4 important investment lessons from this 6-bagger stock

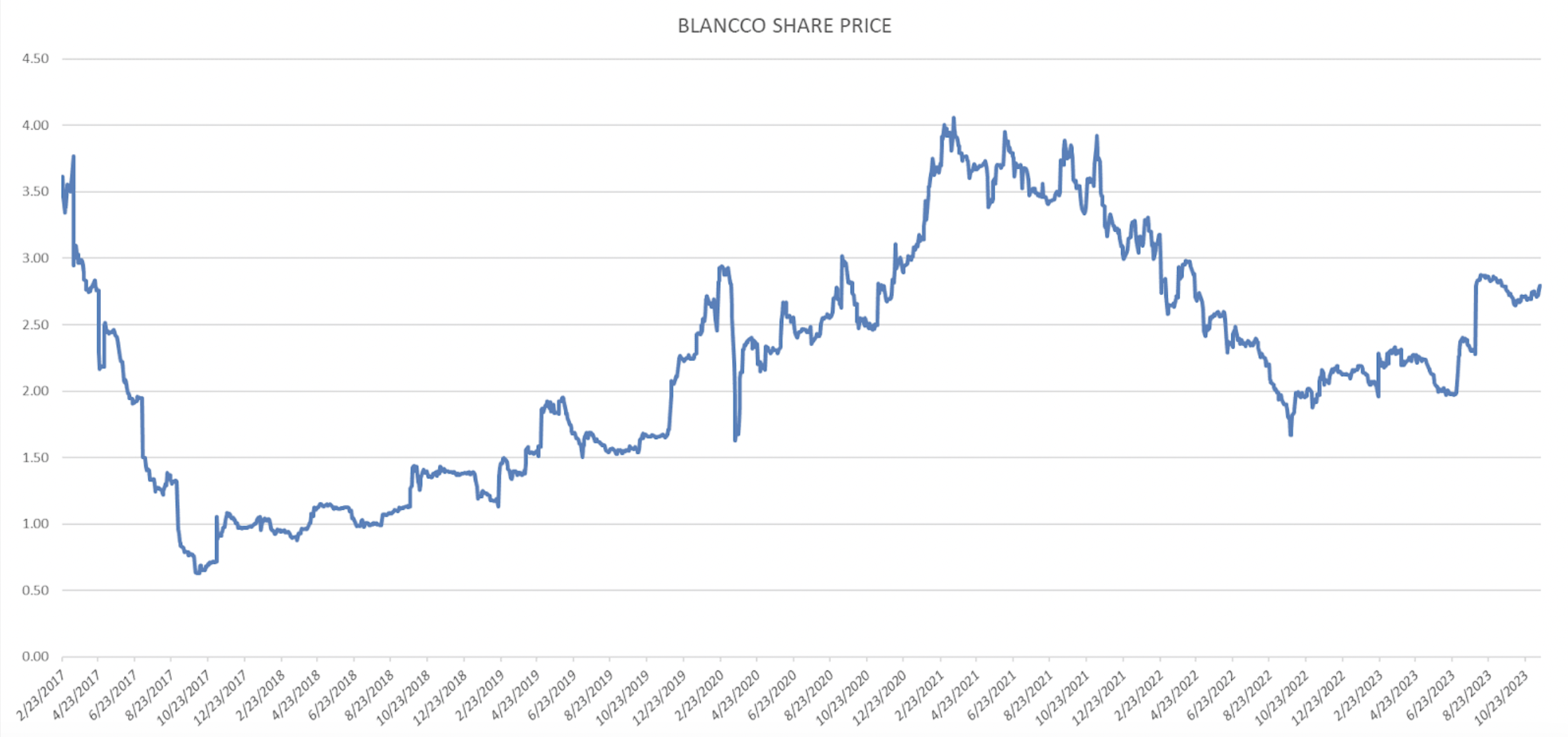

In late 2017, there weren't many buyers of Blancco Technology Group (LON: BLTG). The CEO had just been fired, the company had overstated its revenue figures, its financial reports were delayed, and the share price had fallen over 80% in a matter of months. It's understandable why most investors were running for the exits.

But we took a different approach. The eventual investment we made in Blancco became one of the Fund's most successful in its 11-year history before it was eventually taken private.

So, what attracted the investment team to Blancco? And what lessons are there to help identify the quality turnaround stories from the duds? In this wire, we’ll answer both of these questions.

