4 unconventional ways to find returns

With low interest rates and high equity prices pervasive around the world, producing attractive returns for a reasonable level of risk across a portfolio is proving increasingly difficult. Alternatives provide investors with returns that have little or no correlation to traditional asset classes like equities and bonds. On day four of the Pinnacle Investment Summit, four fund managers explained their unconventional approaches to generating returns.

Patrick Hodgens from Firetrail Investments says there is an unusual number of opportunities in markets right now, but also an unusual number of risks. He explains both some of the risks and opportunities.

Michael Blakeney from Riparian Capital Partners discusses how investing in water rights can produce consistently high yields – even when the rains are plentiful. He reckons an increase in water-intensive tree crops will support demand over the coming years.

Sean Martin from Solaris Investment Management says investors need to look past the usual suspects for equity income, such as the big banks and Telstra, to find yield and capital growth in unexpected places. He believes that even stocks that have very low running yields can have a place in income portfolios.

Finally, Gino Rossi from Spheria explains why global microcaps could be one of the best ways to play a recovery in the global economy.

I summarise the key points from each manager’s presentation below.

Risks and opportunities are elevated

Patrick Hodgens from Firetrail Investments believes COVID has created a 1-in-10-year opportunity. He sees more potential to add value right now than at any other point since the GFC.

“High share prices dispersion leads to more opportunities.”

Firetrail also tracks the ‘embedded value’ in their portfolio holdings, which has averaged around 17% p.a. over the long term. That number is currently over 33%. Some of the stocks with the highest amount of embedded value include Newcrest Mining (NCM), Chorus (CNU), Qantas (QAN), and Worley (WOR).

Capital raisings also create a significant opportunity for active institutional investors, and he says there’s plenty more to come. So far, just $30 billion of capital has been raised by ASX companies to date. During the GFC, over $100 billion of capital was raised over two years.

“The story here is only in its first chapter”

But where there are opportunities, there are also risks. Hodgens says that market timing risks are elevated right now, with markets having priced in a ‘v-shaped’ recovery. Equity markets may have ‘run too far’, with market valuations at very high levels, even in the middle of a global recession. Firetrail managed this by stripping out all effective exposure to equity markets.

He also sees valuation risks emerging, with a small number of stocks pushing ever-higher multiples.

Finally, a range of macro risks, such as COVID, trade wars, fiscal and monetary policy, the US election, and the impact of the recession.

With all these risks being well discussed, many investors are turning to assets such as gold, gold mining companies, and agriculture. Hodgens says it’s important to find an alternative investment that has low correlation to traditional asset classes as this provides the best diversification benefit.

A high yield opportunity in an essential asset

Australia has one of the most sophisticated and functional water markets in the world, says Michael Blakeney from Riparian Capital Partners. Water has been a resilient asset over the last decade or more as the market has developed. In the 12 years to 30 June 2020, the yield has averaged more than 4%, with capital growth of almost 8% on top of that. He sees plenty of reasons these yields will be maintained in the future.

While it might seem that demand for water would be subject to weather patterns, Blakeney explained that even during rainy seasons, farmers must still irrigate crops.

