5 big themes (and 7 charts) every investor should be aware of

Anyone who has experience in financial markets may be familiar with the Latin phrase "caveat emptor" - or "let the buyer beware". In a market full of confusing signals (and loud noise), there is much more to be aware (or beware) of. In these times, it's up to individual investors to decide whether they lean into the fear, and make discerning decisions about where to play their cash.

At the recent Pinnacle Investment Summit, the thinking and the methodology behind those decisions were on full display. Some managers discussed their concerns around valuations. Others emphasised the importance of understanding balance sheets and finding assets with sustainable earnings. All of them emphasised the importance of individual asset picking.

Livewire was fortunate to be a guest of the Summit when it was in Sydney last week. Here are five of the key takeaways every investor should know.

Price to earnings ratios don't compound, but earnings do

At the global level, valuations are undoubtedly bifurcated. On the one hand, the Magnificent Seven mega-cap tech stocks seemingly defy gravity. On the other hand, most other global stocks are being faced with margin pressures and costs that are ballooning at a rate not seen since at least 2008.

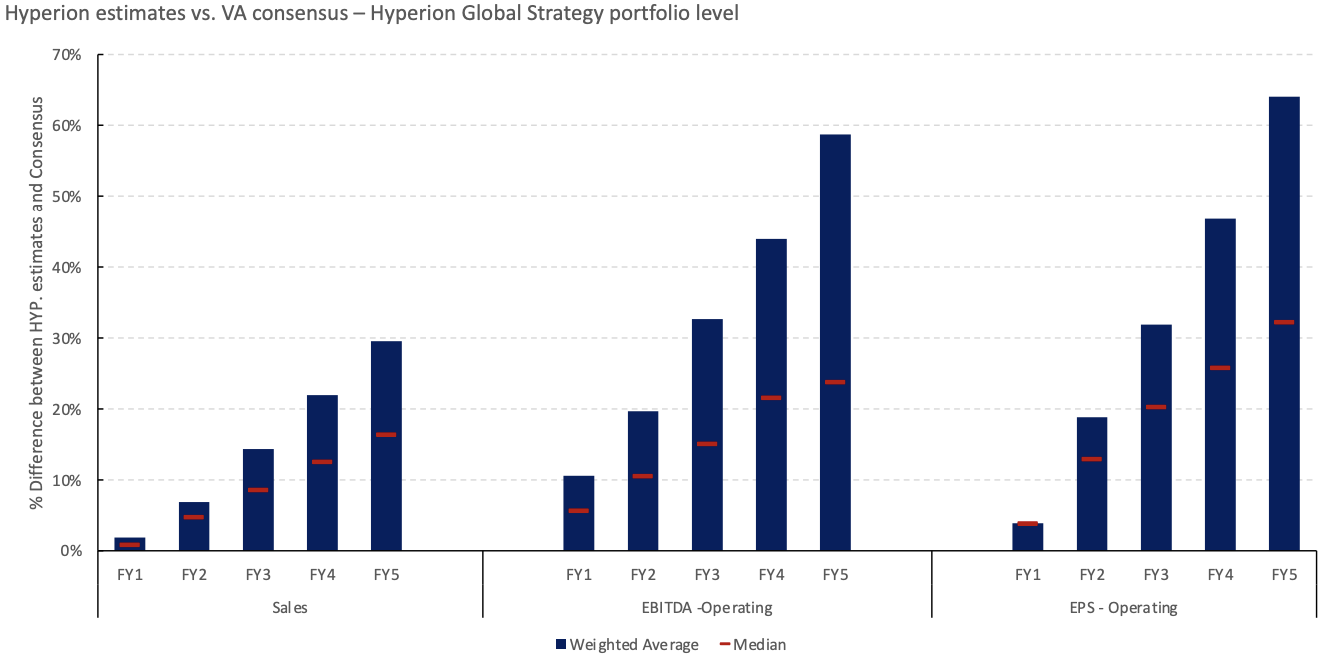

This, in Hyperion Asset Management investment specialist Jolon Knight's mind, brings about an important lesson - prices don't compound but earnings do. And when prices don't reflect earnings, valuations are most likely over or under-hyped. This creates a natural opportunity for valuation exploitation.