About Blancco

In the 1990s, two Finnish business partners developed software designed to permanently delete the contents of a hard drive at the end of a computer’s file. Over time, the process was tweaked to deal with different types of hardware - computers, laptops, tablets and mobile phones - and different types of drives.

Today, the company’s technology is used by Specialised IT Asset Disposal firms (ITADs) and large corporate clients to deal with mountains of used hardware each week. If data security means anything to them, they’ll want to clear all those hard drives before recycling or re-selling their old hardware.

The opportunity

Up until March 2017, the business had been trading well. It had exited some of its other business operations to become a pure-play software company and its share price rose to 300p.

Things changed in April 2017, when the company revealed that a review of its cash flow forecasts was going to impact the cash at bank during the coming quarters. Eventually, it was revealed that the prior year’s revenue figures were overstated. Then, the big bombshell from September 2017:

“Blancco Technology Group PLC announces that, following matters that have recently come to the Board's attention, the Board has decided to reverse £2.9 million of revenues represented in two contracts that had previously been booked during the financial year ended 30 June 2017.”

The revelations cost the CEO his job and the company’s full-year results were deferred to an unspecified date while they tried to work out exactly what the revenue was. By October 2017, the company was trading at 48p a share, down 84% and trading at 1x revenue.

The stock price fall might have been entirely justified, but we felt it was also fertile ground for overreaction. After speaking with one of the founders, with sales executives and customers, we developed confidence that Blancco remained a growing business with significant tailwinds, happy customers and strong profitability.

After laying out a full thesis in 2017, it was at this point that we made an initial investment in the company right into the teeth of the market panic.

Increase weighting with greater confidence

A new CEO, Matt Jones, joined the business in March 2018 and released his first set of results a few months later. This also included an updated strategy for the company. These results confirmed that Blancco’s problems were temporary. These developments helped confirm the team’s initial thesis.

During the next couple of years, by June 2019, Blancco moved firmly out of recovery mode and into growth mode. Sales and profit expectations for the financial year 2019 were upgraded. By June 2019, Blancco was a 10.3% weighting in the Fund, having risen 73% during that financial year.

“Let your winners run” is one of those trite sayings that is wrong as often as it is right. But business valuation is an inexact science and risk is a variable. Forager’s “upside” valuation didn’t change dramatically through this period, but the probability of that case unfolding increased dramatically alongside Blancco’s growth, profitability and cash flow.

Portfolio management matters

By June 2021, Blancco had increased meaningfully for the fourth year in a row, with its share price rising in line with Forager’s investment team’s estimate of its value. Things were looking good for the business.

In the middle of a tech bubble, though, enthusiasm was running high. While still liking Blancco’s prospects, it no longer justified a maximum weighting. By the number of shares held, we’d already sold more than 70% of our peak holding from 2 years earlier.

That proved fortuitous. In both financial years ended June 2022 and 2023, Blancco’s share price fell. Prior selling meant that, in the latter months of 2022, we were able to start adding to the investment again. We should have bought more aggressively.

A frustrating ending

Unfortunately, it wasn’t just the investment team at Forager who were optimistic about the future of Blancco.

In mid-2023, Francisco Partners put in a bid for the shares of 223p to take the company private. Although this was an uplift in the share price at the time, the team at Forager believed it massively undervalued the company.

Although we worked hard to convince other shareholders otherwise, the bid went through in October and ultimately, the battle was lost.

Lessons from Blancco

They say you learn the most from mistakes but successes can be instructive too. This investment contained both. We give ourselves an 8 out of 10 in this stock. We should have sold the lot in mid 2021 and we should have bought a lot more in late 2022 and early 2023.

We were also never entirely happy with the makeup of the board and should have worked on that more aggressively over our years of ownership. But we got a lot right too. Blancco has been a great success for Forager investors and a treasure trove of lessons for all of us.

- Developing a thesis that is both contrary and correct is everything when it comes to stock market outperformance. It’s periods and locations of immense pessimism where such opportunities are most likely to be found.

- Due diligence is crucial here: It can enable you to confidently turn a loose theory into a firm thesis.

- Risk management is key but rework your odds as new information arrives. Just because a stock has doubled since you bought it, doesn’t mean that the risk/reward equation has deteriorated.

- Managing position size as your perceived edge grows or shrinks.

*For more information on the takeover offer see: Open Letter to all shareholders in Blancco Technology Group

**The takeover was also discussed in this podcast episode and in our Fund Update Webinar.

***You can read the full story here.

1 topic

.jpg)

.jpg)