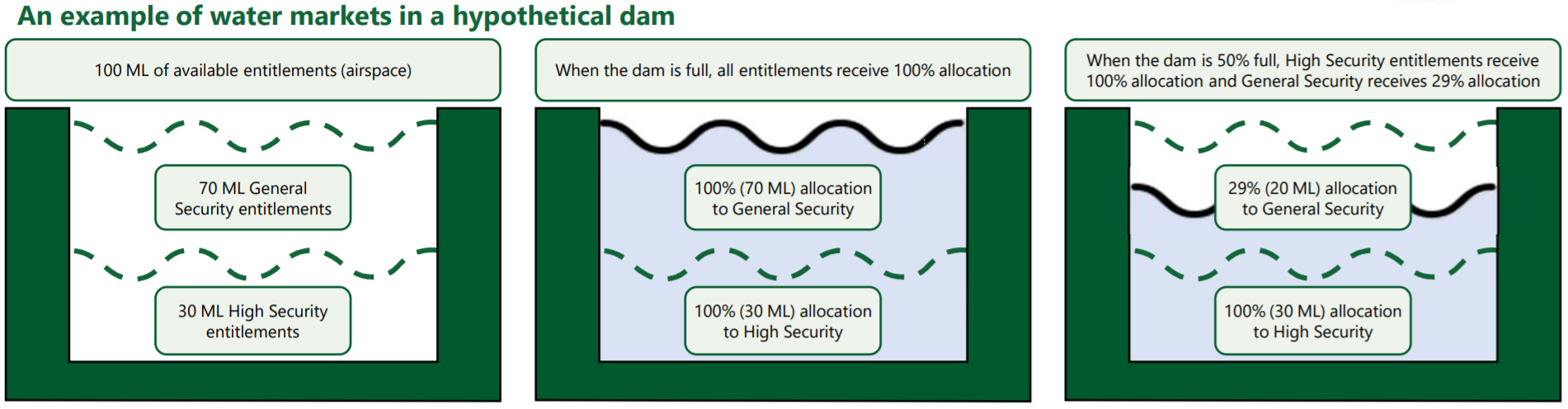

The water trading system in Australia is centred around two types of assets:

- Entitlements – these are the ongoing right to a specific annual water allocation

- Allocations – these are the annual allocations that entitlement holders receive.

There are a limited amount of water entitlements available. In fact, they’ve been decreasing over time as the government has bought them back to increase sustainability.

This creates an incentive for efficient use of water, ensuring high value, high water use crops are grown where water is most plentiful.

Click to enlarge image

Over the long term, Blakeney says that climate change, rising water demand, and increased efficiencies have driven value, and will continue long into the future.

An increasing amount of farmland is being used for tree crops such as almonds. These trees need increasing amounts of water over 7 years as they reach maturity. It’s expensive to grow the trees to maturity, but they have 25-30 year lifespans where they produce high-value crops. For these reasons, farmers are likely to pay for water to irrigate such trees, even if costs rise. Productivity gains by farmers also give users more capacity to pay for water.

“Within the next decade, demand for water will exceed supply.”

In addition to attractive returns, water markets also have little to no correlation to traditional asset classes. Water markets are driven by how much farmers will pay for water, which is unrelated to interest rates or equity prices.

“An investment in water assets can provide an improved liquidity profile for portfolios”

While water trading occasions garners attention from the media, usually in times of drought, the regulatory risks may not be as big as they seem. The industry has been through many reviews at all levels of government, and the current framework is widely accepted.

