45 ASX stocks have a P/E of under 10. These two are also up more than 60% in the past year.

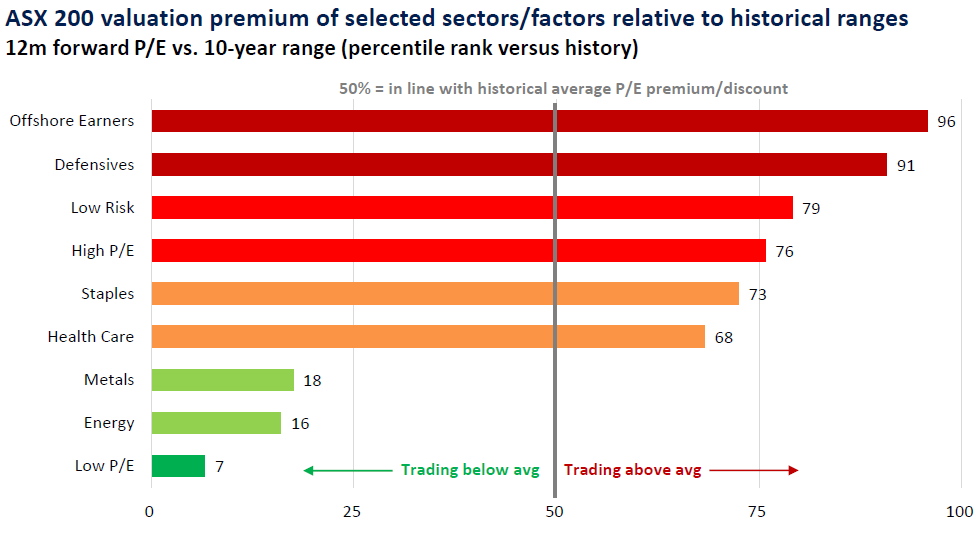

Welcome to the first in our latest Data Deep Dive series. As markets have become more volatile in the past year, the flight to quality investments has become more important than ever. Defensive and “low-risk” stocks now attract some of the top forward P/Es in the market, and many of them are extremely expensive.

This presents a real quandary for investors. How can you justify moving your hard-earned cash into defensive stocks while recognising you will have to pay exorbitant valuations for them?

Of course, P/E valuations are not (and should not be) the only thing you can use to value an investment. But a cheap stock does play a big role in identifying low-hanging opportunities if they pass other quality thresholds.

As of Friday 26 May 2023, there are 45 ASX stocks that have a trailing P/E of below 10.