"If these companies are really high quality and have persistent earnings and sales growth for multi-decade periods, you can see a rerate and uptick cycle," Knight said.

As growth-oriented investors, Hyperion looks for innovators that can also take market share and build long-term runways. They call this the "quality anomaly" - seeking to find companies with structural stories that aren't appreciated by the market.

"They're innovating and they're really misunderstood by the market or they've been misidentified and the true goal of their long-term, earnings profile is yet to be seen," he said before adding the following.

"You really need to be looking forward and investing in tomorrow's winners, not the winners of yesterday."

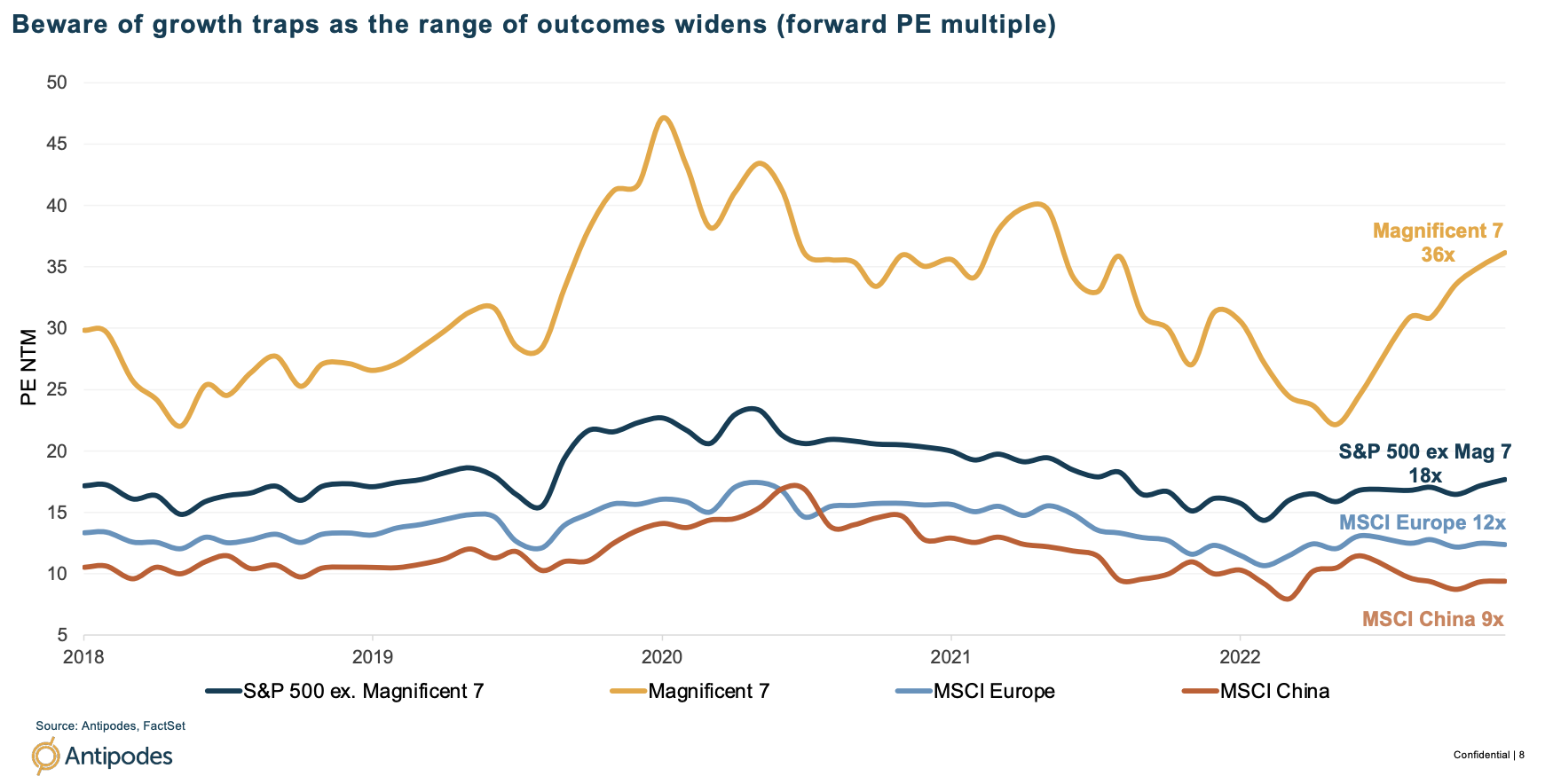

Antipodes CIO Jacob Mitchell, in contrast, is more nuanced. He looks for pragmatic value in these markets. Not only does it produce a smoother return over the long-term market cycle, he says it's also presenting better valuations today (than quality or growth). He also argues that it's time for investors to avoid growth traps in a world where the number of outcomes are so varied.

