7 commodities (and 8 stocks) to watch in this complex market

Cast your mind back to when markets were expecting seven rate cuts from the Federal Reserve, thanks to hopes of an immaculate disinflation in the United States and the persistence of a tight jobs market both stateside and in Australia. The 10-year yield in the US was under 4% and the crude oil price was hovering at around US$70/barrel - a warm price but not one that would cause alarm among investors.

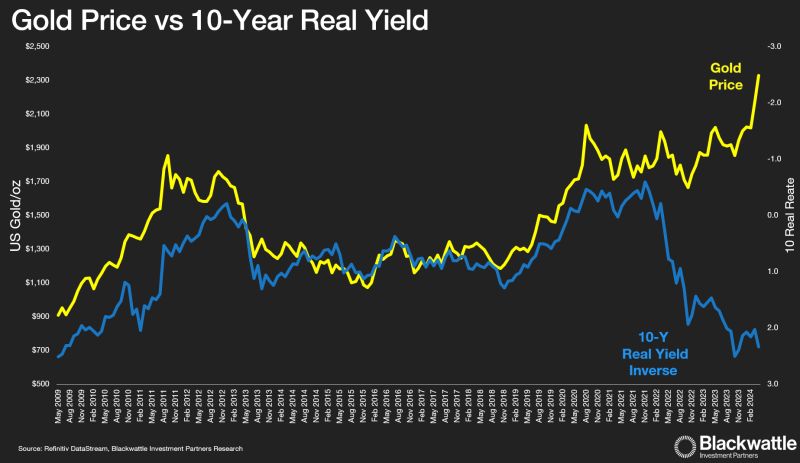

Remember that time? Believe it or not, that was just five months ago. Fast forward to today and everything has changed. Crude oil now has US$100/barrel in its sights, the US 10-year yield is now at 4.5%, and gold prices are at all-time highs despite a breakdown in its traditional relationship with real yields (as can be seen in this next chart):

It's such a remarkable performance that Russel Chesler of VanEck has described the move as a chance for investors to get in on a "once in a decade" opportunity for gold miners. But, as the next 20 minutes will reveal, this bullish view has both its proponents and sceptics.

With this (and other huge moves in the commodities market in mind), Signal or Noise presents its annual episode dedicated to the intersection of commodities and the global economy. Joining yours truly and Diana Mousina, Deputy Chief Economist at AMP are:

- Benjamin Goodwin, Analyst and Portfolio Manager at Merlon Capital Partners

- Daniel Sullivan, Head of Global Natural Resources and Portfolio Manager at Janus Henderson Investors

Note: This episode was taped on Wednesday 10 April 2024. You can watch the episode, listen to the podcast, or read our edited summary.

