6 opportunities for Australian income investors

Note: This episode was taped on Wednesday 5 June 2024. You can watch the video, listen to the podcast, or read our edited summary below.

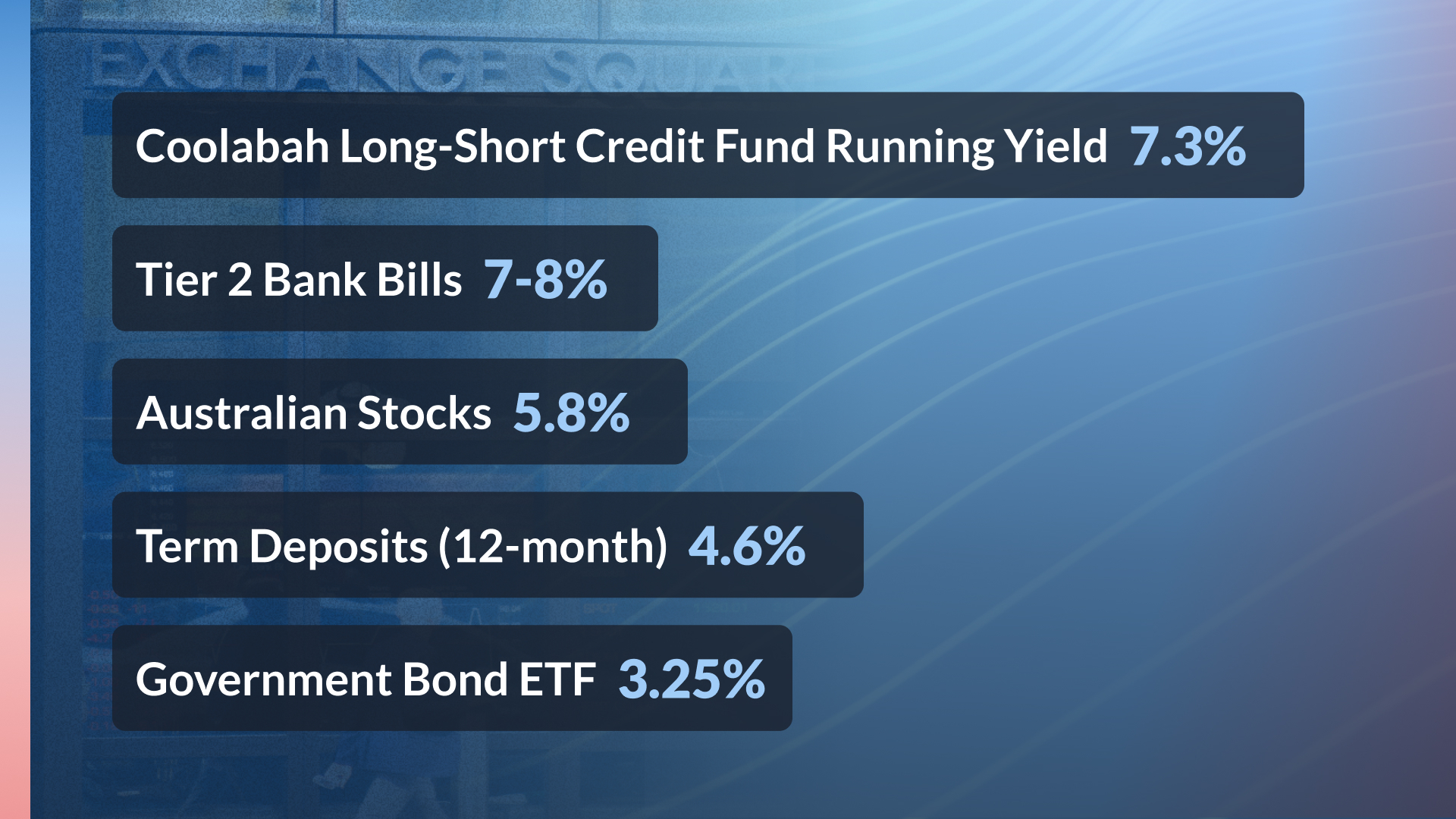

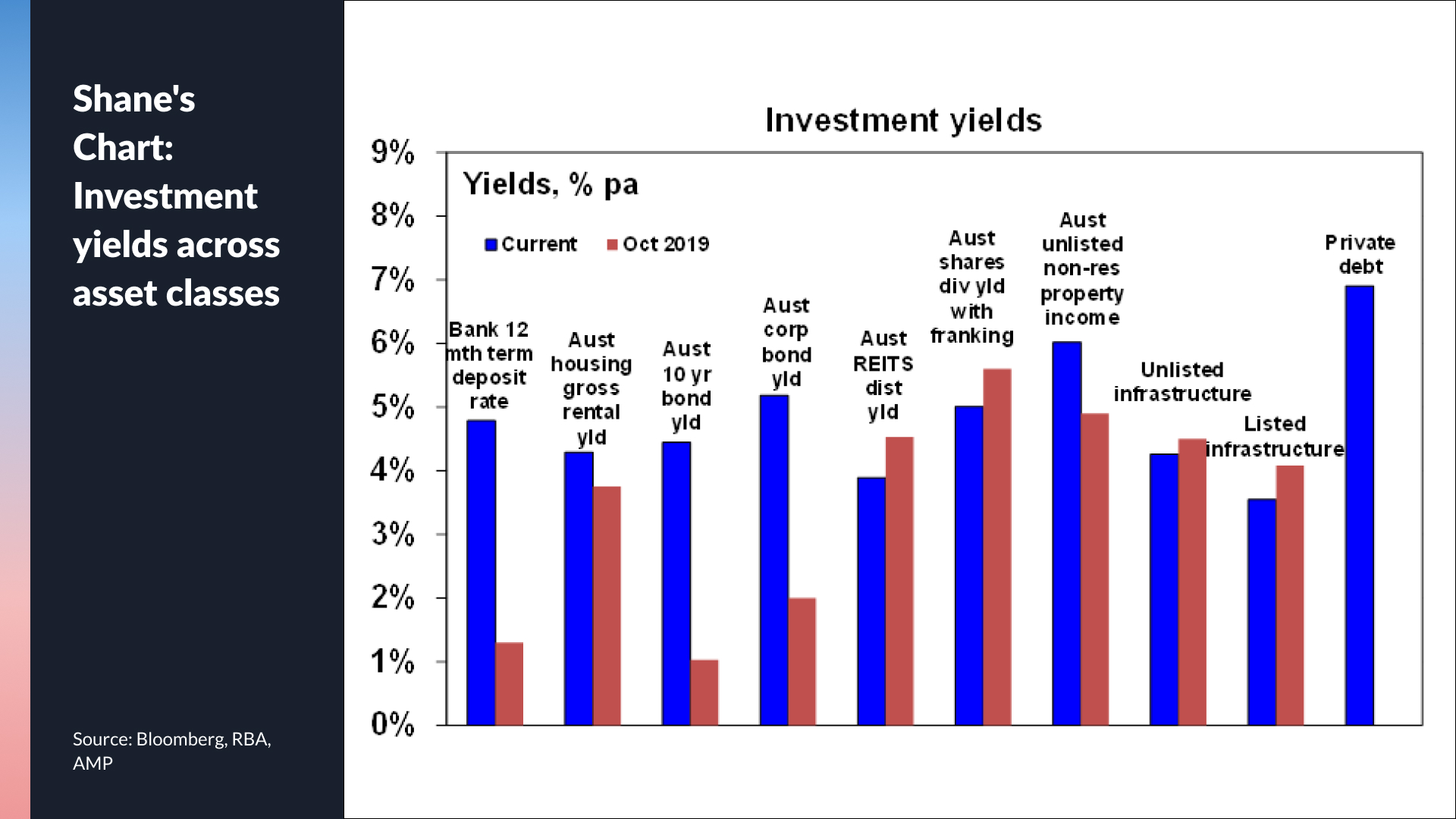

Welcome to the Goldilocks era for income, where a good quality term deposit can pay 5%, an investment grade corporate bond can net you 7-8%, and the hottest trade in town (private credit) is now aiming for upwards of 10% yield. Sure, NVIDIA might be the hottest growth trade in town but there are plenty more opportunities for income investors across asset classes. No longer are rates in the basement and stocks the only place to earn solid yield - as the following flow chart shows.

