Four wires that caught my eye

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

What happened to TPG Telecom?

In the two days following their FY16 results, released on Tuesday, TPG fell 27% - despite the results being in line with analyst forecasts. So what happened? It seems the sell-off was a combination of a lack of organic growth, disappointing guidance, and increased capital spending. The team at Market Matters think that “the period of very strong growth for these telco businesses is coming to an end.” If TPG is on your radar, this straight-forward wire is a great way to get on top of the recent events. (VIEW LINK)

A dozen ways to apply the lessons of Howard Marks

Howard Marks runs the US$ 96 billion Oaktree Capital and is one of the most respected value investors in the world. Talking about his book, The Most Important Thing, Warren Buffett once said; “this is that rarity, a useful book. When I see memos from Howard Marks, they’re the first things I read. I always learn something, and that goes double for this book.” If you haven’t read his book, don’t despair. Tren Griffin from 25iq has summarised twelve of the best lessons and provides some handy tips on putting them into action. (VIEW LINK)

Choosing the right LIC for your strategy

Since the Federal Government’s Future of Financial Advice reforms in 2014, there has been renewed interest in LICs. Heightened interest has, of course, resulted in the floats of a new range of LICs with a wide range of investment strategies. As of 30 June, there were a staggering 90 LICs and LITs (Listed Investment Trusts) on the ASX, leaving investors spoilt for choice. Peter Rae from Independent Investment Research has shared his detailed quarterly LIC report, which covers 30 of these companies. A must read for anyone interested or invested in LICs or LITs. (VIEW LINK)

Token Telstra buy-back Mark II

Telstra announced a $1.5 billion share buy-back last month. While this seems large, it represents less than 2% or the current market capitalisation, explains Dr. Don Hamson from Plato Investment Management. Additionally, he expects the buy-back to be heavily scaled back, similar to 2014’s buy-back, which was scaled back by 70%. It’s not all bad news, though, as his analysis indicates that the buy-back could be advantageous for pension-stage superannuation investors. Plenty here to digest for those considering taking up the buy-back. (VIEW LINK)

Chart of the week

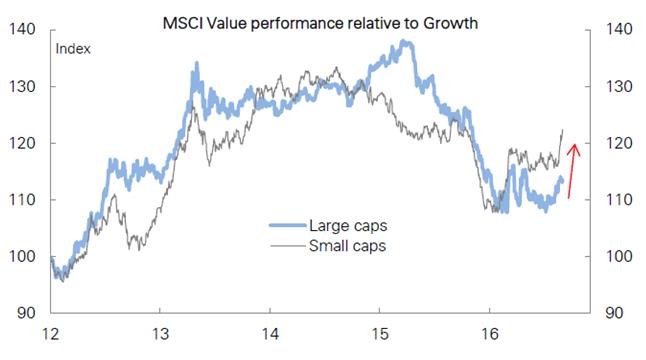

Value starting to make a comeback

Value stocks are starting to show life again after nearly two years of underperformance. The chart below shows the relative performance of value vs. growth for both large-caps and small-caps.

Get the best of Livewire in your inbox each Saturday morning. Sign up for the Livewire Weekly here: (VIEW LINK)

4 topics

1 stock mentioned