4 of the highest quality companies on the ASX

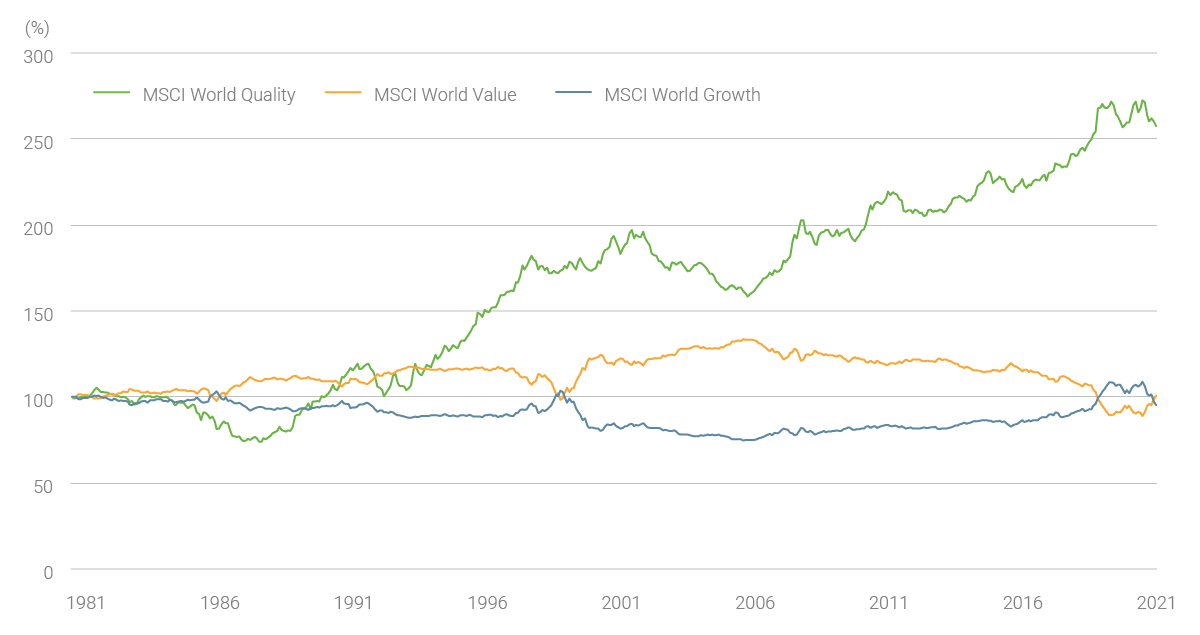

From 1981 to 2022, the MSCI World Quality Index outperformed the MSCI World Index by 2.6% per year - while the growth and value styles generated returns that were pretty much identical to the broader market.

Cumulative Relative Performance versus MSCI World (30 November 1981–31 May 2022). All data in USD. Indices are Net Total Return. (Source: FactSet/Lazard Asset Management)

Even over the past 12 months, the MSCI World Quality Index has returned 26.29%, while the MSCI World has lifted an equally impressive, but certainly smaller, 18.96%. For some comparison, the MSCI World Growth Index and MSCI World Value Index have lifted 24.21% and 13.47% over the past year.

So, is the trend your friend?

In this episode, Livewire's Ally Selby was joined by IML's Daniel Moore and Tribeca Investment Partners' Jun Bei Liu for their thoughts on why investors should be taking a closer look at quality stocks right now - including the factors that investors should look out for when trying to identify the market's quality companies.

They also each name one large cap and one small cap that they believe are the highest quality companies on the ASX. And, just because you all know I love a bit of drama, they also name one stock that the market shouldn't classify as high quality anymore.

Note: This episode was recorded on Wednesday 22 May 2024. You can watch the video, listen to the podcast or read an edited transcript below. In a prior version, Daniel referred to Brainchip as having a $2b market cap - we apologise for any inconvenience this may have caused. We have amended the video and article below.