| Ticker | Company | Price | PE | Mkt Cap | 1 Year |

| WDS | Woodside Energy Group | $34.89 | 8.18 | $66.25 B | 19.90% |

| RIO | Rio Tinto | $107.24 | 9.88 | $39.81 B | -3.20% |

| S32 | SOUTH32 | $3.90 | 7.82 | $17.74 B | -16.24% |

| PLS | Pilbara Minerals | $4.57 | 8.2 | $13.69 B | 62.46% |

| SPK | Spark New Zealand | $4.88 | 8.58 | $9.07 B | 12.44% |

| BSL | Bluescope Steel | $19.03 | 5.18 | $8.73 B | 4.59% |

| YAL | Yancoal Australia | $4.94 | 1.83 | $6.52 B | -18.75% |

| IPL | Incitec Pivot | $3.05 | 7.81 | $5.91 B | -16.58% |

| WHC | Whitehaven Coal | $6.29 | 1.76 | $5.49 B | 24.80% |

| VEA | Viva Energy | $3.22 | 9.73 | $4.99 B | 12.98% |

| JBH | JB Hi-Fi | $44.06 | 8.34 | $4.82 B | -2.72% |

| ILU | Iluka Resources | $11.19 | 9.21 | $4.77 B | 7.00% |

| NHC | New Hope Corporation | $4.95 | 3.51 | $4.37 B | 30.95% |

| HVN | Harvey Norman Holdings | $3.49 | 5.84 | $4.35 B | -19.03% |

| BKW | Brickworks | $25.62 | 6 | $3.9 B | 26.83% |

| BPT | Beach Energy | $1.42 | 6.52 | $3.23 B | -10.44% |

| SGM | Sims | $14.20 | 6.37 | $2.74 B | -19.12% |

| GNE | Genesis Energy | $2.55 | 9.44 | $2.72 B | 3.24% |

| SUL | Super Retail Group | $11.83 | 9.81 | $2.67 B | 28.25% |

| ZIM | Zimplats | $23.81 | 7.49 | $2.56 B | -19.37% |

| PRU | Perseus Mining | $1.83 | 8.09 | $2.5 B | -4.07% |

| SMR | Stanmore Resources | $2.61 | 3.11 | $2.35 B | -1.88% |

| BFL | BSP Financial Group | $4.89 | 2.11 | $2.28 B | -2.20% |

| CRN | Coronado Global Resources | $1.32 | 2.87 | $2.21 B | -40.00% |

| VUK | Virgin Money | $2.89 | 8.56 | $2.02 B | 8.46% |

| SNZ | Summerset Group | $8.38 | 7.2 | $1.95 B | -13.43% |

| APM | APM Human Services International | $2.01 | 6.61 | $1.84 B | -37.96% |

| GNC | Graincorp | $7.72 | 5.19 | $1.73 B | -20.00% |

| MFG | Magellan Financial Group | $7.84 | 6.75 | $1.42 B | -45.78% |

| HLI | Helia Group | $3.27 | 6.69 | $1.09 B | 10.47% |

| HGH | Heartland Group Holdings | $1.46 | 9.48 | $1.04 B | -26.63% |

| ELD | Elders | $6.54 | 8.49 | $1.02 B | -51.12% |

| AAC | Australian Agricultural | $1.57 | 8.92 | $946.34 M | -24.16% |

| WAF | West African Resources | $0.850 | 5.35 | $870.04 M | -32.00% |

| NCK | Nick Scali | $8.71 | 6.92 | $705.51 M | -2.46% |

| SGF | SG Fleet Group | $2.03 | 9.55 | $692.52 M | -10.40% |

| ACL | Australian Clinical Labs | $3.27 | 3.69 | $660 M | -37.83% |

| GRR | Grange Resources | $0.548 | 3.7 | $633.64 M | -64.68% |

| SWM | Seven West Media | $0.385 | 3.08 | $605.86 M | -30.00% |

| WTN | Winton Land | $2.03 | 8.98 | $602.13 M | -41.16% |

| FPR | Fleetpartners Group | $2.19 | 7.4 | $591.52 M | -6.81% |

| PPM | Pepper Money | $1.32 | 4.2 | $578.28 M | -28.14% |

| MYR | Myer Holdings | $0.700 | 7.22 | $574.9 M | 0.6667 |

| PPC | Peet | $1.19 | 8.56 | $560.96 M | 0.1122 |

| GMD | Genesis Minerals | $1.17 | 0.97 | $556.47 M | -23.53% |

Commentary

Of the 45 stocks mentioned here, two are down more than 50% over the past year.

Elders (ASX: ELD) has been the victim of softening livestock trading conditions, weaker crop prices and unseasonably wet weather. Earnings dropped 46% in the first half despite a bump in revenues. But management believes that the second half will be better than the first half, as supply chains ease and freight costs continue to fall. It could also be argued the stock is “deceptively” cheap given PEs in this list are trailing. The number will likely jump after the FY result in August.

In contrast, Grange Resources (ASX: GRR) is sitting at near-52-week lows. The company has been a victim of lower iron ore prices and high energy/operating costs. Much larger rival Rio Tinto (ASX: RIO) is only down 3% in the same time frame.

Having said this, there are two stocks that are also up more than 50% in the past year.

One of them is Pilbara Minerals (ASX: PLS). One of only two lithium producers on the ASX, the stock is up more than 60% in the last 12 months. Pilbara also attracts a BUY from the Market Index broker consensus with 13 sell-side analysts assigning the stock that rating. One of them is Morgan Stanley, which argues that lithium prices bottomed out at the beginning of this year.

The other is Myer Holdings (ASX: MYR). The stock is up more than 65% despite the analyst consensus having no buys and SELL ratings across the board. Why is this? In short, Myer has done what many of the other retailers couldn’t do - double earnings and generate some serious cash flow in an environment when consumers are slowing their spending habits.

This article was published first on Market Index.

2 topics

5 stocks mentioned