Six Buffett insights from the Berkshire Hathaway letter

Over the weekend, Berkshire Hathaway (NYSE:BRK.B) released its 2019 Annual Report along with Warren Buffett’s highly coveted letter to shareholders, one of the most anticipated pieces of financial content in the world each year.

As my colleague Patrick Poke pointed out when he looked at prior year’s missive, the consistency of 89-year old Buffett’s messaging continues to prove remarkable. Probably no other investor in history has been able to maintain such a consistent message of buying quality businesses at a reasonable price over such a long time (since 1965 to be precise).

As is tradition, we summarise the most interesting pieces of wisdom and insights from the world’s most famous investor and also his business partner, 96 year-old Charlie Munger. This year, 6 key points for investors stood out: 1) Acquisitions at a sensible price are proving rare; 2) Stocks will beat bonds (if interest and tax rates remain near today’s low levels); 3) Buffett doesn’t intend to sell any of his top 15 stock holdings; 4) The importance of owner-oriented managers; 5) Berkshire will prosper post-Buffett and Munger; and 6) No buybacks if valuations remain unfavourable.

1) Acquisitions at a sensible price are proving rare

Buffett yet again found little success in deploying Berkshire’s growing cash pile, which stood at US$125 billion at the end of 2019. Berkshire’s last “elephant-sized” deal was the US$37.2 billion purchase for Precision Castparts more than three years ago.

As he has said time and again, Buffett looks for three things in a company:

- They must earn good returns on the net tangible capital required in their operation

- They must be run by able and honest managers

- They must be available at a sensible price

And when Buffett spots such businesses, his preference is to buy 100% of it.

“But the opportunities to make major acquisitions possessing our required attributes are rare. Far more often, a fickle stock market serves up opportunities for us to buy large, but non-controlling, positions in publicly-traded companies that meet our standards.”

In saying that, Buffett was on the hunt. He reportedly passed on Tiffany & Co (acquired by LVMH for US$16 billion) but did make a US$5 billion offer for technology product distributor Tech Data Corp only to be outbid by private equity firm Apollo Global Management.

As I wrote about in a previous article covering how billionaires including Buffett invest, he maintains his principle of refusing to overpay for a company no matter how vast Berkshire’s war chest is becoming.

2) Stocks will beat bonds

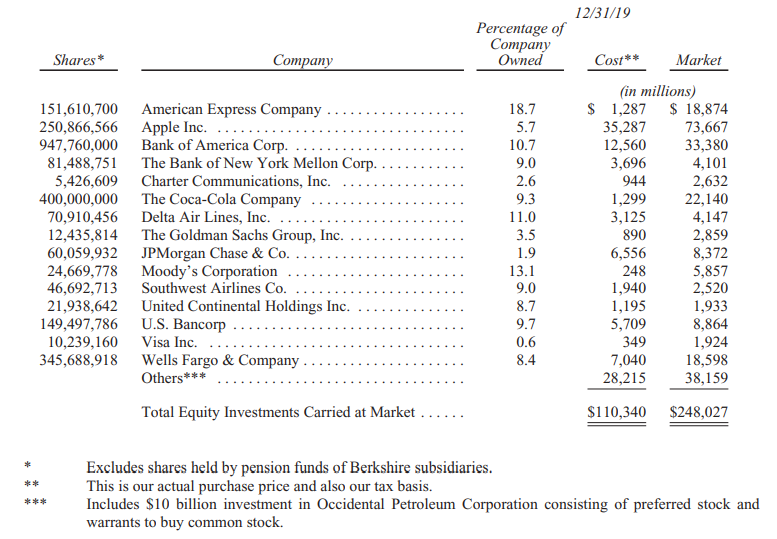

Pointing to Berkshire’s top 15 largest equity holdings surging in value to US$248 billion against a cost base of US$110 billion - and further emphasised by Berkshire’s compound annual gain of 20.3% since 1965 - Buffett remarked that “returns of that order by large, established and understandable businesses are remarkable under any circumstances”, especially when considering returns of ~2.5% that investors have accepted on 30-year U.S. Treasury bonds, for example, over the last decade.

