7 stocks we're backing at Forager, including a recent addition

The end of the 2023 calendar year saw a sharp rise in equity markets in Australia and around the world. Once again, macro considerations were the driving force. Longer-term interest rates fell as investors concluded that global inflation problems have waned. Yields on ten-year Australian government bonds had risen to nearly 5% from 4% at the end of August, then retreated to 4% again by year-end.

The late rally left the All Ordinaries Accumulation Index up 13.0% for the calendar year, while the Forager Australian Shares Fund returned 7.15% in December and 10.9% for the year.

Despite a 15.0% runup since late October, small caps once again underperformed their larger counterparts. Over the last three years, the Small Ordinaries Accumulation Index has returned just 2.9% including dividends, against a 29.1% return from the All Ordinaries Accumulation Index. Micro-cap stocks and those with shorter histories fared even worse.

While many small businesses have made progress over the last three years, the reward has often been lower valuations.

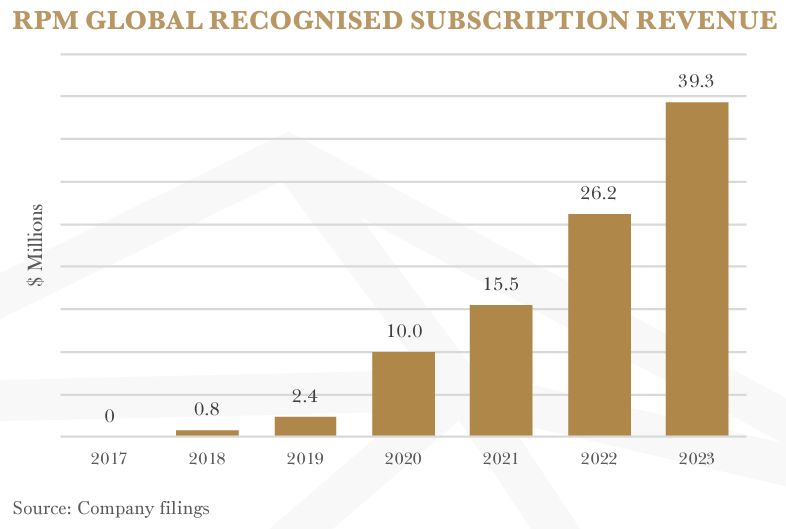

Take the Fund’s largest investment, RPMGlobal (ASX: RUL). The company provides software to miners and mining services businesses. Many of the products are industry standard and key to the operations of a mine site, so very few clients stop using them. The business is run by an aligned management team, has net cash on the balance sheet and has been continuously buying back shares.

While some of those key attributes were there three years ago, there has been plenty of change under the surface. Annual subscription revenue was just $10m in the 2020 financial year. By 2023 it had nearly quadrupled to $39 million. Profit before tax has become meaningfully positive and is due to climb again in 2024 as operating leverage kicks in. Despite all this, RPM’s market capitalisation is only 34% higher than in 2020. The valuation is significantly more attractive today, and we already thought it was a bargain three years ago.

Viva Leisure (ASX: VVA) is another business that has made plenty of progress since 2020. Three years ago, the gym owner had just over 100k paying members. It now boasts more than 186k. Revenue had rebounded to $6.7 million a month post the first of the COVID lockdowns. That number was last pegged at $13.6m. Furthermore, profit margins have climbed from 15% to 21%.

Yet, Viva trades at half of its share price at the end of 2020. A few projects, like club upgrades, technology rollouts and vending machines at clubs will benefit the business in the 2024 financial year. And maturity has also led to larger and more flexible bank funding, providing further organic and acquired growth opportunities. Viva’s valuation multiple has fallen to just eight times our estimate of next years net profit.

Three years ago there was significant uncertainty around when Australian borders would open up to international arrivals, one of the main variables for skydiving and adventure provider Experience Co (ASX: EXP). At the time, Experience had stood down 90% of their staff, divested assets and shored up government support to keep operating. Hit by impairments, the business lost $40m that year.

