7 fund managers pitch why their asset class will help you most in 2024

2024 is shaping up as a fascinating year in markets - simply because the potential for most asset classes is very different to what it was even just five or ten years ago.

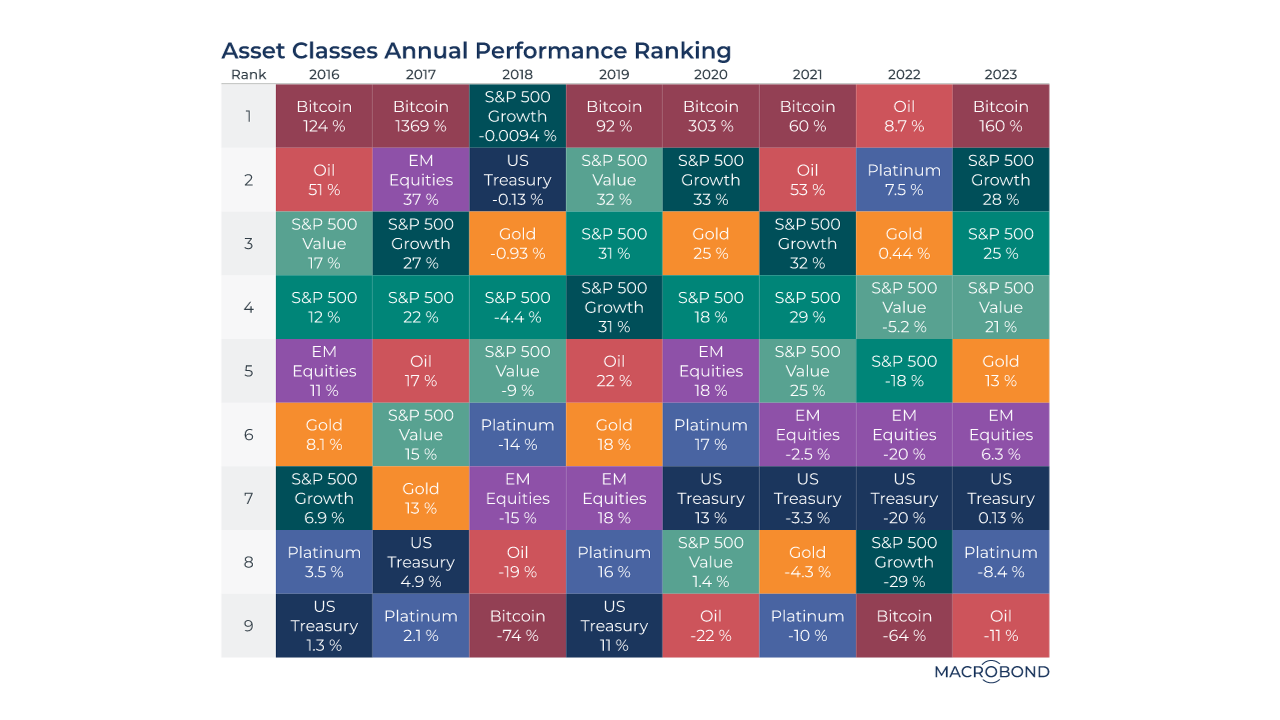

For most of the last decade, equities really were the only game in town if you wanted capital growth (and oddly by historical standards, income as well). Bitcoin may have been the top-performing asset last year but as the following asset quilt from Macrobond shows, the S&P 500 took out the second, third, and fourth positions in one go.

%20(5).png)

While crude oil topped the 2022 rankings, it fell into last place. Gold, on the other hand, had a year which could only be described as "vintage". Although government bonds struggled for most of last year, some private debt and alternatives funds are now delivering double-digit yields. Even Australian corporate credit (investment-grade) did significantly better than the government-issued 10-year bond.

Market returns rarely end the same way two years in a row, however, and the enhanced returns in asset classes outside of equities are making the opportunity set extremely interesting.

With all of this in mind and as part of Livewire's annual Outlook Series, we recently asked 7 of Australia's top fund managers to take part in an eBook titled "The Ultimate Investing Guide". As part of that guide, we asked each fund manager the following question:

Why should investors consider your asset class

above all others in 2024?

Through this question, we wanted each contributor to justify the value of their asset class in the current economic environment. We wanted them to fly the flag and provide a compelling argument to go with it. This wire is the collection of their responses.

Australian stocks: Home of the "safety" play

In a year likely to be more about defensive strategy than offensive manoeuvres, opting for more defensive investment options may not be as glamorous as high-risk plays.