And long-term, he believes equities are still the better bet.

“What we can say is that if something close to current rates should prevail over the coming decades and if corporate tax rates also remain near the low level businesses now enjoy, it is almost certain that equities will over time perform far better than long-term, fixed-rate debt instruments.”

But that rosy prediction comes with a warning: Anything can happen to stock prices tomorrow and investors should be prepared for the occasional major drops in the market “perhaps of 50% magnitude or even greater."

But the combination of the “American Tailwind” and the wonders of compounding will make equities the much better long-term choice for the individual who does not, as he writes, “use borrowed money and who can control his or her emotions. Others? Beware!”

3) Buffett doesn’t intend to sell any of his top 15 stock holdings

There’s a common saying among professional investors that if you’re getting six out of 10 investments right, you’re doing pretty well (for venture capital it’s more like one out of 10). The implication being that the gains on the upside should be more than large enough to offset any losses on the downside.

When my colleague Patrick covered last year’s letter, he noted of the top 15 holdings in Berkshire’s holdings, 14 of them are currently worth more than the company originally paid for them. In 2019 all the top names are in the black, and even the Kraft Heinz holding (not part of the equity portfolio) is still sitting slightly above the cost of purchase.

iPhone maker Apple (NYSE:AAPL, +88.09%), credit ratings agency Moody’s (NYSE:MCO, +70.96%) and telecom company Charter Communications (NYSE:CHTR, +70.22%) were Berkshire’s three best performers over 2019, and stocks that underperformed in the prior year like JP Morgan (NYSE:JPM) and Coca-Cola (NYSE:KO) managed to pop out 46.18% and 20.27% returns (inclusive of dividends), respectively.

In reviewing the equity portfolio’s performance, Buffett took the opportunity to discuss the importance of ignoring daily market movements and turning down the noise.

“Charlie and I do not view the $248 billion detailed above as a collection of stock market wagers – dalliances to be terminated because of downgrades by “the Street,” an earnings “miss,” expected Federal Reserve actions, possible political developments, forecasts by economists or whatever else might be the subject du jour.”

As he’s always emphasised, investors should see themselves as long-term part owners of corporations. In Berkshire’s case, those equity holdings are of corporations generating more than 20% on the net tangible equity capital required to run their businesses. These companies, also, earn their profits without employing excessive levels of debt.

A takeover is like marriage

Interestingly though, Berkshire made a colourful parallel about the businesses which have been acquired and added to the Berkshire empire over time; writing that some have been disappointing, a few were “outright disasters” but a reasonable number exceeded his hopes.

“In reviewing my uneven record, I’ve concluded that acquisitions are similar to marriage: They start, of course, with a joyful wedding – but then reality tends to diverge from pre-nuptial expectations. Sometimes, wonderfully, the new union delivers bliss beyond either party’s hopes. In other cases, disillusionment is swift. Applying those images to corporate acquisitions, I’d have to say it is usually the buyer who encounters unpleasant surprises. It’s easy to get dreamy-eyed during corporate courtships.”

Pursuing that analogy, Buffett says that Berkshire’s marital record remains largely acceptable, with all parties happy with the decisions they made long ago.

Perhaps the message for investors is to marry several businesses to avoid disappointment when one becomes a flop, or to be wary of when a corporation pursues a takeover.

4) The importance of owner-oriented managers

To add to the comments about nupitals, Berkshire took several potshots at the quality of corporate governance in America (some points of which are arguably applicable to Australia).

When it comes to acquisitions, he writes the system works “magnificently for CEOs and the many advisors and other professionals who feast on deals”, pointing out that he has yet to see a CEO who craves an acquisition bring in an informed and articulate critic to argue against it.

“A venerable caution will forever be true when advice from Wall Street is contemplated: Don’t ask the barber whether you need a haircut.”

He also added that job security is fabulous for board members who effectively have been playing the corporate game, earning US$250,000 and beyond for a “pleasant couple days of work" for one company.

