6 shocking predictions for 2024 and beyond

There's a famous saying that predictions are hard to make, especially about the future.

For the closing session of Livewire Live 2023, we asked six presenting fund managers to step out of their comfort zone and deliver a shocking prediction for 2024 and beyond. The aim of the exercise was to stimulate debate; to get investors thinking about where the consensus view could be challenged; and the time frame over which these could play out.

Our speakers delivered opinions on topics ranging from food prices and the end of obesity, plus views on asset prices, inflation, Australia as the lucky country and international travel.

Short, sharp, entertaining and provocative is a great way to describe these six shocking predictions for 2024 and beyond.

#1 Australian food prices will rise beyond our expectations

Timeframe: 1 year

Speaker: Dania Zinurova, Portfolio Manager, Wilson Asset Management

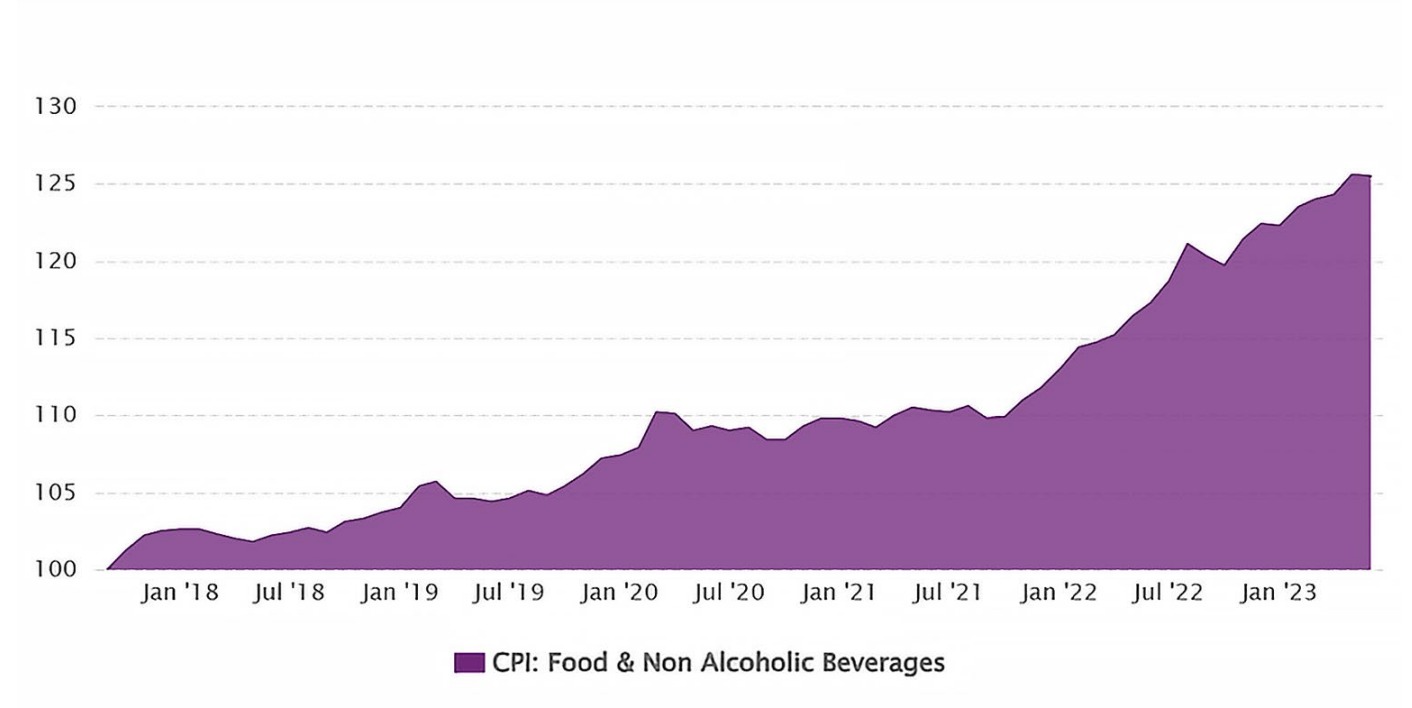

We all know first hand how our weekly grocery basket is becoming more expensive. This trend is set to continue through to the end of 2024 and Zinurova expects the increase to be as much as 9%. This is not a short term trend either.

Three factors are driving this trend:

- The very challenging geopolitical environment globally leading to supply chain issues;

- More frequent and more extreme weather events and;

- The resulting disruption to the global value chain; and the scarcity of land and water resources.

"Australian agricultural land is being acquired by overseas assets. Why? The price for Australian farmland per hectare increased about 195% over the 10 years to 2023. I'll add to this the value of water entitlements here in Australia allocated to irrigators increased 250% over the same period," Zinurova said.

