6 questions with small cap specialist Marcus Burns

Just a day before another crucial RBA meeting, during which the central bank is widely expected to again stand pat on rates, Spheria Asset Management's Marcus Burns recently discussed his view on the cash rate. But more importantly, he also shared how this view is reflected in Spheria's investment portfolios of small- and micro-cap companies.

Companies in the smaller end of the market have been discussed more widely in recent weeks than they have for some time, given the increasingly positive – or at least, far less negative – views on the global macroeconomic outlook.

Burns believes we’re entering a period that will favour micro-caps. He expects the global versus domestic parts of this space will perform in the short and longer term.

In this interview, Burns delves into the details of his portfolio, including how his team identifies successful firms from a global universe of more than 12,000 stocks.

And on the domestic front, he discusses a handful of companies he’s most excited about, including one he suggests has delivered a “record period of organic growth”.

He also names what he regards as the biggest potential risk for markets from here (but don’t worry too much, it’s a low-probability event).

Finally, he reveals the four living legends of the investment world he would invite for dinner (including a bonus fifth guest who passed on almost 75 years ago).

.jpg)

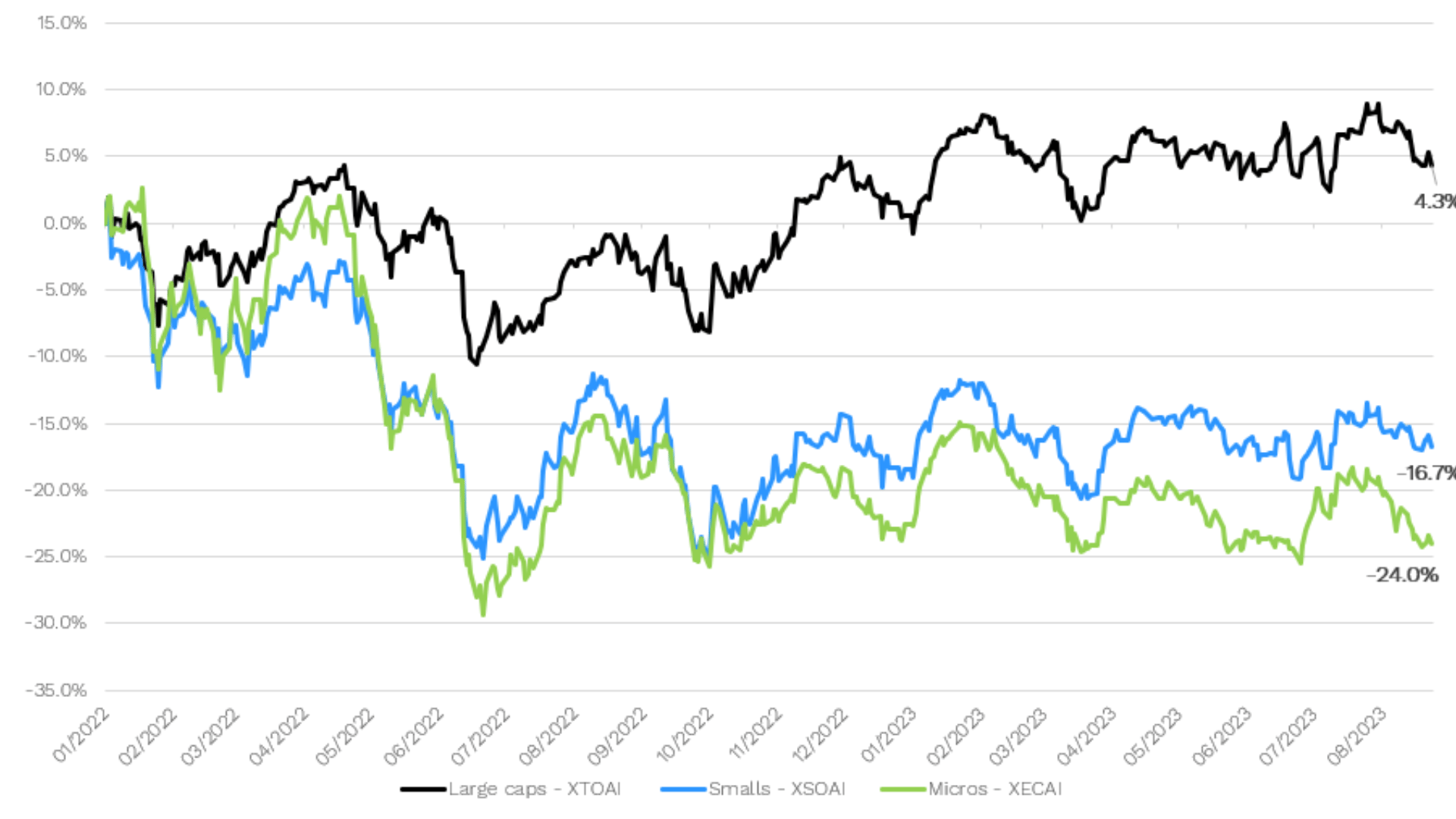

Large versus smalls versus microcap - Returns since January 2022

.png)

How do you weigh the importance of price versus company quality before buying a company?

For some of them, yes, price is crucial. For others, less so.

For example, Vista Group (ASX: VGL), a New Zealand-based global ERP software firm for cinema chains, is a world leader but it went through a torrid time with COVID, with all its customers on the verge of insolvency for two years, making no revenue because we couldn't go out see films. We think Vista is a really high-quality business.

And we’ve owned plant equipment maintenance firm Mader (ASX: MAD) since it IPO’d at a dollar around four years ago – it’s now trading at almost $8 [as of Monday 4 September] so it’s been a phenomenal contributor to the funds.

Indeed, it has grown organically at more than 30% for a decade, which must be pretty close to a record for organic growth.

There’s an opportunistic benefit in buying Mader and Vista at these prices, but for us, there’s a more long-term buy-and-hold strategy behind those two.