And job security now? It’s fabulous. Board members may get politely ignored, but they seldom get fired. Instead, generous age limits – usually 70 or higher – act as the standard method for the genteel ejection of directors.

Despite the illogic of it all, Buffett wrote that he was astounded by how many directors do not own shares of the companies they represent at a board level, pointing to one large U.S. company where eight directors never purchased shares of that business. This particular company had long been a laggard, but the directors were doing wonderfully, he said.

The lesson for investors?

For Berkshire, Buffett and Munger have instilled a culture of seeking business-savvy directors who are owner-oriented and arrive with a strong, specific interest in the company.

“Thought and principles, not robot-like “process,” will guide their actions. In representing your interests, they will, of course, seek managers whose goals include delighting their customers, cherishing their associates and acting as good citizens of both their communities and our country.”

5) Berkshire will prosper post-Buffett and Munger

Buffett wrote that he and Munger long ago entered that time of their lives when media outlets are asking for biographical data they plan to use in their respective obituaries and investors are wondering about who will take over.

“Charlie and I long ago entered the urgent zone. That’s not exactly great news for us. But Berkshire shareholders need not worry: Your company is 100% prepared for our departure.”

He said the two of them based their optimism on five factors:

- First, Berkshire’s assets are deployed in a variety of wholly or partly-owned businesses that, averaged out, earn attractive returns on the capital they use.

- Second, Berkshire’s positioning of its “controlled” businesses within a single entity endows it with some important and enduring economic advantages.

- Third, Berkshire’s financial affairs will be managed in a manner allowing the company to withstand external shocks of an extreme nature.

- Fourth, the company possesses skilled and devoted top managers for whom running Berkshire is far more than simply having a high-paying and/or prestigious job.

- Finally, Berkshire’s directors are constantly focused on both the welfare of owners and the nurturing of a culture that is rare among giant corporations. (He adds the value of this culture is explored in Margin of Trust, a new book by Larry Cunningham and Stephanie Cuba that will be available at Berkshire's annual meeting.)

Succession hints

Buffett waited until the very last page of his letter to reveal a big change. Shareholders will be hearing more from top lieutenants Ajit Jain, Vice Chairman of Berkshire’s insurance operations and Greg Abel, Vice Chairman of its non-insurance operations.

“I’ve had suggestions from shareholders, media and board members that Ajit Jain and Greg Abel -- our two key operating managers -- be given more exposure at the meeting. That change makes great sense. They are outstanding individuals, both as managers and as human beings, and you should hear more from them.”

6) No buybacks if valuations remain unfavourable

Lastly, Buffett said he had in the past discussed both the sense and nonsense of stock repurchases in detail.

The thinking boiled down meeting two conditions a) Buffett and Munger believe that it is selling for less than it is worth and b) the company, upon completing the repurchase, is left with ample cash.

But calculations of intrinsic value are far from precise. Consequently, neither he nor Munger feel any urgency to buy an estimated $1 of value for a 95 cents.

“In 2019, the Berkshire price/value equation was modestly favorable at times, and we spent $5 billion in repurchasing about 1% of the company. Over time, we want Berkshire’s share count to go down. If the price-to-value discount (as we estimate it) widens, we will likely become more aggressive in purchasing shares. We will not, however, prop the stock at any level.”

To many more letters and annual meetings

While Buffett and Munger’s age is hard to ignore, it’s encouraging to see that their wit and ability remain sharp as ever and that their principles have lasted the test of time.

2020 will be an instrumental year for Berkshire, with Jain and Abel set to become bigger faces of the US$560 billion conglomerate. They're sure to be peppered with questions about the future direction of the company.

The Berkshire annual meeting will be held on 3 May 2020 (Australian time) and will be streamed on Yahoo!

Useful resources

- Access the full 13-page letter.

- Read more about how billionaires including Buffett, Bill Gates and Jeff Bezos invest here.

- Check out Warren Buffett portfolio tracker.

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

1 contributor mentioned