For Zinurova, agriculture is a fascinating asset class offering fairly stable capital growth over a longer period of time coupled with income. The supporting evidence for this thesis is 'simple': Global population will continue to increase. The Australian market for investment in these assets should be noted, as Zinurova sees foreign investors continue to look for assets in Australia and buy farmland, agriculture businesses and agriculture assets.

In light of these trends, Zinurova noted the alternative asset investments she holds in the portfolio to take advantage of this:

- An established portfolio of water entitlements

- Australian agriculture assets

- Private equity investments in food related businesses.

#2 Australia enters the worst corporate default cycle since GFC and 1991 recession

Timeframe: 1 year +

Speaker: Christopher Joye, Portfolio Manager & Chief Investment Officer, Coolabah Capital

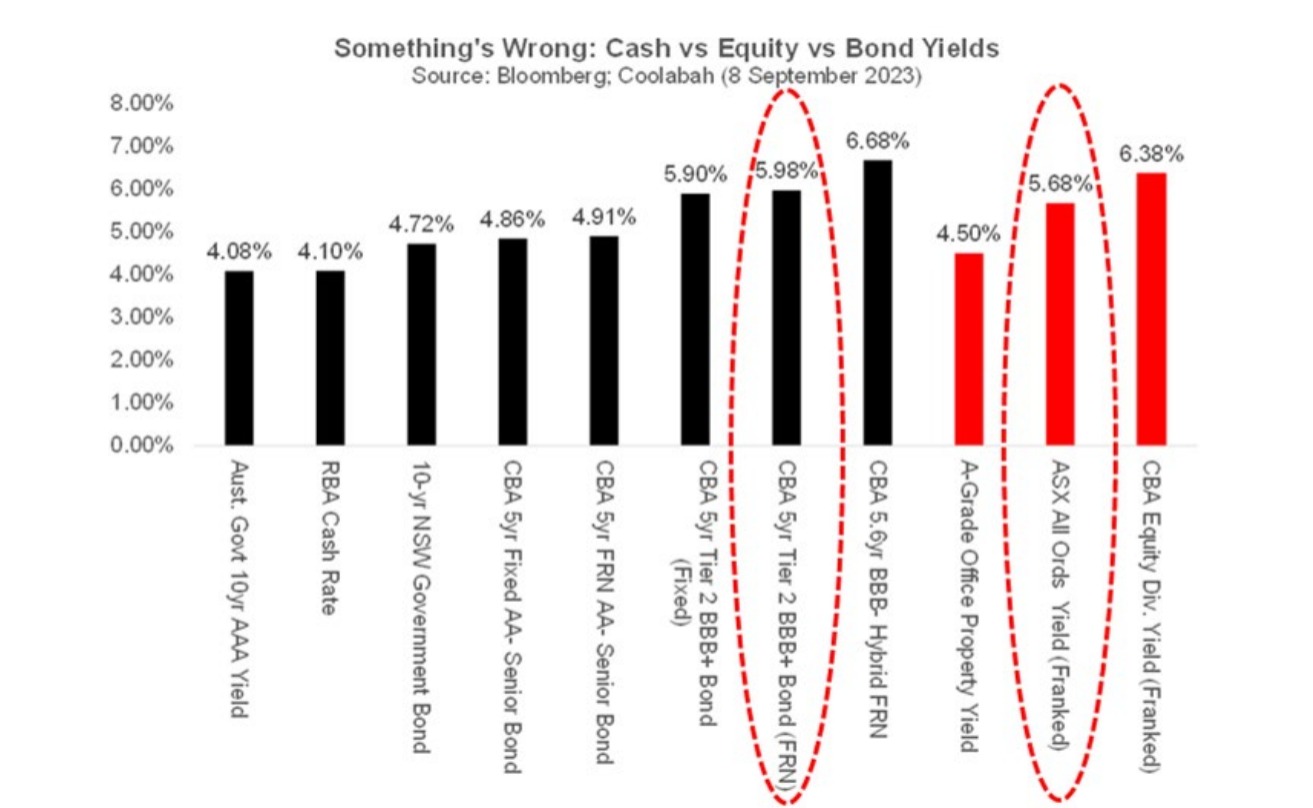

Joye offered three key messages around one theme: equity prices will undergo downward pressure until they offer returns that match what's available from relatively risk-free asset classes. To get to this prediction, Joye painted in detail a picture of inflationary pressures and how these are impacting asset valuations.

According to Joye, the key drivers of inflation in Australia are elevated wage costs coupled with positionally-poor productivity. Wage costs are elevated, increasing the prices for goods and services. The central bank uses wage costs as a key input into the models they draw upon to set cash rates to fight inflation.

He notes the RBA doesn't think it will return to its core inflation target of 2.3% until 2026, two years away. Right now, the effects of that are muted. COVID-19 restrictions restrained household spending at the same time as governments provided unprecedented levels of cash support. At the moment, that's muting the impact from rate rises.