Fast forward to the end of 2023. Airline capacity into Australia is projected to rise to over 90% of pre-COVID levels. Experience’s Reef Adventures business has visitation approaching 2019 levels and skydive volumes are over 50% of historical levels and recovering quickly. Despite operations being hit by Cyclone Jasper, the company recently entered into a new $43m flexible debt facility. The 2025 financial year is shaping up as a return to near-normality for Experience, yet the company’s share price is still 15% below where it was at the end of 2020.

There are plenty more examples in the portfolio, including software company Readytech (ASX: RDY) and Catapult (ASX: CAT), a global leader in elite athlete monitoring technology (on a recent episode of Forager’s Stocks Neat podcast, we hosted an interview with Catapult CEO Will Lopes).

The larger, more liquid companies in the small-cap index have performed best over the past few months. There have been some stellar returns from those that have been able to migrate from small and illiquid to having broader appeal, including Fund investment Gentrack (ASX: GTK) which experienced a 160% share price rise in 2023.

But there remains incredible value in those that are left behind. As enthusiasm for smaller companies continues to return, these businesses should see improved valuations and share price performance. As long as they continue growing their value, we don’t mind if it takes the market some time to appreciate them fully.

Praemium new addition

If inflation is returning to normal, it will be good news for a lot of smaller companies, including new portfolio addition Praemium (ASX: PPS).

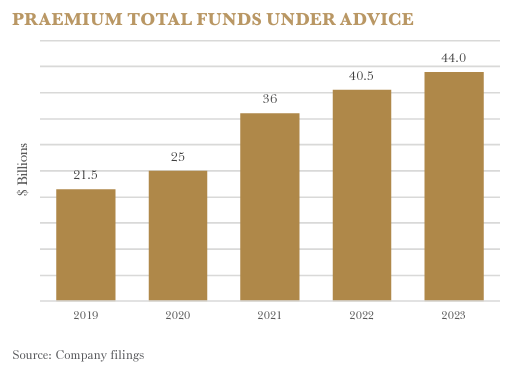

Praemium operates Australia’s third-largest independent investment platform. While Hub and Netwealth dominate the market, Praemium’s $44 billion of funds under advice makes it a serious player and its strength in key niches has enabled it to grow in a competitive space.

New management, a refreshed board and the sale of a loss-making business in the UK had seemingly consigned the listed company’s patchy operational performance to history. With its share price more than halving as financial markets swooned through 2022 and into 2023, we thought the valuation had become appealing.

Just two weeks after the Fund’s modest initial investment, Praemium’s AGM update indicated a serious cost inflation problem, with costs in the first half of this financial year expected to be 10% higher than the second half of last financial year. Combined with still sluggish financial markets in the first quarter of the new financial year, where trading volumes impact Praemium’s revenue, the company now expects its first-half earnings before interest and tax to be 20% lower than the prior corresponding 6-month period. The share itself price ended November down 24%, having been down 34% at the lows. It has since stabilised and we have added further to the investment. The market recovery in November and December should help revenues. However, we will need to see more cost discipline before considering making it a larger investment.

Two Whispir bidders on the scene

We summarised Sorpano Design Technology's takeover offer for Whisper (ASX: WSP) in the November Fund report and hoped for a competing offer to emerge. Those hopes became reality in December, with another bidder entering the picture. Unlike Soprano’s unconditional offer, the new indicative offer from private Australian company Pendula was just that, indicative. From what we can gather, Pendula is a relatively small company. How it expects to pay Whispir shareholders is still uncertain as of today. Still, competition is always good in the game of takeovers and the offer, $0.55 per share, was a decent improvement on Soprano’s $0.48.

Subsequently, Soprano upped its offer to $0.52, Pendula to $0.60 and Soprano again to $0.55, at which point the independent board members gave their support to the unconditional Soprano bid. There is still time for Pendula to firm up its financing and give shareholders more certainty. Either way, it’s going to be a decent result for the Fund given the disappointing operational performance over the past couple of years.

If you share our passion for unloved bargains and have a long-term focus, Forager could be the right investment for you. Click 'FOLLOW' below for more of our insights.

For all of Forager's latest content, videos, podcasts and fund reports, register here.

9 stocks mentioned

1 fund mentioned

.jpg)

.jpg)