EDITED SUMMARY

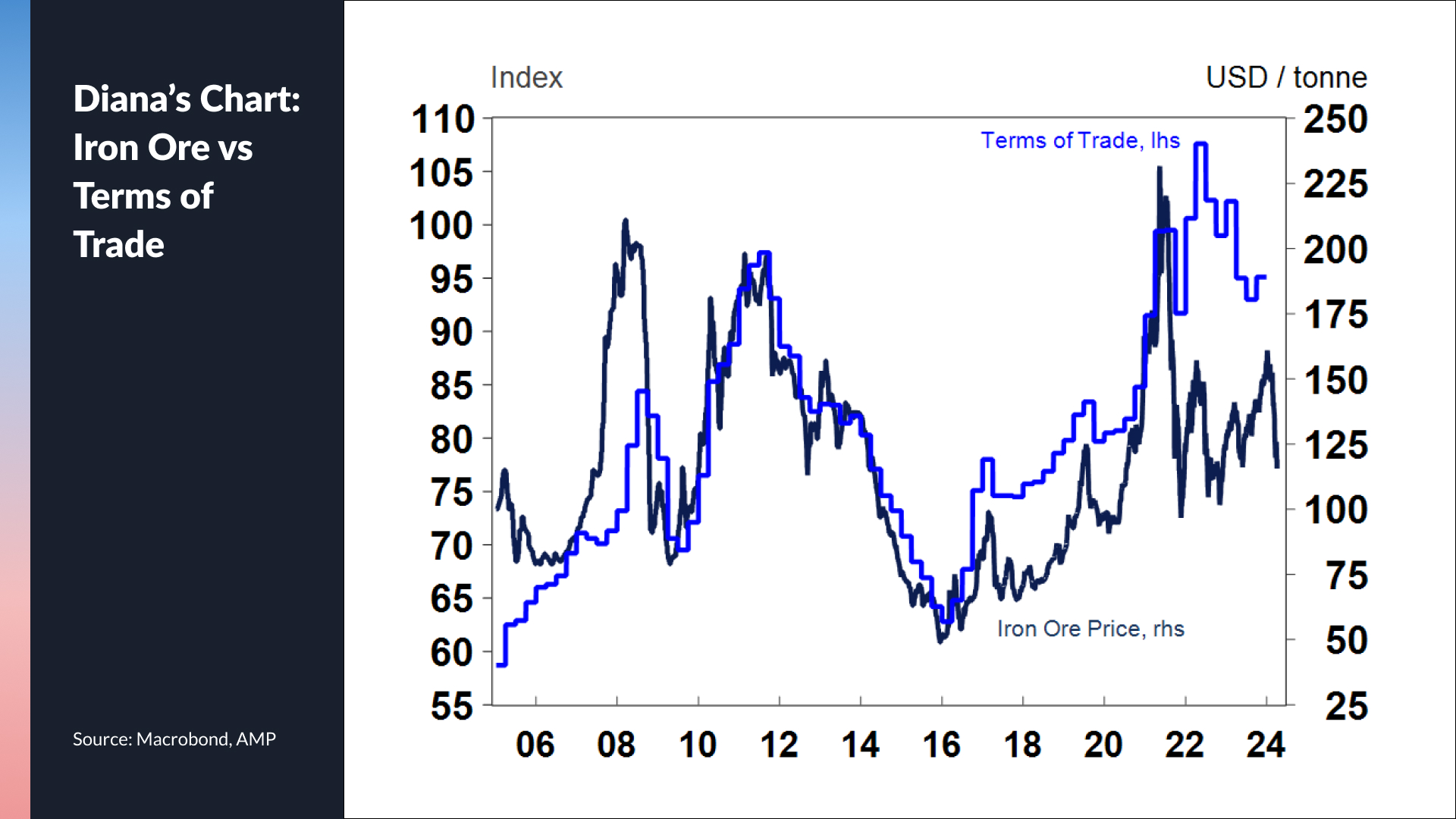

Topic 1: Is the Australian economy (and are investors) overexposed to copper and iron ore prices?

Diana: SIGNAL - While Australia's commodity exports are extremely important, she adds that the implementation of tariffs against Australian companies caused them to find non-Chinese trade markets. Australia can diversify away from China, but she notes this may not be necessary until we see a big shift in demand volumes - even if prices fluctuate.

Diana's Chart: Iron ore vs Terms of Trade

Daniel: SIGNAL - China is absolutely critical for commodities and iron ore's dream run has been a gift for Australia. But now that China has choices for who can supply its metals demands, the boon effects for Australia will fade as time goes on. Daniel's top China-facing commodity pick is Sandfire Resources (ASX: SFR).

Ben: SIGNAL - Australia is an export-led economy and given iron ore and met coal together make up 25% of our exports, any shift in the demand mix for the Chinese economy provides real risks. Ben's top China-facing commodity pick is Whitehaven Coal (ASX: WHC).

Topic 2: Is this a "once in a decade" buying opportunity for gold?

Daniel: SIGNAL (and lots of it) - Daniel thinks this breakout is more than just once in a once-in-a-decade occurrence - he thinks it could be a generational opportunity. The disparity in valuations is rising and he thinks that demand will remain extremely strong moving forward. His top picks in the gold space are Northern Star (ASX: NST) and De Grey Mining (ASX: DEG).

Daniel's Chart: Gold vs USD, Major Currencies vs USD

Ben: SIGNAL and NOISE - Proving there is always a bull and a bear in every market, Ben issues a Signal or Noise first - the price action of gold could be both signal and noise. Given that the gold price has detached from its inverse correlation with real yields (see Blackwattle chart above), equity investors may not believe the gold rally can last.

As the saying goes, if you can't explain your investment succinctly, perhaps you shouldn't be in it at all! (Merlon Capital currently don't hold any gold stocks in their portfolios.)

Diana: NOISE - From a macroeconomic point of view, gold's price is not moving in line with interest rate expectations. Some in the hedge fund community argue that the gold rally demonstrates why the Fed will cut rates even sooner than the market expects - but this is an alternative (and highly uncertain) view.

