5 top-returning funds over 5 years

In recent weeks, we delved into the performance data for some of the newer funds launched in Australia, as part of our Undiscovered Funds series. A track record of returns is one of the things such funds lack.

But that's not an issue for the following funds, having been in the investing business for between seven and 18 years. They've also each established a track record of successful returns during this period, as indicated below.

To compile the following list, I used the following steps on Livewire's "Find Funds" page, first filtering via "Managed Fund" and then "Shares - Australian". I then selected "Performance View" and selected "Performance - 5 years" as the default.

It was interesting to note that three of the following funds are focused on companies in the smaller end of the universe. Each of these - Glenmore Australian Equities, Spheria Australian Microcap and Ausbil MicroCap – returned more than 20% in the last 12 months. The past six months especially has seen smaller company valuations rise as investor sentiment swung and large-caps looked expensive to some investors.

That's a point that two of the portfolio managers from the below funds mentioned. Affluence Funds Management's Daryl Wilson places his fund in the small-caps category, given the skew many listed investment companies have toward companies from the smaller end of the ASX 300.

Katana Asset Management's Romano Sala Tenna also notes the large impact smaller companies can have on overall portfolio performance. “If you get one or two small caps right it can have a massive skew on the outperformance," with some companies graduating into larger indices potentially becoming 10-bagger stocks.

In the following, we look over a longer timeframe at the top performing, long-only, actively managed funds in Livewire's database. We also reveal some of the companies that have driven recent returns, looking back over previous reports and querying portfolio managers on some of the companies that have driven performance over the years.

Note: The following list of funds and companies should be considered general information only. Always seek professional financial advice before making investment decisions.

| Fund name | Fund manager | 5-year performance |

| Glenmore Australian Equities Fund | Glenmore Asset Management | 16.40% |

| Spheria Australian Microcap Fund | Spheria Asset Management | 16.06% |

| Katana Australian Equity Fund | Katana Asset Management | 13.09% |

| Affluence LIC Fund | Affluence Funds Management | 12.22% |

| Ausbil MicroCap Fund | Ausbil Investment Management | 12.07% |

Glenmore Australian Equities

- Five-year return: 16.4%

- Inception: June 2017

The Glenmore Australian Equities fund seeks to invest in quality companies with strong cash flows and reasonable valuations. With a focus on companies in the small- and mid-cap range, many of these opportunities are found in companies within the sub-$500 million range.

Some of the attributes the fund favours include founder-led companies, with strong EPS growth over time. Company holdings also have a history of successful allocation of capital and the ability to deliver strong organic revenue growth, as portfolio manager Robert Gregory recently explained.

He singled out Alliance Aviation Services (ASX: AQZ) as one of his most successful investments since launching the fund.

Some other companies that have been strong contributors to the fund’s performance over the years include:

- Whitehaven Coal (ASX: WHC)

- Cog Financial Services (ASX: COG)

- Arena REIT (ASX: ARF)

- Mineral Resources (ASX: MIN).

Spheria Australian Microcap Fund

- 5-year return: 16.06%

- Inception: May 2016

This fund focuses on Australian and New Zealand-listed companies with a market capitalisation of less than $500 million.

It generally holds between 20 and 65 companies, targeting medium- to long-term outperformance versus its benchmark, the S&P/ASX Small Ordinaries Accumulation Index.

The biggest contributors to Spheria Australian Microcap’s performance as of the end of April were:

Jupiter Mines (ASX: JMS)

Supply Network (ASX: SNL)

Praemium (ASX: PPS)

Some other names that have been strong contributors in the last five years include:

Katana Australian Equity Fund

- 5-year return: 13.09%

- Fund launch: January 2006

Focused on Australian stocks, Katana Asset Management's investment approach is not limited by index weightings, sector restrictions, investment themes or company size.

Co-founder and portfolio manager Romano Sala Tenna notes the difficulty of maintaining a style neutral approach. A value investor himself, Katana's co-portfolio manager Brad Shallard specialises in large-cap growth, while Giuliano Sala Tenna focuses on macro top-down research and growth, especially in the financial services and technology sectors.

“Then throw in technical analysis, and there’s probably about five investment styles,” Sala Tenna says.

While the fund’s core focus is on large-cap names, Sala Tenna emphasises they’re not afraid to step outside the ASX 300 for the right opportunity.

“For small caps, we need to see 50-70% minimum upside to contemplate putting on a position,” he says.