But Joye's modelling suggesting Australian consumers won't deplete their cash buffers until late in 2024; whereas US consumers will do so by the end of 2023.

However, Joye sees that cracks are already emerging. Corporate insolvencies in Australia are running at 2016 levels as insolvencies in commercial real estate construction and residential property developers in particular are increasing. He also noted the rise in zombie companies on the ASX - companies that don't have enough sufficient income to repay the interest on their debt. His analysis indicates a massive increase in home loan delinquencies (30-day arrears rate) for non-bank lenders lending to riskier borrowers (bank lenders' arrears are at much lower levels and show very little increase).

Joye called out the current existential challenge for asset pricing is these discount rates or risk-free rates. Canvassing a variety of asset classes, he showed how the valuations currently being received are tracking lower than across that can be obtained via cash, government bonds and bank bonds.

"What does this mean? Onwards, we'll see downwards pressure on asset prices until they offer sufficiently higher returns above these hurdle rates. The lower- rates-for-longer paradigm is dead as is the search for yield. We welcome the rise of attracting risk-free yield. We will have the worst default cycle since the 1991. And cash and government bonds will outperform equities over the next two to three years," Joye said.

In light of these insights and noting Joye's view of the 'tremendous optionality' to take advantage of the insights on asset pricing, he suggests you should avoid short term illiquid assets "like the plague" and seek out long term liquidity.

#3 The international travel boom is about to bust

Timeframe: 1 year

Speaker: Casey Mclean, Portfolio Manager, Fidelity International

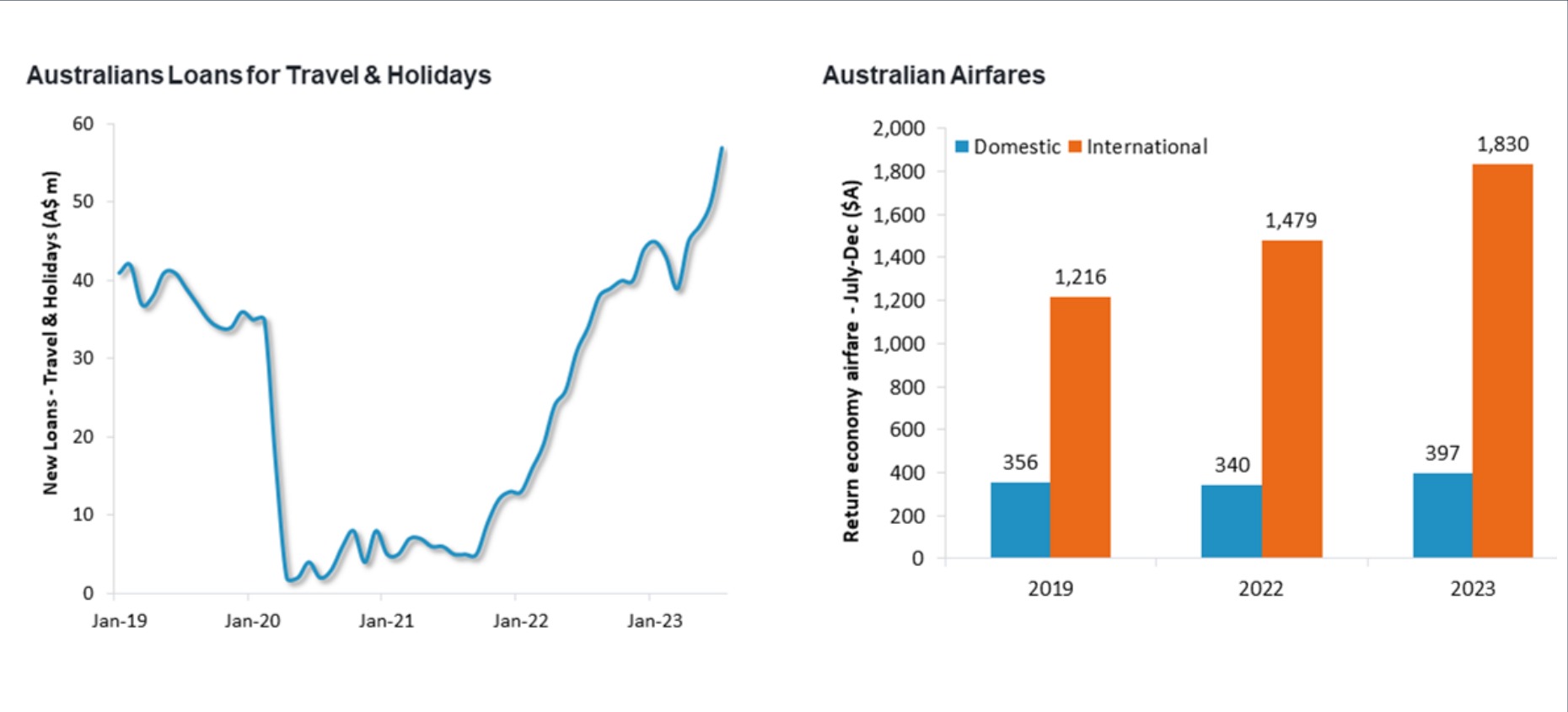

Casey McLean's own recent travel jaunts and those of his friends haven't changed his view that the post-COVID revenge travel trend won't last. But it's not evidence of declining US credit card spending on travel in the June to September quarter, or declining US airfare prices that is strongest for McLean.