Other ways to listen:

EDITED TRANSCRIPT

Ally Selby: Hello and welcome to Livewire's Buy Hold Sell. I'm Ally Selby and today we are talking all about quality. From 1981 until 2022, the MSCI World Quality Index outperformed the MSCI World benchmark by around 2.6% per annum, while the value and growth styles pretty much returned the same as the broader market. So is the trend your friend? To find out, we're joined by Jun Bei Liu from Tribeca and Daniel Moore from IML.

There's obviously a lot of different definitions out there of quality. I want to know what our guests think. Jun Bei, I'm going to start with you. How do you define quality and what factors are important?

Defining Quality

Jun Bei Liu: Quality companies have very strong business franchises and very strong track records - so many years of delivering consistent growth for investors. Quality companies have good management teams and don't surprise investors either on the good side or on the bad side. Good quality companies deliver really good returns on equity, as well as have very good pricing power. Good quality companies know when to use pricing power, don't abuse it and use it to complement the longevity of their growth.

Ally Selby: Over to you Daniel. How do you define quality?

Daniel Moore: For us, a quality company has an enduring competitive advantage and hopefully, that's improving over time. We also like recurring cash flows in a business, and consistent earnings as well. Quality management teams, as Jun Bei said. We want honest management teams, we want passionate management teams that are really intelligent about their business, and a strong balance sheet is also really important.

Ally Selby: We've seen growth outperform in recent times. Why should investors consider quality companies right now?

Why invest in Quality now?

Daniel Moore: I think while growth stocks have done well, there's also a lot of froth in the market around certain themes, like AI. So I think investing, being disciplined and staying invested in quality business is still really important to avoid the lower quality businesses, which when the heat comes out of the market, may fall away. That's really important as well.

Ally Selby: Okay. When do you feel like the heat could come out of the market?

Daniel Moore: Timing is always really difficult, but I guess if interest rates were to rise or not fall as expected that could be a catalyst. If CPI prints are higher than predicted, that could be a factor. Or there could always be leftfield things as well. It could be geopolitics, it could be a number of things.

Ally Selby: Okay. Over to you, Jun Bei. Why should investors consider investing in quality companies right now?

Jun Bei Liu: Honestly, I think investors should always invest in quality companies. Ultimately, it's good quality companies you want to buy and you want to buy the growth. For me, a quality company needs to have growth. You need to have that longevity and expansion of your profits and also the reinvestment into your people and business. So that's quality companies. I think they will always outperform and you should always invest in them. Growth at any price is very dangerous because the flavour comes in and out and investors can be left with a lot of losses.

Ally Selby: Daniel mentioned before that there's a little bit of froth in the market right now. How do quality companies tend to perform in times like these?

Jun Bei Liu: During the frothy times, quality companies can be left behind somewhat. This is actually a great opportunity for investors to rotate to more of these businesses because they're always followed by a very strong period of outperformance. So this is a great time to be looking at those companies, particularly some of them, where recently investors have chosen to invest in the higher growth or growth at any price stocks rather than the quality ones.

Ally Selby: Are these companies safe? What risks should investors be aware of?

Risks investors should be aware of

Jun Bei Liu: Generally, quality companies are reasonably safe because they keep investors up to date with what's happening. They've been delivering growth year in and year out, so generally they're pretty good. But I think the risk here is how we define some of these quality companies. Some of the companies have simply been growing and we assume they're quality companies, but they're not. They might miss on earnings and their share price can fall quite a bit. And generally, quality companies are more expensive because their quality is hard to get. So when they do miss on earnings or when there's a change of management, or something happens, you can get punished when things change.

Ally Selby: Daniel, are there any other risks you want to bring up?

Daniel Moore: I think high valuations mean any company is susceptible to falls if they've got really high valuations and probably the best history of that was the Nifty 50. So if you go back to the 60s, we had these great quality businesses trading around 50 times earnings and they fell 50% in two years in the early 70s. So even the best quality businesses can be vulnerable if the price is too high.

Ally Selby: Everyone knows I love a little bit of spice, a little bit of drama. So I'm going to ask you to name a quality stock or stock that the market thinks is high quality but isn't.

