7 of UBS' best ASX investment ideas for Australia's soft landing

We could all use a good news story right now. For every headline around strong corporate earnings and consumer resilience, there are others around the relentless rise in interest rates and the equity market's "capitulation" moment (more specifically, whether we have reached it yet).

But in every sell-off, there is opportunity.

UBS recently re-released its "best ideas" list to spruce up your portfolio just as the warm weather begins to replace the endless rain we've had in Australia this year. We discussed some of the top-level thinking in a recent edition of Livewire's Charts and Caffeine but this piece will go deeper.

Specifically, this wire will take a look at some of the broker's new buys, and perhaps more importantly, its sells. Plus, we'll take a more in-depth look at the reasons behind these changes with the help of a top-down note that is currently gaining plenty of traction in the financial press.

First things first: Everything's fine...

Let's make one thing clear - UBS are the optimists in the room. While many economists believe Australia will experience some form of recession next year, lead economist George Tharenou believes we won't see one. Better than that, strategists led by Richard Schellbach argue the S&P/ASX 200 is priced for a recession. In Schellbach's view, the re-rates have been excessive - and too extensive to ignore.

"Given we do not expect a recession to play out in Australia, these moves seem overly pessimistic, and present an opportunity to buy into some high quality businesses with solid medium-term prospects," he said.

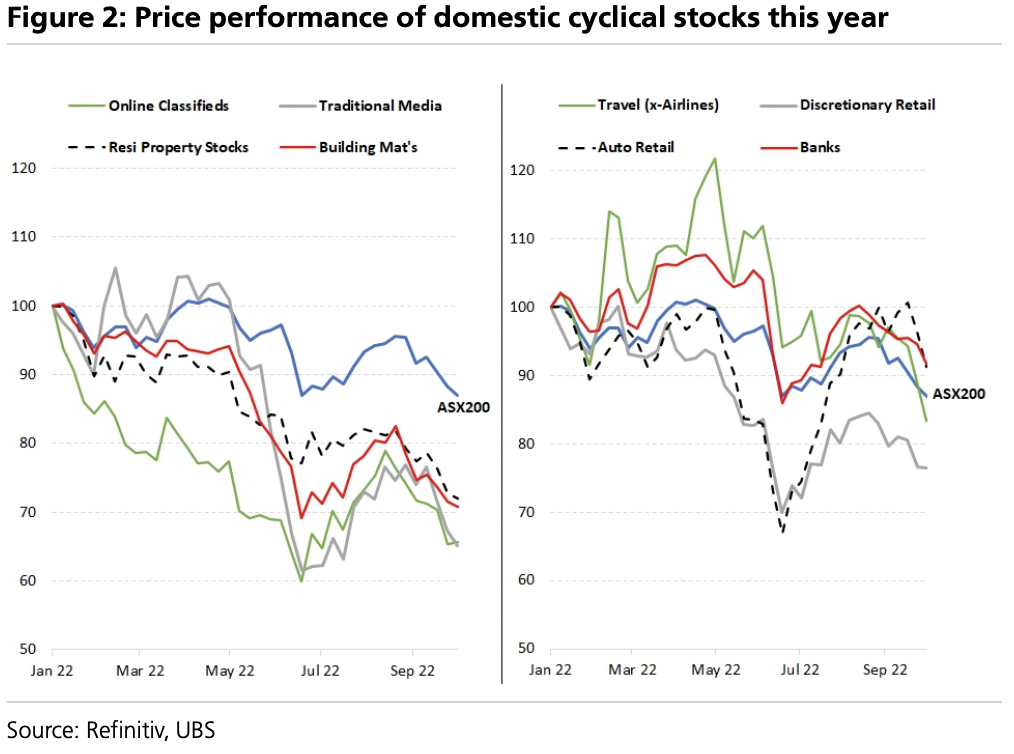

But there is a caveat to Schellbach's view - don't rush to buy the dip. The numbers suggest domestic cyclical stocks are now either at or below mid-cycle valuations, and that implies better bargains ahead for those who are patient enough to stick it out. The next chart is a symbol of this point - the downturns in each sector tell a very different story than if you just looked at the general index.

Further to this point, the index is likely to remain rangebound until the end of the year. That means stock picking will be, once again, the top game in town.

