6 reasons why the RBA's next move is likely down later this year

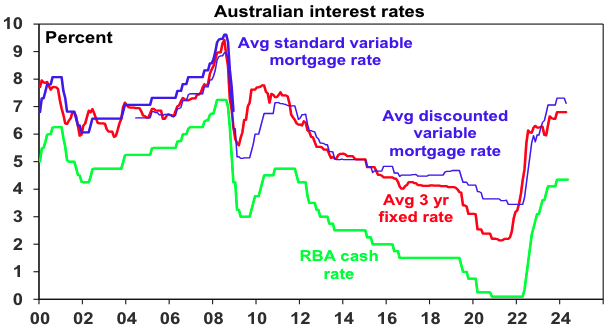

It’s now two years since the RBA first started to raise interest rates, resulting in the biggest tightening cycle since the late 1980s. Rates have gone much higher and stayed high for much longer than I thought would be the case as Australian households proved more resilient than expected thanks to a combination of a boost to demand from reopening after COVID, saving buffers, a greater proportion of borrowers on fixed rates and the strongest population growth rate since the early 1950s. So where to now?

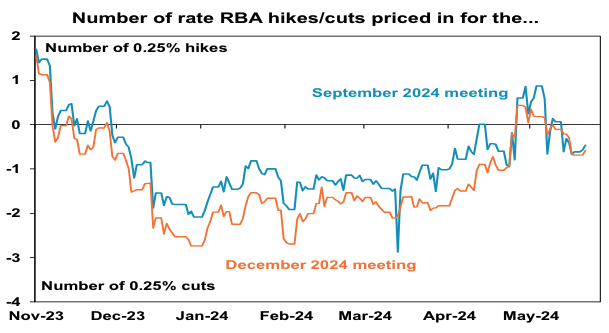

The rollercoaster ride in interest rate expectations This year has seen a bit of a rollercoaster ride in interest rates expectations – which may be what you would expect at a turning point in the cycle. Early in the year, the money markets had priced in nearly three RBA 0.25% cash rate cuts for this year, with around seven Fed rate cuts. After the March quarter inflation scares in Australia and the US, the money market in the US had scaled back to just 1.5 cuts and the local money market started to price in rate hikes.

The last two weeks have seen money markets become dovish again with two cuts priced in by year end for the US and one partly priced in for Australia. The renewed dovishness reflects better April inflation in the US, a less hawkish than feared Fed, a less hawkish than feared RBA, the Budget being seen as neutral, and softer data for local wages and jobs.

The minutes from the last RBA meeting confirmed it considered another hike and didn’t consider a cut and it warned that “the risks around inflation had risen”. This suggests the RBA retains a tightening bias. However, its guidance that it’s difficult “to rule in or out future changes in the cash rate” along with its unchanged forecasts for inflation to fall into the target range next year suggest the tightening bias is mild.

The case for another rate hike

The main arguments for further rate hikes are that:

- services inflation and trimmed mean inflation (a measure of underlying inflation) remained sticky at 4.3% yoy & 4% yoy in the March quarter;

- wages growth could have another leg up, keeping services inflation high as the labour market remains tight with risks flowing from strong increasesin wages for aged care and childcare workers & if the coming Fair Work Commission (FWC) decision for awards comes in high;

- the Budget provided additional stimulus to the economy on top of the Stage 3 tax cuts from July; and finally

- the RBA cash rate is below that in comparable countries- with the ECB at 4.5%, Canada 5%, UK at 5.25%, US at 5.25-5.5% and NZ at 5.5%.

The case for rate cuts later this year

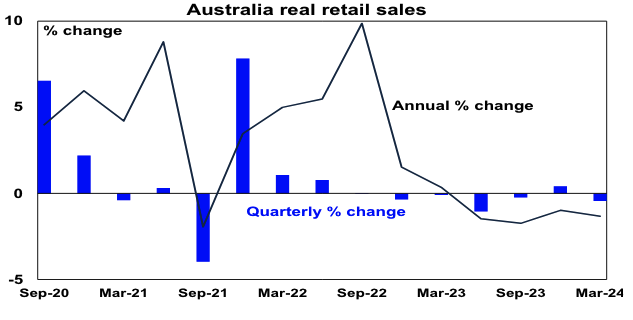

However, while the risks at the next few RBA meetings are still on the upside for rates, the RBA’s hurdle for another hike looks to be high requiring future data to threaten its forecasts for inflation to return to target in 2025 and 2026. We see the most likely outcome as being the RBA holding at current levels, ahead of rate cuts later this year. First, the economy has slowed to a crawl and likely remains in a per capita recession. Real retail sales fell again in the March quarter & are down 5 of the last 6 quarters with per capita retail sales down 7 consecutive quarters.

Consistent with this household spending data suggests real consumer spending is flat to negative on a year ago. While the stage 3 tax cuts are worth $1929 a year for those on average earnings, this only offsets a very small portion of the extra $15,000 or so a household with an average mortgage is paying each year so it’s hard to see it causing a big rise in spending.

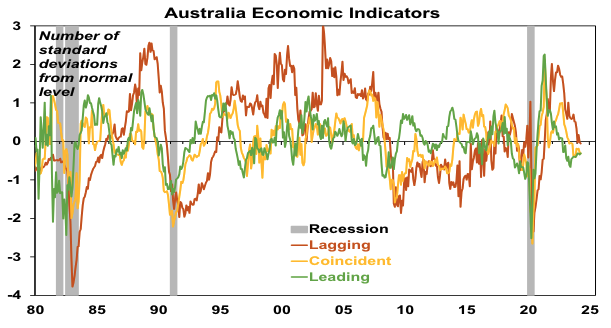

The next chart shows a mix of economic indicators that lead (like building approvals, consumer and business confidence and the yield curve), are coincident with (like employment and retail sales) or lag (like unemployment and delinquency rates) the economy. While none are at recessionary levels and leading indicators have become a bit less negative, both leading and coincident indicators remain below normal levels.