His favourite indicates the wait time at Disneyland on 4 July 2023: 24 minutes compared with 39 minutes in 2019.

He also counsels not getting too excited about China boosting international travel. Not only is the Chinese economy weak, but the Chinese population is also becoming worried about their incomes and property values. They are increasingly seeking out domestic travel - staycations are becoming a trend. He also notes that younger Chinese tourists having different travel preferences to their parents and are not so interested in group travel.

Furthermore, seeking out international travel destinations to buy luxury goods is no longer required as duty free shops have opened in China in places such as Hainan, 'the Chinese Hawaii'

What of Australia? McLean noted the increase in Australian loans for travel and holidays, and also an increase in international airfares. "As international travel enters a nosedive it is the Australian airlines that will be impact."

So while there will be headwinds for the airlines, he still sees opportunities in the sector. His pick? Siteminder (ASX: SDR) is a channel management software for hotels, allowing them to manage their inventory of rooms and prices across booking sites. It helps them sell rooms and manage costs.

"There's still a runway for penetration as around 500,000 hotels worldwide still use excel spreadsheets. And they've only converted 39,000. The unit economics are very strong and we believe this can improve as they roll out more features," Mclean told the event.

#4 Superannuation will make Australia the wealthiest nation in the world (on a per capita basis)

Timeframe: 20 years

Speaker: Andrew McKie, Portfolio Manager. Elston Investment Management

We're still the Lucky Country, according to Andrew McKie. And millennials are the luckiest of the lucky as the effects of the superannuation guarantee levy, compounding and long time horizons mean that Australia's wealth per capita will increase and there will be a nice pot of superannuation funds for their latter years. With increasing life expectancies meaning they'll live into their 90's, those funds will come in handy.

"If you are an advisor or you own an advice business, you must be targeting millennials now," McKie argued. "Millennials will have the biggest pool of real assets in superannuation. They are typically dual income households. And they're long living. Forget about Macquarie. Superannuation is the millennials' millionaire factory.

