4 tips and tricks every ASX ETF investor should know

ETFs have emerged as a staple for investors. But beyond the convenience of portfolio diversification and low-cost access to thematics and international markets, they harbor a trove of intricacies that can significantly impact investment outcomes.

Investing in ETFs is more than just buying a nicely packaged set of stocks. In this wire, we're going to explore some of the niche tips and tricks that often fly under the radar when it comes to ETF investing.

#1 What’s really in it

While the ETF landscape boasts diversity, a handful happen to offer similar products. So the responsibility lies on you to delve deeper into its holdings.

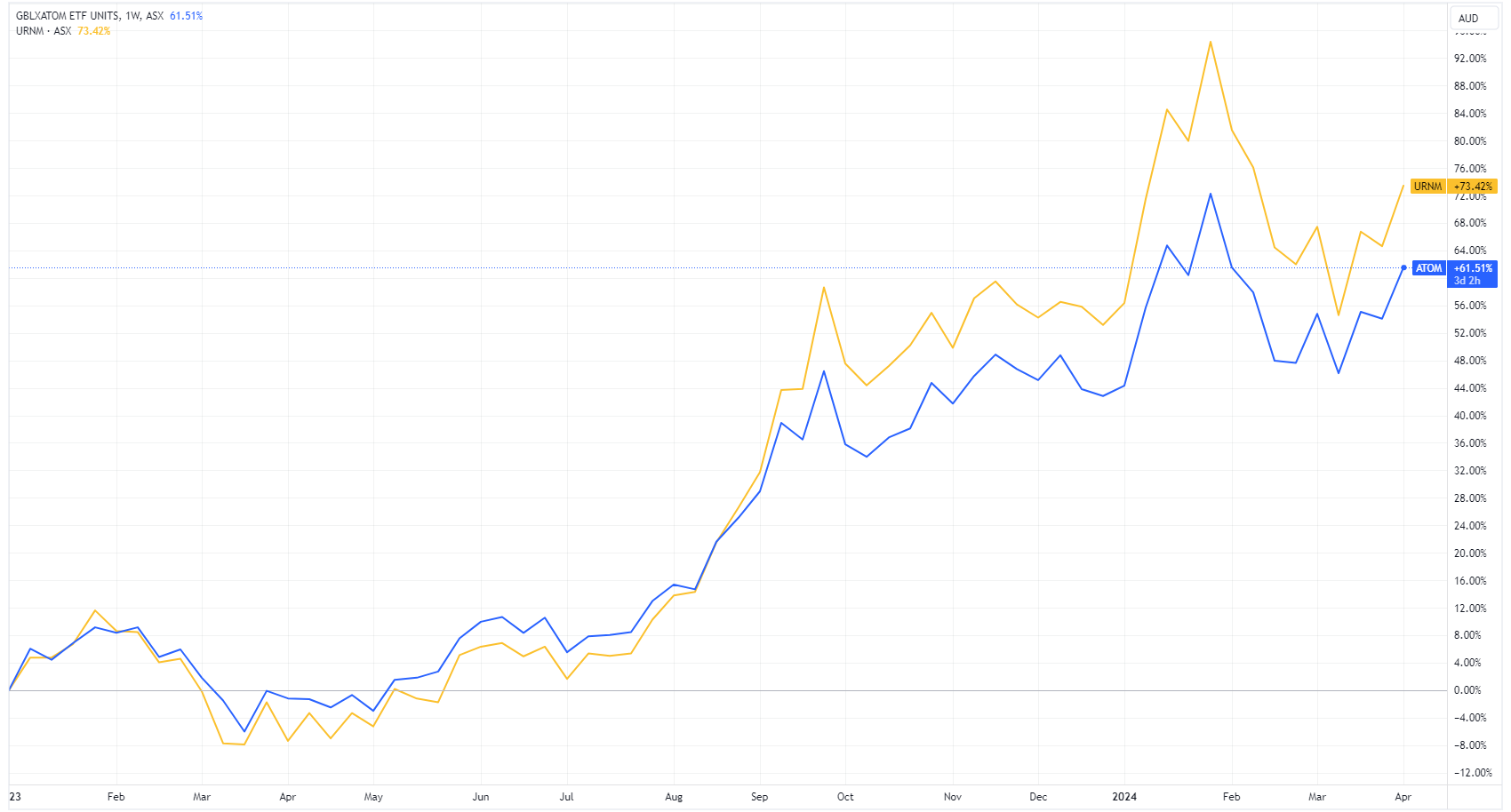

Let’s take the two uranium ETFs for example – The Betashares Global Uranium ETF (ASX: URNM) and Global X Uranium ETF (ASX: ATOM).

