68 ETFs/LICs/LITs paying monthly and quarterly dividends

*Please note this wire has been updated from the original version, as more data came to light

For those seeking regular income, half-yearly or yearly distributions might not cut it. Fortunately, there are a handful of options - across ETFs, LICs/LITs - that offer more frequent distributions - both quarterly and monthly.

But that's where the problems start again. Given the small number of high-frequency dividend/distribution options, comparing them is challenging.

That's where Livewire comes in. As part of our 2024 Income Series, we decided to hunt down these income unicorns and analyse the 5-year, 3-year, and 1-year performance numbers (where available) and their fees.

Before we dive in, a couple of notes: This data was difficult to gather, and despite my best efforts, I may have missed some constituents. If anyone knows of any names that should be on the lists, please leave us a comment. Also, it should be noted that the performance numbers below are total return numbers, not distribution numbers. Distribution numbers will be much lower in some cases and you should do your own research to determine if a product is right for you.

Secondly, a special thank you to the team at Morningstar, which keeps excellent data on the ETF components and has shared the performance numbers with me for the exercise. Unless otherwise specified, all performance data is up until the end of Q1 2024.

High-level insights

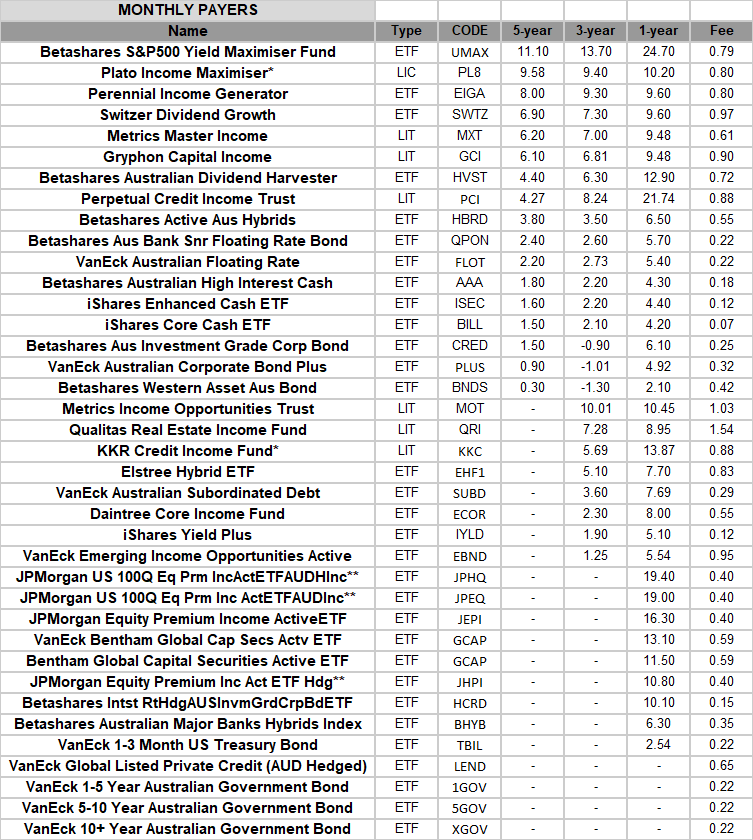

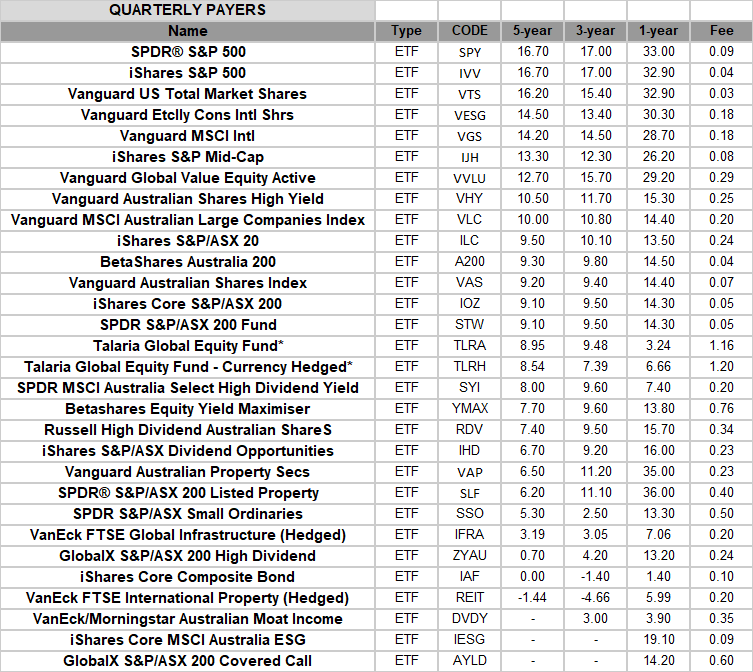

- There are 38 monthly payers and 30 quarterly payers in the tables below

- Generally speaking, the quarterly payers have better returns than the monthly payers - although it should be noted that the quarterly payers are highly concentrated in equities, whilst the monthly payers are more evenly spread across equities, property, private credit, and bonds