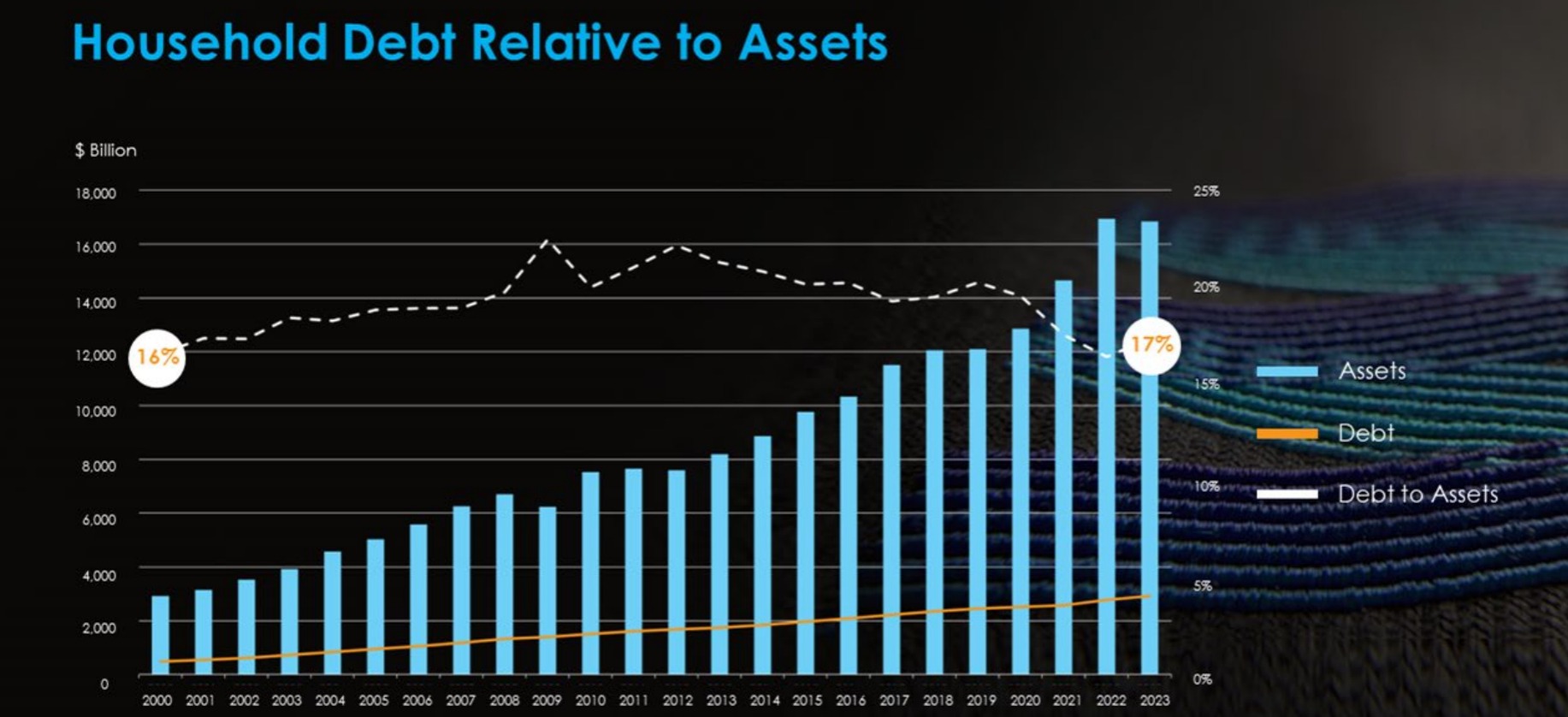

But what about the impact of levels of household debt. McKie offers this chart on the levels of household debt relative to assets as an alternative measure of household wealth. As he quips "The problem with Australian household debt levels is that they are not borrowing enough."

In 20 years when Millennials will draw on these superannuation assets they will drive consumption, so consumer discretionary and travel and leisure sectors will benefit. McKie sees an issue as to whether there will be enough depth in the offerings on the ASX.

#5 'Sticky' inflation to collapse and return to long run average

Timeframe: 1 year+

Speaker: Marcus Burns, Portfolio Manager, Spheria Asset Management

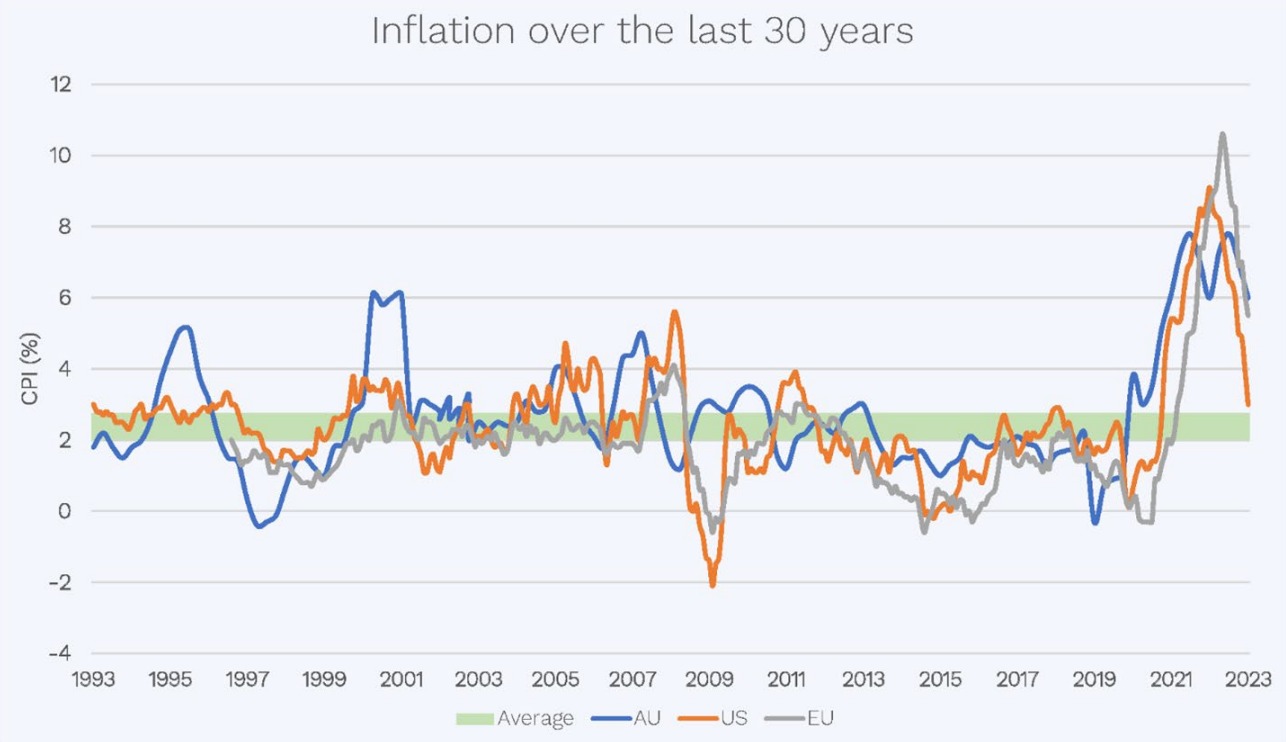

Looking at the trajectory of inflation over the last 30 years in Australia, the USA and Europe Marcus Burns argues "Inflation is not sticky. It's temporary."