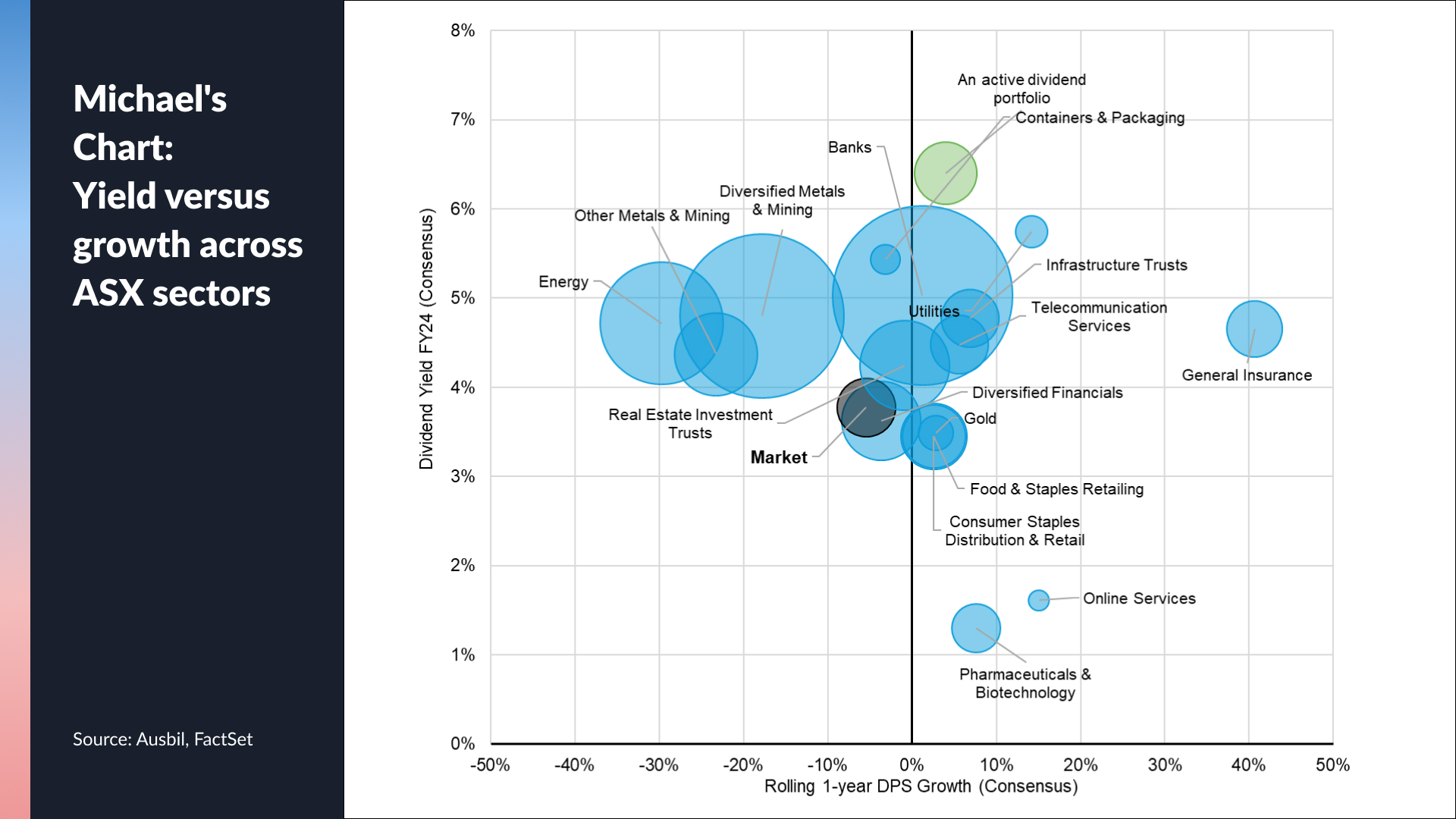

In fact, speaking of stocks, the ASX 200's benchmark dividend yield is now just 3.9% which is a long way from its long-run average of 4.6%. The fall in dividend yields can be attributed to two things - one, prices are expanding and outpacing dividend payouts (which also shows up in the ASX 200's P/E ratio) and two, the biggest dividend payers (the Big Banks and Big Miners) are experiencing an aggregate fall in profits, leading to smaller dividend payouts as well.

