s easy to be put off IPOs altogether. However, when an experienced fund manager like Perpetual’s Jack Collopy says he's interested, it’s worth paying attention. In a world of weak growth, a business that can grow and reinvest at high rates demands a premium. With 7.5% p.a. Like-For-Like sales growth, a long store rollout plan, and high returns on store buy-backs, Shaver Shop has some interesting attributes. Read more to find out why Perpetual is investing in the Shaver Shop IPO: (VIEW LINK)

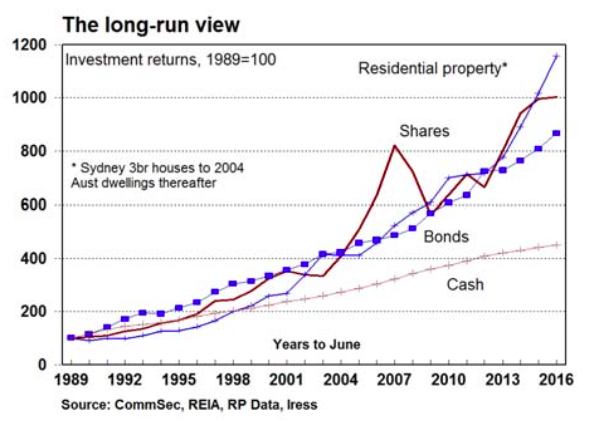

Chart of the week: Long-term asset class returns

This great chart from Commsec's recent Economic Review shows that residential property has surged ahead of shares over the last few years and is now leading the pack for returns.

What's been Trending this week?

Buy Hold Sell: Defensive stocks

4 trading ideas for today’s market

Marcus Padley shares some immediate term ideas for trading. Includes Telstra, Geoff Wilson’s new WAM Leaders Listed Investment Company, and two more: (VIEW LINK)

Start receiving the Livewire Weekly, the best of Livewire in a weekly wrap: (VIEW LINK)

2 topics