However, it's important to remember the fundamental principle: capital saved is

as valuable as the capital gained.

But with the market presenting cheap prices in defensive plays, it makes it an

easy choice to opt for safety in what will be an uncertain year for the global economy.

- Mark Gardner, MPC Markets

Global stocks: The better long-term choice

I don't think they should. I think you want to be there selectively because there are risks in parts of the market. You need to be careful about the prices you're paying.

Having said that, at this point in the cycle, one of the things investors tend to get

overly focused on is the focus on other asset classes like cash and private credit that

can reap 5% and 8-9% respectively. I think the problem with that is that it is a short

duration of 12 months or less. But the very fact interest rates are there is why a lot of

companies are trading cheaply.

- Andrew Clifford, Platinum Asset Management

Fixed Income: Equity-like returns without equity-like risks

Outright yields in IG are very attractive, offering investors the prospect of higher risk-adjusted returns. As evidenced by more recent Australian Dollar issuance, new IG-rated Senior and Tier 2 bank and insurance bonds are offering investors attractive yields akin to the 10-year average ASX 200 equity return (+7.1%).

So, IG yields are currently at longer-term equity average levels without the associated volatility and with significant potential to outperform as spreads and yields normalise over the near to medium term.

Furthermore, in being IG-rated, investors are likely to extract equity-like returns in

2024 without the prospect of the impairments that are more commonplace in high

yield during economic slowdowns.

- Roy Keenan, Darren Langer, Phil Strano and the Yarra Capital Management team

Infrastructure: Earnings remain strong and valuations are due for a reset

From a fundamental perspective, infrastructure companies are in great

shape: they are passing through higher bond yields into higher allowed returns,

which is flowing down to improving earnings profiles. We expect this to continue

through 2024 and into 2025.

On the valuation side, if real yields stabilise from

here we expect the valuation discount caused by 2023’s sharp rise in yields to

close up, creating catalysts for both utilities and growth-sensitive transport

infrastructure as the year plays out.

- Shane Hurst, ClearBridge Investments

Private debt: Providing both growth and defence - sometimes at the same time

Australian investors’ preference for private debt has shifted as the local industry has matured. A decade ago, when the sector was in its infancy and understanding of private debt was limited, investors tended to prefer more conservative strategies with a focus on very high investment-grade borrowers.

Today, a broad cross-section of investors have a better grasp of the benefits of the

asset class and are increasingly adding higher-risk debt to their portfolios too.

All signs point to this appetite continuing to increase in 2024 and beyond as the

genuine benefits of allocating an appropriate proportion of capital to private debt

become even better understood.

- Andrew Lockhart, Metrics Credit Partners

Private equity: A year where the dry powder gets deployed

We see 2024 as a year where our co-investment, secondaries and capital solutions practices will continue screening opportunities and deploy capital globally, at record levels in companies that provide business critical solutions across industries, including software and technology, healthcare, business services, industrial, and unique consumer businesses.

All of our practices, in private companies alongside solid private equity managers, will do so away from the daily volatility of public markets and the risk of redemptions and repricing due to interest rate expectations.

From an investor point of view, we believe this to be an attractive time to be involved within the co-investment, secondaries and capital solutions space as a liquidity provider to private equity managers seeking to preserve fund value in the current market environment.

- José Luis González Pastor, Neuberger Berman

Resources: The "natural" way to outperform the market

Investors should consider the natural resource asset class above all others in 2024 due to the compelling opportunities it offers.

An allocation to natural resources can provide global equity-like return outcomes achieved via a different path while also providing diversification to the ‘Magnificent Seven’ technology companies that are so predominant in investor portfolios today.

Its low correlation with traditional equity and fixed-income assets helps mitigate risk and enhance portfolio stability. As the global demand for resources continues to grow, driven by population growth and the pursuit of higher living standards in developing countries, this sustained demand is creating a strong foundation for potential long-term growth and profitability.

The transition towards renewable energy and the shift to electric vehicles present

significant opportunities for resource-intensive industries. The need for

infrastructure development, supply chain re-shoring, and the adoption of clean

technologies all open doors for enabling natural resource companies to thrive.

Finally, the supply side of the natural resource sector is favourable. Low mining

capital expenditure and healthy balance sheets of major companies position them

to navigate volatility and capitalise on value-creation opportunities.

- Daniel Sullivan, Janus Henderson

9 contributors mentioned