Obviously, the price investors pay matters but when there's dramatic intrinsic value growth over time, it matters less than the company's share price growth. We’re very happy to hold this company.

On the other hand, Pointsbet (ASX: PBH) and Redbubble (ASX: RBL) are turnaround stories.

Pointsbet was selling off its foreign assets to an American investor for a large sum of money, though the rest of the business was very cheap, and we saw an opportunity to buy the stock at a good valuation.

And at Redbubble, we think there's a sound business there that's been really under-priced because it's been investing so heavily for growth, which has seen margins hit very hard. It probably will grow but not at the speed some people are expecting. And so, the founder has come back and is right-sizing it, trying to generate some cash flow. It's very cheap for the kind of position it has and would be a good bolt-on for someone like eBay or Etsy.

In microcaps, you’ve got to be a bit flexible because there are not thousands of companies that meet our process, that have tonnes of cash flow and great balance sheets. And we already own a lot of those that do.

And then there are the opportunities that dip down, such as Redbubble, which was a small cap that became a micro-cap because it had a really torrid period of performance. We thought that was a good turnaround story, and indeed, that's panning out.

Pointsbet is a company that, historically, we didn't want to own. It was a cash-burning growth junkie that got caught up in the whole tech hype a couple of years ago. It got hit really hard and then announced the sale of its assets overseas for a really massive price. So, we saw an opportunity to arbitrage that valuation out.

So yes, we have to be alert to changes in the opportunity set, especially in microcaps. We will do that occasionally with the fund, as long as the balance sheets stack up and we think there's good valuation upside.

What is the most exciting/innovative business you hold in the portfolio and why?

Supply Network Limited (ASX: SNL), which is something like Bapcor (ASX: BAP) but for truck and bus parts, distributing these to aftermarket mechanics.

The company has been taking market share for around 10 years and is a well-run business that is delivering all-organic growth. It also has no gearing. And because it executes so well, we think there’s potential for it to take market share in Australia.

Supply Network Limited

- Market cap: $649.1 million

- 12-month return: 46.12%

- On 28 July, SNL guided toward preliminary revenue of $252.3 million and profit after tax of $27.4 million.