URNM invests in the world’s largest uranium miners or ones that hold physical uranium/uranium royalties. It’s top five holdings include (as of 28 March 2024):

- Cameco Corp (NYSE: CCJ) 15.3%

- Kazatomprom 15.2%

- Sprott Physical Uranium Trust 12.7%

- CGN Mining 5.1%

- Paladin Energy (ASX: PDN) 5.0%

For context, Cameco and Kazatomprom are two of the world’s largest uranium producers while the Sprott Trust is the world’s largest uranium fund (it buys and holds physical uranium).

ATOM offers investors exposure to both uranium mining and the production of nuclear components. It’s top five holdings include (as of 11 April 2024):

- Cameco Corp 23.2%

- Sprott Physical Uranium Trust 8.7%

- Nexgen Energy (NASDAQ: NXE) 6.0%

- Uranium Energy 4.4%

- Nac Kazatog Regs 4.3%

Both ETFs offer relatively pure play uranium exposure. But their share price performance has shown some subtle differences. You can see ATOM slightly outperforming URNM for most of 2023 in the below chart. But URNM started to charge ahead in August 2023 - When uranium prices crossed US$60/lb for the first time since 2011.

When the sector peaked in late January, URNM also experienced a deeper pullback, down around 20% from recent highs while ATOM was down 15%.

#2 To hedge or not to hedge

Currency-hedged ETFs offer Aussie investors an easy way to dip into international markets, without having to worry about currency fluctuations. Having said this, hedging can often work against your returns in the short term.

The US dollar has performed strongly over the past two years, driven by factors such as the Fed's relatively tighter monetary policy stance, safe-haven demand and a resilient US economy. The outperformance of the US dollar results in currency-hedged ETFs underperforming their unhedged counterparts.

For example, the Betashares Nasdaq 100 currency hedged ETF (ASX: HNDQ) is up 55% since its debut on 20 July 2020. While its unhedged counterpart (ASX: NDQ) is up 85.6%.

This begs the question – To hedge or not to hedge?

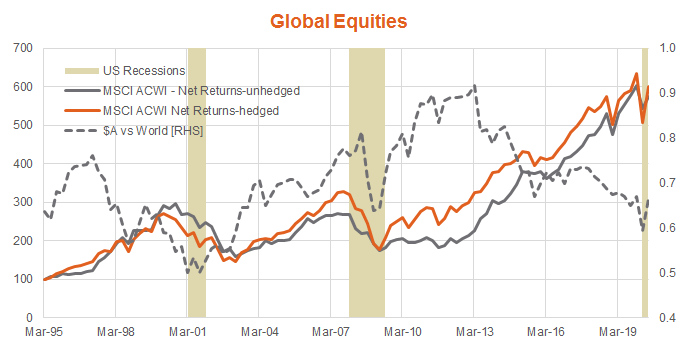

Notwithstanding cycles of appreciation and depreciation, the Australian dollar has remained relatively flat over the past 25 years. The below chart from Betashares shows similar returns from global equities over this period on a hedged (orange) and unhedged basis (grey).

But over the medium term, there are periods where hedging can result in a meaningful out/underperformance. In the late 1990s, the Australian dollar fell while global equities surged, resulting in better returns for unhedged products. In the early 2000s, the Australian dollar appreciated alongside the rise in global equities, suggesting investors would have fared better with hedged investments.

Historically, commodity booms, such as the period that followed the dot com bust, bolstered the relative performance of the Australian dollar (favours hedging exposure). Whereas periods of technology booms, such as those in the late 1990s and the past decade, have typically undermined the Aussie, thus favouring international investing on unhedged returns.