"If you want to own quality or growth, it's actually more expensive than it normally is. Now, we all know you should pay a higher multiple for those characteristics," Mitchell said. "You need to think about whether it is actually gonna be durable growth and durable quality."

As for where the winners and losers are, Mitchell suggests the answers will lie in which companies can continue to sell and keep costs down in a recession (or recession-like environment).

"We want to avoid the cyclicals that become value traps. We want to avoid the growth stocks that end up being growth traps as they mature and also take advantage of socio and macroeconomic change," he said.

"You need to be very wary of the potential for economic sensitivity in some of those names."

Go below the line

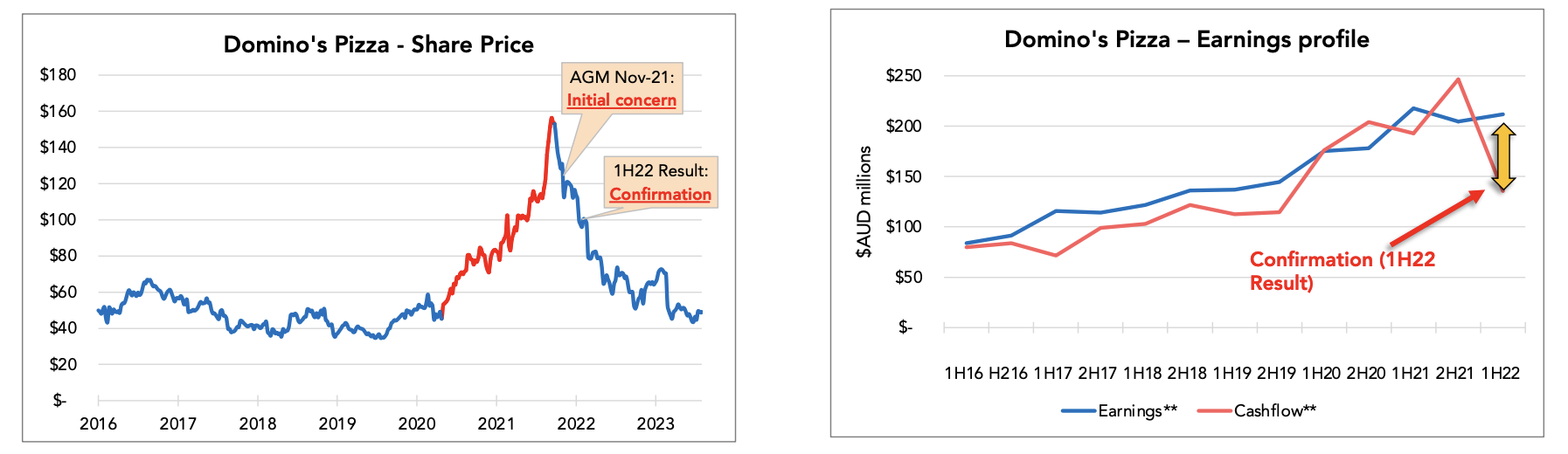

If we learned anything from the most recent reporting season, it's that investors are wasting no time in dumping companies that were perceived to have quality-type metrics but don't end up having them. Solaris Investment Management CIO Michael Bell had been warning of these traps since well before earnings season, encouraging them to look beyond the reported numbers and to go below the top-line.