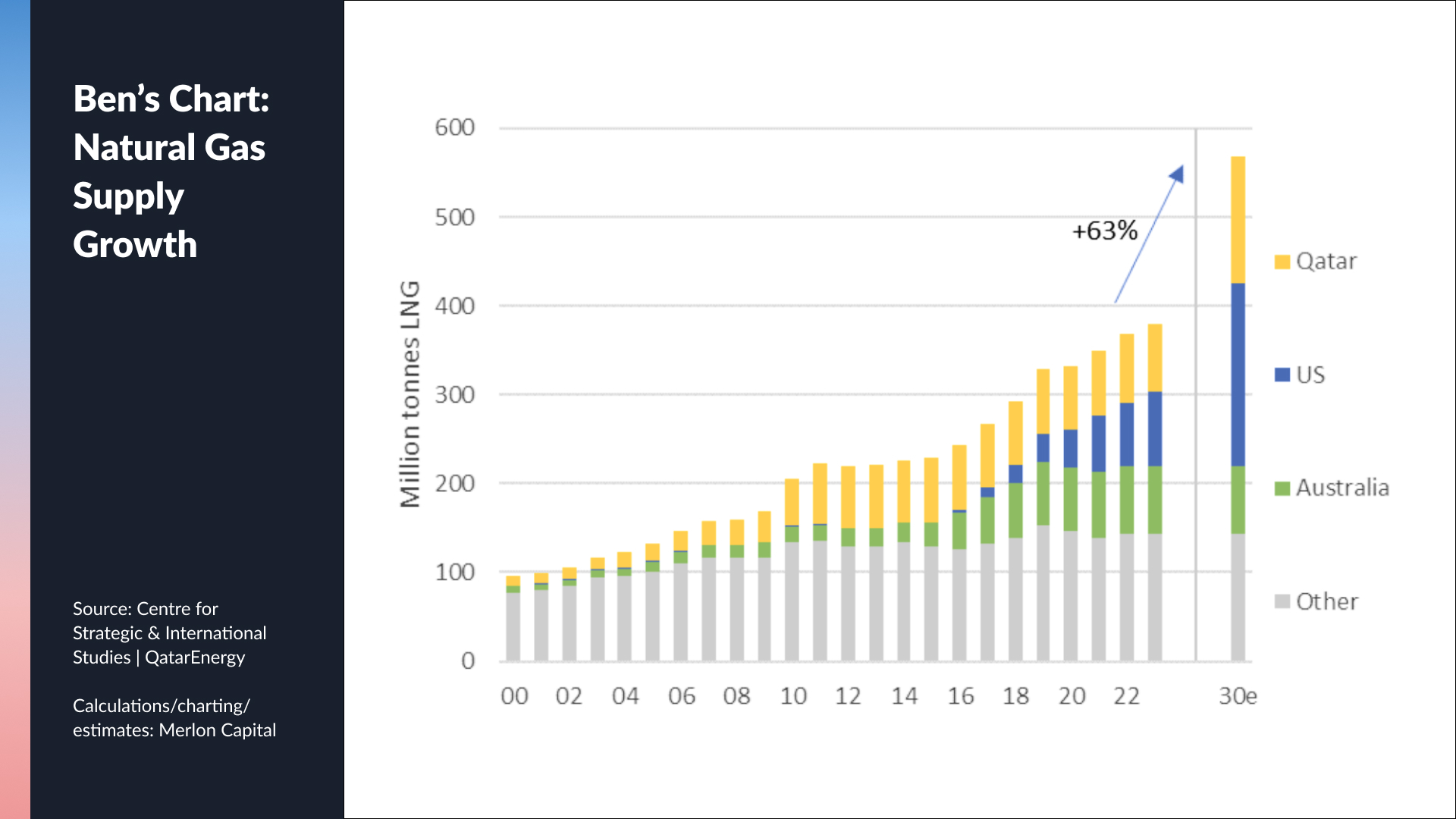

Topic 3: Morgan Stanley upgrades US energy stocks to overweight

Ben: SIGNAL - Demand has improved in the last 12 months and crude oil consumption globally has improved to pre-COVID levels. From the supply side, OPEC+ continue to hold their level of discipline which is price-supportive. Merlon has small investments in both Woodside Energy (ASX: WDS) and Santos (ASX: STO).

Ben's Chart: Global LNG Supply

.jpg)

Diana: SIGNAL - Leading economic indicators are looking more positive and PMIs continue to trend positively, creating a macro backdrop that will be supportive of demand and prices.

Daniel: NOISE - Geopolitical risks are providing more noise than signal and he thinks there is more than enough spare capacity for the next two to three years. Beyond that, Daniel argues there could be a cyclical bull market for oil markets. Daniel's top energy pick is Norwegian firm Aker BP ASA (NO: AKERBP).

What is one other commodity investors should consider for its macro or fundamental tailwinds?

Daniel: URANIUM - Bulls have been waiting for a bull market in uranium prices for 15 years. Now it's started, he sees fundamental supply and demand reasons to keep prices running - fuelled additionally by the push toward nuclear investment. Daniel's top uranium pick is Paladin Energy (ASX: PDN).

Ben: MET COAL - India's demand story in this commodity is fascinating, with volume growth looking supportive. From the supply side, met coal producers are actively divesting their assets creating a supportive backdrop for prices.

Diana: WHEAT - From an inflationary perspective, Diana and the AMP team point to the price action in grains given it has played a big role in higher food inflation. both here and overseas

Our next Signal or Noise episode is our first ever Economists' Round Table, and will be released on 13 May.

5 topics

7 stocks mentioned

4 contributors mentioned