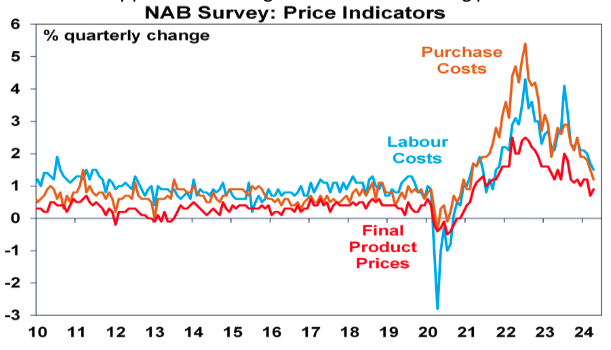

Second, weak demand means inflation is likely to resume its downswing. We have been seeing a quarterly pattern of higher than expected then lower than expected inflation lately which suggests the June quarter could see lower than expected inflation; the Melbourne Institute’s April Inflation Gauge points to a resumption of the falling trend; and similarly the NAB business survey points to a falling trend in cost and selling price inflation.

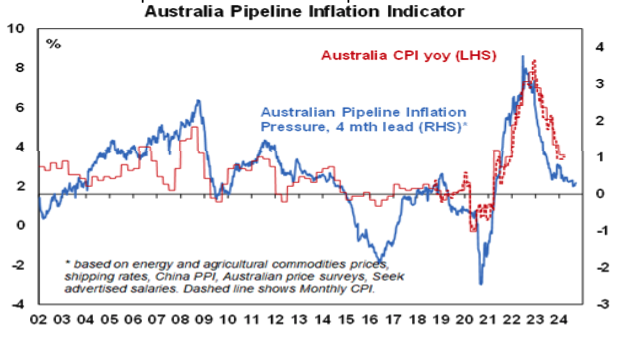

Our Australian Pipeline Inflation Indicator points down.

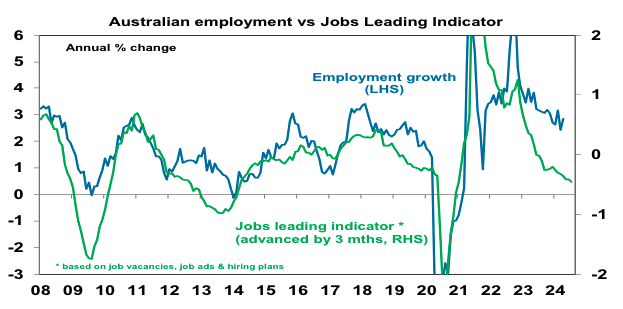

Thirdly, the labour market is cooling, and this points to slower wages growth which will lower services inflation. While the labour market remains tight the trend is up in unemployment & underemployment and falling job vacancies & hiring plans point to slower jobs growth ahead, as evident in our Jobs Leading Indicator which is pointing down.

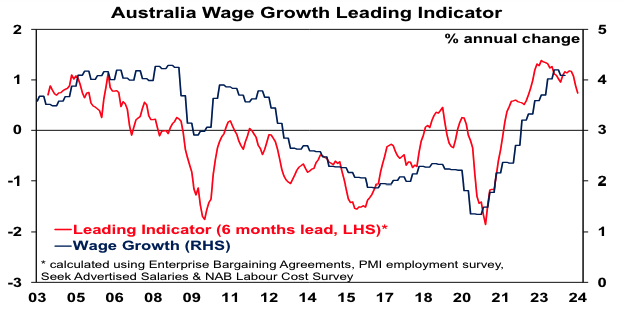

Consistent with this our Wages Leading Indicator points to slower wages growth ahead reflecting softer increases in new Enterprise Bargaining Agreements and lower labour cost surveys.

Fourth, the March quarter global inflation scare appears to be receding. US inflation came in weaker than feared in April and inflation elsewhere is continuing to fall. Both Switzerland and Sweden have now cut rates, the ECB, Canada and UK look on track to start cutting around mid year and the US Fed looks on track to start cutting in September.

Fifth, while the RBA has not raised rates as much as in other comparable countries, the rise in average outstanding mortgage rates exceeds that in other countries (reflecting the higher reliance on short-dated borrowing here in Australia) implying a much bigger hit to households. While average outstanding mortgage rates have increased by 3.3% in Australia, in the US its just been 0.5%, UK 1.6%, Canada 2.5% and NZ 3.2%.

Finally, while the Budget was more stimulatory than ideal, the extra stimulus was relatively modest. The impact on inflation from cost-of-living measures (about 0.5% over the next 12 months) likely means a downwards revision to RBA inflation forecasts. That could result in a potential flow on to underlying inflation measures as various government charges indexed to the CPI go up by a smaller amount and help keep inflation expectations down. So, we have concluded that the Budget did not warrant a change to our prior expectation for inflation to fall to 2.7% by June next year and for the RBA to start cutting rates by year end.

Concluding comment

The risk for interest rates in the next few meetings is still skewed to the upside, particularly if inflation comes on the high side again. However, with the economy weak, the labour market cooling and inflation likely to keep slowing, our base case is for the RBA to remain on hold ahead of rate cuts starting in November or December. We now only expect one rate cut this year (taking the cash rate to 4.1%) and are allowing for two cuts next year, Key to watch will be monthly inflation data, the upcoming FWC decision regarding award wages, unemployment and household spending.

1 topic