2 stocks the market thinks are quality businesses that aren't

Daniel Moore: What I'm going to do is categorise some things. So what I'll say is in every cycle, there are themes that are really hot. So around COVID, there was 'buy now, pay later'. I think a lot of people thought those stocks were high quality, particularly the larger companies and they probably weren't. A year ago, it was lithium and a lot of people thought a lot of those lithium companies were very high-quality companies that probably proved they weren't. And more recently, there are some AI businesses, which I would say probably aren't as high quality as some people think.

Ally Selby: I'm going to push you for a stock. Can you name a stock?

Daniel Moore: So a stock in the AI space - probably Brainchip (ASX: BRN). It's an AI business trading at a north of $500 million market cap. So obviously, lots of people think that's a high-quality business. It loses roughly US$60 million a year, so it's probably not a quality business from our perspective.

Ally Selby: Okay, over to you Jun Bei. What's a business that the market thinks is high quality but you think maybe isn't?

Jun Bei Liu: I'm happy to be the villain here. I'm going to name a company that everyone thinks is a high-quality company, that's James Hardie (ASX: JHX). To be quite frank, I just had a look - and clearly, the company has had a really poor result with poor guidance and the share price fell quite significantly.

I just looked back at the company's history. In the last 11 years, this company has missed nine of its 11 results. Most of those times, its share price fell quite a lot and then eventually recovered. I will give it to James Hardie, it's a growth company, and it's done very well growing, but a good quality company doesn't keep investors in the dark, especially on bad news. Missing nine out of 11 results is really just a sign that management is very bad at expressing bad news to investors, but good at telling them the good news.

So for me, good quality management teams don't keep investors in the dark, they tell them when things are slowing and keep them on track rather than surprising investors. Some investors may have bought right before the result and sold afterwards, and they don't know as minority shareholders what's really going on with this business. So I think there's a lot more to be done with a business like that and it's a shame because it's been growing really fast for many years and now it's just hitting a bit of a headwind.

Ally Selby: Okay, that was two wolves in sheep's clothing. Let's talk about businesses that are actually high quality on the ASX. Jun Bei, I'm going to start with you. What do you think is the highest quality large cap and small cap on the ASX?

4 of the highest quality companies on the ASX

Jun Bei Liu: There are many of them, but I'm going to name the highest-quality large cap - that's Pro Medicus (ASX: PME). This is a company that has grown - not very long ago - from a small cap into a large cap and has continued to grow. It's in the imaging space - it has software that helps the imaging department within hospitals to remotely view imaging and it's just got 7% of the market share in the US and it's now taking share at incredible speed. And the company itself, the software, is AI native. It's been used for a lot of training programs. We just think this company has an incredible amount of leeway and it's very profitable and has high return on equity. It will be our number one pick in the space.

Ally Selby: And how about a small-cap stock?

Jun Bei Liu: I've talked about this small cap before on this show, it's Lovisa (ASX: LOV). It is a company with a great concept that has proven to be very successful in Australia. It then took this model overseas and has proven to be very successful in capturing the market share over there too. The rollout has been quite incredible in the US and it has also now started going into Asia. This company will deliver very good growth for many years to come.

Ally Selby: Okay. Over to you Daniel. What do you think are the highest quality, large and small-cap stocks on the A SX?

Daniel Moore: So for large cap, it has to be REA Group (ASX: REA) for me. Brilliant business. It's the leader in the online classified for real estate and it has delivered earnings growth at around 14-15% per annum for 10 years. Brilliant business. They put up their prices almost 10% a year and no one really bats an eyelid. So, it's an incredible franchise.

And then small caps, I think this one is probably Supply Network (ASX: SNL) and this is a business that reminds me a lot of Reece. It's a distribution business like Reece in the aftermarket for truck and bus parts. It's got a fantastic distribution network. It has a customer base that isn't that price-sensitive. They earn really great returns, so in the 30% range, and it's growing really fast.

Ally Selby: So we had Pro Medicus, Lovisa, Supply Network and REA Group. I hope you enjoyed that episode as much as I did. If you did, why not give it a like? Remember to subscribe to our YouTube channel. We're adding so much great content just like this every single week.

Which "quality" stock do you want to call out on the ASX?

Let us know which stock you believe is posing as a high-quality company, but actually isn't, in the comments section below.

3 topics

6 stocks mentioned

3 contributors mentioned