- While equity-related products have typically delivered the strongest performance historically, if ever there was a time to remember that past performance is not a reliable indicator of future return, now would be it. More on that below.

MONTHLY PAYERS

Method

- The table has been sorted first by 5-year performance, followed by 3-year and 1-year.

- If there is no 5-year performance, the constituent drops directly to the bottom, regardless of performance in the shorter periods

- Generally speaking, those with the best 5-year performance also had some of the best 3- and 1-year performance numbers.

- An outlier is the Betashares Australian Dividend Harvester (ASX: HVST), which has a mid-range 5-year performance but has blitzed the field over the past 12 months.

* Data to the 12 months ending 30 April, 2024

** 6-month performance

The Top 3

Please note the information below is taken from company or investment aggregation websites. We are presenting this information based on the analysis above, and it should not be considered a recommendation. Always do your own research and consult a finance professional before making any investments.

#1 Betashares S&P500 Yield Maximiser Fund (UMAX)

UMAX aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of stocks comprising the S&P 500 Index. UMAX does not aim to track an index.

#2 Plato Income Maximiser (PL8)

PL8 is the first Australian Listed Investment Company targeting to pay monthly dividends, which will appeal to investors who require a dependable income stream from their investment portfolio.

#3 - Perennial Income Generator (EIGA)

QUARTERLY PAYERS

* Data to the 12 months ending 31 May, 2024

Method

- The table has been sorted first by 5-year performance, followed by 3-year and 1-year.

- If there is no 5-year performance, the constituent drops directly to the bottom, regardless of performance in the shorter periods

- As above, those with the best 5-year performance generally have some of the best 3- and 1-year performance numbers.

Insights

Bet against the US equity market at your own peril - that's the message to take from the list of quarterly payers. Three of the top spots are populated with low-cost, index-hugging ETFs in SPY, IVV and VTS. Warren Buffet would be proud.

The other 2 spots? Low-cost global index ETFs.

The Top 3

#1 - SPDR S&P 500 (ASX: SPY)

#2 - iShares S&P 500 (ASX: IVV)

The iShares Core S&P 500 ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities.

#3 - Vanguard US Total Market Shares Index ETF (ASX: VTS)

Vanguard U.S. Total Market Shares Index ETF seeks to track the performance of the CRSP US Total Market Index, providing investors with exposure to a broadly diversified collection of securities that, in the aggregate, approximates the full index in terms of key characteristics.

Looking ahead

As mentioned above, if ever there was a time to remember that past performance is not a reliable indicator of future return, now would be it.

With equity-related products playing a big part in these lists, particularly the quarterly payers, it's worth taking stock of where equity income sits historically - at least from an Australian perspective.

According to Commsec, investors are expected to receive $32 billion in dividends between August and October this year. This sounds like a lot, and it is, but it would be down 24% from a year earlier

One significant reason for the drop is that the big miners—previously paying out historically high dividends—are reverting towards the longer-term averages. The miners enjoyed a Goldilocks period and, for a handful of years, were delivering gross dividend yields well beyond 10%. This is not normal—miners are cyclical, and a reversion to the mean would always happen.

While 87% of ASX 200 companies are electing to pay dividends during the upcoming season, that’s about where the good news ends:

- More of those companies have reduced payouts compared to a year ago.

- Companies have been cutting dividend payout estimates at a clip not seen since 2009 (excluding the COVID-19 period).

- The average dividend payout ratio among ASX 200 companies is near decade lows, at 62%. It was 72% before the pandemic.

This all means that the 12-month forward estimated dividend yield for the ASX 200 is currently hovering just below 4% (the average has been 4.7% since 2005).

All food for thought as you scour the lists above.

Here's the data

For anyone interested in parsing and playing with the data, you can access via the spreadsheet below.

4 topics

10 stocks mentioned

4 funds mentioned