"You need to do the work, particularly in the other factors that aren't told to you by management," he said.

As a result, Bell touts that his team were able to avoid some pretty big landmines. Among them, Domino's Pizza (ASX: DMP).

"While everyone else was buying, we were shorting for our long-short product. The company was looking very overvalued but what gave us a bit more confidence was that at their AGM in November 2021, the company started talking down top-line growth," Bell said. "We saw that deviation [between earnings and share prices] and that gave us the confidence to stay short."

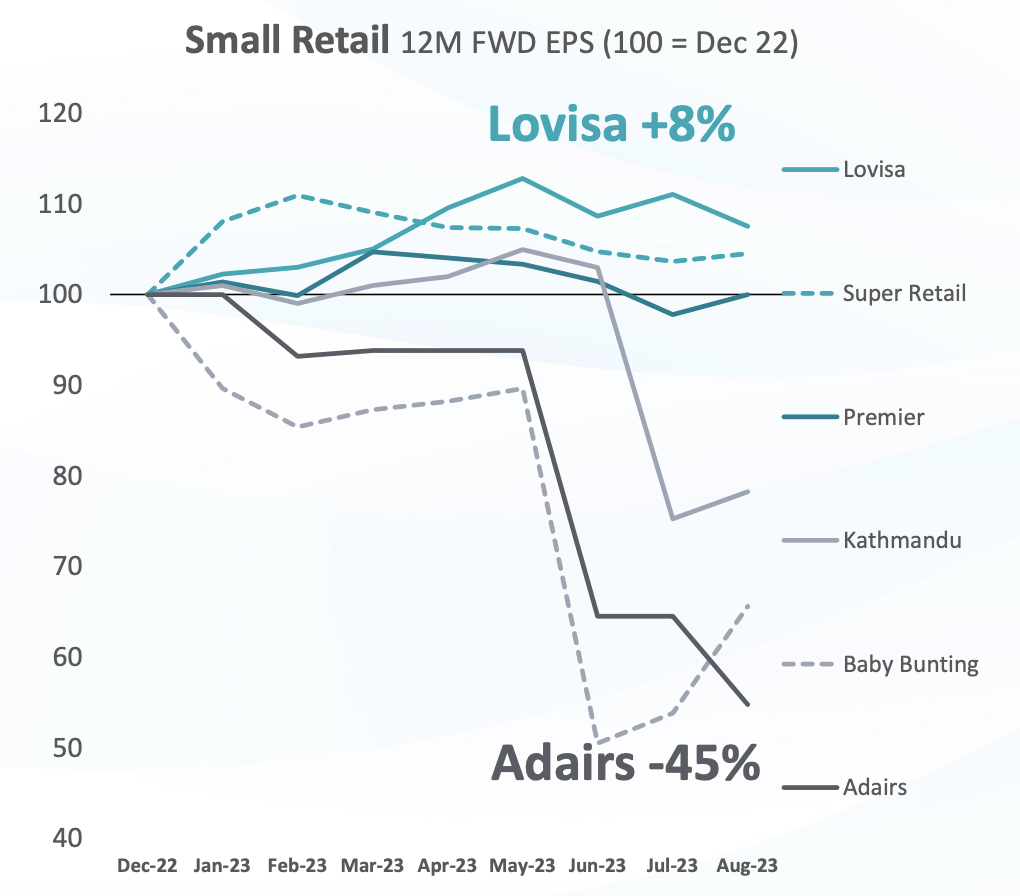

Longwave Capital founding partner and CIO David Wanis took a similar tack, arguing we are at the end of a "magical thinking" era for small cap investors.