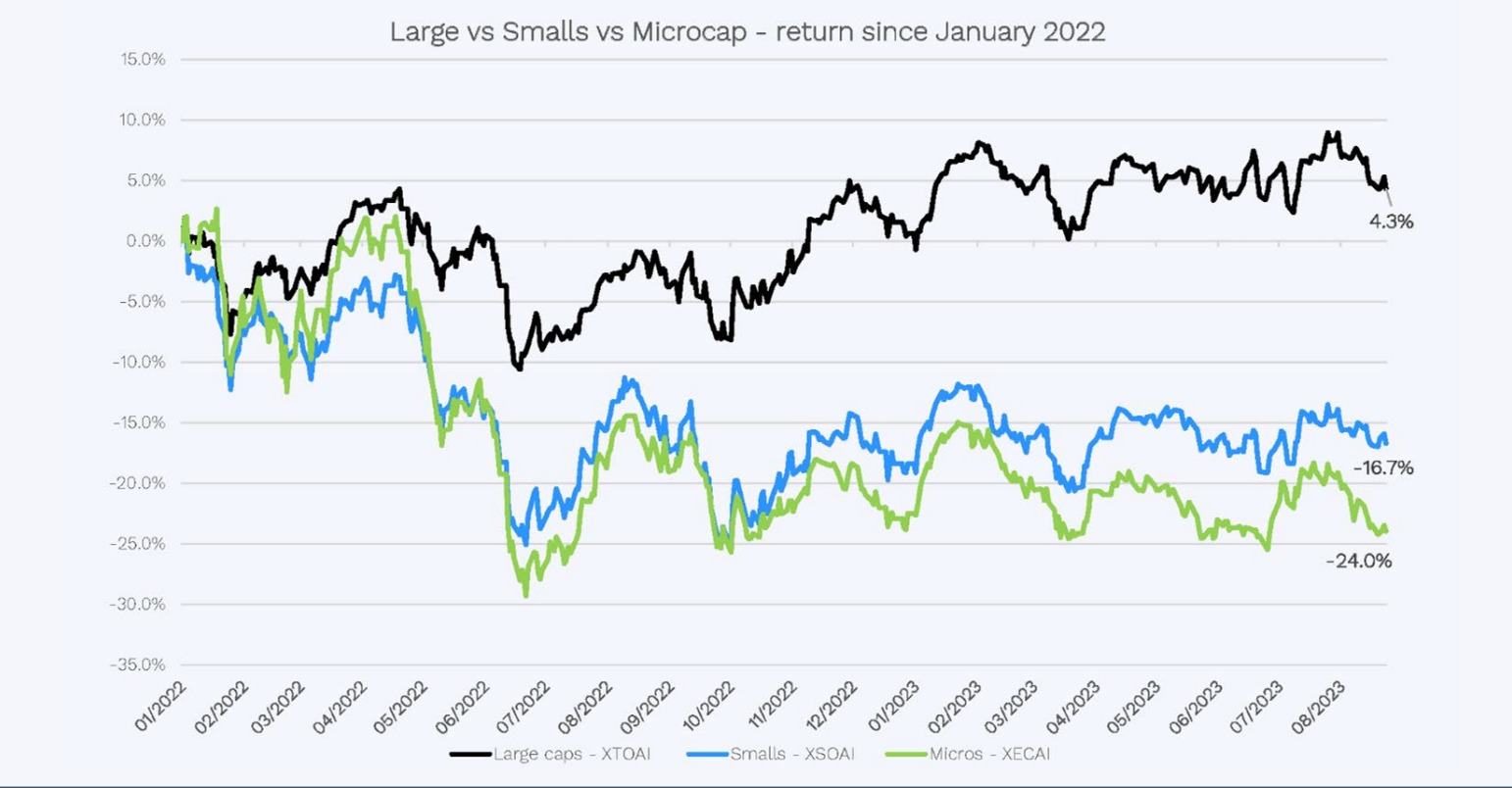

And while we are in a period of higher inflation, he concedes that defensive plays into large caps since January 2022 have delivered better returns than small and micro-cap stocks in Australia.