...But that doesn't mean earnings are on the way up

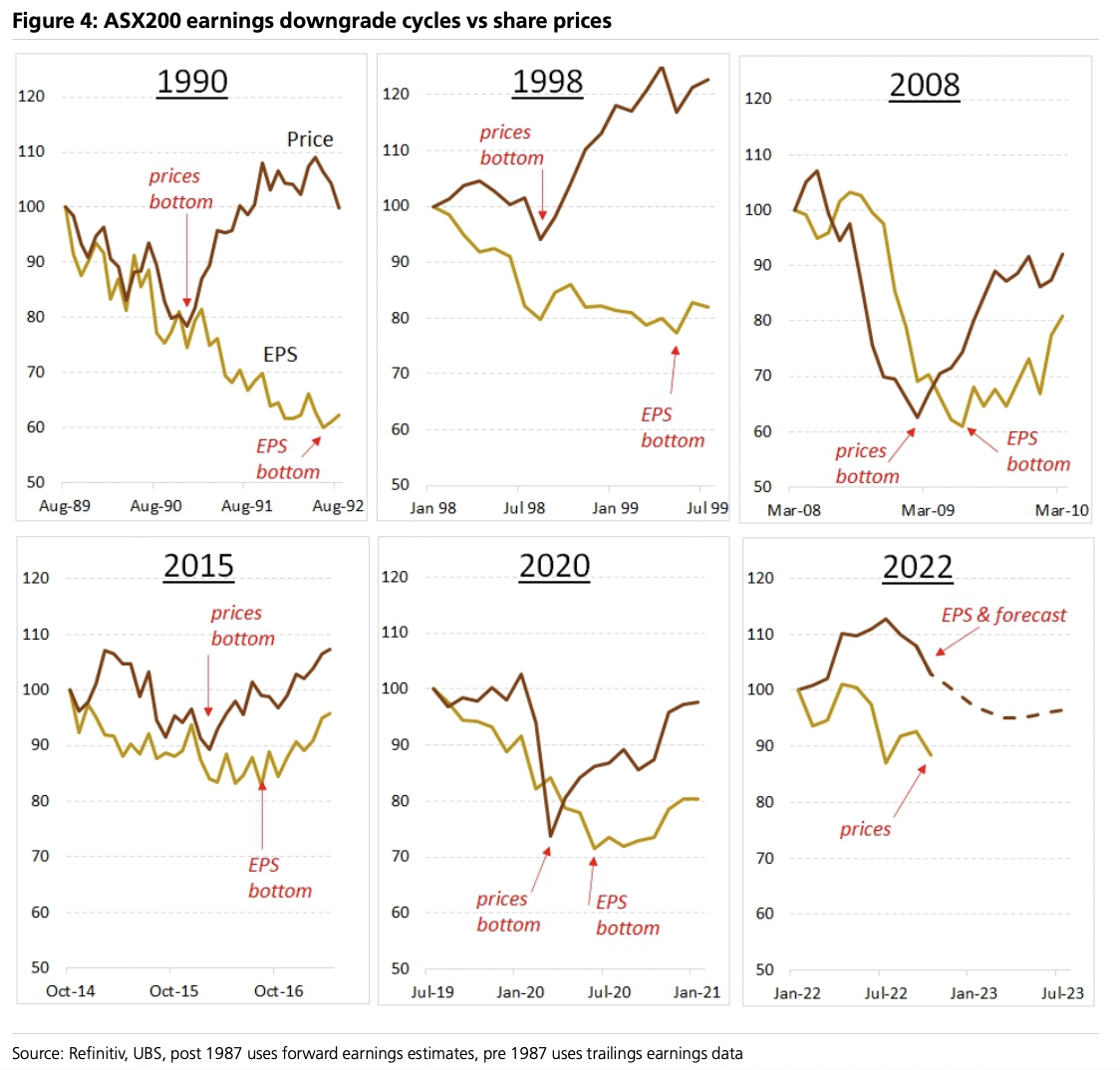

Unfortunately, UBS' optimism on the recession front doesn't spread to earnings, with the team admitting that downgrades are likely to keep coming. In all likelihood, these will continue through to the February 2023 reporting season, it said. But history suggests we may also be a long way through this downgrade cycle. The average cycle lasts just under a year, and that's where Schellbach is also drawing the line.

"Given this earnings downgrade cycle started in May, and was likely to last through to February, we believe the December quarter always presented itself as the likely time whereby shares could start to detach from the ongoing cuts to profit forecasts," he said.

The next collection of charts showcases what he is referring to. The bottom (for share prices, not earnings) usually comes fairly quickly at an aggregate level. And although every cycle is different, he believes there is enough in the charts to suggest we're not far away from the financial equivalent of a pièce de résistance.

Tell me the really good news

So here's the good news. Even if we're not done with this downgrade cycle, there are two ASX stocks that Schellbach is already a fan of. Each month, UBS releases its list of "best ideas" - a list designed to capture up to 30 recommendations (and warnings).

Unlike Morgan Stanley and Goldman Sachs' model portfolios or even Morgans' own best ideas list, this list contains the top buy-rated stocks and the broker's high-conviction sell ideas. After all, half the skill in investing is knowing when to take the money and run.

First, the good news. UBS has two new buy-rated ideas and they are:

Seek (ASX: SEK) and Super Retail Group (ASX: SUL)

There are two primary reasons for the shift in tone around these specific names. One, they fit in with a wider thesis for upgrading the TMT (Tech, Media, Telecoms) and Consumer Discretionary sectors. The other is far more macro (and to me, at least, far more interesting):

"[These] are impressive businesses that have been punished on what we see as excessively bearish macro concerns. We are also drawn to the fact that both these stocks typically outperform when inflation slows," Schellbach said.

And now, the bad news

But for every buy, there has to be a sell. And UBS has not one but six changes it has made in this regard. Two are ideas simply taken out of the "best ideas" list while four are now included in the "worst ideas" list.

Making its way out of the best ideas list are:

- Computershare (ASX: CPU) - Due to its share price outperformance during a period of rising interest rates.

- Metcash (ASX: MTS) - Following a wider downgrade of consumer staples.

On its worst ideas list:

- Commonwealth Bank (ASX: CBA), because of its high valuation and the roll-off of fixed-rate mortgages.

- Pilbara Minerals (ASX: PLS) - Thanks to the crazy run for lithium stocks.

- Harvey Norman (ASX: HVN) - Despite the upgrade to consumer discretionary stocks.

But one thing all three of these worst ideas have in common is labour shortages and risks around input costs. And it's those two factors that are the key risks to UBS' recession-avoidance base case. After all, nothing is infallible in the markets and if you think your case is bulletproof, pricing has a way of humbling even the best in their craft.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

7 stocks mentioned

1 contributor mentioned