But is the fall in aggregate dividend yield a negative signal to get out of stocks? Not according to this month's Signal or Noise panel.

In fact, our panel argue that this is an opportunity for an intelligent investor to find some out-of-consensus income ideas. In addition, now may present an opportune time to move into different kinds of income-paying assets as the cycle changes and the narrative moves from prolonged high rates towards rate cuts.

Joining us for an in-depth conversation about the intersection of macro and income investing are three of Australia's most experienced investors:

- Michael Price, Portfolio Manager for the Ausbil Active Dividend Income - Wholesale Fund

- Amy Xie Patrick, Head of Income Strategies at Pendal

- Shane Oliver, Head of Investment Strategy and Chief Economist at AMP

EDITED SUMMARY

Topic 1: ASX 200 Dividend Yield now below its long-running average

Michael: SIGNAL - Michael believes it's a signal for optimism rather than concern. The declining dividend yield is a function of increasing stock prices. The low yield, in his view, is more indicative of a market believing that dividends will grow again.

Michael's Chart: Yield versus growth across ASX sectors

Shane: SIGNAL - Some of the resource stocks have seen their dividends fall after a period of extraordinary profits. Shane is also concerned the low dividend yield might provide a valuation signal and is vulnerable to a correction. The real key, in Shane's view, is to see whether we can still get a soft landing in Australia.

