5 things you need to know about AI and what it means for investments

AI has been one of the biggest winners of 2023. It’s been behind the resurgence of tech stocks and both celebrated or maligned depending on who you talk to. Most of the big consulting firms, from Deloitte to PwC, have released reports discussing the implications - and we are currently watching the EU negotiate a new AI law. There’s a lot to take in so in brief, here are the 5 things you need to know.

1. Artificial intelligence is more than just ChatGPT

At a base level, AI is a series of algorithms and rules that are designed to be responsive and ‘learn’ as time goes on. Deloitte describes new generations of AI as “techniques that involve creating or generating new data – such as images, text, music or other types of content – based on patterns or examples from existing data”. You’ll hear Large Language Models (LLM) referred to alongside AI. LLMs are machine learning models that understand and generate text in a human-like fashion – aka ChatGPT or Google Bard.

2. AI’s value extends across sectors and industries

When people think about AI, what most typically comes to mind is the ability to generate content and imagery, but there are far more valuable applications of AI that will have extraordinary implications for our lives. One example is the use of AI in simulation. You can read more in this interview with Franklin Templeton’s Francyne Mu.

Another example is the range of applications in healthcare – be it in terms of experimentation designed around AI to speed up the process, or in use for diagnostics and imaging. Further to this, AI adoption can boost productivity and profitability of a business, according to IBM’s six year study which found 11.5% direct revenue gains for companies in optimising (advanced maturity) stages of AI.

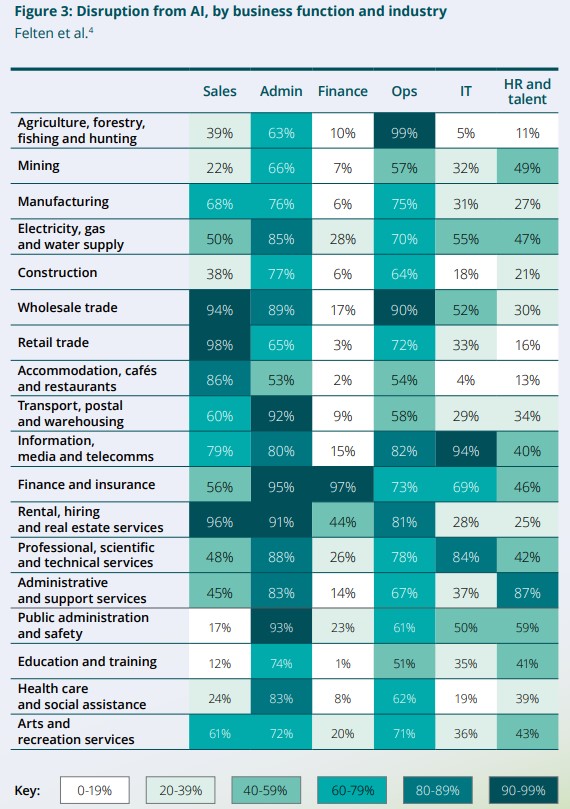

3. 26% of the Australian economy (nearly $600 billion in economic activity) will be disrupted by AI

Deloitte anticipates disruption in finance, ICT and media, professional services, education and wholesale trade. Within this, admin and operation roles face the greatest disruption. Australia is substantially behind its global peers in use of and adoption of AI technology at a corporate and government level. In fact, Deloitte notes that data suggests only 9.5% of larger Australian businesses are using AI.

4. Countries are increasingly regulating AI given the implications for security

AI is not regulated in Australia yet, though there are government bodies exploring the implications. Internationally, the European Union Is due to enact the world’s first comprehensive legislation around AI – the Artificial Intelligence Act to classify AI systems by risk and mandate certain development and use requirements. It covers ethical concerns and implementation challenges.

Two significant inclusions are the ban on AI technology in biometric surveillance and the requirement for generative AI systems to disclose AI-generated content. Some companies in Europe have protested the proposed legislation, arguing that they will hamper innovation.