#3 ETFs that go to zero

There are inverse funds that seek to provide investors with returns that are negatively correlated to a specified market. These include:

- Australian Equities Bear Hedge Fund (ASX: BEAR)

- Australian Equities Strong Bear Hedge Fund (ASX: BBOZ)

- US Equities Strong Bear Hedge Fund (ASX: BBUS)

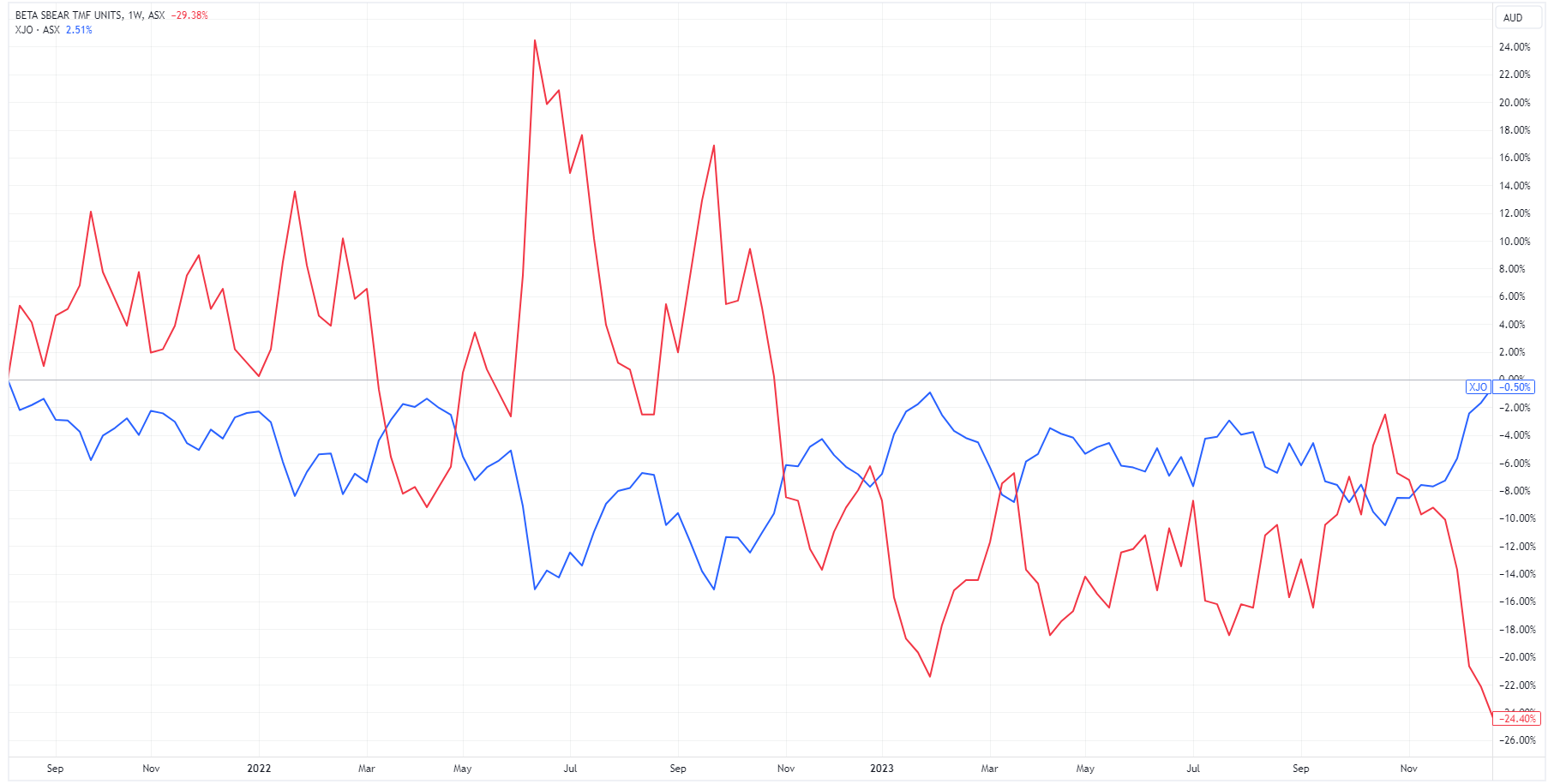

BBOZ seeks to generate magnified returns that are negatively correlated to the S&P/ASX 200 Accumulation Index – A 1% fall will generally be expected to deliver a 2.0% to 2.75% increase in the value of the fund.