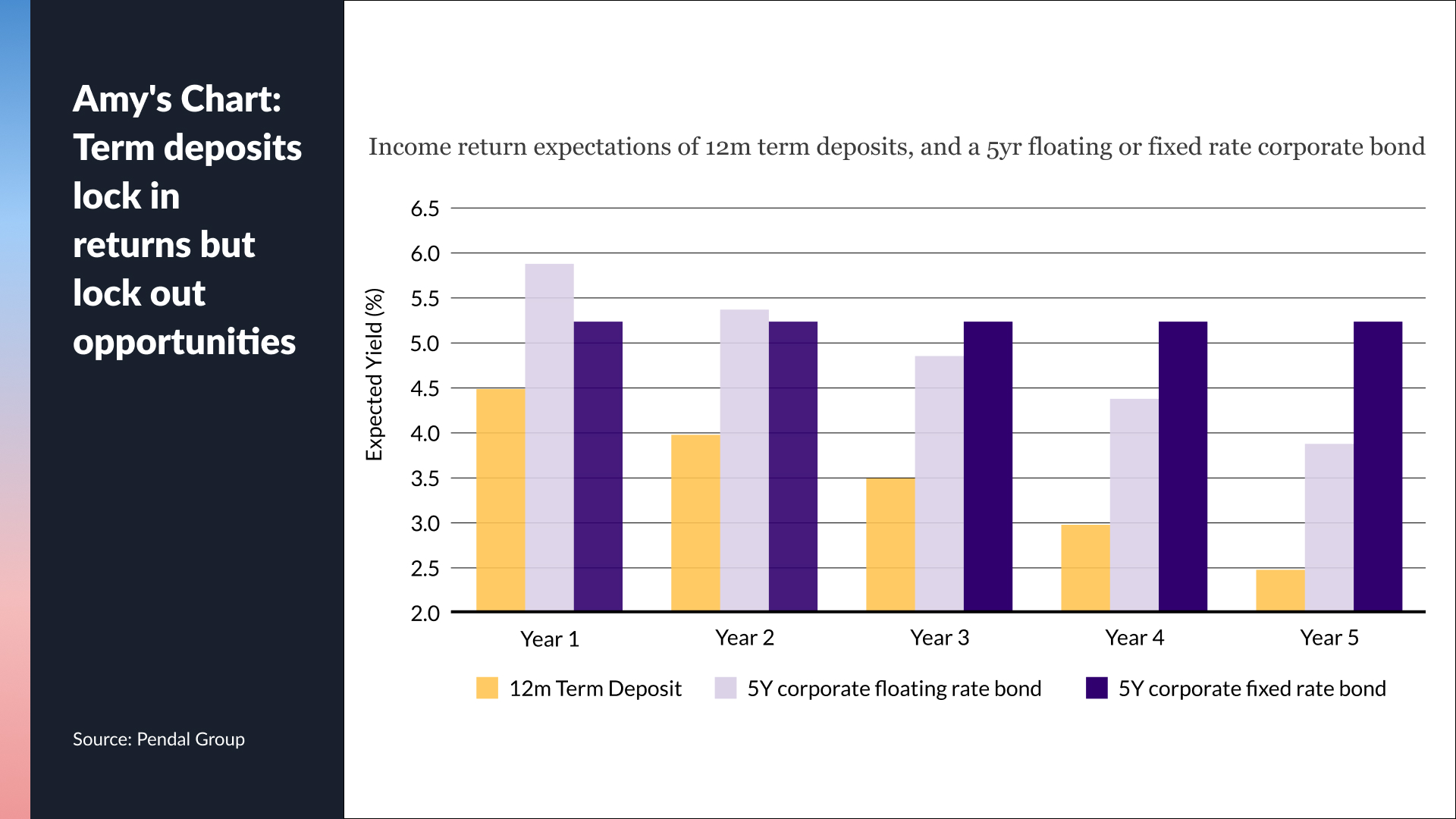

Amy: SIGNAL - The signal for Amy is not necessarily that the yield is below the long-term average but rather, the trend is declining. She also points out that the risk-reward between stocks and bonds has slimmed dramatically in the last three years - and she believes that means there is now lower-hanging fruit to garner elsewhere for income.

Topic 2: Australian fixed income indicators suggest boom not bust to come

Amy: NOISE - In her own words, "There is just so much noise here". In her view, the 2s/10s curve is given too much attention as a recession indicator especially when the actual lag between the inversion and the actual recession's start is so variable. She also says that rising corporate bond yields are just a function of how much risk-free yields (the cash rate) have risen. She also argues that credit spreads are too tight and she thinks they are vulnerable to any black swans/unexpected shocks.

Amy's Chart: Term deposits lock in returns but lock out opportunities

Michael: NOISE - The one thing we know about term deposits is that any return you have made after you can withdraw your money is that it is eaten away by inflation.

Shane: NOISE - The 2s/10s curve has been useful in the US but only at times - the lag is still playing out in Australia. In fact, the 2s/10s curve indicator is actually borderline useless for the Australian context. The tightness of spreads may signal how relaxed markets are but it would be wise not to push that argument too far.

Topic 3: Marrying the macro to the fundamentals

Shane finds his biggest macro signal in the retail sales/household spending data given that 60% of the Australian economy is driven by consumer spending. If this figure continues to remain weak even after tax cuts, then it may serve as a big cue for the RBA to cut rates. Shane's biggest macro noise comes from inflation given it is such a backward-looking indicator.

Amy finds her biggest macro signal in a lesser-known collection of signals around central bank speak (what she called "peak hawkishness" data). Peak hawkishness signals peak yields and therefore a shift in the investing paradigm. Her favourite point of macro noise is the US jobs report (non-farm payrolls) and it stems from the overemphasis on wage inflation and the amount of revisions that particular data point receives.

Amy's three favourite trades:

- Extend bond duration

- Investment grade credit (fixed-rate corporate bonds)

- Focus on finding defensive high quality income (A to AA-rated bonds)

Michael offered the same data points as Shane - but in the inverse direction. He argues inflation is still the key signal for investors while GDP forward-looking indicators (like retail sales) are the macro noise investors should avoid.

Michael's three favourite trades:

- Helia Group (ASX: HLI) - for a pure income play

- Worley (ASX: WOR) - for a part-income, part-growth play

- Insurance, and particularly Suncorp (ASX: SUN)

Shane's Chart: Investment yields across a range of asset classes

Signal or Noise is now entering its mid-year break. The show will return in early August with the August Reporting Season preview.

3 stocks mentioned

1 fund mentioned

3 contributors mentioned