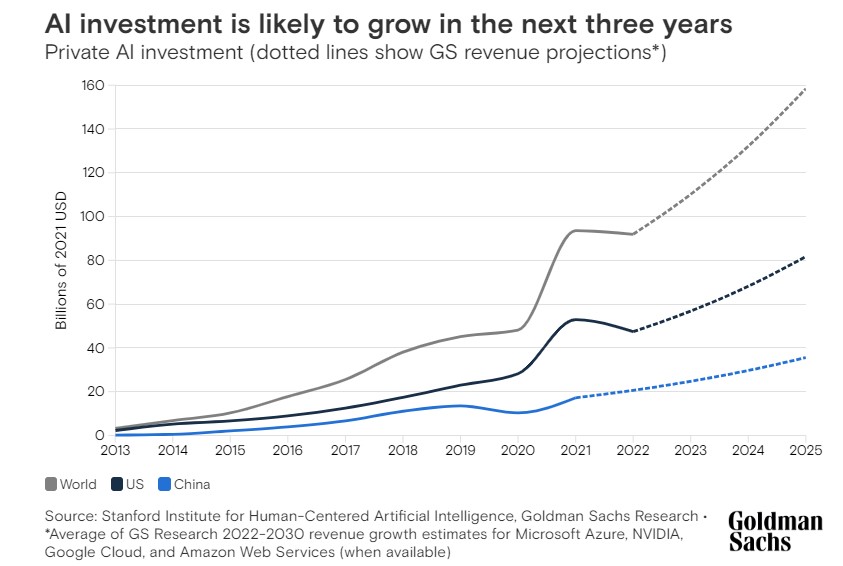

5. AI investment is forecast to approach $200 billion by 2025

Goldman Sachs estimate that AI-related investment could range from 1.5-4% of GDP, depending on country for major AI leaders. Moving beyond that, PwC suggested that AI could contribute up to $15.7 trillion to the global economy in 2030, with China and US set to enjoy the biggest gains from deployment and investment in AI technology.

What this means for investments?

There are a few things to consider from advances in AI technology.

One aspect investors may like to consider is the applications of AI in setting asset allocation and in researching investments efficiently.

At this stage, AI tools like Bard and ChatGPT offer very basic asset allocation and stock suggestions – but it’s fair to assume that improved data sets could transform the value of these. You can read more about how AI stacks up in portfolio construction here. This is also an area that advisory and portfolio construction businesses will need to factor in their business models. Robo-advice already exists and some firms offer a base level fee for use. Improving technology will be a game-changer for these models. It’s worth considering that AI is only as good as the backend data so free models may not have access to the same quality data backing them as those offered by advisory businesses – though investors will need to research before using them.

When it comes to researching investments, AI could also be a useful means of collating relevant data points efficiently to support analysis – from a business or portfolio management perspective, this might mean enhanced algorithms for filtering compared to more manual options.

As part of researching companies going forward, investors may want to consider noting how companies are starting to deploy AI, particularly in those industries set to be most disrupted like finance. Companies that are behind on this front are most likely to suffer in coming years, while those actively engaging with AI technology may be better positioned to be leaders.

The other consideration is where and how to access the extraordinary growth in AI technology and the industries where it is most set to benefit.

There are the companies providing the infrastructure for the AI technology and then there are companies actually incorporating it for productivity and efficiency gains.

Some examples of those providing the infrastructure are companies like Nvidia (NYSE: NVDA) with its imaging technology, Amazon (NASDAQ: AMZN), IBM (NYSE: IBM) and Apple (NASDAQ: AAPL). Then you could consider the full supply chain, with companies like Synopsys (NASDAQ: SNPS) which offers software to chip companies.

Some companies who are investing in leveraging the technology are Recursion (NASDAQ: RXRX) on the healthcare side, Xero (ASX: XRO) and Wisetech (ASX: WTC). You can also read more about NextDC (ASX: NXT) and how CEO Craig Scroggie is betting on AI in this interview with my colleague Ally Selby.

Investors may also want to consider cybersecurity companies too, considering security concerns that AI technology raises. Some examples include Cisco (NASDAQ: CSCO), Accenture (NYSE: ACN), Crowdstrike (NASDAQ: CRWD) and Fortinet (NASDAQ: FTNT).

What topics would you like me to cover next in 5 things to know about? Let me know in the comments.

2 topics

13 stocks mentioned

2 contributors mentioned