But the mechanisms behind the fund mean that its value eventually goes to zero. If you hold these ETFs for an extended period – You won’t get your money back.

As the Betashares website states: “These funds achieve their short exposure by selling futures contracts, not by short selling the underlying shares. They also typically rebalance their short exposure periodically to keep the level of short exposure within a specified range. As a result, short funds do not aim to produce the exact opposite of the index’s return over time.”

The ASX 200 traded above the 7,600 level on four occasions between August 2021 and December 2023. The key dates to note include:

- 16 August 2021

- 5 January 2022

- 20 April 2022

- 28 December 2024

Let’s take a look at where BBOZ was trading for each of the respective dates:

- 16 August 2021 – $4.13

- 5 January 2022 – $4.00

- 20 April 2022 – $3.70

- 28 December 2024 – $3.01

While the ASX 200 went nowhere for almost two-and-a-half years, BBOZ lost a quarter of its value. So it's never wise to hold these products for more than a few weeks!

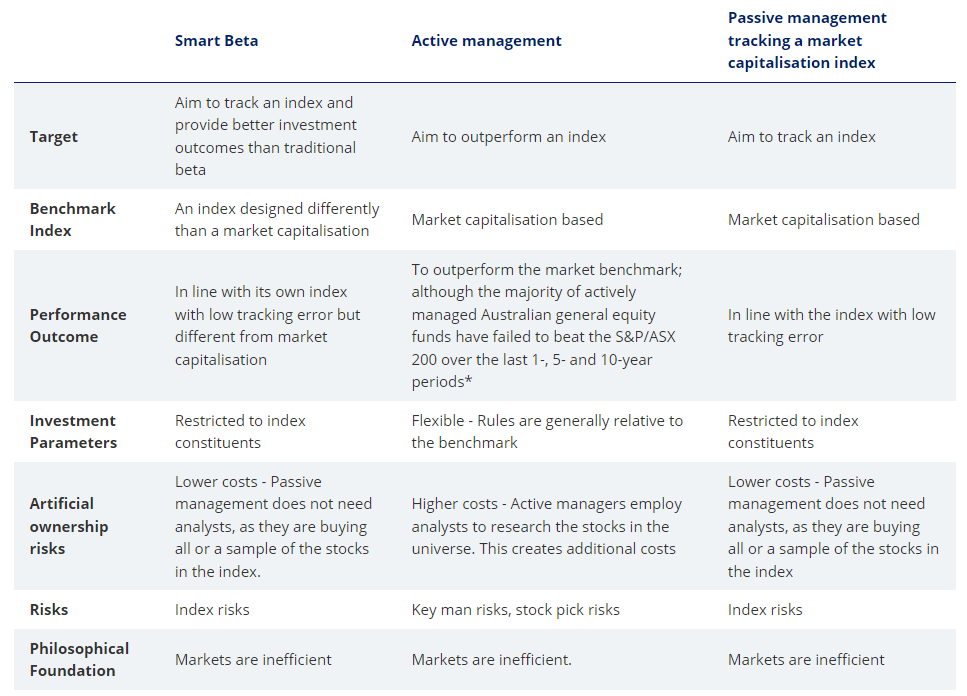

#4 Investing in 'Smart Beta'

Smart beta is the term given to ETFs that uses a measure other than the traditional market cap-weighted approach when selecting shares, bonds or other assets. Simply put, these ETFs take a “smarter” approach to what goes into the fund other than the size of the company.

Some of the main types of smart beta include:

- Equal-weighting: The same weight or value is given to each holding

- Factor-based: Introduces themes such as Quality, Value or Momentum

- Capping: A maximum weighting is applied to all holdings

- Fundamentally weighted: Focuses on metrics such as revenue growth, dividend yields, earnings track record or other fundamental factors

VanEck has outlined some of the main pros and cons of smart beta in the table below.