You have funds focused on local and global small and micro-cap stocks. Where are the most compelling opportunities?

In the short term, I’d say it’s domestic microcaps because it’s been the most oversold sector in the market. We think there has been a much bigger dislocation [here versus in global microcaps].

As people have been favouring large-cap, defensive stocks – those delivering returns more akin to fixed income – as interest rates have risen, that liquidity has dried up in Aussie microcaps.

But in the long-term, I’d have no hesitation in naming the Global Opportunities Fund because the universe is so enormous, with around 12,000 stocks – you get a really large breadth of companies that have come out of the gate performing well, with a landscape to grow into. And the inefficiencies are even bigger, on a global basis.

What’s your view on interest rates and does this view affect your investment style?

I think we’ve got another rate hike here in Australia, maybe two – then I think the RBA will probably be done. And that’s because of that differential between us and the US, which is just too great currently. [The US Federal Funds rate is currently in the 5.25% and 5.50% range.]

There’s also the point that inflation is, arguably, coming down. Freight rates from China are down 80%, commodity prices have come off the boil, and you’ve got ex-factory prices for firms like Nick Scali (ASX: NCK) and Breville (ASX: BRG), with the prices they’re paying for goods out of China falling. So, I think there are very good signs that inflation is unwinding.

If goods inflation is coming down, I think wage inflation pressure will come off as well. It’s all interlinked.

It sounds like something I’d obviously say, given I’m a small- and micro-caps fund manager, but I think this environment is positive for smalls and micros. We tend to do well through two-thirds or three-quarters of the market cycle, but when rates get cut really aggressively – as we saw a couple of years ago – that’s when we struggle the most.

And in terms of our investment style, we don’t change how we invest – whether rates are going up or down. We pick a style and maintain it through the cycle.

The more “fundamental” the market, the better we perform on a relative basis. And when it’s more speculative and less rational, we tend to do less well. But if rates are peaking and flattening, we should do okay, because fundamentals come back to the fore.

I think we’re in a market environment that should play well into our style of owning companies based on valuation, free cash flow, and balance sheets.

And if we get back to a period of aggressive rate cutting and to negative real rates again, we might struggle, frankly. No one’s good at every point in the cycle and anyone who thinks they are will likely to lose money.

But I’d also emphasise that in macro forecasting, we don’t have a competitive advantage, though we do hold views on the environment. It’s very easy to get caught up in trying to do macro forecasts, but even if we’re spot on, I might completely mess up my [analysis of] investment fundamentals.

It’s much more important for us to work out what Supply Network (ASX: SNL) or Redbubble (ASX: RBL) is doing through the cycle than for us to forecast the interest rate or inflation rate in six- or 12-months time.

Outside of recession, what is the biggest risk to markets now – particularly something that people are underestimating?

The biggest risks to markets are usually completely unforeseen, and the biggest risk to markets over most timeframes are those aggressive, liquidity-draining events.

For example, a situation where rates have to rise massively to attract capital. And I’m making this up completely, but let’s say the US or China had a bond crisis - an aggressive negative delta and liquidity event.

If you could have a dinner party with four famous investors, who would they be and why?

- Peter Lynch – because I read his books early in my career, he’s an interesting guy and a quality growth investor.

- Ben Graham – Because he’s a grumpy old-fashioned value, no-nonsense investor.

- Phil Fisher – He’s the author of Common Stocks and Uncommon Profits (which Buffett read as well) and I loved it.

- John Meynard Keynes – Because he’s the father of economics.

The ghost of Joseph Schumpeter [An Austrian political economist, born in 1883 and died in 1950)]. Because he was an absolute character. He had three goals in life: To be the greatest economist in the world, to be the best horseman in all of Austria, and to be the greatest lover in all of Vienna. He claimed to have fulfilled two out of those three but didn't say which of them he didn't fulfil. Having him along would certainly liven up the conversation.

Follow updates on Livewire Live

Tickets to Livewire Live have sold out. Readers can stay up to date with exclusive interviews and event coverage on the Livewire Live series page.

2 topics

8 stocks mentioned

2 funds mentioned

1 contributor mentioned