"The largest investment style from two years ago was magical thinking. Magical thinking was the thing that saw a record number of loss-making companies trade at over $100 million market capitalisations. Interest rates went to zero and investors lost their minds," Wanis quipped.

And now?

"Within the same sectors, we are seeing very large divergences in the earnings outcomes of the businesses," he said while adding that taking sector views are no longer enough. You need to know what stocks in what sectors can pass on those price increases and outperform.

A perfect case in point is small-cap retail. For instance, Lovisa (ASX: LOV) has generated a massive return in a way that Adairs (ASX: ADH) hasn't. And Lovisa has certainly been a shining light in a sector that hasn't received a lot of love as consumers unwind their excess savings.

Assumptions are dangerous

The next lesson focuses on assumptions. How many times have you heard the assumption that the Big Banks would flourish under interest rate hikes, or that healthcare companies would thrive in a recessionary environment, or that commercial real estate is doomed? All of these themes may broadly occur but, in all likelihood, the return profiles may be overhyped.

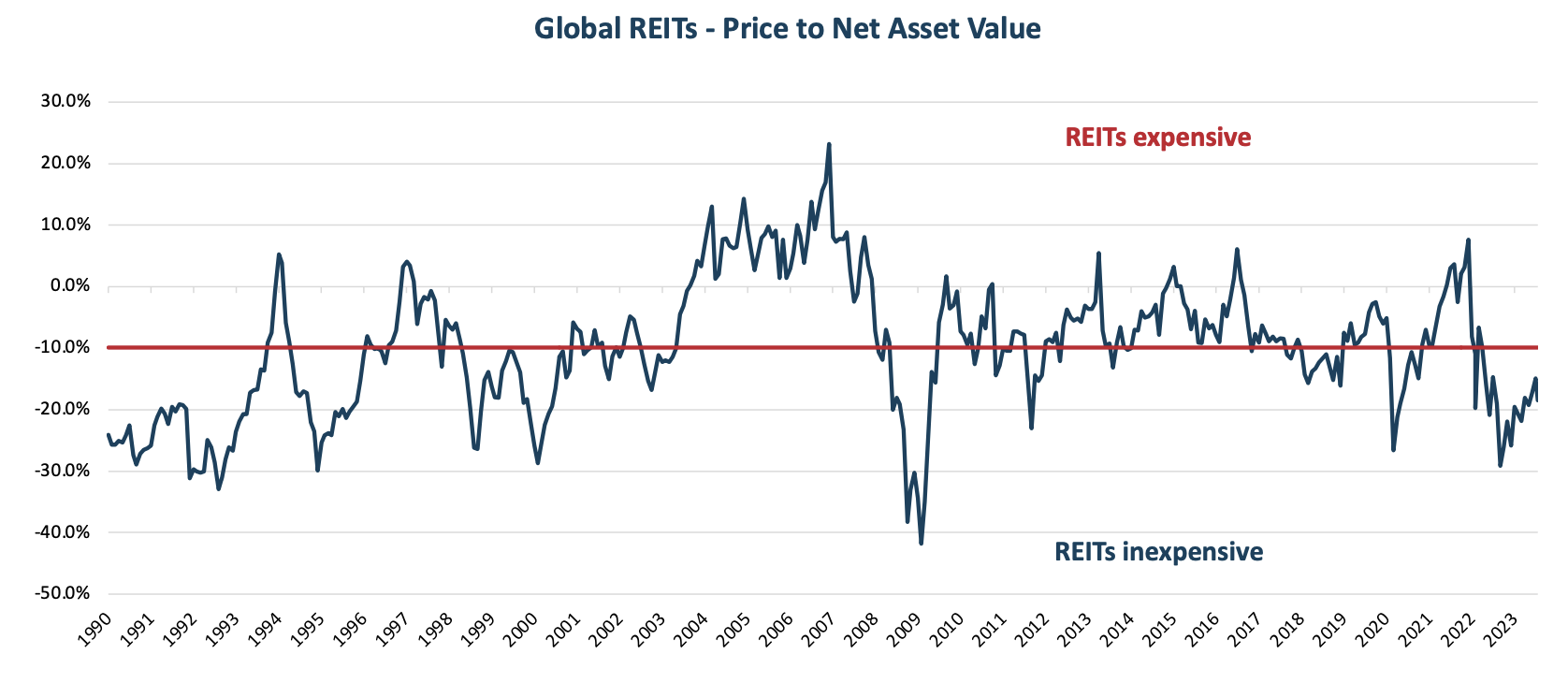

No one knows that last theme especially better than Resolution Capital Portfolio Manager Julian Campbell-Wood. He argues that the sell-off in global REITs has gone too far and that opportunity is now knocking at these valuations.

"You're supported by sound capital structures and that's a competitive advantage for the listed sector at this point, low leverage, good access to debt and equity and then taking advantage of some of the opportunities that are arising and finally discounted relative valuations, both the equities underlying real estate and over time the sector's delivered competitive returns," Campbell-Wood said.

At the other end of the scale has been the assumption that corporate balance sheets are in good health. But as we learned throughout August, a sickly balance sheet that flows through to a dividend cut (or suspension) received a very brutal reaction from the market.