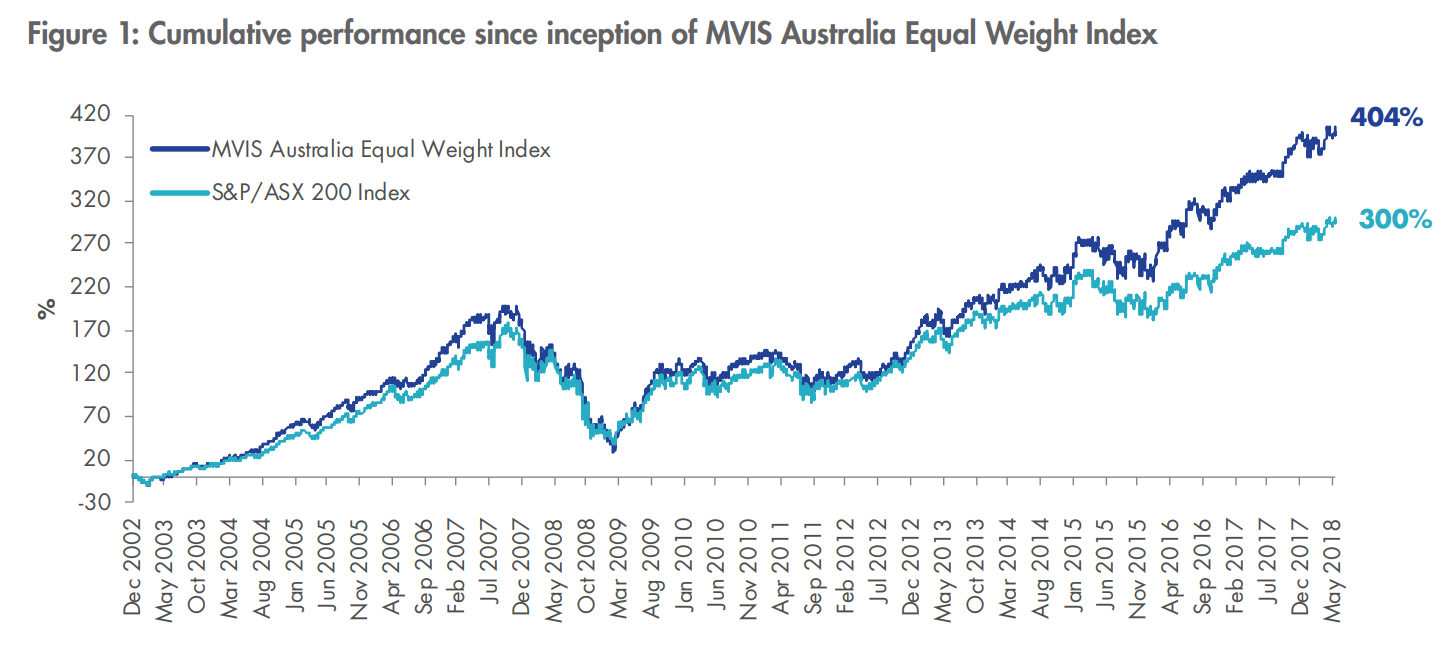

Why should you care about 'smart beta' ETFs? Because they tend to outperform the Index (it's been mathematically proven by a whitepaper from VanEck). Here are my key takeaways from the report.

- Skew: Research by Bessembinder using 90 years of stock data found that very large positive returns from a few stocks offset modest or negative returns from typical stocks.

-

Ergodicity: Larger cap stocks, being big mature businesses, are less likely to go completely bust but have limited growth potential compared to smaller, less mature businesses.

- Smaller stocks outperform the large: Smaller stocks exhibit more extreme positive and negative returns but the positive contributions outweigh the negative (e.g. a stock can't fall more than 100% but there are plenty that rise well over 1,000%)

- Putting it all together: "This finding that the smaller stocks outperform the larger stocks immediately explains the consistent outperformance of equal weighting over market capitalisation weighting. Equal weighting has consistently given greater exposure to the smaller stocks than market capitalisation weighting does. It is as simple as that."

..png)

..png)

4 topics

10 stocks mentioned

7 funds mentioned