The ‘old way’ is no longer working for equity income

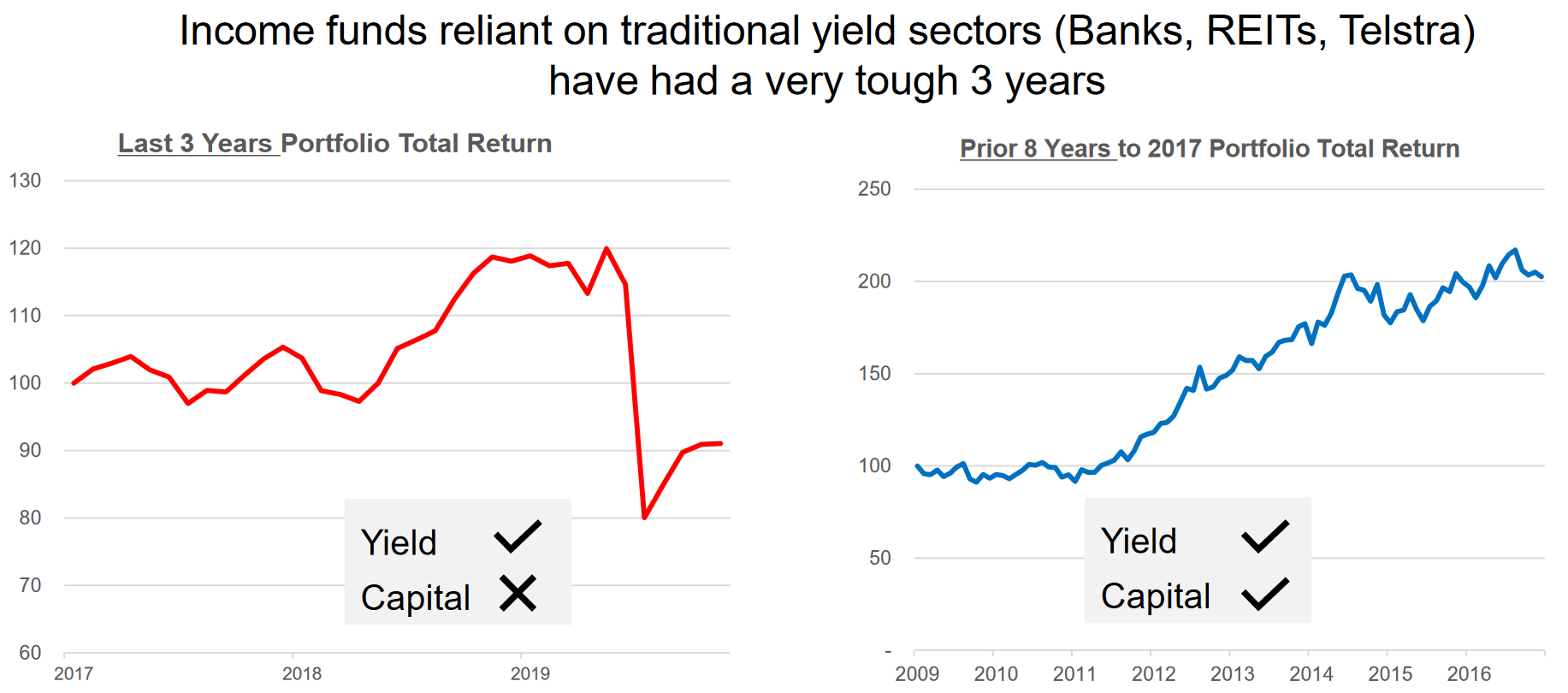

Equity income investors have traditionally relied on the big banks, REITs, and Telstra for yield. While these companies have generally been paying high dividends up until COVID, significant capital losses have meant that total returns have been poor, explained Sean Martin from Solaris Investment Management.

Martin says that investors must look outside the box to find stocks that provide both yield and capital returns. He shared two examples:

BHP

While traditional income investors might scoff, BHP is now offering both strong yields; 7.7% p.a. over the last 3 years as well as capital returns.

“BHP is a yield generating machine”

Following the last resources downturn, the miners had a major change in behaviour. They changed their capex approach, started paying increased and special dividends, and engaged in off-market buybacks. With a 5.5% yield based on forward estimates, Martin says Solaris are happy to remain exposed to this stock.

Macquarie Group

Likewise, Macquarie is not a stock that’s traditionally been included in income portfolios, but Australia’s biggest investment bank now provides an attractive level of yield – 5% p.a. over the last 3 years. On a total return basis it looks even better – 19.3% p.a. over the same period.

“We believe it can – like it has – achieved the twin goals of capital appreciation and an attractive yield”

While yield is important, he says that growth matters too. Some stocks in the portfolio have relatively low yields of around 2% or lower. Examples include Northern Star, CSL, Appen, Goodman Group, Altium, and James Hardie. While these companies don’t have high running yields, the capital appreciation has more than made up for it.

But on a ‘purchase yield’ basis, where the dividend is divided by the purchase price, instead of the current price, these growth companies look much more attractive.

“Growth matters, and growth enables a company to provide a very good yield, if you’re smart enough to hang onto the position.”