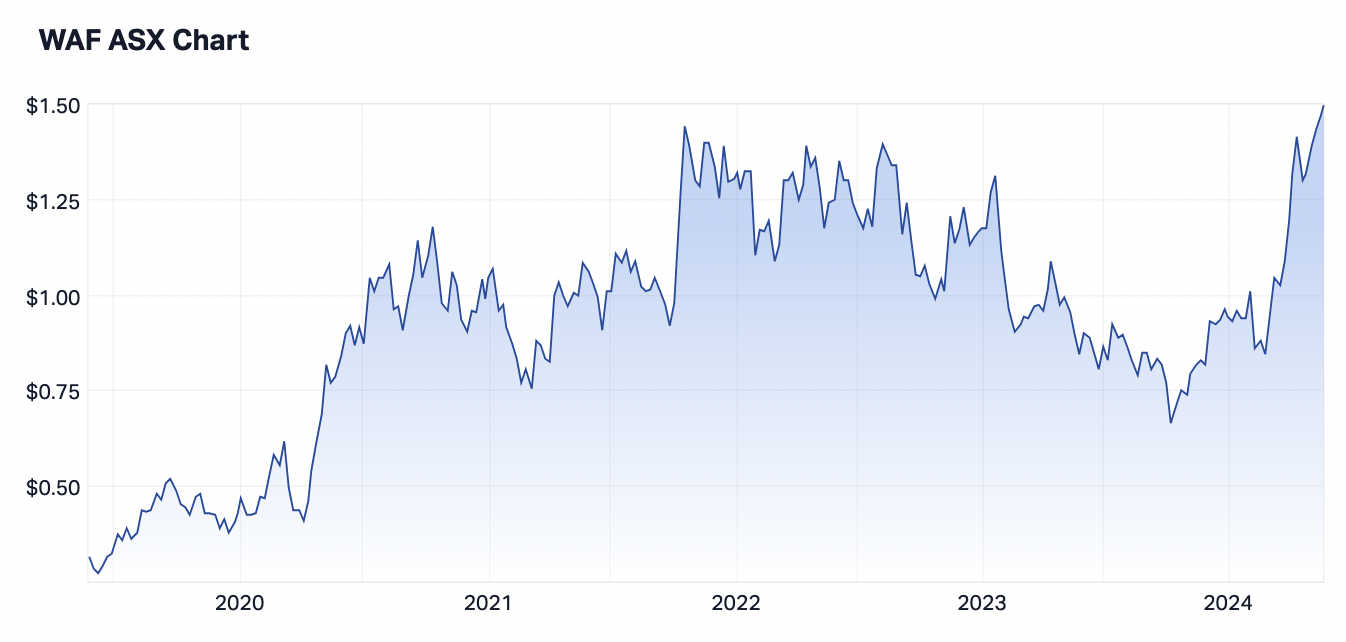

Some of the recent top contributors to the Katana Australian Equity Fund's performance were outlined in its April investor update:

Whitehaven Coal (ASX: WHC)

South 32 (ASX: S32)

West African Resources (ASX: WAF)

The resources sector is a common theme among the companies that have helped drive Katana’s performance over the years. Casting back over fund updates in the past five years, Mineral Resources (ASX: MIN) is one that has featured repeatedly.

In terms of positioning, MIN is the fund’s single largest allocation currently and has been in there for most of the last 18 years. While individual positions rarely go above 5%, Sala Tenna says its MIN holding has hit 7% previously – with only two other names, Commonwealth Bank and CSL having nudged past 5%.

Some other names that have been large contributors to performance include:

Affluence LIC Fund

- 5-year return: 12.22%

- Fund launch: May 2016

This fund provides exposure to a diverse mix of Australian companies via its portfolio of between 20 and 35 listed investment companies. It aims to beat the ASX 200 Accumulation index over rolling three-year periods, while minimising the volatility. It also targets an annual income yield of at least 5% per annum, paid quarterly.

The LICs in the portfolio, which is managed by Affluence CIO and founder Daryl Wilson, are grouped across the following categories:

- Alpha Generators – LICs deemed capable of beating the market

- Discount Capture – LICs trading at attractive discounts to net tangible assets (NTA)

- Event Driven – special situation vehicles such as IPOs.

The biggest contributors to performance as at the end of March were:

VGI Partners (ASX: VG1)

Thorney Opportunities (ASX: TOP)

Australian Unit Office Trust (ASX: AOF)

As portfolio manager and co-founder Daryl Wilson reveals, the largest contributors to the fund’s performance in the past five years are:

- CD Private Equity Fund 1, 2 and 3 (ASX: CD1), (ASX: CD2) and (ASX: CD3) – LICs invested solely in US-based unlisted assets

- L1 Long Short Fund (ASX: LSF)

- WAM Alternatives (ASX: WMA), previously Blue Sky Alternatives.

- NGE Capital (ASX: NGE)

- Regal Investment Fund (ASX: RF1).

Ausbil MicroCap Fund

- 5-year return: 12.07%

- Fund launch: February 2010

Investing primarily in small-cap and micro-cap companies (those from outside the S&P/ASX 200), the Ausbil fund’s investment approach spans both growth and value.

The investment team, led by portfolio managers Arden Jennings and Andrew Peros, aims to outperform the S&P/ASX Emerging Companies index. Investors should be aware that new investments in the Ausbil MicroCap fund are open only to existing unitholders.