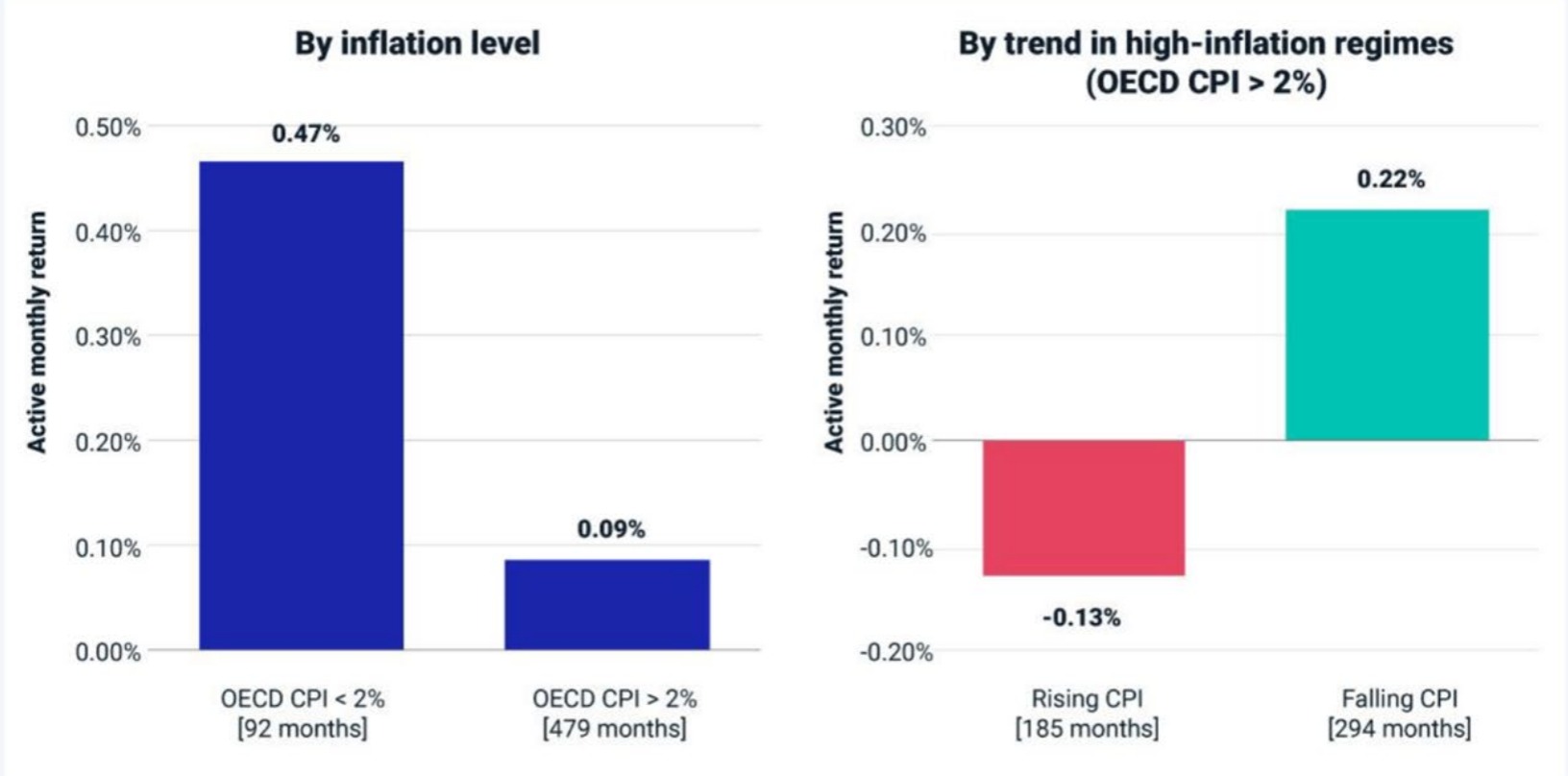

However - and reminding us that he is a small cap specialist - he notes that in periods of declining inflation and CPI measures, small caps perform better than large caps.

"Looking over 50 years, MSCI data shows us that small caps outperform in both periods of low and high inflation (the left hand side of the chart). But in periods of transition (the right hand side of the chart), large caps outperform, but in periods of falling inflation, small caps outperform again."

So if high inflation is just a phase we're going through, how will that phase end? In addition to the weight of historic evidence, Burns argues the AI productivity and quantum computer revolutions will see a return to low inflation.

#6 The end of obesity

Timeframe: 1 year +

Speaker: Dr David Allen, Head of Long Short Strategies, Plato Investment Management

There are winners and losers from the success of anti-obesogenic drugs, according to David Allen. The winners are not only the individuals who gain health benefits from lower weight, or governments that benefit from a lower health spend on managing chronic diseases where obesity is a co-morbidity.