One way to benefit from a global recovery

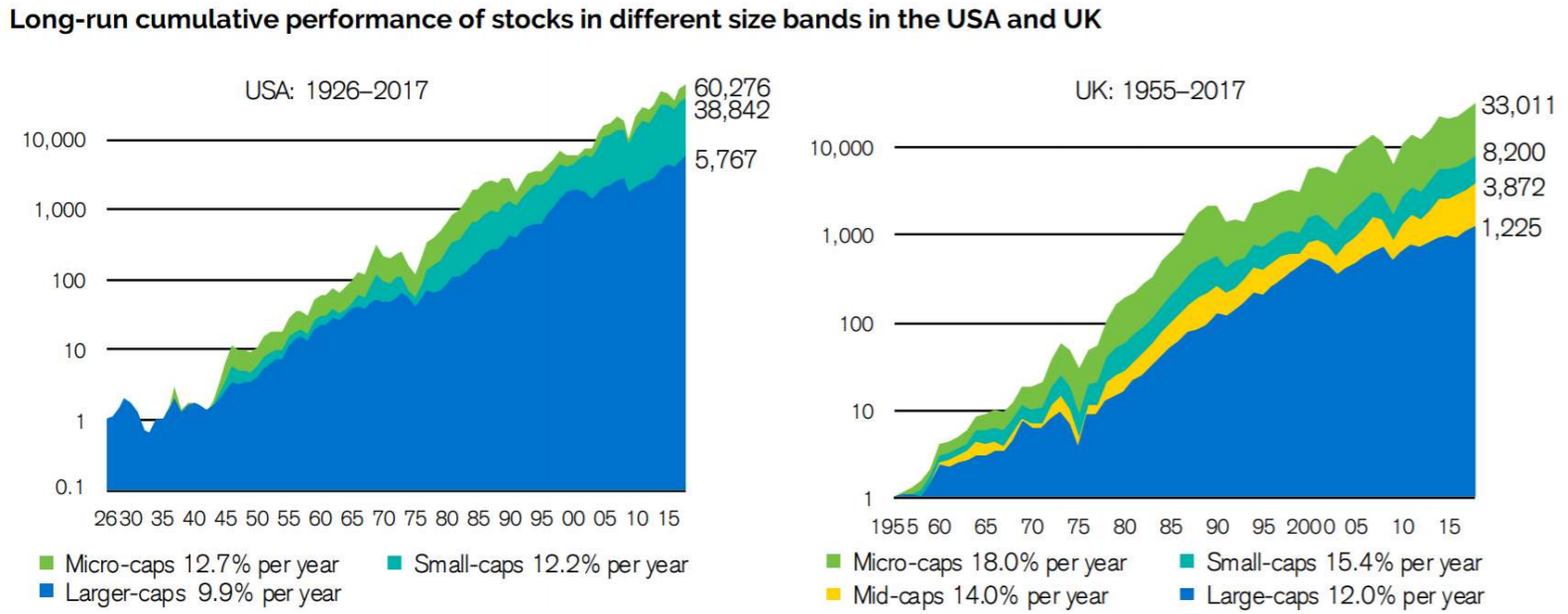

While global microcaps is an emerging asset class overseas, in Australia, it’s not as well known, explained Gino Rossi from Spheria. While Australian investors may think of microcaps as companies below $200 million in market value, any company with a market cap under $1 billion is considered a microcap by global standards.

Over the very long term, micro caps are the best performing segment of the market, as shown in the charts below.

There are more opportunities for stock picking in microcaps too, for several reasons:

- Microcaps also tend to produce more winners and more losers – i.e. higher dispersion

- 39% of microcaps have no analyst coverage at all, and the average microcap is covered by just 1.9 analysts

- It is much easier to gain access to management compared to large caps.

Microcaps are also a good way to play the ‘reopening of the economy’. Microcaps have traditionally led the bounce out a crash or recession, and we saw this again in March and April.

“A lot of (microcap) outperformance happens when the economy is accelerating”

Microcaps still offer relatively good value though, with more attractive multiples on most popular measures such as PE ratios and EV/EBIT.

Rossi pointed to US-listed Collectors, a company that specialises in grading collectables such as coins and trading cards. It's generating excellent free cash flow, has low gearing, and no coverage by any brokerage firms.

He also likes Swedish safety company Mips, which creates safety devices that sit inside helmets to help protect against serious brain injuries. It produces high returns, and has a huge blue sky opportunity to expand into construction and safety helmets.

Think differently

Today's unusual and volatile markets require investors to think differently about their investment portfolios. The inclusion of alternative investment strategies can provide important diversification benefits along with attractive returns.

If you're a Sophisticated or Professional Investor, you can sign up for the final session of the Pinnacle Investment Summit here. For retail investors, follow Glenn Freeman to get his coverage of the event.

Like this wire? Let us know by hitting the 'like' button to the left.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

1 topic

6 stocks mentioned

4 contributors mentioned