The portfolio emphasises founder-led companies, the Ausbil MicroCap team pointing to data showing such firms tend to outperform over time. More than 50% of the portfolio is currently invested in founder-led companies.

"Founders tend to have a long-term mindset when making decisions, they are aligned to all investors with significant ‘skin in the game’ and tend to drive a high performing culture, with an ‘owner’s mindset’ across the organisation," say Jennings and Peros.

Some of the recent top contributors to the fund’s performance were outlined in Ausbil’s April investor update:

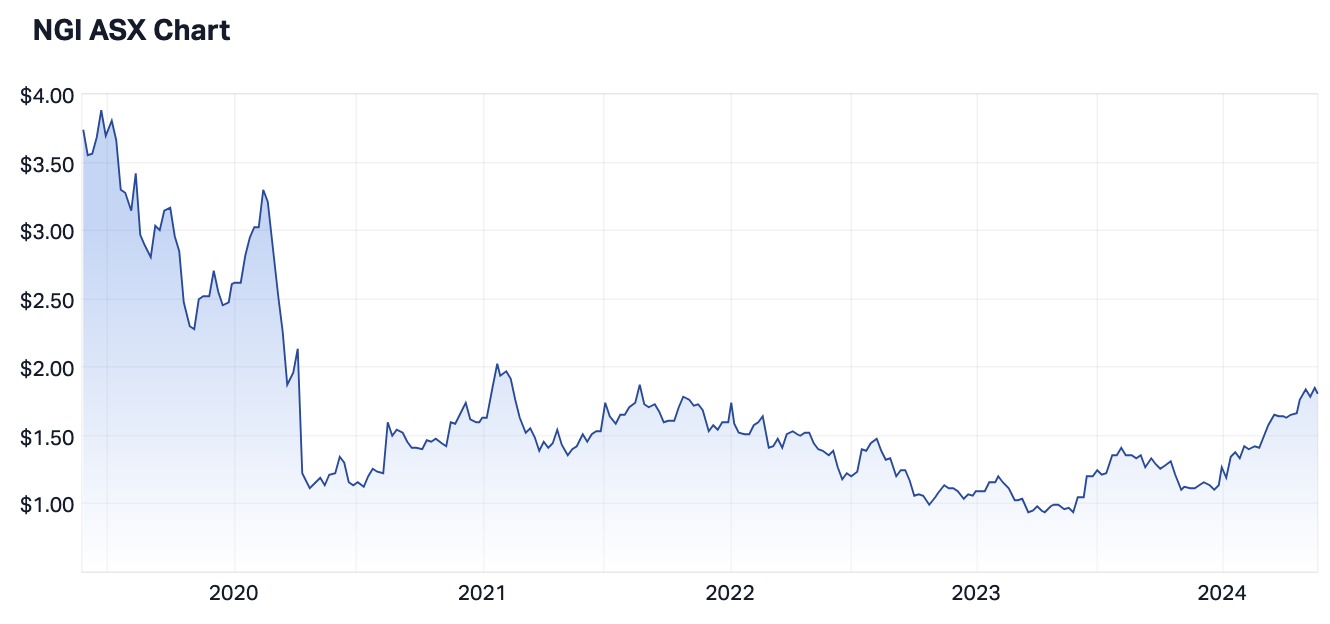

Navigator Global Investments (ASX: NGI)

NGI owns minority stakes in a portfolio of diversified hedge fund businesses globally. "We believe NGI is trading at a discount to the cost of replicating a similar portfolio of underlying managers, and with the balance sheet fixed, we are excited about the prospects for the company," say Ausbil portfolio managers Jennings and Peros.

Life360 (ASX: 360)

Held in the fund since 2021, 360 is a leading and fast-growing family safety platform for 66 million users globally. "We believe 360 is still in the early stages of monetising its global user base as it develops its premium membership solution and undertakes a global rollout," say Jennings and Peros.

"If 360 could be a quarter as successful as Uber on a per user basis, we see a pathway to potentially doubling consensus free cash flow estimates in 2026."

Some other stocks they call out as big contributors to the fund's performance in the past five years include:

- Uniti Group – A successful challenger to the NBN, Uniti Group was acquired in 2022 by Morrison and Brookfield Asset Management, at a significant premium of $5 per share versus Ausbil’s initial entry price of $1.20 in August 2019.

- Johns Lyng Group (ASX: JLG) – Another founder-led business, this insurance, building and restoration services company was a position established in May 2019, and has since graduated out of the micro-cap fund.

- Lovisa (ASX: LOV) – A "fast fashion" jewellery retailer that is creating a global brand through its global store rollout, Lovisa has also expanded outside of the micro-cap universe so is no longe held in the fund. Though like Johns Lyng, it is held in the Ausbil Australian SmallCap Fund.

What do you think?

If you own any of the above companies or have held them in the past, please let us know your thoughts in the comments below.

2 topics

30 stocks mentioned

6 funds mentioned

5 contributors mentioned