Drug companies such as Novo Nordisk (makers of Wegovy) and Eli Lilly (NASDAQ: LLY) (makers of Mounjaro, expected to be approved towards the end of 2023) are winners. Allen notes that they own shares in these companies. The price of Novo Nordisk (currently the largest company in Europe, having just overtaken LMVH according to Allen) has responded positively to the SELECT study of 18,000 people with the results released last month.

"Why was this such a game changer? It showed that it reduced heart disease by 20%. This is going to unlock funding by the US government, by health insurers and governments globally."

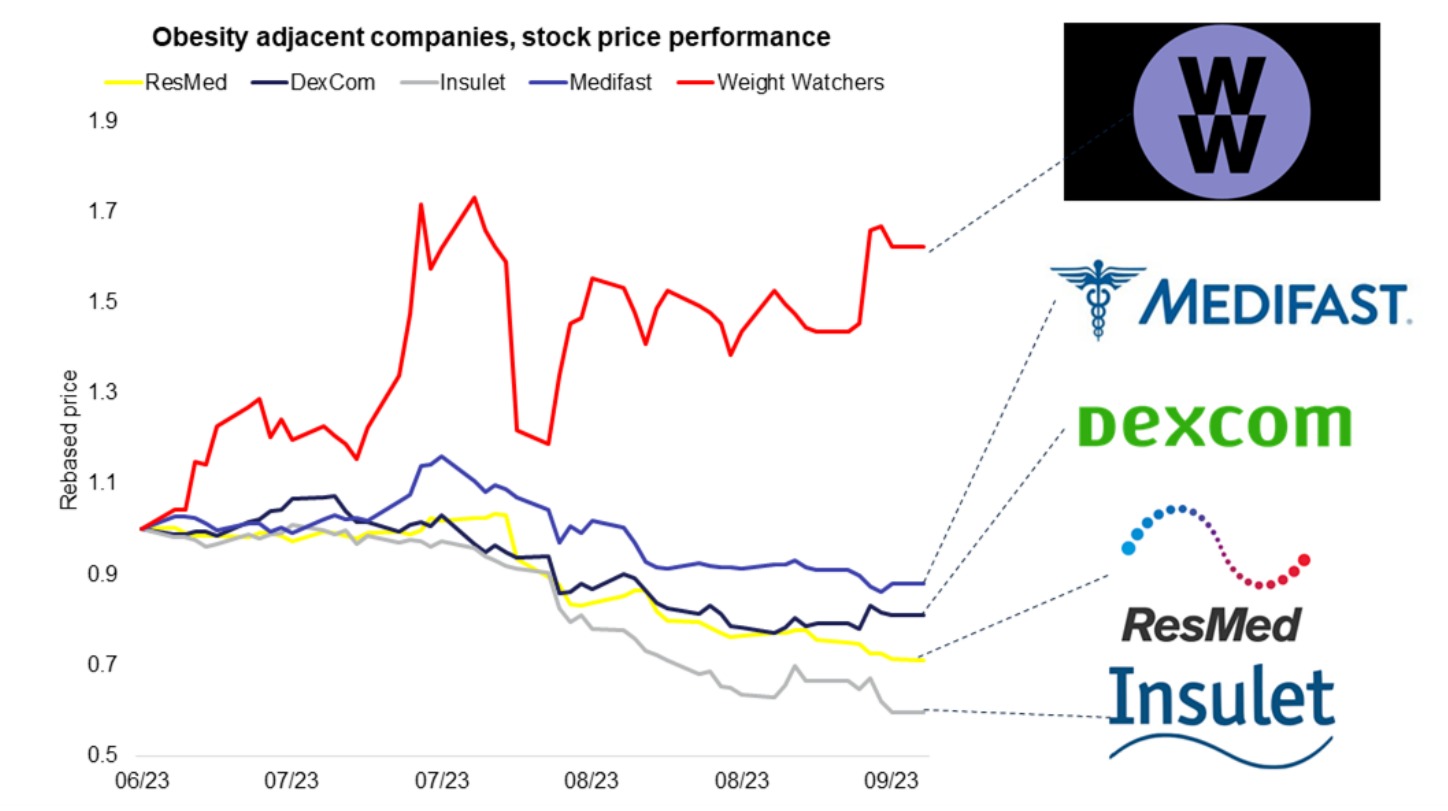

And the losers from this prediction? Allen identifies two themes. The first of these are companies that offer obesity adjacent treatments such as Medifast (NYSE: MED), Dexcom (NASDAQ: DXCM), Resmed (ASX: RMD) and Insulet (NASDAQ: PODD). Weight Watchers (NASDAQ: WW) reversed this trend in this space courtesy of its investment in a tele-health company earlier this year that only does Wegovy consultations.

The other theme is a longer term trend according to Allen, and that's what he's described as fast food companies as consumers cut back on high calorific foods.

Watch the full session here