5 themes for rising interest rates and inflation

Global inflationary pressures and interest rates have lifted notably so far this year thanks to strong demand and supply bottlenecks. Inflation appears likely to remain high and more central banks are looking to raise interest rates.

This note considers five potentially attractive investment themes for a rising rate environment.

Rising rates and rising inflation

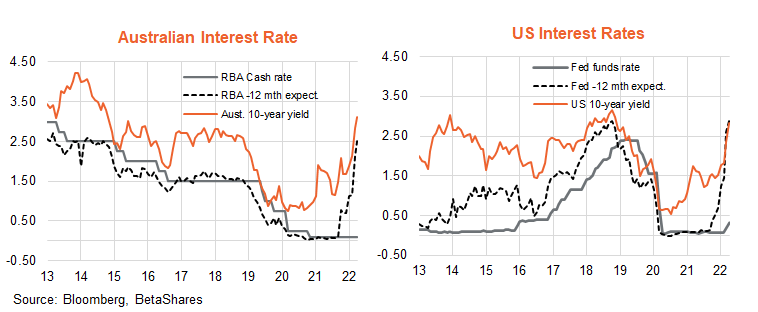

The shift in global interest rate expectations since late last year has been one of the most dramatic in modern history. Having once suggested the rise in US inflation was “transitory” and US official interest rates might not rise for several years, the US Federal Reserve is now pencilling in a lift in the Fed funds rate from 0.5% p.a. to 1.9% p.a. by year-end, and 2.8% p.a. by end-2023.

As seen in the chart below, interest rate expectations have also lifted dramatically in Australia, with the market expecting the cash rate to rise to 2.5% over the next 12-months or only modestly less than expected in the US over this period.

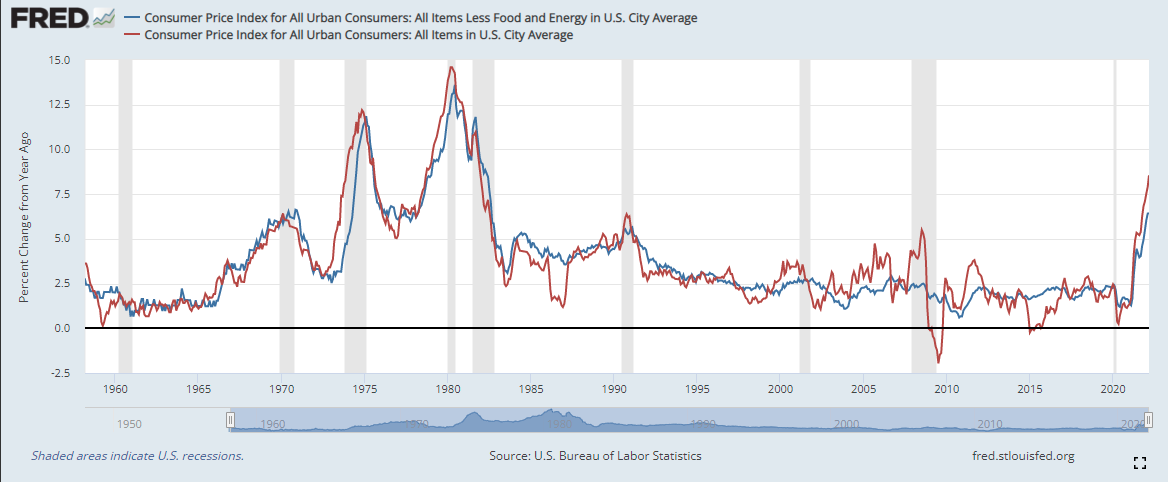

A major catalyst for the shift in interest rate expectations has been the persistent rise in inflation, especially in the US. As evident in the chart below, both headline and core US consumer price inflation have lifted to the highest rates in 40 years. Russia’s invasion of Ukraine last month has only added to upward food and energy price pressures, given that both these countries are major food and energy exporters, and their supplies threaten to be severely disrupted if hostilities rage on for several more months.