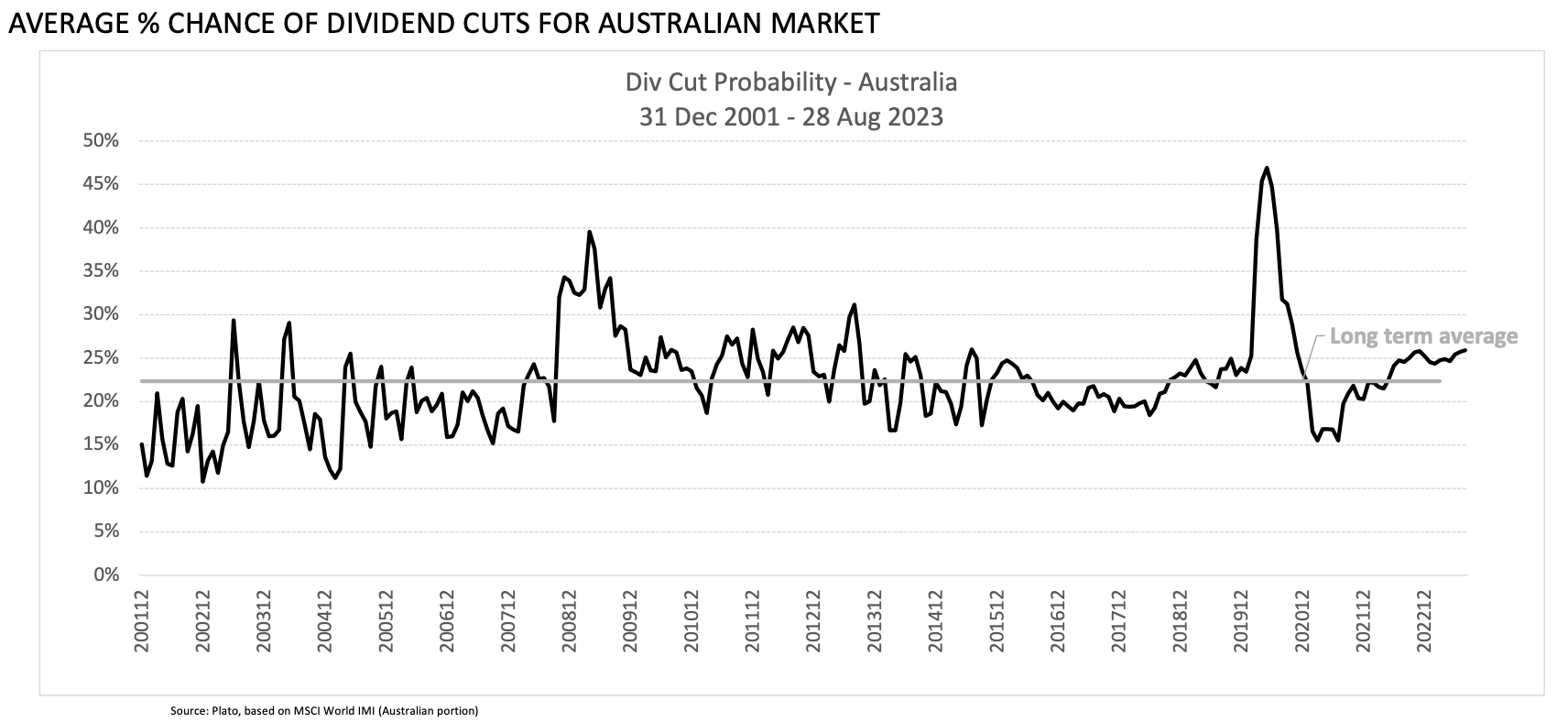

Last month's reporting season saw a 21% decline in year-on-year dividend declarations. But before you all start worrying, Plato Investment Management's Dr. Don Hamson and Peter Gardner have reasons for you to remain optimistic.

"Things are a bit tougher, but from a company perspective, this is still pretty good. We expect to deliver a 9% yield this year out of our portfolio," Hamson said. "What we have seen in this [dividend cutting] indicator is that it's ticked up for the last 18 months as interest rates have risen. But it hasn't shot up. We are only just above the long-term average."

And speaking of income, there has long been an assumption that dividends are one of the best forms of income for investors.

While that's certainly true, Metrics Credit Partners Founder and Managing Partner Andrew Lockhart also reminds investors that dividends come with the risk of being cut and eliminated. In contrast, private debt allows an investor to be both defensive and generate a strong, inflation-linked return even during an economic slowdown.

"You get tighter terms, tighter conditions, less availability of capital, higher pricing. So I would argue in this environment, it's actually a very attractive time in which to invest in private credit," Lockhart said. "The beauty of private debt is in the absence of downside volatility in well performing highly diversified portfolios," he added.

