6 Common-sense rules for shorting the market

Vega Capital

In my last Livewire post, I commented that The Vega Fund would be looking closely at economic data over the coming months to determine whether it should remain long (and weather out what I believe is a temporary correction) or whether going short would be a viable option.

Let’s say we come to the view that a recession is coming, decide to liquidate our long positions and go short. This is a more complicated proposition than remaining long and the risks can actually be higher.

At Vega Capital, I’ve developed a series of risk management tools for shorting the market with put options and today I want to share them.

i) Only short when you have real conviction.

Firstly it should be noted that The Vega Fund will rarely short the market, being long pays off over the long term and generally has lower risks. The only time when The Fund will short is when its algorithms can foresee future impairments to economic growth via the debt cycle.

Yet when it does go short, it will do so with a large position. To short with a large position requires a lot of conviction and thus evidence based on real data.

This brings us to our first rule, only short when you have real conviction. Hearing predictions of recession from the media happens about once a quarter, and since recessions occur about once every 5 to 12 years, it’s going to cost us too much to short every time we see panic.

Hence we should only short the market when real impairments to the debt cycle are present which can’t be reversed with say a whiff of good news.

ii) Position sizes should be set in relation to price action.

Put those Japanese candlesticks away because that’s not what I mean here!

As the market falls, it’s a less appealing target to go short on because it's cheaper relative to its future dividends and thus more attractive for others to buy.

As such, the amount of your portfolio you short the market with when it’s fallen 10 per cent should be a lot more than the amount you short when it’s fallen 30 per cent or 50 per cent.

iii) Be careful when increasing your bet size if the position moves against you.

When investing in stocks, you may find one whose prospects you believe are good and notice it trading at a fair price. As such you buy it and when its price falls you naturally buy more.

When buying put options to short the market, if the put option falls in price but the prospects for the market are still poor, it technically is a better deal. Yet in the stock investment case you have time – you could even wait a few years for those prospects to play out. But when buying options, we can’t be as patient since our view needs to play out by the maturity date or our investment will be worth zero – even if we later end up being right.

Thus you could invest more as the put option price falls but you might be investing in it all the way to zero.

So here options are different to stocks. Thus you may wish to set a limit as to the amount of money you’re willing to invest in shorting the market and leave it fixed.

iv) Take profits along the way to control downside exposure.

This is a similar principle to that of Rule 2. As the markets price falls, it’s a less attractive prospect for shorting and your existing position size should take this into account.

As such, I’ve noticed that progressively taking profits when shorting generally improves backtest results, regardless of what strategy is used to do this.

v) Bet cheaply against yourself.

As the market capitulates, bullish bets (for example, long call options) will often become very cheap and can hence become quite valuable if the market were to begin to recover (however unlikely this might seem at the time).

If using the VIX to bet against yourself when short the market, it goes without saying that you’ll be shorting the VIX futures. You should increase your short positions as the VIX rises and reduce as it falls. Be careful here though, as it’s likely that brokers/exchanges will increase margin requirements for VIX futures during times of market stress.

vi) Have a plan for when you’ll exit your short trade.

Recessions/market capitulations are temporary events and eventually, the market will recover. Remaining short the market via long puts through a market recovery is typically a wealth eroding experience since both price and implied volatility will go against you.

As such, it's best to have a plan for what financial/macroeconomic variables would need to improve for your view on the economy or market to change, such that you’re happy to liquidate your short positions and position for the market recovery.

I’d encourage investors to read Ray Dalio’s latest book ‘Principles for Navigating Big Debt Crises’ (which he has published as a free download) as a guide on what variables may be worthwhile to consider.

To sum it up

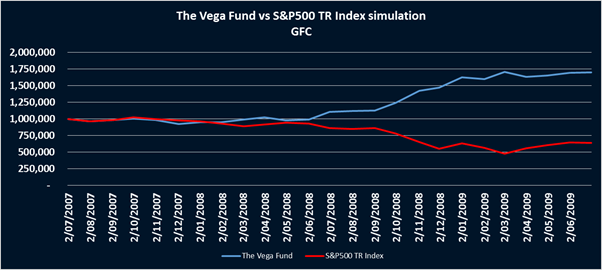

Using these principles in conjunction with rigorous algorithmic macroeconomic analysis can result in some particularly strong performance when markets go through a recession. The below chart demonstrates a backtest of The Vega Fund’s strategy over the GFC using a $1m hypothetical portfolio.

Note that the algorithm had no prior warning of the crisis – it could only work with the data which was publically available at each time increment.

From myself at Vega Capital, I wish you a very safe and happy Christmas!

7 topics

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.

Expertise

Scott has seven years of experience in investment and risk management, was previously an analyst at Montgomery Investment Management, and holds a degree Economics from the UWA as well as a Master’s degree in Financial Mathematics from UNSW.