Commodity exposures in a period of rising inflation

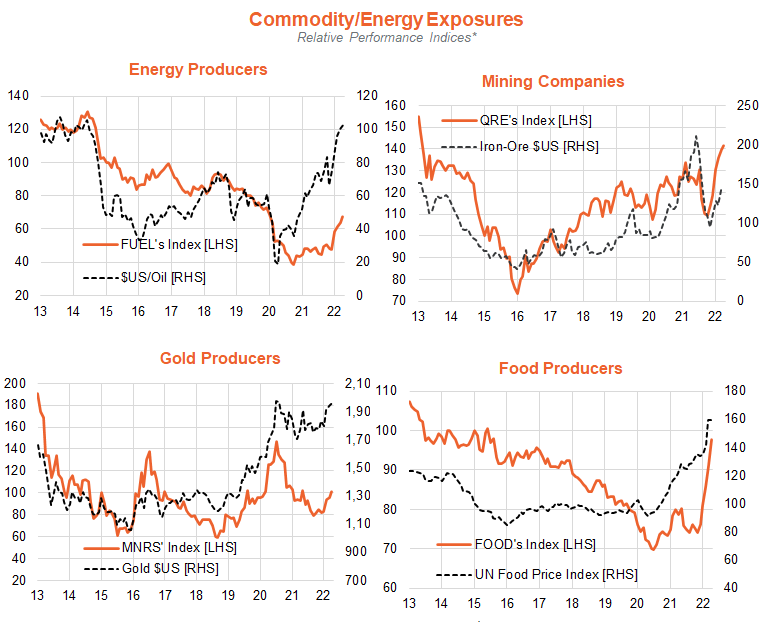

Some of the investment exposures of most potential interest in this heightened inflationary environment are in the commodities areas.

The chart below depicts the relative performance of various commodity-related indices:

- Global energy producers

- Australian resource companies

- Global gold producers

- Global food producers

As evident, all have enjoyed solid performance versus global equities over the past month, in line with the strength in oil, gold, food and iron-ore prices. As is also apparent, commodity exposures, in general, have been outperforming since late last year – before Russia’s assault on Ukraine – in line with the solid post-COVID recovery in global economic growth.

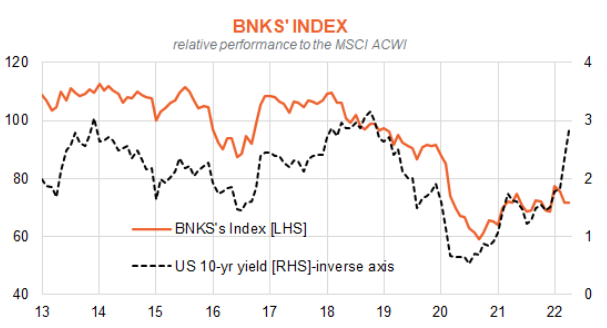

Global banks – slow grind higher as rates rise

The fifth exposure which has tended to do relatively well in an environment of rising interest rates is the global banks. This is because rising rates tend to be associated with stronger profit margins as medium-term bank lending rates tend to widen by more than the cost of short-term funding costs. Rising credit demand due to strong economic growth also tends to be supportive of global banks.

As seen in the chart below, global banks have tended to outperform since late 2020 – in line with the trend higher in bond yields. They suffered a modest relative performance setback more recently despite the further surge higher in bond yields.

This appears to reflect concerns over the possible financial market impact of global sanctions on Russia, such as the write-down of certain Russian financial assets and even a potential sovereign debt default. That said, given the substantial lift in global interest rates – and the likelihood they may well rise higher or at least hold around current levels – there appears to be scope for further potential “catch-up” relative performance by global banks in the coming months.

Valuations still attractive

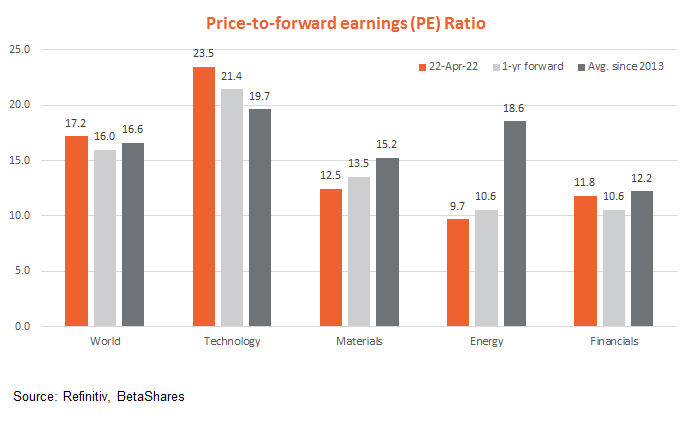

Last but not least, it’s also worth noting that energy, materials and financial stocks are still trading at reasonable price-to-earnings discounts from their long-run averages.

In the chart below, for example, the global MSCI materials sector is trading at a price-to-forward earnings ratio of 12.5 compared with an average since 2013 of 15.2*. Even allowing for the market’s expected 8% decline in material sector forward earnings over the coming year (due to an assumed weakening in commodity prices), the forward PE ratio at current price levels in one year’s time would be 13.5 – or still below its longer-run average.

The same attractive valuation argument also broadly holds true for the energy and financial sector. By contrast, the global technology sector is still trading at an above-average valuation, even allowing for expected 9.5% growth in forward earnings over the coming year.

*I’ve taken the average since 2013 as a reasonable valuation metric as global bond yields broadly began to flatten out from this period after having trended downward for several decades previously.

Follow for more Bassanese Bites

Each week I publish my latest thoughts on the macro events shaping the ETF landscape. To be the first to read my insights, hit the follow button below.

Trusted by hundreds of thousands of Australian investors, BetaShares offers cost-effective, simple and liquid access to the broadest range of ETF investment solutions available on the ASX, covering almost every asset class and investment strategy.

2 topics

5 stocks mentioned