Markets do (and will) repeat past mistakes

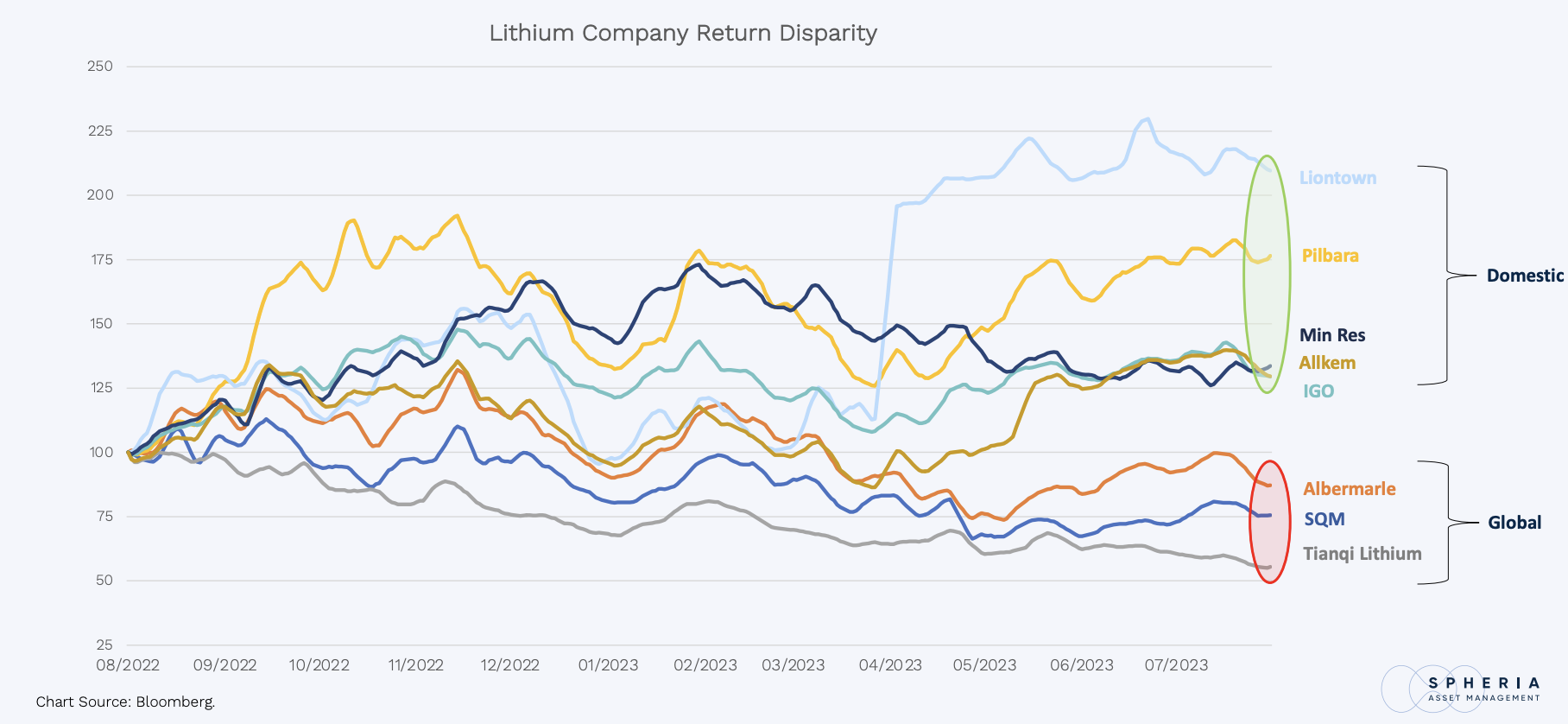

History doesn't always repeat itself but it sure does rhyme a lot. Markets have fashions and investors tend to crowd into favoured thematics, stocks, and narratives. Spheria Asset Management's Marcus Burns believes we are at another of those moments where investors crowd into "expensive growth" stocks.

He says the disparity in valuations should be an opportunity to look further.

"Our bottom line is that there's been substantial divergence in smaller companies between value and growth, between small caps and large," Burns said.

Nowhere is this valuation dispersion more apparent than in lithium stocks. While companies like Liontown Resources (ASX: LTR) and Pilbara Minerals (ASX: PLS) trade at extraordinary valuations, global rivals like Albemarle and Tianqi Lithium look much more appealing. That's despite the actual lithium price more than halving since early 2022.

"There's a lot of money crowded into this space trying to get a return, which is a real risk," Burns said.

Seize an uncomfortable opportunity

And finally, to quote the Warren Buffett line, be greedy when others are fearful and be fearful when others are greedy. In the case of Firetrail's Blake Henricks, he looks for companies that have that unloved and untapped edge.

"You can make a lot of money by buying unpopular companies," he said. "Old world assets are more attractive in the new world - even as some people have thrown them to the side."

For instance, the world still needs gas and investors still need gold as a reliable hedge for uncertainty. The two takeover offers for portfolio holdings Newcrest Mining (ASX: NCM) and Origin Energy (ASX: ORG) are living proof of this.

This is part one of our coverage of the Pinnacle Investment Summit. My colleague Kym Sheehan will be writing part two, showcasing these investors' top investment ideas for the year ahead. Make sure you are subscribed to her profile so you don't miss the story.

Learn more

The annual Pinnacle Investment Summit took place across Australia over the past two weeks.

The Summit included investment insights from Pinnacle Investment Management Group’s affiliated asset managers including, Antipodes, Firetrail Investments, Hyperion Asset Management, Longwave Capital, Metrics Credit Partners, Plato Investment Management, Resolution Capital, Solaris Investment Management, and Spheria Asset Management.

Financial advisers and wholesale investors can access video replays from the Pinnacle Summit Series here:

2 topics

7 stocks mentioned

9 contributors mentioned